Professional Documents

Culture Documents

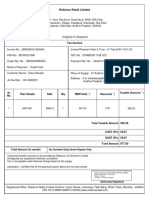

Tax Invoice: Quikr India PVT LTD

Uploaded by

V.B. Loganathan Loganathan0 ratings0% found this document useful (0 votes)

85 views1 pageQuikr India Pvt Ltd has issued a tax invoice to Loganathan VB for convenience fees of Rs. 502.54. The invoice includes details of the customer such as name, address, GSTIN and contact information. It also provides the HSN code, taxable value, SGST, CGST and total amount due of Rs. 593.

Original Description:

Health

Original Title

016323

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentQuikr India Pvt Ltd has issued a tax invoice to Loganathan VB for convenience fees of Rs. 502.54. The invoice includes details of the customer such as name, address, GSTIN and contact information. It also provides the HSN code, taxable value, SGST, CGST and total amount due of Rs. 593.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

85 views1 pageTax Invoice: Quikr India PVT LTD

Uploaded by

V.B. Loganathan LoganathanQuikr India Pvt Ltd has issued a tax invoice to Loganathan VB for convenience fees of Rs. 502.54. The invoice includes details of the customer such as name, address, GSTIN and contact information. It also provides the HSN code, taxable value, SGST, CGST and total amount due of Rs. 593.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

TAX INVOICE

Quikr India Pvt Ltd.

Gunta No. 106, Sub No. 5, 6, 7, 8 & 9, Rachenahalli, (No. 167, Dr. S.R.K. Nagar Post), Krishnarajapuram

Hobli, Bangalore – 560045

Email: contact@quikr.com Website: contact@quikr.com

GSTIN: 29AACCK7004R1Z1 CIN: U74130KA2005PTC087280

Customer Name: Nature of Invoice : Original

Customer Address: # N89/1, 4th Cross, Nagappa Block, Behind Albek Invoice No :

Hotel, Srirampuram Post. C2C/OCT18/016323

State: Karnataka Invoice Date : 30-Oct-2018

Pin Code: 560021 Nature of Transaction : INTRA-STATE

Email Id: loganathanvb2@gmail.com Customer Type: : Unregistered

Mobile No: 9035170899 Nature of Supply: : Services

GSTIN / UID: Place of Supply: : Karnataka

HSN/ SA CODE Description Base Price Discount Net Taxable Value

999799 - Other

Convenience Fees 502.54 0.00 502.54

services

Subtotal 502.54

SGST : 9.0% 45.23

CGST : 9.0% 45.23

Total 593.00

Whether Tax to be paid by Recipient under Reverse Charge NO

Certified that the particulars given in the invoice are true and correct.

If you have any question about this invoice, please contact doorstep@quikr.com or 080-67364545.

Declaration: This purchase is intended for end user consumption and not for resale.

For Quikr India Pvt. Ltd.

Authorised Signatory

You might also like

- Ak 1991884221-1560333289 PDFDocument1 pageAk 1991884221-1560333289 PDFKuchibhotla Madhava SastryNo ratings yet

- Invoice - 11380391 PDFDocument1 pageInvoice - 11380391 PDFGREEN LIFENo ratings yet

- TK 321061036 Q 27Document1 pageTK 321061036 Q 27sanjaychourasia2001No ratings yet

- Tax Invoice: Advance Receipt Voucher NoDocument2 pagesTax Invoice: Advance Receipt Voucher NokmuraliNo ratings yet

- NC78691577813083Document2 pagesNC78691577813083spganeNo ratings yet

- CombinepdfDocument4 pagesCombinepdfmurali.trichyNo ratings yet

- TK406204138 C 67Document1 pageTK406204138 C 67BHERI USHANo ratings yet

- Item Invoice DownloadDocument3 pagesItem Invoice DownloadA. SinghaniaNo ratings yet

- Item Invoice DownloadDocument3 pagesItem Invoice DownloadA. SinghaniaNo ratings yet

- Item Invoice DownloadDocument3 pagesItem Invoice DownloadA. SinghaniaNo ratings yet

- CVQ23 12574Document3 pagesCVQ23 12574Pawan MishraNo ratings yet

- Caf DeliveryDocument5 pagesCaf Deliveryprem.sNo ratings yet

- Cargo Royal September 2023Document1 pageCargo Royal September 2023Hindi BoyNo ratings yet

- Tax Invoice: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesTax Invoice: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total Amountmohan SNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoicePari JaiswalNo ratings yet

- Myntra 6Document3 pagesMyntra 6Prapti ShahNo ratings yet

- serviceCustomerInvoice 2297 2023 10 25 serviceCustomerInvoice-b95cadc9-2297-6cf15573 1c80 4597 bf22 336ccecfeacbs36DU3l0fb-5039332339Document1 pageserviceCustomerInvoice 2297 2023 10 25 serviceCustomerInvoice-b95cadc9-2297-6cf15573 1c80 4597 bf22 336ccecfeacbs36DU3l0fb-5039332339saksham kapoorNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoiceJadhao AjinkyaNo ratings yet

- Internet Bill October 2019 March 2020Document4 pagesInternet Bill October 2019 March 2020Prashanshu100% (1)

- TaxInvoice 10412726Document2 pagesTaxInvoice 1041272619UBCA020 HARIHARAN KNo ratings yet

- Purchase Receipt 934883Document1 pagePurchase Receipt 934883Aryan VermaNo ratings yet

- Service Customer InvoiceDocument1 pageService Customer InvoiceorgancorpNo ratings yet

