Professional Documents

Culture Documents

Case 1 CVP

Uploaded by

Hiba N IkhmyesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 1 CVP

Uploaded by

Hiba N IkhmyesCopyright:

Available Formats

C/MAcases/Merrion Products

Management Accounting Case:

Merrion Products Limited

Author: Peter Clarke, UCD Business School, Dublin

Key words: Decision making with Limiting Factors (Constraints)

Introduction

Merrion Products Limited is a company owned by the Carroll family. The company

manufactures hand-made chocolate biscuits from imported South American cocoa,

which are sold to a small number of large retail outlets in the local area. When the

company was founded some years ago, a single plain chocolate biscuit (Type A) was

manufactured and resulting profits were adequate to satisfy the family shareholders.

A few years later, it was decided to introduce new chocolate biscuits, using the same

cocoa, but refined in different ways to suit different consumer tastes. These

additional products are referred to (hereunder) as Type B, C and D respectively and

each are sold in the same size biscuit tin. The company is now the brand leader in the

segment for home-made, quality biscuits made from real cocoa and the company

has always been able to meet demand for its four products.

Not surprisingly, the audited financial statements of Merrion Products Limited

indicated that the company generated satisfactory operating profits with strong cash

flow. The various family members concentrated mainly on the administrative and

selling side of the business. Each family member was paid a basic salary and, in

addition, they all shared a sales commission of 10% of total sales revenue for the

year.

Members of the Carroll family agree that the company's profitability was mainly

attributable to two factors. The first factor was the high quality of its products with a

guaranteed delivery date to various retail outlets. Michael Carroll, the managing

director of the firm, often boasted that the number of customer complaints in any

one year could be counted on the fingers of one hand. The second reason for its

success was due to subtle marketing and presentation so that each product type was

perceived by potential customers as different. While the ingredients and production

methods were similar, they were not considered complementary products and each

had their own brand loyalty. Thus, the sales of one product could fluctuate without

affecting the sales of the other products, or the refusal of orders for one product

would not lead to cancellation of orders for other product types.

The current problem

An important feature of each biscuit type was that the chocolate coating was made

from the best South American cocoa available. Until recently this raw material was

© Peter Clarke, 2014 1

C/MAcases/Merrion Products

available in unlimited quantities and was purchased by Merrion Products quarterly in

advance as required. However, recent political instability in the exporting country

resulted in a restricted availability of cocoa. Michael Carroll, the managing director,

called a meeting to discuss the problem and its impact on the budget for the

forthcoming quarter.

At the start of the meeting Michael Carroll explained, "Unfortunately our worst

suspicions have been confirmed. I saw things at first hand and also had discussions

with our Embassy officials. I made direct contact with our usual supplier of cocoa and

he indicated that, at current prices, he will be unable to deliver more than €72,000 of

raw materials per quarter until conditions improve. Simply, the supply of cocoa is

restricted due to the current political situation in the host country and a bad harvest.

Since my return home I have made extensive enquiries regarding possible alternative

supplies but they are not available in the short-term. We've just got to accept it for

now!"

Una Carroll, the only daughter in the family, filled the role of company accountant.

After obtaining a business studies degree she joined the family firm. Her role was to

monitor progress against budget targets. Generally, the actual financial performance

met the budget targets pretty well. Una knew from experience that as long as

budgeted profit was higher than last year then everyone was happy. However, the

budget setting process for each quarter was unsophisticated in that output levels

were determined by amiable consensus among family members. Preference was

usually given to the highest priced product type since this procedure maximized sales

commission for the family members. After discussion she argued that “our budgets

for the next quarter shall have to be carefully prepared”. She circulated basic cost

and operating data for the forthcoming quarter, based on previous estimates (Exhibit

1).

Una continued "In my opinion there is little scope for any reduction in costs. We

can't change, at least in the short term, our direct material costs. All our other

production costs are already down to an absolute minimum. Sales commission is the

only thing that we could effectively cut."

