Professional Documents

Culture Documents

Accounting Information System

Uploaded by

legion17Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Information System

Uploaded by

legion17Copyright:

Available Formats

Accounting 1

House published on www.jps-

www.jps-dir.com

Accounting information system

Debit &credit

The left side of any account is the debit side .the right is the credit

All assets & expenses increase in the debit side .decrease in the credit side

All liabilities & revenues increase in the credit side .decrease in the debit side

Stock holder equity common stock & retained earnings increase in the credit side

Dividends increase in the debit side

double entry :

it is the equalty of debit & credit . it provide logical method for recording transaction &

offers ameans of proving the accuracy of the recoreded amount

basic equation

assets = liabilities + stockholders equity

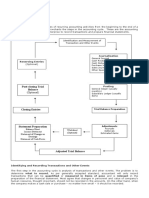

Accounting cycle steps

1- identfy & measure transaction and event

2- journalization

3- posting

4- unajusted trial balance

5- adjustment

6- adjusted trial balance

7- statement preparation

8- closing

– -: -0105030092 : 0502265272 e-mail:.acchouse_scada@yahool.com-

022622173-022622168-1016448872 : < =>? @ 8 A 35 8 9 : : ; -: 6 7 WWW.AHSCADA.COM

0124059666- 034851600- 034865655 : L ; M NO : L ; M

Accounting 2

House published on www.jps-

www.jps-dir.com

Identification and Measurement of

Transactions and Other Events

Journalization

General Journal

Reversing Entries Cash Receipt s Journal

(Optional) Cash Disbursements Journal

Purchases Journal

Sales Journal

Other Special Journals

Post-Closing THE

Posting

Trial Balance

General Ledger (Usually Monthly)

(Optional) ACCOUNTING

Subsidiary Ledgers (Usually Daily)

CYCLE

Closing Trial Balance

(Nominal Accounts) Preparation

Statement Preparation Adjustments

Income Statement Work Sheet Accruals

Retained Earnings (Optional) Prepayments

Balance Sheet Estimated Items

Cash Flows

Adjusted Trial Balance

– -: -0105030092 : 0502265272 e-mail:.acchouse_scada@yahool.com-

022622173-022622168-1016448872 : < =>? @ 8 A 35 8 9 : : ; -: 6 7 WWW.AHSCADA.COM

0124059666- 034851600- 034865655 : L ; M NO : L ; M

Accounting 3

House published on www.jps-

www.jps-dir.com

identfy & measure transaction and event

transaction and event used to descibe the changes in an entity assets.liabilty & owners equity

Events are of two types:

A) external : involve interaction between an entity & its environment

B) internal events : occur within an entity

transaction : are particular kind of external events maybe an exchange in wich entity both

receives & sacrifice value

journalizing :

General Ledger: It is a collection of all assets, liability,stockholders equity , revenue and

expenses account.

T-Account is a convenient method of illustrating the effect of trasaction on

particular assets , liability, equity,revenue, expense

eg: Depreciation expense $ 500

Accumulated depreciation- Office expence $ 500

DE. Depreciation expense CR

Depreciation expense $500

DE. ACCUMULATED DEPRECIATION CR.

Accumulated depreciation – Office expense $500

A subsidiary ledger is a group of accounts with a common characteristic, e.g., all are

customer accounts, that is, all are accounts receivable. The subsidiary ledger facilitates the

– -: -0105030092 : 0502265272 e-mail:.acchouse_scada@yahool.com-

022622173-022622168-1016448872 : < =>? @ 8 A 35 8 9 : : ; -: 6 7 WWW.AHSCADA.COM

0124059666- 034851600- 034865655 : L ; M NO : L ; M

Accounting 4

House published on www.jps-

www.jps-dir.com

recording process by freeing the general ledger from the details of individual balances. Thus,

a typical merchandising enterprise has subsidiary ledgers containing accounts with customers

(accounts receivable or customers’ ledger) and creditors (accounts payable or creditors’

ledger).

the advantages of using subsidiary ledgers are that they:

1. Show transactions affecting one customer or one creditor in a single account, thus

providing necessary up-to-date information on specific account balances.

