Professional Documents

Culture Documents

Finsight Finsight: Steps of Portfolio Investment

Uploaded by

virat kohli0 ratings0% found this document useful (0 votes)

14 views2 pagesFinsight

Original Title

FINSIGHT Report

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinsight

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pagesFinsight Finsight: Steps of Portfolio Investment

Uploaded by

virat kohliFinsight

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

DR.

REDDY'S LABORATORIES

FINSIGHT

STEPS OF PORTFOLIO INVESTMENT

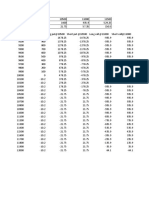

As a group we were given hypothetical 1 crore of amount, of which 75, 00,000 were suggested to invest into

one’s own portfolio and balance of 25,00,00 into other groups portfolios; after which, following steps were

taken.

i. Determination of investment portfolio (Distribution of cash between sectors)

ii. Justification of Portfolio Selection (Issue buy order)

iii. Review of Portfolio (weekly) (Issue buy/sell order)

iv. Review of portfolio performance (justification of final value of portfolio/produce financial statements)

KEY LEARNINGS OF GROUP

We have learned that past performance does not guarantee the same performance of stocks in future

results as the results or performances are bound to change in accordance with the market conditions

and the company decisions for its future.

Different strategies for selecting stocks and to make our portfolio more efficient in terms of gaining

more profit. While doing the investment one should consider the investment objectives, risks, charges,

and expenses factors carefully.

The return of investment and the principle value of an investment will fluctuate during the time of

trading it may go high or it may end up in losses, also there are possibilities that the investor’s account

may be worth less than the original investment when liquidated or will gain more profit than the

original investment.

One of the important learning is that, it is very important to stay updated with market news and

developments, since every news has its impacts on market and therefore to our portfolio.

The concept of rebalancing and implementation in our portfolio on fortnight bases helped us in

tracking our portfolio and identify new opportunities in the market.

More research on the risk profile to identify how best we can build our portfolio should have been

done/taken into consideration.

We also learned that it is always safe to diversify our portfolio as this will help to spread our risk

proportion in different stocks in different sector as different sectors react differently to the market

conditions.

We also learned that it is not always possible that blue chip companies will perform good and will

give high returns, as investment in blue chip companies is less or low risky it will give returns low,

compared to mid or small cap companies as investing in this types of companies are more riskier

compare to large cap companies and therefore this type of companies generate higher returns.

Before investing into any stock strong research is needed to make right decisions. Active tracking of

portfolio is necessary as to know where the portfolio stands and are the selected stock performing well

or not.

Thus, a portfolio assessment provides an opportunity for us to reflect on their learning, to self-assess,

and to formulate a deeper understanding of the concepts they are learning beyond a simple surface

explanation. To read and monitor the financial newspapers as well as internet updates on the NSE and

the global financial market.

FINSIGHT

CONTRIBUTION OF GROUP MEMBERS

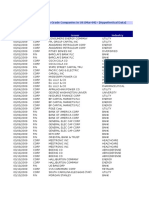

Sr. No. Roll No. Name Contribution

20191004 Divya Wagaralkar Last rebalancing, Product note,

1. Preparation of Final report, Maintaining

Group 2 Tradebook

20191041 Tejas Meena Product note, Maintaining Tradebook &

2. ET Portfolio, Fund Management, Portfolio

Rebalancing & Investment & decision.

20191042 Vinay Verma Last rebalancing and help in previous

3. rebalancing, Maintaining Group 5

Tradebook, Preparation of Final report,

20191052 Sahar Kapadi Product note, Preparation of Final report,

4.

1-week tradebook calculation.

20191135 Jayesh Sawadkar Initial stock selection decisions, Help in

5. Rebalancing, Maintaining Group 7

Tradebook.

20191137 Shashank Talewar Product note, Initial investment decision

6.

& Tradebook Preparation.