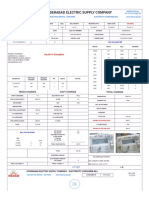

Exhibit 1: Schedule of costs and operating data for quarter.

A B C D Total

Budget sales (tins) 1,500 2,000 2,000 1,500 7,000

Per unit (tin of biscuits) A B C D

Sales price per tin €20 €40 €30 €20 n/a

Direct material (cocoa €(7) €(16) €(13) €(10) n/a

imported)

Other ingredients €(3) €(4) €(6) €(4) n/a

Production overhead (variable) €(2) €(4) €(4) €(2) n/a

Production overhead (fixed) €(1) €(2) €(2) €(1) n/a

Total production cost per tin €13 €26 €25 €17 n/a

© Peter Clarke, 2014 2

C/MAcases/Merrion Products

Non-production costs (per quarter):

Selling costs including commission €25,700

Administration costs €19,900

Interest expense €800

Total non-production costs €46,400

Michael Carroll interjected. "No, I recommend that the sales commission be left

alone. We're all in this venture together and I reckon we're going to have to sell our

way out of our problem. We should keep our selling prices intact and we need to

retain the incentive to sell as much as we can."

Everyone agreed. Patrick Carroll, the eldest member of the family, who acted as the

marketing manager, raised the possibility of maximum sales levels of each product,

given that current selling prices were to be maintained, due to contracts already

signed and said: "We must take into consideration that there is a limit on the amount

of goods that we can sell at existing prices next quarter." Michael Carroll accepted

that the point was valid. After much discussion all family members agreed that the

maximum sales value of each product at current prices for the forthcoming quarter

would be as follows:

Product type €

A 60,000

B 88,000

C 63,000

D 40,000

Subsequently everyone at the meeting realized that the shortage of cocoa would

restrict production so that the above (maximum) sales could not be achieved.

Michael Carroll added "I think we shall have to be more selective in what we produce

in future. However, I recommend that we produce a minimum of 1,000 tins of each

product during the forthcoming quarter. This would comply with legal agreements

which we have already signed for the next quarter and also keep the company's

products in the minds of the public. Una, now is the ideal time to put some of that

theory of yours into practice. If you feel that there is a single, best way to utilize our

production facilities in these circumstances now is the ideal time to let us know."

Everyone agreed and the meeting adjourned.

Una sighed and reached for her pencil and calculator.

Requirements

1. Prepare a statement showing the most profitable production plan for

Merrion Products Limited for the forthcoming quarter. Prepare an income

statement to accompany your recommendation. Explain your workings.

© Peter Clarke, 2014 3

C/MAcases/Merrion Products

2. Calculate the firm's break-even point for the forthcoming quarter, based on

your calculations in 1. above. What fundamental assumptions have you

made?

3. What is the "opportunity cost", if any, associated with the minimum

production of 1,000 tins of each product type?

4. Assuming it was possible to increase all selling prices by €7 per tin without

influencing demand, would this price increase impact on your analysis?

Explain. (It is not necessary to rework your optimal production plan).

© Peter Clarke, 2014 4

You might also like

- Merrion Products LTDDocument3 pagesMerrion Products LTDfbuameNo ratings yet

- Merrion Products Ltd Faces Raw Material ShortageDocument3 pagesMerrion Products Ltd Faces Raw Material ShortageHiba N IkhmyesNo ratings yet

- Workshop Lecture 6 QsDocument5 pagesWorkshop Lecture 6 QsabhirejanilNo ratings yet

- Practice Version - Advanced Problem Solving Test: Mckinsey & CompanyDocument12 pagesPractice Version - Advanced Problem Solving Test: Mckinsey & CompanyPavel TsarevskyNo ratings yet

- TIP Relevant Costing Ex TipDocument10 pagesTIP Relevant Costing Ex TipmaurNo ratings yet

