Professional Documents

Culture Documents

Lecture No4 - Single-Cash-Flow Formulas

Uploaded by

عمر ابن حماه0 ratings0% found this document useful (0 votes)

6 views12 pagesEconomy

Original Title

Lecture No4_Single-Cash-Flow Formulas

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEconomy

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views12 pagesLecture No4 - Single-Cash-Flow Formulas

Uploaded by

عمر ابن حماهEconomy

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

Lecture No.

6

Chapter 3

Contemporary Engineering Economics

Copyright © 2010

Contemporary Engineering Economics, 5th edition, ©2010

Types of Common Cash

Flows in Engineering

Economics

Single cash flow

Equal (uniform)

payment series at regular

intervals

Linear gradient series

Geometric gradient

series

Irregular (random)

payment series

Contemporary Engineering Economics, 5th edition, © 2010

Equivalence

Relationship

Between P and F

Compounding Process –

Finding an equivalent future

value of current cash

payment

Discounting Process –

Finding an equivalent

present value of a future

cash payment

Contemporary Engineering Economics, 5th edition, © 2010

Example 3.7 Single

Amounts: Find F,

Given i, N, and P

Given: P = $2,000, i = Single Cash Flow Formula –

10%, N = 8 years Compound Amount Factor

Find: F

F

F $2,000(1 0.10)8

F P(1 i) N

$2,000(F / P ,10%,8)

$4,287.18 F P(F / P , i , N)

Excel Solution: 0

N

Contemporary Engineering Economics, 5th edition, © 2010

A Typical

Compound Interest

Table – say 12%

To find the compound interest

factor when the interest rate

is 12% and the number

interest periods is 10, we

could evaluate the following

equation using the interest

table.

Contemporary Engineering Economics, 5th edition, © 2010

Example 3.8 Single

Amounts: Find P,

Given i, N, and F

Given: F = $1,000, i = Single Cash Flow Formula – Present

12%, N = 5 years Worth Amount Factor

Find: P

N F

P $1,000(1 0.12)5

P F (1 i)

$1,000(P / F ,12%,5)

$567.43 P F (P / F , i , N)

Excel Solution: 0

N

Contemporary Engineering Economics, 5th edition, © 2010

Example 3.9 Single

Amounts: Find i,

Given P, F, and N

Given: F = $40, P = $20, N Solving for i

= 5 years

Find: i

Excel Solution:

Contemporary Engineering Economics, 5th edition, © 2010

Example 3.10 Single

Amounts: Find N,

Given P, F, and i

Given: P = $6,000, F = Solving for N

$12,000, and i = 20%

Find: N

F 2P P(1 0.20)N

2 1.2N

log2 N log1.2

log2

N

log1.2

3.80 years

Excel Solution:

Contemporary Engineering Economics, 5th edition, © 2010

Rule of 72

Approximating Number of Years Required to Double an

Initial Investment at Various Interest Rates

how long it will take

for a sum of money

to double

72

N

interest rate (%)

72

20

3.6 years

Contemporary Engineering Economics, 5th edition, © 2010

Example 3.11

Uneven Payment

Series

How much do you

need to deposit today (P)

to withdraw $25,000 at n

=1, $3,000 at n = 2, and

$5,000 at n =4, if your

account earns 10%

annual interest?

$25,000

$3,000 $5,000

0

1 2 3 4

Contemporary Engineering Economics, 5th edition, © 2010

Check to see if $28,622 is indeed sufficient

0 1 2 3 4

Beginning 0 28,622 6,484.20 4,132.62 4,545.88

Balance

Interest 0 2,862 648.42 413.26 454.59

Earned

(10%)

Payment +28,622 -25,000 -3,000 0 -5,000

Ending $28,622 6,484.20 4,132.62 4,545.88 0.47

Balance

Rounding error

It should be “0.”

Contemporary Engineering Economics, 5th edition, © 2010

Example 3.12 Future

Value of an Uneven Series

with Varying Interest

Rates

Given: Deposit series as given

over 5 years

Find: Balance at the end of

year 5

Contemporary Engineering Economics, 5th edition, © 2010

You might also like

- Module 6 - Single Cash Flow FormulasDocument12 pagesModule 6 - Single Cash Flow FormulasBob HopeNo ratings yet

- Lecture No5 - Equal-Payment - Series-ModifiedDocument13 pagesLecture No5 - Equal-Payment - Series-Modifiedpoqwuradfo apdsoaafNo ratings yet

- Chapter 3Document100 pagesChapter 3Hoshi0% (1)

