Professional Documents

Culture Documents

Tax Collection at Source

Uploaded by

obayapalliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Collection at Source

Uploaded by

obayapalliCopyright:

Available Formats

Tax collection at Source

Effective October 1st, 2020, provisions of Section 206C (1H) of Income Tax Act

1961 come into effect whereby Tax Collection at Source [TCS] will be

applicable on Sale of Goods by applicable vendors. Section 206C(1H) has the

following provision :-

“Every person, being a seller, who receives any amount as consideration for sale of any

goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous

year, other than the goods being exported out of India or goods covered in sub-section (1) or

sub-section (1F) or sub-section (1G) shall, at the time of receipt of such amount, collect from

the buyer, a sum equal to 0.1 per cent. of the sale consideration exceeding fifty lakh rupees

as income-tax….:”

In view of the above, the following may please be noted :-

1. Applicable vendors who sell goods to HPCL as per threshold limits shall

comply with the legal requirement.

2. Vendors to note and update HPCL’s PAN: AAACH1118B. Any claim of

higher rate of TCS by virtue of mistakes in updation of HPCL PAN shall

not be entertained.

3. Applicable vendors, in order to collect TCS from HPCL should either claim

the same on the Invoice or claim through separate document

4. Onus of compliance towards collection, remittance to Govt. , filing of

applicable returns and issuance of TCS Certificate to HPCL rests with

vendors.

5. HPCL will pay the TCS amount to the vendor once the same reflects in its

Tax Credit Portal [Form 26AS]

You might also like

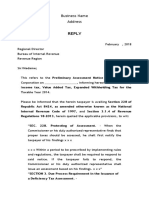

- Reply On PANDocument6 pagesReply On PANPaul Casaje89% (18)

- Tariel Kapanadze and Tesla CircuitsDocument9 pagesTariel Kapanadze and Tesla Circuitskishbud100% (13)

- Note On Applicability of TDS Under Section 194Q and TCS Under Section 206CDocument15 pagesNote On Applicability of TDS Under Section 194Q and TCS Under Section 206CvamshiNo ratings yet

- Note On TDSDocument3 pagesNote On TDSRadha KrishnaNo ratings yet

- Section 194Q and 206CCA TDS/TCS RulesDocument4 pagesSection 194Q and 206CCA TDS/TCS RulesnamanojhaNo ratings yet

- How To Deal With 206AADocument5 pagesHow To Deal With 206AAnamanojhaNo ratings yet

- Section 194Q: Provisions On Sale of Goods by A BuyerDocument3 pagesSection 194Q: Provisions On Sale of Goods by A BuyerkotisrinivasuNo ratings yet

- Article On Section 194Q and Common Queries TheretoDocument5 pagesArticle On Section 194Q and Common Queries TheretonamanojhaNo ratings yet

- Guideline_0212_21Document8 pagesGuideline_0212_21canamanagrawal11No ratings yet

- HPBL Liquor Sales Policy 2017-1829032017185129Document12 pagesHPBL Liquor Sales Policy 2017-1829032017185129anilNo ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- AssignmentDocument5 pagesAssignmentsakshizanjage7888No ratings yet

- Sales Tax Special Procedure (Withholding) Rules, PDFDocument6 pagesSales Tax Special Procedure (Withholding) Rules, PDFAli MinhasNo ratings yet

- Tax Deduction at Source On Purchase of Goods (Section 194 Q)Document7 pagesTax Deduction at Source On Purchase of Goods (Section 194 Q)Pallavi SharmaNo ratings yet

- 30.draft Section 194Q and 206C (1H) MBRC Circular Modified 03072021Document6 pages30.draft Section 194Q and 206C (1H) MBRC Circular Modified 03072021ashok babuNo ratings yet

- Tax Collection at Source ProjectDocument15 pagesTax Collection at Source ProjectShivamPandeyNo ratings yet

- Input Tax Credit or ITCDocument14 pagesInput Tax Credit or ITCgriefernjanNo ratings yet

- Faqs On Tds Under Section 194Q On Purchase of GoodsDocument11 pagesFaqs On Tds Under Section 194Q On Purchase of GoodsAbhishek GuptaNo ratings yet

- India Of: SS, S A o OweveDocument6 pagesIndia Of: SS, S A o OwevevijayNo ratings yet

- S 206C (1H) – Updated - Taxguru - inDocument11 pagesS 206C (1H) – Updated - Taxguru - inHEMANT PARMARNo ratings yet

- Input Tax CreditDocument10 pagesInput Tax CreditSme 2023No ratings yet

- CST - RULES PondicherryDocument26 pagesCST - RULES PondicherrySR CapitalsNo ratings yet

- CGST Act 16-21Document37 pagesCGST Act 16-21Dasari NareshNo ratings yet

- Frequently Asked QuestionsDocument8 pagesFrequently Asked QuestionsKrissNo ratings yet

- Input Tax Credit On Iphones (Capital Goods) - Taxguru - inDocument5 pagesInput Tax Credit On Iphones (Capital Goods) - Taxguru - inJain TradesrNo ratings yet

