Professional Documents

Culture Documents

Goods and Services: Value Added Tax

Goods and Services: Value Added Tax

Uploaded by

Maika J. PudaderaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Goods and Services: Value Added Tax

Goods and Services: Value Added Tax

Uploaded by

Maika J. PudaderaCopyright:

Available Formats

Goods and services[edit]

Value added[edit]

Main article: Value added tax

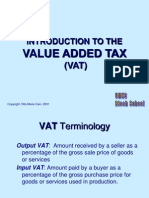

A value added tax (VAT), also known as Goods and Services Tax (G.S.T), Single Business Tax, or

Turnover Tax in some countries, applies the equivalent of a sales tax to every operation that creates

value. To give an example, sheet steel is imported by a machine manufacturer. That manufacturer

will pay the VAT on the purchase price, remitting that amount to the government. The manufacturer

will then transform the steel into a machine, selling the machine for a higher price to a wholesale

distributor. The manufacturer will collect the VAT on the higher price, but will remit to the government

only the excess related to the "value added" (the price over the cost of the sheet steel). The

wholesale distributor will then continue the process, charging the retail distributor the VAT on the

entire price to the retailer, but remitting only the amount related to the distribution mark-up to the

government. The last VAT amount is paid by the eventual retail customer who cannot recover any of

the previously paid VAT. For a VAT and sales tax of identical rates, the total tax paid is the same,

but it is paid at differing points in the process.

VAT is usually administrated by requiring the company to complete a VAT return, giving details of

VAT it has been charged (referred to as input tax) and VAT it has charged to others (referred to as

output tax). The difference between output tax and input tax is payable to the Local Tax Authority.

Many tax authorities have introduced automated VAT which has

increased accountability and auditability, by utilizing computer-systems, thereby also enabling anti-

cybercrime offices as well.[citation needed]

You might also like

- Goods and Services TaxDocument8 pagesGoods and Services TaxNeeraj MundaNo ratings yet

- Value Added Tax (VAT)Document33 pagesValue Added Tax (VAT)chirag_nrmba15No ratings yet

- VatDocument9 pagesVatmayurgharatNo ratings yet

- Value Added TaxDocument2 pagesValue Added TaxMalayJenaNo ratings yet

- GST RoadmapDocument14 pagesGST Roadmapsiddhumesh1No ratings yet

- Registration: Without Any TaxDocument5 pagesRegistration: Without Any TaxvanitakajaleNo ratings yet

- Vat Presentation: Nikita GanatraDocument26 pagesVat Presentation: Nikita Ganatrapuneet0303No ratings yet

- Vat Presentation: Nikita GanatraDocument26 pagesVat Presentation: Nikita GanatraShubham GoyalNo ratings yet

- Changes Faces of Vat TaxDocument103 pagesChanges Faces of Vat TaxArvind MahandhwalNo ratings yet

- Goods and Services Tax (GST) in India: A Presentation byDocument27 pagesGoods and Services Tax (GST) in India: A Presentation bymanukleo100% (1)

- Introduction To TheDocument11 pagesIntroduction To The9211420420No ratings yet

- VATDocument11 pagesVATSaurav KumarNo ratings yet

- There Is No Such Thing As 'SST'Document1 pageThere Is No Such Thing As 'SST'hfdghdhNo ratings yet

- GST in IndiaDocument27 pagesGST in IndiaDawn LoveNo ratings yet

- Vat Vs GST FinalDocument35 pagesVat Vs GST FinalJatin GoyalNo ratings yet

- GST in IndiaDocument5 pagesGST in IndiaKayam YaminiNo ratings yet

- Types of TaxesDocument3 pagesTypes of TaxesKynaat MirzaNo ratings yet

- V A TDocument64 pagesV A TJennifer Garcia EreseNo ratings yet

- Project Report On Value Added Tax VATDocument77 pagesProject Report On Value Added Tax VATshehzanamujawarNo ratings yet

- What Is Value Added TaxDocument2 pagesWhat Is Value Added TaxsushanwinsNo ratings yet

- VALUE ADDED TAX - NotesDocument18 pagesVALUE ADDED TAX - NoteslooserNo ratings yet

- Value Added Tax (VAT) : A Presentation by Sanjay JagarwalDocument39 pagesValue Added Tax (VAT) : A Presentation by Sanjay JagarwalJishu Twaddler D'CruxNo ratings yet