- Lecture MarketingDocument7 pagesLecture MarketingRolan Manuel PaduaNo ratings yet

- MAS 03 CVP AnalysisDocument4 pagesMAS 03 CVP AnalysisJoelyn Grace MontajesNo ratings yet

- Chapter 6Document10 pagesChapter 6Tariku KolchaNo ratings yet

- Managerial Accounting Practice Questions Set 1Document5 pagesManagerial Accounting Practice Questions Set 1BawakNo ratings yet

- Mock Paper 1 Process Variacne and Budget With Answers MTQ Batch 2 BI 2014Document12 pagesMock Paper 1 Process Variacne and Budget With Answers MTQ Batch 2 BI 2014Zaira AneesNo ratings yet

- Ch. 9 Production and ProductivityDocument6 pagesCh. 9 Production and ProductivityHANNAH GODBEHERENo ratings yet

- Soal Mojakoe Akuntansi Manajemen UTS Genap 2019 2020Document6 pagesSoal Mojakoe Akuntansi Manajemen UTS Genap 2019 2020Adi NugrohoNo ratings yet

- Soal Uts Abm 2 - Sesi 1Document2 pagesSoal Uts Abm 2 - Sesi 1alyaa rabbaniNo ratings yet

- PST2001 Without SolutionsDocument7 pagesPST2001 Without SolutionsMatteo CalonaciNo ratings yet

- 3420 - Midterm Review QuestionsDocument11 pages3420 - Midterm Review QuestionsANKIT SHARMANo ratings yet

- F5 PM Jun21 - Mock 1Document18 pagesF5 PM Jun21 - Mock 1Lalan JaiswalNo ratings yet

- Basic Micro Econ - Semi Final ModuleDocument11 pagesBasic Micro Econ - Semi Final ModuleCristy RamboyongNo ratings yet

- Cost Accounting 2Document1 pageCost Accounting 2ExequielCamisaCrusperoNo ratings yet

- Fill in The Blanks by Using The Words or Phrases Given BelowDocument8 pagesFill in The Blanks by Using The Words or Phrases Given BelowhokageNo ratings yet

- Final Exam, s1, 2018-FINAL PDFDocument14 pagesFinal Exam, s1, 2018-FINAL PDFShivneel NaiduNo ratings yet

- Managerial Accounting Practice Problems2 PDFDocument9 pagesManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- All But 7Document6 pagesAll But 7bestmoosena100% (2)

- Islamic Univ. of Gaza Advanced Managerial Accounting Final Exam Break-Even AnalysisDocument3 pagesIslamic Univ. of Gaza Advanced Managerial Accounting Final Exam Break-Even AnalysisRabah ElmasriNo ratings yet

- JC and BP SeatworkDocument4 pagesJC and BP SeatworkJhoana HernandezNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisAnne BacolodNo ratings yet

- Higher Accounting Decision Making Pupil Notes & TasksDocument21 pagesHigher Accounting Decision Making Pupil Notes & Tasksrerhans1No ratings yet

- Relevant Costs (Part 2) : F. M. KapepisoDocument21 pagesRelevant Costs (Part 2) : F. M. KapepisosimsonNo ratings yet

- Heriot-Watt University Accounting - December 2015 Section II Case Studies Case Study 1Document5 pagesHeriot-Watt University Accounting - December 2015 Section II Case Studies Case Study 1sanosyNo ratings yet

- Break Even WorksheetDocument12 pagesBreak Even WorksheetDipti BhundiaNo ratings yet

- ExerciseDocument3 pagesExerciseK61CA Cao Nguyễn Hạnh ChâuNo ratings yet

- A Project Report ON Cost Sheet Analysis OF Coca - Cola: Institute of Technology and ManagementDocument11 pagesA Project Report ON Cost Sheet Analysis OF Coca - Cola: Institute of Technology and Managementkattyperrysherry33% (3)

