Professional Documents

Culture Documents

Figure L.4 - Color Gamuts (8.6.5.4, "Lab Colour Spaces") : RGB Cmyk L A B

Uploaded by

Hermey Marc Villegas0 ratings0% found this document useful (0 votes)

17 views2 pagesOriginal Title

pdf-lib_page_copying_example.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views2 pagesFigure L.4 - Color Gamuts (8.6.5.4, "Lab Colour Spaces") : RGB Cmyk L A B

Uploaded by

Hermey Marc VillegasCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

PDF 32000-1:2008

L*a*b *

RGB

CMYK

Figure L.4 – Color gamuts (8.6.5.4, "Lab Colour Spaces")

AbsoluteColorimetric RelativeColorimetric

Saturation Perceptual

Figure L.5 – Rendering intents (8.6.5.8, "Rendering Intents")

© Adobe Systems Incorporated 2008 – All rights reserved 735

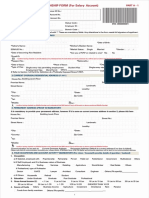

2013 Form 1040-V Department of the Treasury

Internal Revenue Service

What Is Form 1040-V How To Prepare Your Payment

It is a statement you send with your check or money • Make your check or money order payable United

to “

order for any balance due on the “Amount you owe” line States Treasury.” Do not send cash.

of your 2013 Form 1040, Form 1040A, or Form 1040EZ. • Make sure your name and address appear on your

You can also pay your taxes online or by phone either by a check or money order.

TIP direct transfer from your bank account or by credit or debit

card. Paying online or by phone is convenient and secure

• Enter your daytime phone number and your SSN on

your check or money order. If you are filing a joint return,

and helps make sure we get your payments on time. For

enter the SSN shown first on your return. Also enter

more information, go to www.irs.gov/e-pay.

“2013 Form 1040,” “2013 Form 1040A,” or “2013 Form

How To Fill In Form 1040-V 1040EZ,” whichever is appropriate.

Line 1. Enter your social security number (SSN). If youare • To help us process your payment, enter the amount on

filing a joint return, enter the SSN shown first onyour the right side of your check like this: $ XXX.XX. Do not

return. use dashes or lines (for example, do not enter “$ XXX—”

Line 2. If you are filing a joint return, enter the SSNshown or “$ XXX xx/100”).

second on your return.

How To Send In Your 2013 Tax Return,

Line 3. Enter the amount you are paying by check or

money order.

Payment, and Form 1040-V

Line 4. Enter your name(s) and address exactly asshown • Detach Form 1040-V along the dotted line.

on your return. Please print clearly. • Do not staple or otherwise attach your payment or Form

1040-V to your return or to each other. Instead, just put

them loose in the envelope.

• Mail your 2013 tax return, payment, and Form 1040-V to

the address shown on the back that applies to you.

Cat. No. 20975C Form 1040-V (2013)

d Detach Here and Mail With Your Payment and Return d

1040-V

Form

Payment Voucher OMB No. 1545-0074

Department of the Treasury

Internal Revenue Service (99)

a Do not staple or attach this voucher to your payment or return. 2013

1 Your social security number (SSN) 2 If a joint return, SSN shown second 3 Amount you are paying by check or Dollars Cents

on your return money order. Make your check or

money order payable to 'United States

Treasury'

4 Your first name and initial Last name

Print or type

If a joint return, spouse’s first name and initial Last name

Home address (number and street) Apt. no. City, town or post office, state, and ZIP code (If a foreign address, also complete spaces below.)