- Vat MeDocument3 pagesVat MeTamanna MukherjeeNo ratings yet

- Alue Added TaxDocument1 pageAlue Added TaxRavindra Singh RathoreNo ratings yet

- Goods and Services Tax " Future in India": by - Joe Suhas Thambi Rahul Aurade MET Institute of Management, NasikDocument33 pagesGoods and Services Tax " Future in India": by - Joe Suhas Thambi Rahul Aurade MET Institute of Management, NasikJOEMEETSMONUNo ratings yet

- Ad Valorem TaxDocument4 pagesAd Valorem TaxManoj KNo ratings yet

- Solutions For GST Question BankDocument73 pagesSolutions For GST Question BankSuprajaNo ratings yet

- A Value Added TaxDocument6 pagesA Value Added TaxReeta SinghNo ratings yet

- VAT Vs ST 208Document5 pagesVAT Vs ST 208vidhi kandoiNo ratings yet

- Tax Ii MSDocument245 pagesTax Ii MSSAMBIT KUMAR PATRINo ratings yet

- Goods & Service Tax CompleteDocument76 pagesGoods & Service Tax CompleteAyesha khanNo ratings yet

- Value Added Tax: Submitted by Nirbhay Singh Submitted To Dr. Praerna SharmaDocument17 pagesValue Added Tax: Submitted by Nirbhay Singh Submitted To Dr. Praerna SharmaNirbhay SinghNo ratings yet

- Business EnvironmentDocument12 pagesBusiness EnvironmentArpit JainNo ratings yet

- Ijems V4i5p107Document4 pagesIjems V4i5p107Annpourna ShuklaNo ratings yet

- Difference Between VAT and GST (With Comparison Chart)Document7 pagesDifference Between VAT and GST (With Comparison Chart)Arundhuti RoyNo ratings yet

- Value Added Tax Definition Examples InvestopediaDocument7 pagesValue Added Tax Definition Examples InvestopediaZicoNo ratings yet

- Goods and Services Tax (GST) in India: Ca R.K.BhallaDocument30 pagesGoods and Services Tax (GST) in India: Ca R.K.BhallaIrfanNo ratings yet

- Value-Added Tax and Tot NotesDocument28 pagesValue-Added Tax and Tot NotesBrooks BrookNo ratings yet

- VAT Guide 2023Document46 pagesVAT Guide 2023ELIJAHNo ratings yet

- Goods & Services Tax (GST) - (One Nation One Tax)Document40 pagesGoods & Services Tax (GST) - (One Nation One Tax)sumukh0% (1)

- Value Added TaxDocument11 pagesValue Added TaxPreethi RajasekaranNo ratings yet

- Presentation On GST by Himanshu and KrishnaDocument21 pagesPresentation On GST by Himanshu and KrishnahimanshuNo ratings yet

- Role of Digital Signature Certificate in GSTDocument13 pagesRole of Digital Signature Certificate in GSTreginlu tayangNo ratings yet

- Value Added Tax (VAT)Document1 pageValue Added Tax (VAT)Parth UpadhyayNo ratings yet

- Introduction To GSTDocument14 pagesIntroduction To GSTAadil KakarNo ratings yet

- GST Project PDFDocument47 pagesGST Project PDFjassi7nishadNo ratings yet

- GST Impact On The Supply ChainDocument8 pagesGST Impact On The Supply ChainAamiTataiNo ratings yet

- Gstinindia A Brief NoteDocument30 pagesGstinindia A Brief NoteMahaveer DhelariyaNo ratings yet

- VAT GuideZRADocument56 pagesVAT GuideZRADaniel Glen-WilliamsonNo ratings yet

- Goods & Services Tax - GST: Amar ShawDocument15 pagesGoods & Services Tax - GST: Amar ShawChetan KaushikNo ratings yet

- Sales Tax: Consumption Tax Point of Purchase Percentage Exemptions Tax-InclusiveDocument4 pagesSales Tax: Consumption Tax Point of Purchase Percentage Exemptions Tax-Inclusive943993No ratings yet

- Value Added TaxDocument3 pagesValue Added TaxNahid Hussain AdriNo ratings yet

- Value Added Tax PPT at Bec Doms Bagalkot MbaDocument22 pagesValue Added Tax PPT at Bec Doms Bagalkot MbaBabasab Patil (Karrisatte)No ratings yet

