Professional Documents

Culture Documents

Proof of Cash (Adjusted Balance Method)

Uploaded by

Dio NolascoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proof of Cash (Adjusted Balance Method)

Uploaded by

Dio NolascoCopyright:

Available Formats

REY OCAMPO ONLINE!

AUDITING PROBLEMS

Proof of Cash (Adjusted Balance Method)

You were able to obtain the following information during SOLUTION GUIDE:

your audit of Euro Company:

Bank

Reconciling items:

(B) (R) (D) (E)

Nov. 30 Dec. 31 11/30 Dec. Dec. 12/31

Undeposited collections P200,000 P120,000 Unadjusted bal.

Outstanding checks 80,000 60,000 DIT – 11/30

Customer’s notes collected by - 12/31

bank 100,000 120,000 OC – 11/30

Bank service charges 2,000 3,000 - 12/31

Erroneous bank debits 10,000 20,000 Error, Dr.–11/30

Erroneous bank credits 40,000 30,000 - 12/31

NSF checks not redeposited 5,000 7,000

Error, Cr.–11/30

Customer's check deposited

- 12/31

December 10, returned by

NSF check red.

bank on December 16

Adjusted bal.

marked NSF, and

redeposited immediately;

Books

no entry made on books for

return or redeposit 10,000 (B) (R) (D) (E)

11/30 Dec. Dec. 12/31

Unadjusted balances: Unadjusted bal.

Books ? 90,000 Note coll.– 11/30

Bank 230,000 ? - 12/31

BSC – 11/30

December Transactions: - 12/31

NSF check–11/30

Bank Books - 12/31

Receipts P420,000 P270,000

NSF check red.

Disbursements 500,000 407,000

Adjusted bal.

REQUIRED:

1. Prepare a 4-column bank reconciliation for the month

of December, using the form that reconciles both the

book and bank balances to a correct cash amount.

2. Adjusting entries as of December 31.

- end -

Page 1 of 1 www.prtc.com.ph

You might also like

- Bank Reconciliation BookkeepingDocument5 pagesBank Reconciliation BookkeepingJoyce Ericka P. BalonNo ratings yet

- Chapter 3 - Bank ReconciliationDocument2 pagesChapter 3 - Bank ReconciliationJerome_JadeNo ratings yet

- Chapter 111213Document8 pagesChapter 111213Angel Alejo Acoba0% (1)

- Ellen Company Cash Bank ReconciliationDocument8 pagesEllen Company Cash Bank ReconciliationShaine PacsonNo ratings yet

- Week 4 - Lesson 4 Cash and Cash EquivalentsDocument21 pagesWeek 4 - Lesson 4 Cash and Cash EquivalentsRose RaboNo ratings yet

- Financial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyDocument8 pagesFinancial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyJamhel MarquezNo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- Proof of Cash by Lailane PPTXDocument19 pagesProof of Cash by Lailane PPTXAnna Marie RevisadoNo ratings yet

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- HW On Cash ADocument7 pagesHW On Cash ARedNo ratings yet

- Reviewer in InventoriesDocument2 pagesReviewer in InventoriesNicole AutrizNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- Auditing - MIDTERM EXAMDocument9 pagesAuditing - MIDTERM EXAMmoNo ratings yet

- Summary For Account ReceivablesDocument6 pagesSummary For Account ReceivablesDevine Grace A. Maghinay100% (1)

- Financial Accounting - ReceivablesDocument7 pagesFinancial Accounting - ReceivablesKim Cristian MaañoNo ratings yet

- Answer Key Far Assessment Questionairre 1Document22 pagesAnswer Key Far Assessment Questionairre 1Johnfree VallinasNo ratings yet

- Calculate allowance for doubtful accounts for Barr CompanyDocument5 pagesCalculate allowance for doubtful accounts for Barr CompanyAbbygailNo ratings yet

- AIS Prelim ExamDocument4 pagesAIS Prelim Examsharielles /No ratings yet

- Partnership Formation Discussion ProblemsDocument2 pagesPartnership Formation Discussion ProblemsMicca AndraeNo ratings yet