2. Free the general ledger of excessive details relating to accounts receivable and

accounts payable. As a result, a trial balance of the general ledger does not contain

vast numbers of individual account balances.

3. Help locate errors in individual accounts by reducing the number of accounts

combined in one ledger and by using control accounts.

4. Make possible a division of labor in posting by having one employee post to the

general ledger and a different employee post to the subsidiary ledgers.

ILLUSTRATION 1: Relationship between General and Subsidiary Ledgers

Illustration 1 is based on the following transactions:

Sales and Collection Transactions

Credit Collections on Account

Sales

Jan. 10 Aaron Co. $ 6,000 Jan. 19 Aaron Co. $ 4,000

12 Branden Inc. 3,000 21 Branden Co. 3,000

20 Caron Co. 3,000 29 Caron Co. 1,000

$12,000 $ 8,000

======= =======

– -: -0105030092 : 0502265272 e-mail:.acchouse_scada@yahool.com-

022622173-022622168-1016448872 : < =>? @ 8 A 35 8 9 : : ; -: 6 7 WWW.AHSCADA.COM

0124059666- 034851600- 034865655 : L ; M NO : L ; M

Accounting 5

House published on www.jps-

www.jps-dir.com

JOURNAL:

the book of original entry where transactions and selected other events are initially

recorded .

GENERAL JOURNAL: It consists of four parts :

1- The accounts and the amount to be debited

2- The accounts and the amount to be credited

3- Date

4- An explanation

Special journals

special journals expedite the journalizing and posting process for frequently occurring

transactions. The most common special journals are: sales journals, purchases journal,

cash receipts journal, and cash payments journal.

Posting:

It is the process of trasfering the essential facts and figuers from the book of original

entry to the ledger accounts .

The number in the posting reference coloumn serves two pourposes:

1- Indicate the ledger account number of account involved.

2- To indicate that the posting has been completed for the particular item.

TRIAL BALANCE:

It is a list of accounts and their balances at a given time .

The primary pourpose of a trial balance is to prove the mathimatical equality of

debit and credit .

A trial balance also uncoveres errors in journalizing and posting in addition

it is useful in the preparation of finantial statement .

ADJUSTING ENTRIES:

They are made at the end of the accounting period in short adjustment are needed to

ensure that the revenue recognition and matching principals are followed .

– -: -0105030092 : 0502265272 e-mail:.acchouse_scada@yahool.com-

022622173-022622168-1016448872 : < =>? @ 8 A 35 8 9 : : ; -: 6 7 WWW.AHSCADA.COM

0124059666- 034851600- 034865655 : L ; M NO : L ; M

Accounting 6

House published on www.jps-

www.jps-dir.com

Adjusting entries are required every time financial statements are

prepared .

TYPES OF ADJUSTING ENTIES:

Adjusting entries can be classified as either prepayments or accruals .

Each of these clases has two sub-categories

PREPAYMENTS ACCRUALS

1- Prepaid expenses. expenses paid 3- Accrued revenues :

in cash and recorded as assets Earned but not yet received

before they are used or consumed . in cash or recorded .

2- Unearned revenues : 4- Accrued expenses:

Revenues received in cash Expenses incurred

and recorded as liabilities but not yet paid in cash

before they are earned. or recorded

Adjusting entry for prepayments:

Prepaid expenses expaire either with the passege of time eg.(rent and insurance) or

through use and consumption eg. (supplies)

Prepaid expense adjusting entry results in a debit to an expense account

and credit to an asset account .

UNEARNED REVENUES:

The anjusting entry for unearned revenues results in a debit (decrease )

to a liability account and a credit increase to revenue account .