- Interest Formulas - Equal Payment Series: Lecture No.5 Professor C. S. Park Fundamentals of Engineering EconomicsDocument25 pagesInterest Formulas - Equal Payment Series: Lecture No.5 Professor C. S. Park Fundamentals of Engineering EconomicsIshan JindalNo ratings yet

- Interest Formulas For Single Cash Flows: Lecture No.6 Contemporary Engineering EconomicsDocument18 pagesInterest Formulas For Single Cash Flows: Lecture No.6 Contemporary Engineering EconomicsSyed NaqiuddinNo ratings yet

- Inde 232 Chapter 2Document44 pagesInde 232 Chapter 2Abdullah AfefNo ratings yet

- Assignment ExcelDocument3 pagesAssignment ExcelTarek KamelNo ratings yet

- Chapter 2 Factors Effect Time Interest MoneyDocument21 pagesChapter 2 Factors Effect Time Interest MoneyMohammad RamzanNo ratings yet

- Factors: How Time and Interest Affect MoneyDocument25 pagesFactors: How Time and Interest Affect MoneySultan KhalofahNo ratings yet

- Chapter 2 - Factors, Effect of Time & Interest On MoneyDocument13 pagesChapter 2 - Factors, Effect of Time & Interest On MoneyAdnan AliNo ratings yet

- Interest Formulas For Single Cash Flows: Lecture No.4 Professor C. S. Park Fundamentals of Engineering EconomicsDocument10 pagesInterest Formulas For Single Cash Flows: Lecture No.4 Professor C. S. Park Fundamentals of Engineering Economicsmaria_santhosh_inigoNo ratings yet

- Engineering EconomyDocument37 pagesEngineering EconomyScribd MeNo ratings yet

- Factors: How Time and Interest Affect MoneyDocument21 pagesFactors: How Time and Interest Affect Moneyquik silvaNo ratings yet

- Lecture No7 - Unconventional Equivalence CalculationsDocument9 pagesLecture No7 - Unconventional Equivalence Calculationsعمر ابن حماهNo ratings yet

- Chapter 2Document45 pagesChapter 2Dark HunterNo ratings yet

- Ch3 Combining FactorsDocument21 pagesCh3 Combining FactorsNUR IZZAH NABILA BINTI ISKANDAR SYAH A18KT0230No ratings yet

- Chapter3 Combining FactorsDocument11 pagesChapter3 Combining FactorstobiveNo ratings yet

- Ch2 FactorsDocument28 pagesCh2 FactorsAtirah AsnaNo ratings yet

- Lec 3Document31 pagesLec 3Muhammad YaseenNo ratings yet

- Factors: How Time and Interest Affect MoneyDocument21 pagesFactors: How Time and Interest Affect MoneyHassan TalhaNo ratings yet

- Lecture No9 - Unconventional Equivalence CalculationsDocument9 pagesLecture No9 - Unconventional Equivalence CalculationskhodorNo ratings yet

- ISE431 L3 3rDocument23 pagesISE431 L3 3rjohnNo ratings yet

- Module 11c Nominal Payment Using TableDocument22 pagesModule 11c Nominal Payment Using TableCarljohari Hussein AriffNo ratings yet

- Engineering Economy, Engineering EconomyDocument74 pagesEngineering Economy, Engineering EconomyJoelle KharratNo ratings yet

- Combining Factors into an Equivalent Annual WorthDocument25 pagesCombining Factors into an Equivalent Annual Worth王泓鈞No ratings yet

- GE 161 Fall 2011 Printed: 10/4/2011 Page 1: Time Value of Money - 1Document14 pagesGE 161 Fall 2011 Printed: 10/4/2011 Page 1: Time Value of Money - 1John ZhaoNo ratings yet

- Lecture5-Equal Payment SeriesDocument25 pagesLecture5-Equal Payment SeriesGanda GandaNo ratings yet

- CH 2Document17 pagesCH 2خالد شاهNo ratings yet

- (4-1) Future Value (FV) Single-Payment Compound Amount FormulaDocument6 pages(4-1) Future Value (FV) Single-Payment Compound Amount FormulaMr sfeanNo ratings yet

- Lecture 5 Engineering Economics Interest Equivalence (Part 2) 1Document23 pagesLecture 5 Engineering Economics Interest Equivalence (Part 2) 1Natanael SiraitNo ratings yet

- NE364 Lec 05Document17 pagesNE364 Lec 05rizkiNo ratings yet

- Dwnload Full Contemporary Engineering Economics 5th Edition Park Solutions Manual PDFDocument35 pagesDwnload Full Contemporary Engineering Economics 5th Edition Park Solutions Manual PDFnenupharflashilysp5c100% (16)

