Professional Documents

Culture Documents

Non-Profit Organizations As A Customer Group of Digital Banks in Singapore

Uploaded by

Varun Mittal0 ratings0% found this document useful (0 votes)

8 views1 pageThis is an overview of the Non-profit Organizations profile, their addressable needs and opportunities for financial institutions to serve this segment.

Original Title

Non-Profit Organizations as a customer group of digital banks in Singapore

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis is an overview of the Non-profit Organizations profile, their addressable needs and opportunities for financial institutions to serve this segment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageNon-Profit Organizations As A Customer Group of Digital Banks in Singapore

Uploaded by

Varun MittalThis is an overview of the Non-profit Organizations profile, their addressable needs and opportunities for financial institutions to serve this segment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

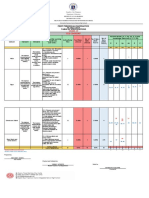

Non-Profit Organizations (NPOs)

Customer segment profile Opportunities in the market segment Case Study

Context:

Addressable needs How can FIs help? A bank is looking for a solution to provide increased transparency in the

donation process made by the donors to the NPOs’.

Traceability Transparency Time Opportunities:

30% of money NPO’s heavy Due to the Collections From 2012-2018, online donations worldwide increased year-on-year at an

donated as reliance on nature of the average of 10.7%, cumulatively adding up to USD 149.1 billion.

foreign aid is lost public funding non-profit

to corruption and demands industry,

Recommended solution:

fraud, according greater raising funds is Increased desire by the public and Provide a affordable and transparent

to the United transparency a recurring NPOs for cost-effective collection and traceable solution to transfer It is recommended that the FI utilize digital technology to prevent international

solutions that offer a greater level of money overseas allowing aid payments fraud.

Nations. in donations. struggle for

them. auditability and traceability of customization of payments frequency. • A cloud-based, end-to-end digital payments solution can be created to

donations. provide a secure, private and fully-traceable service.

Religious • Currency exchange can be done by the banks to eliminate the high foreign

Charities

Organizations exchange and bank fees.

• All transactions are traceable and permanently recorded in the platform.

Non-profit Companies • Fraud detection and protection programs are also included in the system.

Insurance

Global trends Client impact:

• Decrease in the cost of cross-currency payments through optimization of

There is a growing need for group Insurance policy tailored to the needs bank and foreign exchange fees.

insurance policies by NPOs without of NPOs.

P&L statements. • Increase transparency of donations through payment tracking system.

31% 25%

40%

31% of donors 25% of donors 40% of Contact Us:

Loans

worldwide complete their Millennial

donate to donations on donors are

NPOs outside mobile enrolled in a Varun Mittal

FinTech Hub

their country devices. monthly giving Rising necessity of NPO-tailored Assess creditworthiness of NPOs by EY Global Emerging Markets

of residence. program. loans for acquisition, construction analyzing their payments footprint, FinTech lead www.ey.com/sg/FinTechHub

and equipment. such as rent and utility bill payment. varun.mittal@sg.ey.com

© 2019 EYGM Limited. All Rights Reserved. ED None

You might also like

- Proof of Concept (POC) Compilation KitDocument39 pagesProof of Concept (POC) Compilation KitVarun MittalNo ratings yet

- Call Centre Operations Performance ImprovementDocument1 pageCall Centre Operations Performance ImprovementVarun MittalNo ratings yet

- Financial Freedom Index - Platform WorkersDocument32 pagesFinancial Freedom Index - Platform WorkersVarun MittalNo ratings yet

- Trinidad and Tobago International Financial Center: Develop Local Firms For New Financial ServicesDocument13 pagesTrinidad and Tobago International Financial Center: Develop Local Firms For New Financial ServicesVarun MittalNo ratings yet

- ASEAN SMEs: Transforming For The FutureDocument30 pagesASEAN SMEs: Transforming For The FutureVarun MittalNo ratings yet

- EY Fintech Ecosystem PlaybookDocument53 pagesEY Fintech Ecosystem PlaybookVarun Mittal100% (1)

- Thailand Fintech LandscapeDocument19 pagesThailand Fintech LandscapeVarun MittalNo ratings yet

- Ey Industrializing Blockchain in AseanDocument17 pagesEy Industrializing Blockchain in AseanVarun MittalNo ratings yet

- Digital Bad Debts Collection Platform Using Machine LearningDocument1 pageDigital Bad Debts Collection Platform Using Machine LearningVarun MittalNo ratings yet

- Impact of Digital Banks On Incumbents in SingaporeDocument20 pagesImpact of Digital Banks On Incumbents in SingaporeVarun MittalNo ratings yet

- Small and Medium Enterprises As A Customer Group of Digital Banks in SingaporeDocument1 pageSmall and Medium Enterprises As A Customer Group of Digital Banks in SingaporeVarun MittalNo ratings yet