ADJUSTEMENT OF ACCRUALS:

An adjusting entry for accrued revenue results in a debit (increase)to an asset

account and a credit (increase ) to a revenue account.

the adjusting entry for accrued expenses results a debit

(increase) to an expense account and a credit (increase) to a liability account

CLOSING:

It is the procedure generally followed to reduce the balance of nominal (temporary)

accounts to Zero in order to prepare the accounts for the next period’s transactions

– -: -0105030092 : 0502265272 e-mail:.acchouse_scada@yahool.com-

022622173-022622168-1016448872 : < =>? @ 8 A 35 8 9 : : ; -: 6 7 WWW.AHSCADA.COM

0124059666- 034851600- 034865655 : L ; M NO : L ; M

Accounting 7

House published on www.jps-

www.jps-dir.com

REVERSING ENTRIES:

It is made at the beginning of the next accounting period and is the exact opposite of the

related adjusting entry made in the previous period

A work sheet is a columnar sheet of paper used to adjust the account balances and

prepare the financial statements. Use of a work sheet helps the accountant prepare the

financial statements on a more timely basis. It is not necessary to delay preparation of

the financial statements until the adjusting and closing entries are journalized and

posted.

– -: -0105030092 : 0502265272 e-mail:.acchouse_scada@yahool.com-

022622173-022622168-1016448872 : < =>? @ 8 A 35 8 9 : : ; -: 6 7 WWW.AHSCADA.COM

0124059666- 034851600- 034865655 : L ; M NO : L ; M

You might also like

- Housing Choice Voucher Payments ContractBody of Contract Part B 52641Document12 pagesHousing Choice Voucher Payments ContractBody of Contract Part B 52641shaundirelemonde100% (1)

- Rene Rofe - Bombshell BoudoirDocument9 pagesRene Rofe - Bombshell Boudoirlegion17100% (1)

- Administration of EstateDocument23 pagesAdministration of EstateAbhinav Arora100% (1)

- A Revisit On The Fundamentals of AccountingDocument53 pagesA Revisit On The Fundamentals of AccountingGonzalo Jr. Ruales100% (1)

- B071H6YNMNDocument395 pagesB071H6YNMNbhabhijee100% (2)

- Accounting Unit 3 Notes - ATARNotesDocument22 pagesAccounting Unit 3 Notes - ATARNotesAnonymous rP0DTw58XNo ratings yet

- Top Trading TipsDocument55 pagesTop Trading TipsRadhika TrisyahdanaNo ratings yet

- SISTACO Ambassador Reward ProgramDocument13 pagesSISTACO Ambassador Reward ProgramSistacoNo ratings yet

- At The End of The Accounting PeriodDocument16 pagesAt The End of The Accounting PeriodAra ArinqueNo ratings yet

- Solution Manual of Financial Management by Cabrera PDFDocument2 pagesSolution Manual of Financial Management by Cabrera PDFMaria Diane Almeyda100% (2)

- Landl Co vs. Metropolitan Bank & Trust CompanyDocument1 pageLandl Co vs. Metropolitan Bank & Trust Companyvallie21No ratings yet

- CILO 2: Apply The Recording Process: Marieta G. Tabasondra, CPA, MMBMDocument62 pagesCILO 2: Apply The Recording Process: Marieta G. Tabasondra, CPA, MMBMNeama1 Radhi100% (1)

- 101 Finals Departmental-JenDocument8 pages101 Finals Departmental-Jenmarie patianNo ratings yet

- The Accounting Information SystemDocument31 pagesThe Accounting Information SystemSteveKing100% (1)

- Intercompany Sales Problem Solving Exercises (Test Bank)Document2 pagesIntercompany Sales Problem Solving Exercises (Test Bank)Kristine Esplana ToraldeNo ratings yet

- Complaint BlankDocument3 pagesComplaint BlankRoger Montero Jr.No ratings yet

- Basic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)Document17 pagesBasic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)LiaNo ratings yet

- The Accounting CycleDocument34 pagesThe Accounting CycleMarriel Fate CullanoNo ratings yet

- Engineering Economics Reviewer Part 1 PDFDocument88 pagesEngineering Economics Reviewer Part 1 PDFagricultural and biosystems engineeringNo ratings yet