You might also like

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Portfolio Optimization Techniques in Mutual Funds - Trends and IssuesDocument66 pagesPortfolio Optimization Techniques in Mutual Funds - Trends and Issuesjitendra jaushik83% (6)

- 10 Steps To Invest in Equity - SFLBDocument3 pages10 Steps To Invest in Equity - SFLBSudhir AnandNo ratings yet

- Project Dissertation: Submitted in The Partial Fullfilment of MBADocument50 pagesProject Dissertation: Submitted in The Partial Fullfilment of MBAAshish BaniwalNo ratings yet

- AMFI Mutual Fund (Advisor) Module: Preparatory Training ProgramDocument231 pagesAMFI Mutual Fund (Advisor) Module: Preparatory Training Programallmutualfund100% (5)

- 9 Mutual FundsDocument32 pages9 Mutual FundsarmailgmNo ratings yet

- Major Project 1st DraftDocument18 pagesMajor Project 1st DraftTushar RanaNo ratings yet

- Summer Internship Report 8.10Document83 pagesSummer Internship Report 8.10Alok0% (1)

- Dcom507 Stock Market Operations PDFDocument301 pagesDcom507 Stock Market Operations PDFPanchala TirupathiNo ratings yet

- Falcon FundDocument33 pagesFalcon FundARYA SHETHNo ratings yet

- A Project Report ON Portfolio Management Services: IndexDocument58 pagesA Project Report ON Portfolio Management Services: IndexrohitjagtapNo ratings yet

- Corporate CA1Document19 pagesCorporate CA1jagrati upadhyayaNo ratings yet

- Vaibhav Hirwani - SIP ProjectDocument62 pagesVaibhav Hirwani - SIP ProjectSushank AgrawalNo ratings yet

- Series-V-A: Mutual Fund Distributors Certification ExaminationDocument218 pagesSeries-V-A: Mutual Fund Distributors Certification ExaminationAjithreddy BasireddyNo ratings yet

- FinalReport A10Document8 pagesFinalReport A10Aayushi ChandwaniNo ratings yet

- Portfolio Management Project: For Dr. Mayank Joshipura's IAPM CourseDocument3 pagesPortfolio Management Project: For Dr. Mayank Joshipura's IAPM CoursejadgugNo ratings yet

- Vivek ProjectDocument93 pagesVivek ProjectMohmmedKhayyumNo ratings yet

- Portfolio ManagementDocument9 pagesPortfolio ManagementAvinaw KumarNo ratings yet

- Investools Introduction To Trading Stocks Slides PDFDocument285 pagesInvestools Introduction To Trading Stocks Slides PDFpaoloNo ratings yet

- Dissertarion Preject ReportDocument64 pagesDissertarion Preject ReportSaurabh RathoreNo ratings yet

- Set A Firm Foundation With Asset Allocation: Step 1-Understanding The ClientDocument5 pagesSet A Firm Foundation With Asset Allocation: Step 1-Understanding The ClientPalha KhannaNo ratings yet

- Project On Kotak Mahindra BankDocument88 pagesProject On Kotak Mahindra BankBalaji100% (6)

- Evaluating Portfolio and Making Investment DecisionsDocument19 pagesEvaluating Portfolio and Making Investment DecisionsIshan FactsNo ratings yet

- Performance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDDocument74 pagesPerformance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDPrashanth PBNo ratings yet

- Financial Advisory and Research of Mutual FundsDocument42 pagesFinancial Advisory and Research of Mutual FundsJobin GeorgeNo ratings yet

- Mutual FundsDocument18 pagesMutual FundsnishaNo ratings yet

- Assignment Part 1Document24 pagesAssignment Part 1lienn_5No ratings yet

- ChapterDocument90 pagesChapterRavi SharmaNo ratings yet

- Investment Analysis and Portfolio Management of Indian Breweries Market 2017Document34 pagesInvestment Analysis and Portfolio Management of Indian Breweries Market 2017deepanshiNo ratings yet

- What To Evaluate in A Mutual Fund Factsheet - Investor EducationDocument3 pagesWhat To Evaluate in A Mutual Fund Factsheet - Investor EducationAnkit SharmaNo ratings yet

- Commodity MarketDocument65 pagesCommodity MarketGarima DhawanNo ratings yet

- Id IciciDocument11 pagesId IciciKhaisarKhaisarNo ratings yet

- Summer Internship Report 8.10Document98 pagesSummer Internship Report 8.10KanishkTVNo ratings yet

- Portfolio Management 2023 Students' VersionDocument40 pagesPortfolio Management 2023 Students' VersionAram Shaban FATTAHNo ratings yet

- Portfolio Management ProjectDocument7 pagesPortfolio Management ProjectDeepti MhatreNo ratings yet