- Calculating Compound InterestDocument6 pagesCalculating Compound InterestReygie FabrigaNo ratings yet

- WRD720S-2022 - Task 01 - EE Rev1 - Model AnswerDocument12 pagesWRD720S-2022 - Task 01 - EE Rev1 - Model AnswerMeg TNo ratings yet

- Factors: How Time and Interest Affect MoneyDocument21 pagesFactors: How Time and Interest Affect MoneymidoNo ratings yet

- Time Value of Money Analysis for Engineering ProjectsDocument18 pagesTime Value of Money Analysis for Engineering ProjectsJun Hao HengNo ratings yet

- 5 Time Value of Money 1Document33 pages5 Time Value of Money 1jnfzNo ratings yet

- Engineering Economy: Name: Hernandez, Arvin D. CH040 - C11Document5 pagesEngineering Economy: Name: Hernandez, Arvin D. CH040 - C11Patricia DavidNo ratings yet

- Advanced Engineering Economics Lecture 1.2 Influence of Time and Interest on MoneyDocument31 pagesAdvanced Engineering Economics Lecture 1.2 Influence of Time and Interest on MoneyA GlaumNo ratings yet

- EE Chapter 2Document24 pagesEE Chapter 2Dian Ratri CNo ratings yet

- IV. Combining FactorsDocument7 pagesIV. Combining FactorsKevin Giovani TanotoNo ratings yet

- 16 Engineering EconomicsDocument29 pages16 Engineering Economicsmichelle leoNo ratings yet

- Ch03 Combining FactorsDocument42 pagesCh03 Combining FactorsJoelle KharratNo ratings yet

- Module 7 - Equal Payment SeriesDocument13 pagesModule 7 - Equal Payment SeriesBob HopeNo ratings yet

- Lecture+No4+ +Time+Value+of+MoneyDocument14 pagesLecture+No4+ +Time+Value+of+MoneyschatzNo ratings yet

- Module 3Document5 pagesModule 3RyuddaenNo ratings yet

- Contemporary Engineering Economics 5th Edition Park Solutions ManualDocument35 pagesContemporary Engineering Economics 5th Edition Park Solutions Manualbyronrogersd1nw8100% (17)

- Module 2Document7 pagesModule 2RyuddaenNo ratings yet

- 4B WK Compound InterestDocument10 pages4B WK Compound InterestNessa MarasiganNo ratings yet

- Chap. 3Document20 pagesChap. 3Khuram MaqsoodNo ratings yet

- Gen - Math G11 Q2 Wk2 Compound-InterestDocument7 pagesGen - Math G11 Q2 Wk2 Compound-Interestfackastuckerz98No ratings yet

- Assignment 1+2 SolutionsDocument4 pagesAssignment 1+2 SolutionsMinh TuyềnNo ratings yet

- Solution. Investment 1: Simple Interest, With Annual Rate RDocument11 pagesSolution. Investment 1: Simple Interest, With Annual Rate RLucky Gemina67% (3)

- Philippine High School Enhancement Review on Simple and Compound InterestDocument12 pagesPhilippine High School Enhancement Review on Simple and Compound InterestJames Earl AbainzaNo ratings yet

- Chapter 2 Engineering EconomyDocument33 pagesChapter 2 Engineering Economymudassir ahmadNo ratings yet

- Factors: How Time and Interest Affect Money: Engineering EconomyDocument33 pagesFactors: How Time and Interest Affect Money: Engineering Economymudassir ahmadNo ratings yet

- Engineering Economy Uniform SeriesDocument36 pagesEngineering Economy Uniform SeriesJohn Carlo CapateNo ratings yet

- Engineering Economics: Ali SalmanDocument19 pagesEngineering Economics: Ali SalmanMuhammad atif latifNo ratings yet

- Lecture No5 - Equal-Payment - SeriesDocument12 pagesLecture No5 - Equal-Payment - Seriesعمر ابن حماهNo ratings yet

- Lecture No8 - Nominal and Effective Interest RatesDocument16 pagesLecture No8 - Nominal and Effective Interest Ratesعمر ابن حماهNo ratings yet

- Lec 5Document9 pagesLec 5shan0214No ratings yet

- Lecture No2 - Time Value of MoneyDocument18 pagesLecture No2 - Time Value of Moneyعمر ابن حماهNo ratings yet

- International HR StrategiesDocument51 pagesInternational HR Strategiesmandar85% (26)