- Module 4 Accounting Cycle (Journalizing To Adjustments)Document2 pagesModule 4 Accounting Cycle (Journalizing To Adjustments)Normel DecalaoNo ratings yet

- Recording Business TransactionsDocument29 pagesRecording Business TransactionsDheeraj SinghalNo ratings yet

- Accounting CycleDocument15 pagesAccounting CycleDeligateaux MalaysiaNo ratings yet

- Module 1 Chapter 2 Accounting ProcessDocument116 pagesModule 1 Chapter 2 Accounting ProcessADITYAROOP PATHAKNo ratings yet

- Trial Balance: JAIIB / AFB / MODULE - C / UNIT 2 - Preparation of Final AccountsDocument7 pagesTrial Balance: JAIIB / AFB / MODULE - C / UNIT 2 - Preparation of Final Accountscpk200No ratings yet

- Accounting Information SystemDocument58 pagesAccounting Information SystemMohammed Akhtab Ul HudaNo ratings yet

- 46604bosfnd p1 cp2 U1 PDFDocument30 pages46604bosfnd p1 cp2 U1 PDFPrasang GuptaNo ratings yet

- Accounting CycleDocument25 pagesAccounting CyclepadayonmhieNo ratings yet

- Module 9 Completing The Accounting CycleDocument5 pagesModule 9 Completing The Accounting CyclemallarilecarNo ratings yet

- A Review of The Accounting CycleDocument46 pagesA Review of The Accounting CycleRNo ratings yet

- Samuel Owa Milestone 1Document9 pagesSamuel Owa Milestone 1Sam Olamibode OwaNo ratings yet

- 74606bos60479 FND cp2 U1Document51 pages74606bos60479 FND cp2 U1Filip Jain100% (1)

- The Accounting CycleDocument9 pagesThe Accounting Cycletoma hawkNo ratings yet

- ISR 111 - Chapter 7 MaterialsDocument9 pagesISR 111 - Chapter 7 MaterialsTrisha Nicole FajardoNo ratings yet

- Engineering Economics Unit 5Document51 pagesEngineering Economics Unit 5smnavaneethakrishnan.murugesanNo ratings yet

- 2108AFE Topic 4 - Accounting Information Systems - StudentDocument38 pages2108AFE Topic 4 - Accounting Information Systems - StudentAnh TrầnNo ratings yet

- Bcfa 1: Fundamentals of Accounting 1Document14 pagesBcfa 1: Fundamentals of Accounting 1Arlene PerlasNo ratings yet

- General Ledger Accounting Training Manual: Author: Ask SAP ExpertDocument78 pagesGeneral Ledger Accounting Training Manual: Author: Ask SAP Expertsaif RashidNo ratings yet

- Abm Ss1 Module II BaDocument8 pagesAbm Ss1 Module II Baeloixxa samNo ratings yet

- A Review of The Accounting CycleDocument46 pagesA Review of The Accounting CycleLiezl MaigueNo ratings yet

- Topic 3 - Recording Transactions (STU)Document80 pagesTopic 3 - Recording Transactions (STU)Kim ChiNo ratings yet

- Rules: of Double Entry, Accounting Cycle & Record KeepingDocument34 pagesRules: of Double Entry, Accounting Cycle & Record KeepingMUSTAFA KAMAL BIN ABD MUTALIP / BURSAR100% (1)

- Topic 3 - Recording Transactions (STU)Document60 pagesTopic 3 - Recording Transactions (STU)thiennnannn45No ratings yet

- Events: The Accounting Information SystemDocument13 pagesEvents: The Accounting Information Systemkayla tsoiNo ratings yet

- MFM 5049 - Session 1 2 PresentationDocument38 pagesMFM 5049 - Session 1 2 PresentationLakmal SilvaNo ratings yet

- Accounting 101: Using Debits and Credits by Susan D. FerrellDocument28 pagesAccounting 101: Using Debits and Credits by Susan D. FerrellAldo CalderaNo ratings yet