- AssetPlus BrochureDocument12 pagesAssetPlus Brochurechetan expertgsNo ratings yet

- Business School November 10 Courseware InformationDocument35 pagesBusiness School November 10 Courseware InformationMukta KapoorNo ratings yet

- Fin Report 11904567Document9 pagesFin Report 11904567vinayNo ratings yet

- Portfolio ManagementDocument71 pagesPortfolio ManagementAnantha Nag100% (1)

- Asset AllocationDocument8 pagesAsset AllocationAnonymous Hw6a6BYS3DNo ratings yet

- Factors Influencing The Mutual Fund/Scheme Selection by Retail InvestorsDocument29 pagesFactors Influencing The Mutual Fund/Scheme Selection by Retail InvestorsSarwar JahanNo ratings yet

- Equity FundsDocument3 pagesEquity FundsRosyDayNo ratings yet

- Analysis Mutual Fund PerformaDocument103 pagesAnalysis Mutual Fund PerformaSamuel DavisNo ratings yet

- Portfolio Management - Part 2: Portfolio Management, #2From EverandPortfolio Management - Part 2: Portfolio Management, #2Rating: 5 out of 5 stars5/5 (9)

- Research ReportDocument92 pagesResearch ReportSuraj DubeyNo ratings yet

- 18U61E0027 - INVESTMENT DECISION ANALYSIS - Indiabulls - NewDocument36 pages18U61E0027 - INVESTMENT DECISION ANALYSIS - Indiabulls - NewMohmmedKhayyumNo ratings yet

- ASSET ALLOCATION IN FINANCIAL PLANNING SAlilDocument31 pagesASSET ALLOCATION IN FINANCIAL PLANNING SAlilSalil TimsinaNo ratings yet

- BATBC Stock Analysis ReportDocument86 pagesBATBC Stock Analysis ReportBokul Hossain0% (1)

- Handout Mutual FundsDocument6 pagesHandout Mutual FundsZUNERAKHALIDNo ratings yet

- Project Report On Portfolio ConstructionDocument37 pagesProject Report On Portfolio ConstructionMazhar Zaman67% (3)

- Benefitting From The Weak MarketDocument12 pagesBenefitting From The Weak MarketSabyasachi ChowdhuryNo ratings yet

- Senior High School: Business FinanceDocument9 pagesSenior High School: Business Financesheilame nudaloNo ratings yet

- Mutual FundDocument10 pagesMutual FundIndraneel BishayeeNo ratings yet

- Unit TrustDocument27 pagesUnit TrustnorfitrahmNo ratings yet

- Home Log in Sign UpDocument7 pagesHome Log in Sign UpPooja AgarwalNo ratings yet

- Mfi 0516Document48 pagesMfi 0516StephNo ratings yet

- Wealth Builder PDFDocument14 pagesWealth Builder PDFrajran07No ratings yet

- The Financial Habits Code : Six Codes to Extraordinary Financial FreedomFrom EverandThe Financial Habits Code : Six Codes to Extraordinary Financial FreedomNo ratings yet

- VaradDocument4 pagesVaradvirat kohliNo ratings yet

- OnclusionDocument2 pagesOnclusionvirat kohliNo ratings yet

- CarDocument1 pageCarvirat kohliNo ratings yet

- 5a CaseDocument1 page5a Casevirat kohliNo ratings yet

- Mid Week 7Document2 pagesMid Week 7virat kohliNo ratings yet

- Structure of Financial MarketsDocument3 pagesStructure of Financial Marketsvirat kohliNo ratings yet

- Seminar Guest SummaryDocument1 pageSeminar Guest Summaryvirat kohliNo ratings yet

- Iron CondorDocument2 pagesIron Condorvirat kohliNo ratings yet

- Mutual Fund Growth PerformanceDocument1 pageMutual Fund Growth Performancevirat kohliNo ratings yet

- Short Iron CondorDocument3 pagesShort Iron Condorvirat kohliNo ratings yet

- Stock Price at Expirati OnDocument5 pagesStock Price at Expirati Onvirat kohliNo ratings yet

- Money MarketDocument32 pagesMoney MarketHabyarimana ProjecteNo ratings yet

- Money MarketDocument32 pagesMoney MarketHabyarimana ProjecteNo ratings yet

- FinMod Final AssignmentDocument17 pagesFinMod Final Assignmentvirat kohliNo ratings yet