- Cash With Cash EqualantDocument5 pagesCash With Cash EqualantkaviyapriyaNo ratings yet

- Cash AssignmentDocument2 pagesCash AssignmentRocelyn OrdoñezNo ratings yet

- Midterm Exam No. 1Document2 pagesMidterm Exam No. 1Anie Martinez100% (1)

- Ia1.activity 3Document1 pageIa1.activity 3kathie alegarme100% (1)

- INTACC Reviewer Cash and EquivalentsDocument9 pagesINTACC Reviewer Cash and EquivalentsCzarhiena SantiagoNo ratings yet

- Cash and Cash EquivalentDocument5 pagesCash and Cash EquivalentPau SantosNo ratings yet

- AFAR06-01 Partnership AccountingDocument8 pagesAFAR06-01 Partnership AccountingEd MendozaNo ratings yet

- Pq-Cash and Cash EquivalentsDocument3 pagesPq-Cash and Cash EquivalentsJanella PatriziaNo ratings yet

- Tigg Mortgage's Accrued Interest Receivable on $200K LoanDocument4 pagesTigg Mortgage's Accrued Interest Receivable on $200K LoanMelody BautistaNo ratings yet

- AT - Activity - No. 8 - Substantive Testing - Axl Rome P. FloresDocument3 pagesAT - Activity - No. 8 - Substantive Testing - Axl Rome P. FloresDanielle VasquezNo ratings yet

- IntAcc Reviewer - Module 2 (Problems)Document26 pagesIntAcc Reviewer - Module 2 (Problems)Lizette Janiya SumantingNo ratings yet

- Audprob Cash2 Bsa4 2Document5 pagesAudprob Cash2 Bsa4 2Mark Gelo WinchesterNo ratings yet

- Handout Audit of ReceivablesDocument6 pagesHandout Audit of ReceivablesJahanna MartorillasNo ratings yet

- IntAcc Quiz 1 PDFDocument9 pagesIntAcc Quiz 1 PDFMyles Ninon LazoNo ratings yet

- Prob 3Document3 pagesProb 3jikee11No ratings yet

- Receivable Financing Qualifying Exam Review Sample QuestionsDocument4 pagesReceivable Financing Qualifying Exam Review Sample QuestionsHannah Jane Umbay0% (1)

- Receivables and Allowance for Doubtful Accounts ProblemsDocument3 pagesReceivables and Allowance for Doubtful Accounts ProblemsAdyangNo ratings yet

- CORPORATE LIQUIDATION STATEMENTDocument73 pagesCORPORATE LIQUIDATION STATEMENTCasper John Nanas MuñozNo ratings yet

- Module 1 Notes and Loans ReceivableDocument21 pagesModule 1 Notes and Loans ReceivableEryn GabrielleNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument6 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionAIENNA GABRIELLE FABRO100% (1)

- Proof+of+Cash ProblemsDocument2 pagesProof+of+Cash ProblemshelaihjsNo ratings yet

- P1-01 Cash and Cash EquivalentsDocument5 pagesP1-01 Cash and Cash EquivalentsRachel LeachonNo ratings yet

- Accounting Information System ReviewerDocument17 pagesAccounting Information System ReviewerAcain RolienNo ratings yet

- Petty Cash Fund SetupDocument5 pagesPetty Cash Fund SetupJay Lou PayotNo ratings yet

- Chapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceDocument32 pagesChapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceLeonardoNo ratings yet

- Cash and Cash EquivalentsDocument33 pagesCash and Cash EquivalentsJohn kyle Abbago100% (2)

- FAR FPB With Answer KeysDocument16 pagesFAR FPB With Answer KeysPj ManezNo ratings yet

- Audit of Cash PDFDocument11 pagesAudit of Cash PDFRyan Prado AndayaNo ratings yet