- A Review of The Accounting CycleDocument44 pagesA Review of The Accounting CycleBelle PenneNo ratings yet

- Ccounting Nformation YstemDocument37 pagesCcounting Nformation YstemafridaNo ratings yet

- BBAW2103 - Tutorial 1Document69 pagesBBAW2103 - Tutorial 1M THREE THOUSAND RESOURCESNo ratings yet

- Managerial Accounting1Document33 pagesManagerial Accounting1MM-Tansiongco, Keino R.No ratings yet

- Principles of Accounting RevisionDocument99 pagesPrinciples of Accounting RevisionHoang Khanh Linh NguyenNo ratings yet

- IctfhfghjmkkDocument11 pagesIctfhfghjmkkJerald BrillantesNo ratings yet

- Accounting Process: Unit - 1 Basic Accounting Procedures - Journal EntriesDocument33 pagesAccounting Process: Unit - 1 Basic Accounting Procedures - Journal EntriesVenky VenkteshNo ratings yet

- Accounting Process: Unit - 1 Basic Accounting Procedures - Journal EntriesDocument113 pagesAccounting Process: Unit - 1 Basic Accounting Procedures - Journal Entriesyash jain100% (1)

- Accounting PracticeDocument17 pagesAccounting PracticeMAGOMU DAN DAVIDNo ratings yet

- Lec 5Document56 pagesLec 5Sara Abdelrahim MakkawiNo ratings yet

- POA WK 7 LECT 2 VER 1 28032021 115402am 17112022 110442am 06052023 101809amDocument65 pagesPOA WK 7 LECT 2 VER 1 28032021 115402am 17112022 110442am 06052023 101809ammuhammad atifNo ratings yet

- Lecture 5 - Books of Accounts and Double Entry SystemDocument7 pagesLecture 5 - Books of Accounts and Double Entry SystemmallarilecarNo ratings yet

- Assignment Cover: Muzondo Itai Lionel, P2019517B, Bcom (Hons) Marketing Management 1Document13 pagesAssignment Cover: Muzondo Itai Lionel, P2019517B, Bcom (Hons) Marketing Management 1Lionel Itai MuzondoNo ratings yet

- Accounting CycleDocument8 pagesAccounting CycleRescopin LorraineNo ratings yet

- Books of Accounts and Double-Entry SystemDocument9 pagesBooks of Accounts and Double-Entry SystemLacson DennisNo ratings yet

- Class NotesDocument45 pagesClass NotesNaveed Whatsapp Status100% (1)

- Posting and Preparation of Trial BalanceDocument15 pagesPosting and Preparation of Trial Balance愛結No ratings yet

- Financial Accounting, 4e: Weygandt, Kieso, & KimmelDocument67 pagesFinancial Accounting, 4e: Weygandt, Kieso, & KimmelBestboyshoyoNo ratings yet

- Project in Fabm: Group 3Document93 pagesProject in Fabm: Group 3Carl Joseph OrtegaNo ratings yet

- Lecture 2Document38 pagesLecture 2Preet LohanaNo ratings yet

- Lecture 3 DoubleentrysystemDocument47 pagesLecture 3 Doubleentrysystem叶祖儿No ratings yet

- Construct Ten-Column Worksheets: Key To Resources 2 3 Inventory Control Methods 3 Feedback To Activities 18Document20 pagesConstruct Ten-Column Worksheets: Key To Resources 2 3 Inventory Control Methods 3 Feedback To Activities 18hemacrcNo ratings yet

- Accounting Cycle: Recording, Posting Transactions & Trail BalanceDocument28 pagesAccounting Cycle: Recording, Posting Transactions & Trail BalanceMuskan binte RaisNo ratings yet

- M8C Closing The Accounting BooksDocument9 pagesM8C Closing The Accounting BooksShean VasilićNo ratings yet

- Accounting - 2. The Accounting ProcessDocument19 pagesAccounting - 2. The Accounting ProcessChi Kei KeungNo ratings yet