- IAPMDocument2 pagesIAPMKeshav RanaNo ratings yet

- SIFD - Dr. SabithaDocument15 pagesSIFD - Dr. SabithaSampath SanguNo ratings yet

- Dharmesh Textiles Limited: Summary of Rated Instruments Instrument Rated Amount (In Rs. Crore) Rating ActionDocument7 pagesDharmesh Textiles Limited: Summary of Rated Instruments Instrument Rated Amount (In Rs. Crore) Rating ActionJeffNo ratings yet

- Business Proposal - Solar Street LightDocument4 pagesBusiness Proposal - Solar Street LightAhmad Rum33% (3)

- Top Equity AnalystsDocument3 pagesTop Equity Analystsishfaque10No ratings yet

- FICCI Gems & JewelleryDocument36 pagesFICCI Gems & JewellerykavenindiaNo ratings yet

- China Hotel IndustryDocument10 pagesChina Hotel IndustryProf PaulaNo ratings yet

- Business Valuation: Valuation Methodologies Discounts and PremiumsDocument43 pagesBusiness Valuation: Valuation Methodologies Discounts and PremiumsTubagus Donny SyafardanNo ratings yet

- SOA Exam FM SyllabusDocument6 pagesSOA Exam FM Syllabuscrackjak4129No ratings yet

- Accounting 12Document140 pagesAccounting 12sainimanish170gmailc0% (2)

- Ipe Miscellaneous InsuranceDocument41 pagesIpe Miscellaneous InsuranceSatish PeriNo ratings yet

- PWC Ifrs 16 The Leases Standard Is Changing 2016 02 enDocument16 pagesPWC Ifrs 16 The Leases Standard Is Changing 2016 02 envarhun4812No ratings yet

- Case Study of Tata Motors: Presented By, Akansha Mer Amanpreet Singh Bhavana Agarwal Gaurav Bisht Yamesh ShahDocument21 pagesCase Study of Tata Motors: Presented By, Akansha Mer Amanpreet Singh Bhavana Agarwal Gaurav Bisht Yamesh ShahAmarendra GautamNo ratings yet

- Chapter 23 CPWD ACCOUNTS CODEDocument17 pagesChapter 23 CPWD ACCOUNTS CODEarulraj1971No ratings yet

- Indian Healthcare Successful Business ModelsDocument27 pagesIndian Healthcare Successful Business ModelsMahesh MahtoliaNo ratings yet

- 2012-08 CPA Journal AugustDocument84 pages2012-08 CPA Journal AugustshrikantsubsNo ratings yet

- Shashi FinalDocument86 pagesShashi FinalVidyaNo ratings yet

- AshokaDocument16 pagesAshokaManjesh KumarNo ratings yet

- HKICPA QP Exam (Module A) Feb2008 Question PaperDocument8 pagesHKICPA QP Exam (Module A) Feb2008 Question Papercynthia tsuiNo ratings yet

- Ratio AnalysisDocument61 pagesRatio AnalysisHariharan KanagasabaiNo ratings yet

- Project On Andhra Bank: Chapter: 1. Introduction of BankDocument47 pagesProject On Andhra Bank: Chapter: 1. Introduction of BankMukesh ManwaniNo ratings yet

- Data Science Banking and FintechDocument25 pagesData Science Banking and FintechBenoit Carrenand100% (2)

- 2-2mys 2003 Dec QDocument6 pages2-2mys 2003 Dec Qqeylazatiey93_598514No ratings yet

- Unifi Capital PresentationDocument40 pagesUnifi Capital PresentationAnkurNo ratings yet

- Chapter 14 Sol StudentsDocument4 pagesChapter 14 Sol StudentsAllen Grce100% (2)

- Guildbook: UsurersDocument38 pagesGuildbook: UsurersGnomeMadeIon100% (3)

- Issue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)Document10 pagesIssue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)ayush jainNo ratings yet

- MBA AssignmentDocument2 pagesMBA Assignmentg_d_dubeyciaNo ratings yet

- An Overview of Business Finance-1Document24 pagesAn Overview of Business Finance-1HamzaNo ratings yet

- Daftar Akun PT AlamandaDocument4 pagesDaftar Akun PT AlamandaWigit Marseto AdjiNo ratings yet