- Acctg Ats1Document2 pagesAcctg Ats1Christian N MagsinoNo ratings yet

- Saviour Exam 2Document1 pageSaviour Exam 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- Cash and Cash Equivalents Handouts (1084)Document7 pagesCash and Cash Equivalents Handouts (1084)dian12 parksoohNo ratings yet

- Prelim Learning Task 1 PDFDocument5 pagesPrelim Learning Task 1 PDFAdrian FaminianoNo ratings yet

- Banking Assignment No. 4Document3 pagesBanking Assignment No. 4Rossette AnasarioNo ratings yet

- Financial Accounting 1Document35 pagesFinancial Accounting 1Bunbun 221No ratings yet

- Total Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Document8 pagesTotal Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Anonymous LC5kFdtcNo ratings yet

- Perpetual BowmanDocument19 pagesPerpetual BowmanEric AntonioNo ratings yet

- Bank Reconciliation and Adjusting EntriesDocument4 pagesBank Reconciliation and Adjusting EntriesJocy DelgadoNo ratings yet

- Determine cash shortage as of Dec 31, 2015Document2 pagesDetermine cash shortage as of Dec 31, 2015elsana philipNo ratings yet

- Proof of Cash Baht CompanyDocument6 pagesProof of Cash Baht CompanySr. Janet PereyraNo ratings yet

- Proof of Cash Baht CompanyDocument6 pagesProof of Cash Baht CompanyCJ alandy100% (1)

- ZMSQ 12 Activity Based CostingDocument10 pagesZMSQ 12 Activity Based CostingJohn Carlo Peru0% (1)

- Standard Costs and Variance Analysis 1236548541Document12 pagesStandard Costs and Variance Analysis 1236548541anon_39534635275% (4)

- zMSQ-02 - Variable & Absorption CostingDocument11 pageszMSQ-02 - Variable & Absorption CostingKekenn EscabasNo ratings yet

- Glo 17a 2019Document284 pagesGlo 17a 201900smac00No ratings yet

- Subject Verb AgreementDocument9 pagesSubject Verb AgreementDavid Vilca100% (1)

- Error Correction Sample ProblemsDocument42 pagesError Correction Sample ProblemsKatie BarnesNo ratings yet

- Audit of Cash and Cash EquivalentsDocument10 pagesAudit of Cash and Cash EquivalentsVel JuneNo ratings yet

- Subject Verb AgreementDocument7 pagesSubject Verb AgreementAkshit SharmaNo ratings yet

- PRTC SalesDocument169 pagesPRTC SalesCharla Suan100% (1)

- ObliCon ReviewerDocument6 pagesObliCon ReviewerrizrizNo ratings yet

- SALES Memory AidDocument39 pagesSALES Memory AidAgniezka AgniezkaNo ratings yet

- Lecture 1 Management ScienceDocument7 pagesLecture 1 Management ScienceDio NolascoNo ratings yet

- CHAPTER 2 Caselette - Correction of ErrorsDocument37 pagesCHAPTER 2 Caselette - Correction of Errorsmjc24100% (4)

- Auditing Theory Test BankDocument32 pagesAuditing Theory Test BankJane Estrada100% (2)

- The Philipine ConstitutionDocument16 pagesThe Philipine ConstitutionDio NolascoNo ratings yet

- UTSDocument3 pagesUTSDio NolascoNo ratings yet

- Behavioral Science: The Study of Human BehaviorDocument2 pagesBehavioral Science: The Study of Human BehaviorDio NolascoNo ratings yet

- LP Detailed Solution Simplex 1Document6 pagesLP Detailed Solution Simplex 1Dio NolascoNo ratings yet

- Internet Archive v. Shell - Document No. 2Document1 pageInternet Archive v. Shell - Document No. 2Justia.comNo ratings yet

- Buscom SPDocument16 pagesBuscom SPCatherine Joy Vasaya100% (1)

- Bartending BasicsDocument18 pagesBartending Basicsrubike rubikeNo ratings yet

- Sale of 1845 Land LeaseDocument14 pagesSale of 1845 Land LeaseSimon MonteiroNo ratings yet