- KamoptikoDocument1 pageKamoptikoSarah BoisrondNo ratings yet

- Vince's Pizza Break-Even Analysis & Profit TargetDocument1 pageVince's Pizza Break-Even Analysis & Profit TargetNelzen GarayNo ratings yet

- 10Document2 pages10AlexNo ratings yet

- Anjlo LTDDocument3 pagesAnjlo LTDHafiz Waqas100% (1)

- Accounting For Joint and By-ProductsDocument16 pagesAccounting For Joint and By-ProductsElla DavisNo ratings yet

- f5 Mock 1Document20 pagesf5 Mock 1Salome farrenNo ratings yet

- Foundation of Microeconomics-Consumers and Firms v1Document37 pagesFoundation of Microeconomics-Consumers and Firms v1RAYMUND JOHN ROSARIONo ratings yet

- Advanced Problem Solving TestDocument10 pagesAdvanced Problem Solving TestMikhail DomanovNo ratings yet

- From Kitchen to Consumer: The Entrepreneur's Guide to Commercial Food PreparationFrom EverandFrom Kitchen to Consumer: The Entrepreneur's Guide to Commercial Food PreparationRating: 3 out of 5 stars3/5 (1)

- Zero-Gapped: HOW TO RAISE YOUR BARBERSHOP PERFORMANCE USING TRIED AND TESTED GROWTH HACKING STRATEGIESFrom EverandZero-Gapped: HOW TO RAISE YOUR BARBERSHOP PERFORMANCE USING TRIED AND TESTED GROWTH HACKING STRATEGIESNo ratings yet

- The Cost of Doing Business Study, 2019 EditionFrom EverandThe Cost of Doing Business Study, 2019 EditionNo ratings yet

- Model Answer: Launch of a laundry liquid detergent in Sri LankaFrom EverandModel Answer: Launch of a laundry liquid detergent in Sri LankaNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Embarrassment of Product Choices 1: How to Consume DifferentlyFrom EverandEmbarrassment of Product Choices 1: How to Consume DifferentlyNo ratings yet

- Building Brand Equity: The Importance, Examples & How to Measure ItFrom EverandBuilding Brand Equity: The Importance, Examples & How to Measure ItNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Summary of B. Joseph Pine II & James H. Gilmore's The Experience Economy, With a New Preface by the AuthorsFrom EverandSummary of B. Joseph Pine II & James H. Gilmore's The Experience Economy, With a New Preface by the AuthorsRating: 3 out of 5 stars3/5 (1)

- Products that Last: Product Design for Circular Business ModelsFrom EverandProducts that Last: Product Design for Circular Business ModelsNo ratings yet

- Accelerating the Incubation and Commercialisation of Innovative Energy Solutions in the EU and China: Joint Statement Report Series, #5From EverandAccelerating the Incubation and Commercialisation of Innovative Energy Solutions in the EU and China: Joint Statement Report Series, #5No ratings yet

- The Brandgym, third edition: A Practical Workout to Grow Your Brand in a Digital AgeFrom EverandThe Brandgym, third edition: A Practical Workout to Grow Your Brand in a Digital AgeNo ratings yet

- The Key to Higher Profits: Pricing PowerFrom EverandThe Key to Higher Profits: Pricing PowerRating: 5 out of 5 stars5/5 (1)

- Introduction to Dynamic Macroeconomic General Equilibrium ModelsFrom EverandIntroduction to Dynamic Macroeconomic General Equilibrium ModelsNo ratings yet

- 200 Ideas To Improve The Profitability Of Your PharmacyFrom Everand200 Ideas To Improve The Profitability Of Your PharmacyRating: 5 out of 5 stars5/5 (1)

- Biochemistry of Lipids OutlineDocument51 pagesBiochemistry of Lipids OutlineHiba N IkhmyesNo ratings yet

- 2-Biochemistry of Proteins 8-8-2020Document27 pages2-Biochemistry of Proteins 8-8-2020Hiba N IkhmyesNo ratings yet