Foreign country name Foreign province/state/county Foreign postal code

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 20975C

You might also like

- Electronic Filing Instructions For Your 2020 Federal Tax ReturnDocument38 pagesElectronic Filing Instructions For Your 2020 Federal Tax ReturnPeter LaFontaine100% (3)

- 1040-V Template 10-03-08Document1 page1040-V Template 10-03-08Justin Vance100% (6)

- HERBERT HERNANDEZ 2019 Tax Return PDFDocument31 pagesHERBERT HERNANDEZ 2019 Tax Return PDFSwazelleDiane50% (2)

- Chase Name Change 0202Document2 pagesChase Name Change 0202Mason DukeNo ratings yet

- Money Laundreing - PDF SDocument61 pagesMoney Laundreing - PDF SsayliNo ratings yet

- Kotler Pom17e PPT 14Document38 pagesKotler Pom17e PPT 14Muhammad Syanizam100% (1)

- Form 1040-V: What Is Form 1040-V How To Prepare Your PaymentDocument2 pagesForm 1040-V: What Is Form 1040-V How To Prepare Your PaymentGary KrimsonNo ratings yet

- This Text Was Added With Javascript!: Form 1040-VDocument1 pageThis Text Was Added With Javascript!: Form 1040-VHermey Marc VillegasNo ratings yet

- f1040v 2009Document2 pagesf1040v 2009enickNo ratings yet

- Form 1040-V: What Is Form 1040-V and Do You Have To Use It? How To Send in Your 2009 Tax Return, Payment, and Form 1040-VDocument2 pagesForm 1040-V: What Is Form 1040-V and Do You Have To Use It? How To Send in Your 2009 Tax Return, Payment, and Form 1040-Vapi-26236657No ratings yet

- f1040v 2008Document2 pagesf1040v 2008enickNo ratings yet

- What Is Form 1040-VDocument2 pagesWhat Is Form 1040-VLamont RylandNo ratings yet

- F 1040 VDocument2 pagesF 1040 VNotarys To Go0% (1)

- What Is Form 1040-V?Document2 pagesWhat Is Form 1040-V?camilacorredor1998No ratings yet

- What Is Form 1040-V?Document2 pagesWhat Is Form 1040-V?Josh VannucciNo ratings yet

- 2008 Form 1040 Individual Tax ReturnDocument54 pages2008 Form 1040 Individual Tax ReturnjakeNo ratings yet

- Electronic Filing Instructions For Your 2008 Federal Tax ReturnDocument14 pagesElectronic Filing Instructions For Your 2008 Federal Tax ReturnjakeNo ratings yet

- NY CA 01-01-1953 9984 TXPRDocument98 pagesNY CA 01-01-1953 9984 TXPRAdmin OfficeNo ratings yet

- 1.4 IRS Form 1040VDocument1 page1.4 IRS Form 1040VBenne James100% (1)

- 2009 Hotrum G Form 1040 Individual Tax Return - Tax2009Document15 pages2009 Hotrum G Form 1040 Individual Tax Return - Tax2009jakeNo ratings yet

- Instructions For Form IT-201-V: Payment Voucher For Income Tax ReturnsDocument2 pagesInstructions For Form IT-201-V: Payment Voucher For Income Tax ReturnsQunariNo ratings yet

- Form 1041-V: What Is Form 1041-V and Do You Have To Use It? No Checks of $100 Million or More AcceptedDocument2 pagesForm 1041-V: What Is Form 1041-V and Do You Have To Use It? No Checks of $100 Million or More AcceptedKingzuluone1No ratings yet

- Form 1041-V: What Is Form 1041-V and Do You Have To Use It? No Checks of $100 Million or More AcceptedDocument2 pagesForm 1041-V: What Is Form 1041-V and Do You Have To Use It? No Checks of $100 Million or More AcceptedPnut Hallman100% (1)

- File by Mail Instructions For Your 2009 Federal Tax ReturnDocument11 pagesFile by Mail Instructions For Your 2009 Federal Tax ReturnjakeNo ratings yet

- F 1040 VDocument2 pagesF 1040 Vtambache69No ratings yet

- 1040-V - Payment VoucherDocument2 pages1040-V - Payment Voucherjohnbaptistchruckkdk100% (1)

- Documents (942,202212311058, F99NEE)Document2 pagesDocuments (942,202212311058, F99NEE)LertoraNo ratings yet

- US Internal Revenue Service: F8453ol - 2000Document2 pagesUS Internal Revenue Service: F8453ol - 2000IRSNo ratings yet

- US Internal Revenue Service: fw4s - 2005Document2 pagesUS Internal Revenue Service: fw4s - 2005IRSNo ratings yet