- T Thhee Ffrraam Meew Woorrkk Ooff AaccccoouunnttiinnggDocument9 pagesT Thhee Ffrraam Meew Woorrkk Ooff AaccccoouunnttiinnggLuvlene mullos saltonNo ratings yet

- IBCS Chart Template 07 2016-03-21 RHDocument9 pagesIBCS Chart Template 07 2016-03-21 RHlegion17No ratings yet

- IBCS Chart Template 05 2016-04-08 RHDocument6 pagesIBCS Chart Template 05 2016-04-08 RHlegion17No ratings yet

- IBCS Chart Template 06 2016-03-21 RHDocument6 pagesIBCS Chart Template 06 2016-03-21 RHlegion17No ratings yet

- IBCS Chart Template 04 2016-03-03 RHDocument8 pagesIBCS Chart Template 04 2016-03-03 RHlegion17No ratings yet

- IBCS Chart Template 03 2016-04-08 RHDocument6 pagesIBCS Chart Template 03 2016-04-08 RHlegion17No ratings yet

- IBCS Chart Template 02 2016-05-16Document5 pagesIBCS Chart Template 02 2016-05-16legion17No ratings yet

- IBCS Chart Template 01 2018-01-24 RHDocument12 pagesIBCS Chart Template 01 2018-01-24 RHlegion17No ratings yet

- Selmark Collection GladysDocument7 pagesSelmark Collection Gladyslegion17No ratings yet

- Case Study SEMDocument20 pagesCase Study SEMlegion17No ratings yet

- IPP Report PDFDocument296 pagesIPP Report PDFMuhammad ZubairNo ratings yet

- Operations and Productivity SlidesDocument47 pagesOperations and Productivity SlidesgardeziiNo ratings yet

- Health Financing Strategy Period 2016-2025 - EN - Copy 1Document47 pagesHealth Financing Strategy Period 2016-2025 - EN - Copy 1Indah ShofiyahNo ratings yet

- Ra 7722Document5 pagesRa 7722Niel A.No ratings yet

- FS of Infinity Adventure Farm and ResortDocument35 pagesFS of Infinity Adventure Farm and ResortbeldiansitsolutionsNo ratings yet

- LeasingDocument44 pagesLeasingpriyankamahale100% (5)

- Statement On CARO, 2003Document357 pagesStatement On CARO, 2003Vikas Ralhan100% (1)

- Two SMAs and Three Stop Loss Strategy - Sept28Document4 pagesTwo SMAs and Three Stop Loss Strategy - Sept28BiantoroKunartoNo ratings yet

- PT 3 AccountingDocument19 pagesPT 3 AccountingYzzabel Denise L. TolentinoNo ratings yet

- Euro MarketDocument35 pagesEuro MarketPari GanganNo ratings yet

- EMT 301 Lecture 4 - Copy - Copy-1Document31 pagesEMT 301 Lecture 4 - Copy - Copy-1Abraham Temitope AkinnurojuNo ratings yet

- Basic Principles of Taxation (Inherent Powers of The State)Document2 pagesBasic Principles of Taxation (Inherent Powers of The State)Yeshua Santos100% (2)

- 1049 IndAS Notes by CA Chiranjeev Jain PDFDocument28 pages1049 IndAS Notes by CA Chiranjeev Jain PDFMaya ChaudharyNo ratings yet

- Project Report ON: Investment IN EquitiesDocument63 pagesProject Report ON: Investment IN Equitiesvaishu7896541384No ratings yet

- STK 030411-IDocument24 pagesSTK 030411-Ipranav11100% (1)

- Stock Price (EUR) Exchange RateDocument2 pagesStock Price (EUR) Exchange RateHoàng NhưNo ratings yet

- 231.720 Ay18-19Document10 pages231.720 Ay18-19Arindam MondalNo ratings yet

- Income Recognition and Asset ClassificationDocument21 pagesIncome Recognition and Asset Classificationsagar7No ratings yet

- 1.8 CarderoDocument29 pages1.8 CarderoRodrigo Flores MdzNo ratings yet