- 3-Hemoglobin and Fibrous Protein 20-10-2020Document55 pages3-Hemoglobin and Fibrous Protein 20-10-2020Hiba N IkhmyesNo ratings yet

- 6-Glycosaminoglycans 9-11-2020Document22 pages6-Glycosaminoglycans 9-11-2020Hiba N IkhmyesNo ratings yet

- Biochemistry 1: - Biochemistry of Amino Acids - Biochemistry of Proteins - Portrait of Allosteric ProteinDocument55 pagesBiochemistry 1: - Biochemistry of Amino Acids - Biochemistry of Proteins - Portrait of Allosteric ProteinHiba N IkhmyesNo ratings yet

- Biochemistry of Amino Acids - Biochemistry of Proteins - Portrait of Allosteric Protein - EnzymesDocument32 pagesBiochemistry of Amino Acids - Biochemistry of Proteins - Portrait of Allosteric Protein - EnzymesHiba N IkhmyesNo ratings yet

- Merrion Products Ltd teaching case focuses on decision making with scarce resourcesDocument3 pagesMerrion Products Ltd teaching case focuses on decision making with scarce resourcesHiba N IkhmyesNo ratings yet

- 8-Plasma Membranes 28-7-2020Document37 pages8-Plasma Membranes 28-7-2020Hiba N IkhmyesNo ratings yet

- 297-Article Text (Editorial Production) - 394-1-10-20190726 PDFDocument10 pages297-Article Text (Editorial Production) - 394-1-10-20190726 PDFHiba N IkhmyesNo ratings yet

- Information: Examining The E and Information Adoption On Purchase Intentions in An Accelerated Digital Marketing ContextDocument12 pagesInformation: Examining The E and Information Adoption On Purchase Intentions in An Accelerated Digital Marketing ContextHiba N IkhmyesNo ratings yet

- Addressing Competition and Driving GrowthDocument12 pagesAddressing Competition and Driving GrowthHiba N IkhmyesNo ratings yet

- Smart Digital Marketing Capabilities For Sustainable Property Development: A Case of MalaysiaDocument40 pagesSmart Digital Marketing Capabilities For Sustainable Property Development: A Case of MalaysiaHiba N IkhmyesNo ratings yet

- Trends in digital marketing tools: AI, video marketing and chatbotsDocument8 pagesTrends in digital marketing tools: AI, video marketing and chatbotsHiba N IkhmyesNo ratings yet

- Week 3 Induction and DeductionDocument1 pageWeek 3 Induction and DeductionHiba N IkhmyesNo ratings yet

- Addressing Competition and Driving GrowthDocument12 pagesAddressing Competition and Driving GrowthHiba N IkhmyesNo ratings yet

- Addressing Competition and Driving GrowthDocument35 pagesAddressing Competition and Driving GrowthHiba N IkhmyesNo ratings yet

- MKT: 601 Chapter 12: Addressing Competition and Driving GrowthDocument14 pagesMKT: 601 Chapter 12: Addressing Competition and Driving GrowthHiba N IkhmyesNo ratings yet

- Chapter-1: Marketing Channels: Structure and Functions What Is Marketing Channel?Document3 pagesChapter-1: Marketing Channels: Structure and Functions What Is Marketing Channel?KaziRafiNo ratings yet

- Marketing Engineering of Durr StudyDocument3 pagesMarketing Engineering of Durr StudykumarNo ratings yet

- Discuss The Impact of KodakDocument7 pagesDiscuss The Impact of Kodakctsrinivas19No ratings yet

- Dupont Analysis of Adani Power: Particulars 2021 2020Document3 pagesDupont Analysis of Adani Power: Particulars 2021 2020Ananthasankar SNairNo ratings yet

- FI - Cross Currency Swap Theory and Practice (Nicholas Burgess) PDFDocument26 pagesFI - Cross Currency Swap Theory and Practice (Nicholas Burgess) PDFpierrefrancNo ratings yet