- Direct Deposit of Refund To More Than One Account: SampleDocument2 pagesDirect Deposit of Refund To More Than One Account: SampleIRSNo ratings yet

- 2009 Gibbs D Form 1040 Individual Tax Return Tax2009Document23 pages2009 Gibbs D Form 1040 Individual Tax Return Tax2009Jaqueline LeslieNo ratings yet

- US Internal Revenue Service: F8453ol - 2001Document2 pagesUS Internal Revenue Service: F8453ol - 2001IRSNo ratings yet

- Document (661) EncryptedDocument52 pagesDocument (661) Encryptedblueblock113No ratings yet

- My1099 Notice703Document1 pageMy1099 Notice703Selina WalkerNo ratings yet

- 2021 Tax Return Documents (DE CARVALHO COSTA RAF - Client Copy) PDFDocument45 pages2021 Tax Return Documents (DE CARVALHO COSTA RAF - Client Copy) PDFRafael CarvalhoNo ratings yet

- FederalDocument24 pagesFederalNeil NitinNo ratings yet

- US Internal Revenue Service: F8453ol - 2005Document2 pagesUS Internal Revenue Service: F8453ol - 2005IRSNo ratings yet

- Us 1099 2022Document4 pagesUs 1099 2022mks12No ratings yet

- US Internal Revenue Service: fw4s - 1995Document2 pagesUS Internal Revenue Service: fw4s - 1995IRSNo ratings yet

- F 1040 VDocument2 pagesF 1040 Vhottadot730@gmail.comNo ratings yet

- US Internal Revenue Service: f9325Document2 pagesUS Internal Revenue Service: f9325IRSNo ratings yet

- 2023 DD and Tax FormsDocument5 pages2023 DD and Tax FormselantobbyNo ratings yet

- U.S. Individual Income Tax Declaration For An IRS E-File Online ReturnDocument2 pagesU.S. Individual Income Tax Declaration For An IRS E-File Online ReturnIRSNo ratings yet

- 2010 Psztur R Form 1040 Individual Tax ReturnDocument20 pages2010 Psztur R Form 1040 Individual Tax ReturnJaqueline LeslieNo ratings yet

- Sample Tax Return Robb Stark:: Robb's Swarthmore Account Information: 2012 13 2013 14Document5 pagesSample Tax Return Robb Stark:: Robb's Swarthmore Account Information: 2012 13 2013 14Andrew BookerNo ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - RecordsDocument232 pages2019 Chandler D Form 1040 Individual Tax Return - Recordswhat is this100% (3)

- US Internal Revenue Service: F8453ol - 1996Document2 pagesUS Internal Revenue Service: F8453ol - 1996IRSNo ratings yet

- T183 TemplateDocument2 pagesT183 TemplateEnd UserNo ratings yet

- 2014 TaxReturnDocument25 pages2014 TaxReturnNguyen Vu CongNo ratings yet

- US Internal Revenue Service: fw4s 06Document2 pagesUS Internal Revenue Service: fw4s 06IRSNo ratings yet

- Furqan 21Document15 pagesFurqan 21Furqan HaiderNo ratings yet

- US Internal Revenue Service: fw4s - 1994Document2 pagesUS Internal Revenue Service: fw4s - 1994IRSNo ratings yet

- US Internal Revenue Service: F8453ol - 2003Document2 pagesUS Internal Revenue Service: F8453ol - 2003IRSNo ratings yet

- US Internal Revenue Service: fw4s07 AccessibleDocument2 pagesUS Internal Revenue Service: fw4s07 AccessibleIRSNo ratings yet

- State District of ColumbiaDocument20 pagesState District of ColumbiaRoger federerNo ratings yet

- Fowlis, Jesse - T183Document2 pagesFowlis, Jesse - T183End UserNo ratings yet

- C Ujeniuc 2Document17 pagesC Ujeniuc 2cujeniucYAHOO.COMNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- Marks and SpencerDocument32 pagesMarks and Spencermissira19100% (1)