- TDS & TCSDocument19 pagesTDS & TCSpawan dhokaNo ratings yet

- TDS On Purchase-Sec 194Q of Income Tax ActDocument1 pageTDS On Purchase-Sec 194Q of Income Tax ActUpendra BardhanNo ratings yet

- New TDS Provisions: Rmaconsultancy - in +91-9672372075 Office@rmaconsultancy - inDocument7 pagesNew TDS Provisions: Rmaconsultancy - in +91-9672372075 Office@rmaconsultancy - inCA Ranjan MehtaNo ratings yet

- Input TaxDocument23 pagesInput TaxIana Gonzaga FajardoNo ratings yet

- Tcs On Sales From 01102020Document2 pagesTcs On Sales From 01102020akanshaNo ratings yet

- 2007 Sro 660Document5 pages2007 Sro 660Haseeb JavidNo ratings yet

- Chapter 18 Spr. 24Document12 pagesChapter 18 Spr. 24Asad HanifNo ratings yet

- 4 Docx p10Document2 pages4 Docx p10monsanjibNo ratings yet

- Clause 17 Guidance NoteDocument4 pagesClause 17 Guidance NoteAditya GoyalNo ratings yet

- RMC No. 8-2024Document5 pagesRMC No. 8-2024Anostasia NemusNo ratings yet

- All About TDS On Immovable Property Purchase (194IA) - Taxguru - inDocument5 pagesAll About TDS On Immovable Property Purchase (194IA) - Taxguru - inKhusboo ChowdhuryNo ratings yet

- Chapter 8 - Input Tax Credit - NotesDocument57 pagesChapter 8 - Input Tax Credit - Notesmohd abidNo ratings yet

- Sales Tax, Excise & Customs Act SummaryDocument29 pagesSales Tax, Excise & Customs Act SummaryRana SabNo ratings yet

- Section 16 of CGST Act 2017 - Eligibility & Conditions For Taking Input Tax Credit - Taxguru - inDocument3 pagesSection 16 of CGST Act 2017 - Eligibility & Conditions For Taking Input Tax Credit - Taxguru - inDHANNNo ratings yet

- BTMCQS ............Document40 pagesBTMCQS ............Rana SabNo ratings yet

- Taxguru - In-Higher Rate of Duty Drawback IGST Refund Under GST RegimeDocument8 pagesTaxguru - In-Higher Rate of Duty Drawback IGST Refund Under GST RegimeNITIN KUMARNo ratings yet

- Amir Hamza Sikandar. 01-112171-002. Advanced Taxation AssignmentDocument6 pagesAmir Hamza Sikandar. 01-112171-002. Advanced Taxation AssignmentMehreen KhanNo ratings yet

- Commercial Tax Regulations EnglishDocument25 pagesCommercial Tax Regulations EnglishYeyint099No ratings yet

- Part 3Document4 pagesPart 3Cahaya HaniNo ratings yet

- b0d9c Reply To 16 4 NoticeDocument7 pagesb0d9c Reply To 16 4 NoticeahemadriandcoNo ratings yet

- PPT-CA Ketan Vajani - TCS and TDS - Recent Amendments - 19.11.2020Document37 pagesPPT-CA Ketan Vajani - TCS and TDS - Recent Amendments - 19.11.2020Kartik AgrawalNo ratings yet

- Obligations: 1. RegistrationDocument5 pagesObligations: 1. RegistrationPhilip AlamboNo ratings yet

- Taxation: 4. Other Percentage TaxDocument6 pagesTaxation: 4. Other Percentage TaxMarkuNo ratings yet

- TCS on Sale of Goods Effective October 1, 2020Document12 pagesTCS on Sale of Goods Effective October 1, 2020javed aliNo ratings yet

- Applicable Tax Deduction at Source Tds 2023Document4 pagesApplicable Tax Deduction at Source Tds 2023Hemangi PrabhuNo ratings yet

- VAT Claims ProcessingDocument8 pagesVAT Claims ProcessingMatthew TiuNo ratings yet

- May 2022Document6 pagesMay 2022Chandu NeredibilliNo ratings yet

- CA Inter Income Tax May22 Statutory UpdatesDocument8 pagesCA Inter Income Tax May22 Statutory UpdatesD SoniNo ratings yet

- Taxguru - In-Reversal Recovery of ITC Due To Time Limit Us 164 A Possible View in Departments Favour PDFDocument7 pagesTaxguru - In-Reversal Recovery of ITC Due To Time Limit Us 164 A Possible View in Departments Favour PDFKoushikNo ratings yet

- Atlas Consolidated Mining v. CirDocument2 pagesAtlas Consolidated Mining v. CirImmah Santos100% (1)

- Input Tax Credit RulesDocument23 pagesInput Tax Credit RulesRAJBIR SINGH TADANo ratings yet

