Professional Documents

Culture Documents

Caselet For Section

Uploaded by

Medha Singh0 ratings0% found this document useful (0 votes)

12 views1 pageOriginal Title

Caselet for Section

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageCaselet For Section

Uploaded by

Medha SinghCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

FM Group Discussion for Mid-Term Exam – Caselet for Section I

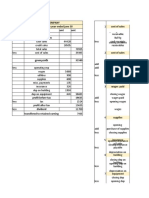

Shankar Jaikishan Enterprises is in the Groceries business and is considering two projects with identical

initial investments of Rs 6,00,000, but different expected future cash flows. As the table below shows,

the expected cash flows for Project A drop over time, but rise for Project B. The firm requires a 10%

return on its investments and is trying to decide on the feasibility of investing in these two projects.

Year Project A Rank Project B Rank

0 -6,00,000 -6,00,000

1 4,20,000 1,20,000

2 3,60,000 3,00,000

3 1,20,000 6,00,000

NPV @ 10% ₹ 1,54,087.84 2 ₹ 1,88,921.52 1

IRR 29% 1 25% 2

MIRR @ 10% Reinvestment Rate 20% 2 21% 1

Advise the company in view of the conflicting results (rankings) provided by different approaches.

You might also like

- Homework Week4Document6 pagesHomework Week4Baladashyalan Rajandran0% (1)

- Decision Trees: Ans.: Invest in Y Value Rs. 4,900Document5 pagesDecision Trees: Ans.: Invest in Y Value Rs. 4,900parthibandipanNo ratings yet

- Finance Practice ProblemsDocument54 pagesFinance Practice ProblemsMariaNo ratings yet

- Task 19Document3 pagesTask 19Medha SinghNo ratings yet

- Data Analysis For ManagersDocument8 pagesData Analysis For ManagersMedha SinghNo ratings yet

- FM: Assignment QuestionsDocument1 pageFM: Assignment QuestionsdvraoNo ratings yet

- Rahul Shah 21bsp3195Document24 pagesRahul Shah 21bsp3195Charvi GosaiNo ratings yet

- Rahul Shah 21bsp3195Document24 pagesRahul Shah 21bsp3195Charvi GosaiNo ratings yet

- Midterm Test April2021Document5 pagesMidterm Test April2021NURUL FATIN NABILA BINTI MOHD FADZIL (BG)No ratings yet

- Project Planning and Capital BudgetingDocument16 pagesProject Planning and Capital BudgetingtoabhishekpalNo ratings yet

- Capital Rationing 0u9sbal38rDocument3 pagesCapital Rationing 0u9sbal38rRising ThunderNo ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- Capital Budgeting For MSC Finance Basic Revision SumsDocument5 pagesCapital Budgeting For MSC Finance Basic Revision SumskimjethaNo ratings yet

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Ejercicios Semana 3 Sesión 1 B (Evaluación de Proyectos)Document3 pagesEjercicios Semana 3 Sesión 1 B (Evaluación de Proyectos)Alison Joyce Herrera Maldonado0% (1)

- UNIT-II-Problems On Capital BudgetingDocument2 pagesUNIT-II-Problems On Capital BudgetingGlyding FlyerNo ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- Cash Flow Probability Cash Flow Probability Proj A Proj B Proj A Year Project A Project B Expected Value Discount Rate PV (Encf)Document10 pagesCash Flow Probability Cash Flow Probability Proj A Proj B Proj A Year Project A Project B Expected Value Discount Rate PV (Encf)hardik100No ratings yet

- Techniques For Risk AnalysisDocument7 pagesTechniques For Risk AnalysisshahiankitNo ratings yet

- Assignment Ch2Document7 pagesAssignment Ch2Ashraf Seif El-NasrNo ratings yet

- AFM - IMM 110 (II) April 20, 2021Document3 pagesAFM - IMM 110 (II) April 20, 2021Aashish RanjanNo ratings yet

- Previous Year Question Paper (F.M)Document10 pagesPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- Practice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Document3 pagesPractice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Sumit Kumar SahooNo ratings yet

- Chapter - 10 - Capital Budgeting DecisionsDocument17 pagesChapter - 10 - Capital Budgeting DecisionsVishwa ShahNo ratings yet

- Introduction To SFAD (Class1)Document17 pagesIntroduction To SFAD (Class1)Asmer KhanNo ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- Tybms Sem Vi SFM AsssignmentDocument1 pageTybms Sem Vi SFM AsssignmentGauri SawantNo ratings yet

- SFM - 1Document3 pagesSFM - 1ketulNo ratings yet

- Wishways Assessment - 1 - Business FinanceDocument12 pagesWishways Assessment - 1 - Business Financewishways srinivasNo ratings yet

- Tutorial 4 - Investment AppraisalDocument3 pagesTutorial 4 - Investment AppraisalAmy LimnaNo ratings yet

- Practice SheetDocument2 pagesPractice Sheetishapnil 63No ratings yet

- Monte Carlo Simulation and Risk Assessment in Capital BugetingDocument19 pagesMonte Carlo Simulation and Risk Assessment in Capital BugetingEin LuckyNo ratings yet

- Investment Appraisal TutorialDocument6 pagesInvestment Appraisal TutorialQin Yi NgNo ratings yet

- Financial Management End Term Paper - Batch 2020-22Document4 pagesFinancial Management End Term Paper - Batch 2020-22Swastik NayakNo ratings yet

- Assignment For Kohat University Ralated With Asif JevedDocument8 pagesAssignment For Kohat University Ralated With Asif JevedAfaq IffiNo ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet

- Set ADocument3 pagesSet AManish KumarNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- FM - Assignment 2 (Capital Budgeting) - 2019-2021Document3 pagesFM - Assignment 2 (Capital Budgeting) - 2019-2021dangerous saif100% (1)

- Cap Budg QuestionsDocument6 pagesCap Budg QuestionsSikandar AsifNo ratings yet

- Class 12 Accountancy Practical Sample Paper 4Document1 pageClass 12 Accountancy Practical Sample Paper 4Rahul singh device &techNo ratings yet

- Finance Questions 3Document2 pagesFinance Questions 3asma raeesNo ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Chapter 6 - Capital BudgetingDocument40 pagesChapter 6 - Capital Budgetingsymtgywsq8No ratings yet

- Chapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsDocument20 pagesChapter 4 Capital Budgeting Techniques 2021 - Practice ProblemsAkshat SinghNo ratings yet

- Chapter 2. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 2. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- FM IISolutionsDocument4 pagesFM IISolutionsSonakshi BhatiaNo ratings yet

- Fundamental of Partnership (Part 4)Document11 pagesFundamental of Partnership (Part 4)Sanchit GargNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerSushmanth ReddyNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Assignment - 1 (Capital Budgeting)Document3 pagesAssignment - 1 (Capital Budgeting)AnusreeNo ratings yet

- 04 Receivables - Additional DrillsDocument2 pages04 Receivables - Additional DrillsRazel MhinNo ratings yet

- 7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BDocument15 pages7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BManish MishraNo ratings yet

- Mba202 - Financial ManagementDocument3 pagesMba202 - Financial ManagementArvind KNo ratings yet

- Problems CF2Document7 pagesProblems CF2TrinhNo ratings yet

- Discounted Cash Flow - 082755Document3 pagesDiscounted Cash Flow - 082755EuniceNo ratings yet

- VND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Document4 pagesVND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Rohit Singh RajputNo ratings yet

- TAGUCI-MA Business Alternatives-Hanan SalmanDocument19 pagesTAGUCI-MA Business Alternatives-Hanan SalmanHanan LutfiNo ratings yet

- Business Finance II: Exercise 1Document7 pagesBusiness Finance II: Exercise 1faisalNo ratings yet

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- Chapter 5. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 5. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- FAMDocument22 pagesFAMMedha SinghNo ratings yet

- 5.8 Fifo Purchase Sales Balance Date Units Cost P.U Total Cost Units Cost P.U Total Cost Units Cost P.UDocument6 pages5.8 Fifo Purchase Sales Balance Date Units Cost P.U Total Cost Units Cost P.U Total Cost Units Cost P.UMedha SinghNo ratings yet

- BV Cia IiiDocument33 pagesBV Cia IiiMedha SinghNo ratings yet

- Connecting Each Macro-Economic IndicatorsDocument7 pagesConnecting Each Macro-Economic IndicatorsMedha SinghNo ratings yet

- SWOT Analysis of Green Economy in IndiaDocument1 pageSWOT Analysis of Green Economy in IndiaMedha SinghNo ratings yet

- Task 17Document7 pagesTask 17Medha SinghNo ratings yet

- School of Business and Management Christ (Deemed To Be University) BangaloreDocument8 pagesSchool of Business and Management Christ (Deemed To Be University) BangaloreMedha Singh100% (1)

- Portfolio Management Through Mutual FundsDocument14 pagesPortfolio Management Through Mutual FundsMedha SinghNo ratings yet

- Swot Analysis of Asset Classes Equity Strength WeaknessDocument8 pagesSwot Analysis of Asset Classes Equity Strength WeaknessMedha SinghNo ratings yet

- Your Personal InformationDocument14 pagesYour Personal InformationMedha SinghNo ratings yet

- Industry Profile of Financial Service IndustryDocument7 pagesIndustry Profile of Financial Service IndustryMedha SinghNo ratings yet

- Assignment: 3 (Medha Singh 127/3A2) : Types of Financial MarketDocument5 pagesAssignment: 3 (Medha Singh 127/3A2) : Types of Financial MarketMedha SinghNo ratings yet

- OST Report 1420145Document27 pagesOST Report 1420145Medha SinghNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentMedha SinghNo ratings yet

- Sapm CaseletDocument6 pagesSapm CaseletMedha SinghNo ratings yet

- Ost UpdateDocument78 pagesOst UpdateMedha SinghNo ratings yet

- DAFMDocument13 pagesDAFMMedha SinghNo ratings yet

- Maynard Company Income Statement For The Year Ended June 30 Cost of Sales Particulars Amt AmtDocument24 pagesMaynard Company Income Statement For The Year Ended June 30 Cost of Sales Particulars Amt AmtMedha SinghNo ratings yet

- 7 Habits of Highly Effective PeopleDocument6 pages7 Habits of Highly Effective PeopleMedha SinghNo ratings yet

- Impact of Covid - 19Document4 pagesImpact of Covid - 19Medha SinghNo ratings yet

- Repo Rate AND Reverse Repo RateDocument12 pagesRepo Rate AND Reverse Repo RateMedha SinghNo ratings yet

- Final PPT AuditDocument29 pagesFinal PPT AuditMedha SinghNo ratings yet

- Functional ManagementDocument2 pagesFunctional ManagementMedha SinghNo ratings yet

- Moral Values AND Character Building: Name: Medha Singh Year Roll No.127 Serial No. 15Document10 pagesMoral Values AND Character Building: Name: Medha Singh Year Roll No.127 Serial No. 15Medha SinghNo ratings yet