- Tax Invoice: Original - CustomerDocument1 pageTax Invoice: Original - Customerneeraj kumarNo ratings yet

- A Printer NerDocument1 pageA Printer NerKarthik2No ratings yet

- Vedantu 01122019 9850Document2 pagesVedantu 01122019 9850Ankit Nandy100% (1)

- NH7510915568400 1Document2 pagesNH7510915568400 1Manthan ShahNo ratings yet

- Service Customer InvoiceDocument1 pageService Customer InvoiceorgancorpNo ratings yet

- Caf DeliveryDocument4 pagesCaf Deliveryprem.sNo ratings yet

- Get Invoice Print 74Document2 pagesGet Invoice Print 74jepsi007No ratings yet

- Service Customer in VoiceDocument1 pageService Customer in VoiceDhayananthNo ratings yet

- MOBILEDocument1 pageMOBILElokeshNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoicerangersuhaibNo ratings yet

- Tax InvoiceDocument3 pagesTax Invoiceabhist9905No ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceBhavesh GuptaNo ratings yet

- Tax Invoice: Cariot Auto Private LimitedDocument2 pagesTax Invoice: Cariot Auto Private Limitedfiatlinea3689No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)rajuNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceorgancorpNo ratings yet

- Myntra 2Document2 pagesMyntra 2Prapti ShahNo ratings yet

- Caf DeliveryDocument4 pagesCaf Deliveryprem.sNo ratings yet

- 86402055Document1 page86402055tsplNo ratings yet

- Service Customer in VoiceDocument1 pageService Customer in VoiceRani GuptaNo ratings yet

- InvoiceDocument2 pagesInvoiceDeepeshwar KumarNo ratings yet

- Caf DeliveryDocument4 pagesCaf Deliveryprem.sNo ratings yet

- Invoice Feb 2022Document1 pageInvoice Feb 2022Azeem KhaliphaNo ratings yet

- Tax in VoiceDocument2 pagesTax in VoiceAkAnKsHa BaLiNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoiceKrishNo ratings yet

- InvoiceDocument1 pageInvoiceG-vision CCTV worksNo ratings yet

- 25 May BusDocument1 page25 May BussagaranacondaNo ratings yet

- FEB InvoiceHistoryDocument1 pageFEB InvoiceHistoryUday SaiNo ratings yet

- Tax Invoice: Customer Information Payment BreakupDocument1 pageTax Invoice: Customer Information Payment Breakupsumit patelNo ratings yet

- Service Customer in VoiceDocument1 pageService Customer in VoicerimeodkharNo ratings yet

- Trips Hotel DownloadETicketDocument2 pagesTrips Hotel DownloadETicketHeart Touching VideosNo ratings yet

- Service Customer InvoiceDocument1 pageService Customer Invoicekhansanku5420No ratings yet

- BC23000123Document1 pageBC23000123azharNo ratings yet

- Tax Invoice: MOB 9964643390 State Name: Karnataka, Code: 29Document2 pagesTax Invoice: MOB 9964643390 State Name: Karnataka, Code: 29Nagabhushana HNo ratings yet

- Service Customer in VoiceDocument1 pageService Customer in VoiceHarsh RajNo ratings yet

- Bill7-874 - 1Document2 pagesBill7-874 - 1harshoffice29No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Can Crystal Power Cells Outlast Alkaline Batteries?: 2015 Project SummaryDocument1 pageCan Crystal Power Cells Outlast Alkaline Batteries?: 2015 Project SummaryV.B. Loganathan LoganathanNo ratings yet

- A. Heading 2Document1 pageA. Heading 2V.B. Loganathan LoganathanNo ratings yet

- Anboli Tam - Receipt PDFDocument1 pageAnboli Tam - Receipt PDFV.B. Loganathan LoganathanNo ratings yet

- Urydgtuostaru??????Document26 pagesUrydgtuostaru??????V.B. Loganathan LoganathanNo ratings yet

- GGHGHTFHJDocument108 pagesGGHGHTFHJV.B. Loganathan LoganathanNo ratings yet

- Yoga - Ultimate Need For Entire Humaninty: Naveya Y. NDocument6 pagesYoga - Ultimate Need For Entire Humaninty: Naveya Y. NV.B. Loganathan LoganathanNo ratings yet

- Pot Cores (5698362321) : Catalog Drawing 3D ModelDocument2 pagesPot Cores (5698362321) : Catalog Drawing 3D ModelV.B. Loganathan LoganathanNo ratings yet

- Collins Talking Points MB PDFDocument4 pagesCollins Talking Points MB PDFV.B. Loganathan LoganathanNo ratings yet

- MusicDocument8 pagesMusicV.B. Loganathan LoganathanNo ratings yet

- Pot Cores (5698221421) : Catalog Drawing 3D ModelDocument2 pagesPot Cores (5698221421) : Catalog Drawing 3D ModelV.B. Loganathan LoganathanNo ratings yet

- GANS Pack With Health Protocols TestimonialsDocument29 pagesGANS Pack With Health Protocols TestimonialsV.B. Loganathan LoganathanNo ratings yet

- Sky Chapter 4Document25 pagesSky Chapter 4Murugan Bhagavathi100% (1)

- Who's Spying On Your Computer?: Spyware, Surveillance, and Safety For SurvivorsDocument4 pagesWho's Spying On Your Computer?: Spyware, Surveillance, and Safety For SurvivorsV.B. Loganathan LoganathanNo ratings yet