- Atlassian: Sales Case Study: Kamini SinghDocument5 pagesAtlassian: Sales Case Study: Kamini SinghSingh KaminiNo ratings yet

- Icmm Sustainable Development FrameworkDocument5 pagesIcmm Sustainable Development Frameworkfaqih rasyidNo ratings yet

- Men Machines Methods Money MaterialsDocument29 pagesMen Machines Methods Money MaterialsAdityaNo ratings yet

- Clemon-The Green StarDocument8 pagesClemon-The Green StarishmamNo ratings yet

- Business Ethics ReviewerDocument8 pagesBusiness Ethics ReviewerKc BaroNo ratings yet

- TallyDocument70 pagesTallyShree GuruNo ratings yet

- Mohit Soni: A, CEB IDocument3 pagesMohit Soni: A, CEB IMohit SoniNo ratings yet

- Features of The Minimum Wages ActDocument8 pagesFeatures of The Minimum Wages ActMahima DograNo ratings yet

- You Need To Identify That There Is A Need To Update The Inventory or Stock. YouDocument3 pagesYou Need To Identify That There Is A Need To Update The Inventory or Stock. YougadigatsweNo ratings yet

- HAND OUT No. 3 FABM The Accounting EquationDocument9 pagesHAND OUT No. 3 FABM The Accounting Equationnatalie clyde matesNo ratings yet

- What Do Interest Rates Mean and What Is Their Role in Valuation?Document3 pagesWhat Do Interest Rates Mean and What Is Their Role in Valuation?Alessandra PilatNo ratings yet

- Fairness and Equality - Sime DarbyDocument18 pagesFairness and Equality - Sime DarbyNoraini Raimi Sajari100% (6)

- Samsung - Strategic Marketing FinalDocument17 pagesSamsung - Strategic Marketing FinalRameeza AbdullahNo ratings yet

- Vat Presentation: RevisionDocument30 pagesVat Presentation: RevisionKartik VermaNo ratings yet

- Salary Account Opening FormDocument12 pagesSalary Account Opening FormVijay DhanarajNo ratings yet

- Tally Practice QuestionsDocument68 pagesTally Practice Questionspranav tomar100% (1)

- Boston Consulting Group - Brazil Confronting The Productivity ChallengeDocument0 pagesBoston Consulting Group - Brazil Confronting The Productivity ChallengeEXAME.comNo ratings yet

- 22087-047 Hoermann Geschaeftsbericht 2019 EN Web Sec 2 PDFDocument53 pages22087-047 Hoermann Geschaeftsbericht 2019 EN Web Sec 2 PDFPARAS JATANANo ratings yet

- Wroksheet Princples of Auditing IIDocument9 pagesWroksheet Princples of Auditing IIEwnetu TadesseNo ratings yet

- 02 - Soft - Copy - Laporan - Keuangan - Laporan Keuangan Tahun 2017 - TW3 - FPNI - FPNI - FS-Consol Q3 2017 (Un-Audited) PDFDocument72 pages02 - Soft - Copy - Laporan - Keuangan - Laporan Keuangan Tahun 2017 - TW3 - FPNI - FPNI - FS-Consol Q3 2017 (Un-Audited) PDFno allNo ratings yet

- 50 Time & WorkDocument3 pages50 Time & WorkPiyush BhartiNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/22Document20 pagesCambridge International AS & A Level: ACCOUNTING 9706/22Ruchira Sanket KaleNo ratings yet

- Perception of Innovation Barriers by Successful and Unsuccessful Innovators in Emerging EconomiesDocument25 pagesPerception of Innovation Barriers by Successful and Unsuccessful Innovators in Emerging EconomiesMikus DubickisNo ratings yet

- Activity of Credit Intermediation and Factoring Companies in PolandDocument5 pagesActivity of Credit Intermediation and Factoring Companies in PolandjournalNo ratings yet

- Smart Communications, Inc. v. City of DavaoDocument3 pagesSmart Communications, Inc. v. City of DavaoluckyNo ratings yet

- Tesfaye WegariDocument85 pagesTesfaye WegariAbiy GetachewNo ratings yet