- The Brillante Virtuoso Case SummaryDocument3 pagesThe Brillante Virtuoso Case Summarysahil chawlaNo ratings yet

- التحفيزات الجبائيةDocument18 pagesالتحفيزات الجبائيةbouamama bNo ratings yet

- 01.yau Chu Vs CA G.R. No. L-78519Document2 pages01.yau Chu Vs CA G.R. No. L-78519Anasor GoNo ratings yet

- Appt Itude 3Document5 pagesAppt Itude 3balaNo ratings yet

- Frank T - Stipulation and Order of Settlement Respondents - OAG 12-2-19 FINALDocument28 pagesFrank T - Stipulation and Order of Settlement Respondents - OAG 12-2-19 FINALBethany100% (1)

- TC 36 R PDFDocument16 pagesTC 36 R PDFkakuNo ratings yet

- Doctrine of State Continuity: October 2, 2018Document3 pagesDoctrine of State Continuity: October 2, 2018Japoy Regodon EsquilloNo ratings yet

- National Budget's New FaceDocument12 pagesNational Budget's New FaceraineydaysNo ratings yet

- Module 4 - The Importance and Challenge of Building RelationshipDocument8 pagesModule 4 - The Importance and Challenge of Building RelationshipRoland KaitoNo ratings yet

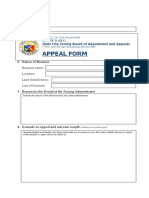

- Appeal or Petition Form for Iloilo City Zoning BoardDocument6 pagesAppeal or Petition Form for Iloilo City Zoning BoardRudiver Jungco JrNo ratings yet

- People V GoDocument33 pagesPeople V GoaratanjalaineNo ratings yet

- Mubadala/DTC Financial Number - Nestride YumgaDocument1 pageMubadala/DTC Financial Number - Nestride YumgaCapitolIntelNo ratings yet

- SLDC V. DSWD Southern Luzon Drug Corporation, Petitioner, vs. The Department of Social Welfare and Development, EtDocument2 pagesSLDC V. DSWD Southern Luzon Drug Corporation, Petitioner, vs. The Department of Social Welfare and Development, Etyetyet100% (1)

- What Type of Government Does Germany HaveDocument2 pagesWhat Type of Government Does Germany HaveBryan PalmaNo ratings yet

- Parallel Lines and Transversals PDFDocument2 pagesParallel Lines and Transversals PDFRonnieMaeMaullionNo ratings yet

- New Land Lease Proclamation No 721 20111Document28 pagesNew Land Lease Proclamation No 721 20111EyobNo ratings yet

- 4 - Cir Vs San Roque Power CorpDocument15 pages4 - Cir Vs San Roque Power CorpcloudNo ratings yet

- Inc Tax Chp. 14Document6 pagesInc Tax Chp. 14Gene'sNo ratings yet

- Santana IPODocument246 pagesSantana IPOyaoanmin2005No ratings yet

- Position Paper New Rh971Document2 pagesPosition Paper New Rh971David DueñasNo ratings yet

- Proforma Invoice: Poner Nombre de Una Empresa AcaDocument1 pageProforma Invoice: Poner Nombre de Una Empresa AcaKatherine Cela Alvarado CabelloNo ratings yet

- Cityam 2011-02-09bookDocument32 pagesCityam 2011-02-09bookCity A.M.No ratings yet

- Lecture Chapter 11 Excise TaxDocument11 pagesLecture Chapter 11 Excise TaxChristian PelimcoNo ratings yet

- Article 1179-1188Document2 pagesArticle 1179-1188Nicole Althea EguiaNo ratings yet

- Lodge Officers Duties of The LodgeDocument2 pagesLodge Officers Duties of The LodgeKeny DrescherNo ratings yet

- PDF - Alcatel-Lucent 7210 SASDocument5 pagesPDF - Alcatel-Lucent 7210 SASRoshan TejasNo ratings yet