- VAT Road To GSTDocument19 pagesVAT Road To GSTVarun PuriNo ratings yet

- Importance of VAT in India: Sales Tax Importer TraderDocument5 pagesImportance of VAT in India: Sales Tax Importer TraderKamal ChawlaNo ratings yet

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Tax LawDocument1 pageTax LawMaika J. PudaderaNo ratings yet

- Real Estate Real Estate Window Tax Listed Buildings Stamp Duty Inheritance Tax Land-Value TaxDocument1 pageReal Estate Real Estate Window Tax Listed Buildings Stamp Duty Inheritance Tax Land-Value TaxMaika J. PudaderaNo ratings yet

- Poll TaxDocument1 pagePoll TaxMaika J. PudaderaNo ratings yet

- Branches of ScienceDocument2 pagesBranches of ScienceMaika J. PudaderaNo ratings yet

- Excise: Indirect TaxDocument1 pageExcise: Indirect TaxMaika J. PudaderaNo ratings yet

- Economic Effects: WealthDocument1 pageEconomic Effects: WealthMaika J. PudaderaNo ratings yet

- Forms: SeigniorageDocument1 pageForms: SeigniorageMaika J. PudaderaNo ratings yet

- Fees and Effective: Direct Tax Indirect TaxDocument1 pageFees and Effective: Direct Tax Indirect TaxMaika J. PudaderaNo ratings yet

- Social-Security Contributions: Corporate TaxDocument1 pageSocial-Security Contributions: Corporate TaxMaika J. PudaderaNo ratings yet

- History: Joint-Stock CompaniesDocument1 pageHistory: Joint-Stock CompaniesMaika J. PudaderaNo ratings yet

- Types: Compliance CostDocument1 pageTypes: Compliance CostMaika J. PudaderaNo ratings yet

- Angola Kenya Brazil MalaysiaDocument1 pageAngola Kenya Brazil MalaysiaMaika J. PudaderaNo ratings yet

- Key Facts: Trade LiberalisationDocument1 pageKey Facts: Trade LiberalisationMaika J. PudaderaNo ratings yet

- Role of MathematicsDocument2 pagesRole of MathematicsMaika J. PudaderaNo ratings yet

- The Financial System: Financial Services Financial Market Circular Flow of IncomeDocument1 pageThe Financial System: Financial Services Financial Market Circular Flow of IncomeMaika J. PudaderaNo ratings yet

- TariffDocument1 pageTariffMaika J. PudaderaNo ratings yet

- Descriptive Labels: Edit EditDocument1 pageDescriptive Labels: Edit EditMaika J. PudaderaNo ratings yet

- Income TaxDocument1 pageIncome TaxMaika J. PudaderaNo ratings yet

- Laffer Curve: When?Document1 pageLaffer Curve: When?Maika J. PudaderaNo ratings yet

- Payroll or WorkforceDocument1 pagePayroll or WorkforceMaika J. PudaderaNo ratings yet

- Reduced Economic WelfareDocument2 pagesReduced Economic WelfareMaika J. PudaderaNo ratings yet

- Normal Goods: Ad Valorem TaxDocument1 pageNormal Goods: Ad Valorem TaxMaika J. PudaderaNo ratings yet

- Sales Tax: Main ArticleDocument1 pageSales Tax: Main ArticleMaika J. PudaderaNo ratings yet

- SharesDocument1 pageSharesMaika J. PudaderaNo ratings yet

- Application: Stock Exchange Initial Public OfferingDocument1 pageApplication: Stock Exchange Initial Public OfferingMaika J. PudaderaNo ratings yet

- Incidence: Tax Incidence Effect of Taxes and Subsidies On PriceDocument1 pageIncidence: Tax Incidence Effect of Taxes and Subsidies On PriceMaika J. PudaderaNo ratings yet

- Financial Mathematics: Main ArticleDocument1 pageFinancial Mathematics: Main ArticleMaika J. PudaderaNo ratings yet

- Pieter Brueghel The Younger:, The Tax Collector's Office, 1640Document1 pagePieter Brueghel The Younger:, The Tax Collector's Office, 1640Maika J. PudaderaNo ratings yet

- External Links: 10.1002/9781119642497.ch80 "Personal Finance"Document1 pageExternal Links: 10.1002/9781119642497.ch80 "Personal Finance"Maika J. PudaderaNo ratings yet

- Means of Financing: TradingDocument1 pageMeans of Financing: TradingMaika J. PudaderaNo ratings yet