- Ruchi Ratan - Resume - NiftDocument1 pageRuchi Ratan - Resume - NiftKARISHMA RAJNo ratings yet

- BMME5103 Full Version Study Guide PDFDocument13 pagesBMME5103 Full Version Study Guide PDFWill NguyenNo ratings yet

- Hyderabad Electric Supply Company: Say No To CorruptionDocument2 pagesHyderabad Electric Supply Company: Say No To CorruptionSajid MallahNo ratings yet

- Sergio Sismondo - Ghost-Managed Medicine - Big Pharma's Invisible Hands (2018, Mattering Press)Document232 pagesSergio Sismondo - Ghost-Managed Medicine - Big Pharma's Invisible Hands (2018, Mattering Press)Rainy DayNo ratings yet

- Cabinet & Vanity Manufacturing in The US Industry ReportDocument38 pagesCabinet & Vanity Manufacturing in The US Industry ReportMarcel GozaliNo ratings yet

- Innovative Access To HSBC's Unique Network of FX LiquidityDocument2 pagesInnovative Access To HSBC's Unique Network of FX LiquidityDev GogoiNo ratings yet

- Managerial Economics & Business Strategy: Quantitative Demand AnalysisDocument34 pagesManagerial Economics & Business Strategy: Quantitative Demand AnalysisYousuf AboyaNo ratings yet

- Business Ethics and Entrepreneurship QuestionsDocument4 pagesBusiness Ethics and Entrepreneurship QuestionstreefreeNo ratings yet

- Cost Volume Profit AnalysisDocument32 pagesCost Volume Profit AnalysisADILLA ADZHARUDDIN100% (1)

- Prime Brokerage: J.P. Morgan MarketsDocument2 pagesPrime Brokerage: J.P. Morgan MarketsMarco PoloNo ratings yet

- Rawkat Literature ReviewDocument3 pagesRawkat Literature ReviewShadman Shahriar 1925389060No ratings yet

- Strategy Index 10 UpdateDocument1 pageStrategy Index 10 UpdateChanuka PrabhashNo ratings yet

- Economics Assingment - 1st Sem - Radhika KhaitanDocument20 pagesEconomics Assingment - 1st Sem - Radhika KhaitanSandeep TomarNo ratings yet

- Topic 7 A Contd Product Marketing.Document10 pagesTopic 7 A Contd Product Marketing.fshishspooferNo ratings yet

- E-Tailing Group 6Document56 pagesE-Tailing Group 6Cristy MaraNo ratings yet

- Product MarketingDocument4 pagesProduct MarketingJolina AnitNo ratings yet

- RMIT International University Vietnam BUSM 3311 - International BusinessDocument6 pagesRMIT International University Vietnam BUSM 3311 - International BusinessNguyễn Ngọc Đại KimNo ratings yet

- Stock Market Analysis FFM ProjectDocument28 pagesStock Market Analysis FFM ProjectqurautlainNo ratings yet

- LINKSMIND Ready To Go Digital PlansDocument16 pagesLINKSMIND Ready To Go Digital Plansjyotirmoy mondalNo ratings yet

- Wasim Khan: T.Y.Bba Seat No: 825Document13 pagesWasim Khan: T.Y.Bba Seat No: 825Mohasin_pathanNo ratings yet

- A Business PlanDocument34 pagesA Business PlanRizzi AngihanNo ratings yet

- Roelandt 1999 Cluster AnalysisDocument17 pagesRoelandt 1999 Cluster AnalysisAndra Andra BNo ratings yet

- Ice FiliDocument15 pagesIce Filivarun_gupta_86100% (1)

- Financial Markets and Institutions OverviewDocument43 pagesFinancial Markets and Institutions OverviewrudraarjunNo ratings yet

- NFLX MarketingDocument3 pagesNFLX Marketingmehtapg3140No ratings yet