- 1971 82 ITR 363 SC 17-08-1971 Kedarnath Jute MFG Co LTD Vs Commissioner of IncomeDocument5 pages1971 82 ITR 363 SC 17-08-1971 Kedarnath Jute MFG Co LTD Vs Commissioner of IncomeAnanya SNo ratings yet

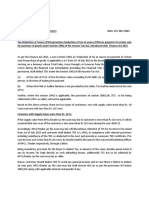

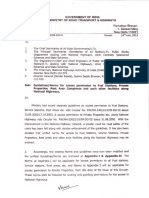

- Circular No. 17 of 2020 (F. No.370133 - 22 - 2020-Tpl) Guidelines Under Section 194-O (4) and Section 206c (1h) of The Income-Tax Act, 1961Document3 pagesCircular No. 17 of 2020 (F. No.370133 - 22 - 2020-Tpl) Guidelines Under Section 194-O (4) and Section 206c (1h) of The Income-Tax Act, 1961Vivek AgarwalNo ratings yet

- Ca. Pathik B. Shah: Value Added Tax Act 2003Document36 pagesCa. Pathik B. Shah: Value Added Tax Act 2003SanjayThakkarNo ratings yet

- FAQs on cash withdrawal TDS rulesDocument2 pagesFAQs on cash withdrawal TDS rulesSuryanarayana DNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- IOCL Guntakal Roads & DrainsDocument5 pagesIOCL Guntakal Roads & DrainsobayapalliNo ratings yet

- Estimating & CostingDocument9 pagesEstimating & CostingArui RegarNo ratings yet

- TenderDocuments PDFDocument305 pagesTenderDocuments PDFPratik GuptaNo ratings yet

- TenderDocuments PDFDocument305 pagesTenderDocuments PDFPratik GuptaNo ratings yet

- TenderDocuments PDFDocument305 pagesTenderDocuments PDFPratik GuptaNo ratings yet

- HPCL Compound Wall in Barmer RajasthanDocument1 pageHPCL Compound Wall in Barmer RajasthanobayapalliNo ratings yet

- Construction TolerancesDocument6 pagesConstruction TolerancesMuhammad IrfanNo ratings yet

- Bank Guarantee TemplateDocument2 pagesBank Guarantee TemplateobayapalliNo ratings yet

- TenderDocuments PDFDocument305 pagesTenderDocuments PDFPratik GuptaNo ratings yet

- Roads, Drains, Culverts Work at IOCL Jodhpur PlantDocument66 pagesRoads, Drains, Culverts Work at IOCL Jodhpur PlantobayapalliNo ratings yet

- IS 2571 (1970) : Code of Practice For Laying In-Situ Cement Concrete Flooring (D 5 Flooring, Wall Finishing and Roofing)Document30 pagesIS 2571 (1970) : Code of Practice For Laying In-Situ Cement Concrete Flooring (D 5 Flooring, Wall Finishing and Roofing)Prashant MalikNo ratings yet

- Line DetailsDocument15 pagesLine DetailsobayapalliNo ratings yet

- IS 2571 (1970) : Code of Practice For Laying In-Situ Cement Concrete Flooring (D 5 Flooring, Wall Finishing and Roofing)Document30 pagesIS 2571 (1970) : Code of Practice For Laying In-Situ Cement Concrete Flooring (D 5 Flooring, Wall Finishing and Roofing)Prashant MalikNo ratings yet

- ST 21Document9 pagesST 21amarnath_jbbNo ratings yet

- Is 10262 2009 PDFDocument21 pagesIs 10262 2009 PDFNatarajan NalanthNo ratings yet

- TelephoneDir 2018Document333 pagesTelephoneDir 2018obayapalliNo ratings yet

- MoRTH Guidelines For Access Permission To Fuel Stations 2014 PDFDocument41 pagesMoRTH Guidelines For Access Permission To Fuel Stations 2014 PDFobayapalliNo ratings yet

- Construction TolerancesDocument6 pagesConstruction TolerancesMuhammad IrfanNo ratings yet

- Brochure SRRDocument23 pagesBrochure SRRobayapalliNo ratings yet

- DAR (Civil) I PDFDocument757 pagesDAR (Civil) I PDFAnkush RanaNo ratings yet

- HB 11953 - 1Document1 pageHB 11953 - 1obayapalliNo ratings yet

- NH Guidelines PDFDocument97 pagesNH Guidelines PDFobayapalliNo ratings yet

- Disposal DPRDocument37 pagesDisposal DPRobayapalliNo ratings yet

- MoRTH Guidelines For Access Permission To Fuel Stations 2014 PDFDocument41 pagesMoRTH Guidelines For Access Permission To Fuel Stations 2014 PDFobayapalliNo ratings yet

- Vishnu EamcetDocument1 pageVishnu EamcetobayapalliNo ratings yet

- Is 456 2000Document108 pagesIs 456 2000obayapalliNo ratings yet

- Disposal DPRDocument37 pagesDisposal DPRobayapalliNo ratings yet

- IS-875-Part1 - Dead Loads For DesignDocument39 pagesIS-875-Part1 - Dead Loads For Designlokesh2325100% (7)