- State of FinTech in ASEANDocument36 pagesState of FinTech in ASEANVarun MittalNo ratings yet

- Singapore National Service Full-Time As A Customer Group of Digital Banks in SingaporeDocument1 pageSingapore National Service Full-Time As A Customer Group of Digital Banks in SingaporeVarun MittalNo ratings yet

- The Future Silver Economy As A Customer Group of Digital Banks in SingaporeDocument1 pageThe Future Silver Economy As A Customer Group of Digital Banks in SingaporeVarun MittalNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Migne. Patrologiae Cursus Completus: Series Latina. 1800. Volume 51.Document516 pagesMigne. Patrologiae Cursus Completus: Series Latina. 1800. Volume 51.Patrologia Latina, Graeca et OrientalisNo ratings yet

- Bag Technique and Benedict ToolDocument2 pagesBag Technique and Benedict ToolAriel Delos Reyes100% (1)

- Countable 3Document2 pagesCountable 3Pio Sulca Tapahuasco100% (1)

- Lab 2 - Using Wireshark To Examine A UDP DNS Capture Nikola JagustinDocument6 pagesLab 2 - Using Wireshark To Examine A UDP DNS Capture Nikola Jagustinpoiuytrewq lkjhgfdsaNo ratings yet

- Karthik ResumeDocument2 pagesKarthik ResumeArun Raj ANo ratings yet

- Freshers Jobs 26 Aug 2022Document15 pagesFreshers Jobs 26 Aug 2022Manoj DhageNo ratings yet

- GTA IV Simple Native Trainer v6.5 Key Bindings For SingleplayerDocument1 pageGTA IV Simple Native Trainer v6.5 Key Bindings For SingleplayerThanuja DilshanNo ratings yet

- Bluestar Annual Report 2021-22Document302 pagesBluestar Annual Report 2021-22Kunal PohaniNo ratings yet

- s15 Miller Chap 8b LectureDocument19 pagess15 Miller Chap 8b LectureKartika FitriNo ratings yet

- Information Technology Project Management: by Jack T. MarchewkaDocument44 pagesInformation Technology Project Management: by Jack T. Marchewkadeeps0705No ratings yet

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Document6 pagesRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNo ratings yet

- Laboratorio 1Document6 pagesLaboratorio 1Marlon DiazNo ratings yet

- ISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)Document9 pagesISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)duraisingh.me6602No ratings yet

- Minuets of The Second SCTVE MeetingDocument11 pagesMinuets of The Second SCTVE MeetingLokuliyanaNNo ratings yet

- MV Lec PDFDocument102 pagesMV Lec PDFJonas Datu100% (1)

- Morse Potential CurveDocument9 pagesMorse Potential Curvejagabandhu_patraNo ratings yet

- Lateritic NickelDocument27 pagesLateritic NickelRAVI1972100% (2)

- Explore The WorldDocument164 pagesExplore The WorldEduardo C VanciNo ratings yet

- Vedic Maths Edited 2Document9 pagesVedic Maths Edited 2sriram ANo ratings yet

- Industrial Machine and ControlsDocument31 pagesIndustrial Machine and ControlsCarol Soi100% (4)

- Power Control 3G CDMADocument18 pagesPower Control 3G CDMAmanproxNo ratings yet

- Chem Resist ChartDocument13 pagesChem Resist ChartRC LandaNo ratings yet

- Planning EngineerDocument1 pagePlanning EngineerChijioke ObiNo ratings yet

- Daikin FUW Cabinet Fan Coil UnitDocument29 pagesDaikin FUW Cabinet Fan Coil UnitPaul Mendoza100% (1)

- Principles of Business Grade 10 June 2021 Time: 1 1/2 Hrs. Paper 2 Answer ONLY 1 Question in Section I. Section IDocument3 pagesPrinciples of Business Grade 10 June 2021 Time: 1 1/2 Hrs. Paper 2 Answer ONLY 1 Question in Section I. Section Iapi-556426590No ratings yet

- Zygosaccharomyces James2011Document11 pagesZygosaccharomyces James2011edson escamillaNo ratings yet

- Asan Visa Ae102901499Document2 pagesAsan Visa Ae102901499hardeep ranaNo ratings yet

- Advent Wreath Lesson PlanDocument2 pagesAdvent Wreath Lesson Planapi-359764398100% (1)

- Benko Gambit-Jacobs and Kinsman, 1999Document163 pagesBenko Gambit-Jacobs and Kinsman, 1999johnson Greker100% (3)

- Ac221 and Ac211 CourseoutlineDocument10 pagesAc221 and Ac211 CourseoutlineLouis Maps MapangaNo ratings yet