- Methods of Valuation of FirmsDocument90 pagesMethods of Valuation of Firmsmuskaan bhadadaNo ratings yet

- JPMorgan Chase London Whale GDocument15 pagesJPMorgan Chase London Whale GMaksym ShodaNo ratings yet

- Quotation - Householders - LAPSONDocument1 pageQuotation - Householders - LAPSONCredsureNo ratings yet

- Hyper Launch BrochureDocument22 pagesHyper Launch BrochureQuintin McDonaldNo ratings yet

- SIRIM QAS Certification for PVC-Insulated CablesDocument2 pagesSIRIM QAS Certification for PVC-Insulated Cablesyusuf mohd salleh100% (1)

- KALAMAZOO Case Study SolutionDocument13 pagesKALAMAZOO Case Study SolutionSanskriti sahuNo ratings yet

- Understanding Cryptocurrencies: Bitcoin, Ethereum, and Altcoins As An Asset ClassDocument24 pagesUnderstanding Cryptocurrencies: Bitcoin, Ethereum, and Altcoins As An Asset ClassCharlene KronstedtNo ratings yet

- Caso Carvajal S.A.Document22 pagesCaso Carvajal S.A.Indrenetk Leon100% (1)

- 2021 Remaining Ongoing CasesDocument2,517 pages2021 Remaining Ongoing CasesJulia Mar Antonete Tamayo AcedoNo ratings yet

- Motion To Reduce BondDocument4 pagesMotion To Reduce Bonderika barbaronaNo ratings yet

- Building Contruction Workers Regulation of Employment and Working Conditions Act 1996Document14 pagesBuilding Contruction Workers Regulation of Employment and Working Conditions Act 1996omarmhusainNo ratings yet

- SAP NetWeaver WAS Administration TrainingDocument8 pagesSAP NetWeaver WAS Administration Trainingchaduvula1995No ratings yet

- SCM Furniture 027Document14 pagesSCM Furniture 027Mohaiminul IslamNo ratings yet

- Institute of Management Studies and Research: KLE Society'sDocument22 pagesInstitute of Management Studies and Research: KLE Society'sRutuja HukkeriNo ratings yet

- Exponential Growth Decay Extra Practice W - AnswersDocument3 pagesExponential Growth Decay Extra Practice W - AnswersEdal SantosNo ratings yet

- FSA Guide 20Document16 pagesFSA Guide 20David DangNo ratings yet

- Designing The Perfect Procurement Operating Model: OperationsDocument9 pagesDesigning The Perfect Procurement Operating Model: Operationspulsar77No ratings yet

- Max AR Final 130812 PDFDocument731 pagesMax AR Final 130812 PDFsnjv2621No ratings yet

- Ijcs 127281Document34 pagesIjcs 127281Faten bakloutiNo ratings yet

- BSBMGT516 ASSEMENT UNIT Written Knowledge QestionsDocument8 pagesBSBMGT516 ASSEMENT UNIT Written Knowledge QestionsChathuri De Alwis50% (2)

- Solved A Religious Organization Is Considering Spreading Its Message Into Illinois PDFDocument1 pageSolved A Religious Organization Is Considering Spreading Its Message Into Illinois PDFAnbu jaromiaNo ratings yet

- Carbon Market Year in Review 2020Document26 pagesCarbon Market Year in Review 2020Sayaka TsugaiNo ratings yet

- Expected Questions For Business Laws For June 22 ExamsDocument8 pagesExpected Questions For Business Laws For June 22 ExamsFREEFIRE IDNo ratings yet

- Philips V NLRC PDFDocument7 pagesPhilips V NLRC PDFIoa WnnNo ratings yet

- Sales Receipt: Company Name 123 Main Street Hamilton, OH 44416 (321) 456-7890 Email AddressDocument1 pageSales Receipt: Company Name 123 Main Street Hamilton, OH 44416 (321) 456-7890 Email AddressParas ShardaNo ratings yet

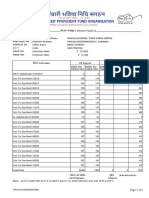

- Member Passbook DetailsDocument2 pagesMember Passbook DetailsNaveen SinghNo ratings yet

- Presentation On Corporate GovernanceDocument29 pagesPresentation On Corporate Governancesuren471988No ratings yet

- CHAPTER 1.1 Basic Concepts of ManagementsDocument15 pagesCHAPTER 1.1 Basic Concepts of ManagementsRay John DulapNo ratings yet

- Tax credit claim form guideDocument2 pagesTax credit claim form guideVivian KongNo ratings yet