Professional Documents

Culture Documents

Chapter-8 Difference Between Regular & Composition Firm PDF

Chapter-8 Difference Between Regular & Composition Firm PDF

Uploaded by

TEJA SINGHOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter-8 Difference Between Regular & Composition Firm PDF

Chapter-8 Difference Between Regular & Composition Firm PDF

Uploaded by

TEJA SINGHCopyright:

Available Formats

Hello & Welcome Again to my website TallyClass.

com & Lets Begin the next chapter of my Full GST course - Difference Between

Composition & Regular Firms. jisme ham what is composition firm & What is regular firm ko samjhenge

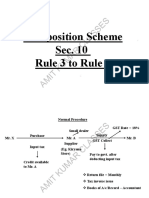

Chapter 8 : What is Composition Firm and Regular Firms

GST me Firm ko 2 Tarah Se Registered Kiya Ja Sakta hai.

1. Composition Firm

2. Regular Firm

Ab In Dono Firm Me Kya Fark Hai Ye Jaante hai Di Gayi Index Ko Dekhe

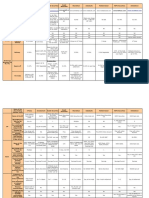

Subject Composition Firms Regular Firms

Agar kisi Firm Ki 1 Saal Ki Sale 1.5 Crore Agar kisi Firm Ki 1 Saal ki Sale 1.5 Crore

Turnover Limit se Kam hai to Firm Ko Composition Me Se Jyada Hai to Firm Ko Regular me

Registered Karwaya Ja Sakta hai. Registered Karna Aniwarya hai.

Regular Ke Liye Koi Optional Registration

Nahi Hai.

Agar Firm Ki 1 Saal Ki Sale 1.5 Crore se

Maanlo Kisi Ne Ye Sochke Composition

Optional Registration kam hai To Propritor chahe to Regular me

me Firm Registered Karwai Ki Uski Sale

Bhi Registration Karwa Sakta Hai.

1.5 Crore se Kam Hogi aur 1.5 Crore Se

Upar Chali Gai to Composition Firm Ko

Regular Karwana Aniwarya hai.

Regular Firm Ko Har Mahine 1 Return

Composition Firm ko Quarterly Return (3

Lagana Padta hai Jise GSTR3B Return

GST Return Mahine me Ek Baar) Lagana Padta hai. Jise

Kehte hai.

CMP08 Return Kehte hai.

Composition Firm me Purchase Par Lagni Regular Firms Ko input GST aur output

Wali GST ki Input nahi Li Ja Sakti Aur GST ka Pura Record Rakhna Padta hai.

Na Hi Sales Par GST Lagaya Ja Sakta Hai.

Applicable Of Tax Rates Yaani Har Month Kitni Purchase Ki Aur

Yaani Purchase Me Jo Tax Hamne Sarkar Uspar Kitana Tax pay Kiya aur Har

Ko Pay Kar Diya Usko Customer Se Bhi Mahine Kitni Sale Ki Aur Us Par Kitna

Wapas nahi Liya Ja Sakta Tax Collect Kiya.

Regular Firm Me GSTR3B Return Ke

According Agar Tax Payble Banta Hai

To Tax Pay Karna hai Nahi Banta hai To

Nahi Karna hai

For Example

1 Mahine me 1000 ki Purchase ki Jispar

Composition Firm har 3 mahine me jitna 500 Rs. Tax purchase ke sath hi paid kar

Sale karti hai Usko Return Ke Sath Sale ka diya.

1% Tax pay Karna Padta hai. aur Usi Mahine 1200 Ki Sales Ki Jispar

Tax Liability 700 Rs. Tax Customer Se Collect Kiya.

For Example 3 Mahine Me 250000 Rs. Ki

Sale Hui To 250000 Rs. Ka 1% Yani 2500 Yaha Hamari Tax Liability Banti hai To

Rs. Sarkar Ko Pay Karna Padta Hai. Baki Ka Balance 700-500=200 Rs Tax

Sarkar Ko Pay Karna Hai

Aur yahi Maanlo Sale 800 Rs. hi Hui aur

customer se tax 300 Rs. Hi Wasul Kiya to

200 Rs. Ab Bhi Sarkar Ke Paas Jama

Rahenge

Tax Paid Karne Ki Jarurat Nahi

Composition Firm Me Tally Me Purchase

Regular Firm Me Tally me Purchase Ya

ya Sales Ki entry Karne Par SGST &

Sales Ki Entry Karne Par Item Ki Taxable

CGST ya IGST nahi Lagaya Jata.

Example Of Entry Value Alag Likhi Jati Hai Aur Us Par

Lagne Wala Tax SGST & CGST ya IGST

Direct Tax Included Item Ki Value

Lagaya Jayega.

Daalkar Entry Kar Di Jati Hai.

Composition Firm me jo Bill Banta hai Use Regular Firm Me Jo Bill Banta Hai Use

Name Of Invoice

Bill Of Supply Kehte Hai. Tax Invoice Kaha Jata Hai.

Regular Firm me Purchase Par Input Tax

Liya Ja Sakta Hai Aur Sales Par Dusri Firm

Composition Firm me Books Keeping

ko Tax Diya Ja Sakta hai.

Karna Easy Hai aur Quarterly Return Yani

Advantage

3 Mahine Me Kewal 1 hi Return Lagana

yani agar koi Customer Regular Firm Me

Padta Hai

Registered hai aur wo Input lene ke liye

Invoice Maangle To Diya Ja Sakta hai.

Agar koi Customer Regular Firm me har Mahine Return Lagana Padta hai usme

Registered hai Aur Composition Firm wale bhi tax mismatch ka pura dhyan rakhna

DisAdvantage

Se input lene ke liye With Tax invoice padta hai books keeping me bhi savdhani

Maangle To nahi Diya Ja Sakta. baratni padti hai.

To Ye Composition aur Regular Firm me Different hai Jyada tar log firm ko Regular me hi Registered karwate hai.

ummid karta hu ki aapko ache se samajh me aa gaya hoga. ham aage ke chapter me jo bhi sikhenge filhar Regular Firms ke According

hi sikhenge.

Composition Firm Ki Accounting Bahut hi aasan hai Regular firm ki accounting sikhne ke baad composition firm ki bhi accounting

sikhaunga filhal ham Regular Firm Ki Accounting Sikhenge.

Jald Milenge Naye Chapter ke Sath

tab tak ke liye take care & happy Learny

You might also like

- Sell+On+Amazon Beginner's Guide E BookDocument17 pagesSell+On+Amazon Beginner's Guide E BookSanthoshini BhaskaranNo ratings yet

- Sears Holdings - How To Buy 17 Dollars For 17 Cents (OTCMKTS - SHLDQ) - FINALDocument8 pagesSears Holdings - How To Buy 17 Dollars For 17 Cents (OTCMKTS - SHLDQ) - FINALEric MooreNo ratings yet

- Binary Betting: An introductory guide to making money with binary betsFrom EverandBinary Betting: An introductory guide to making money with binary betsNo ratings yet

- Tackle Your Payroll Tax Debt: Proven Strategies Every Sub-Contractor Business Owner Should Know While Dealing With the IRSFrom EverandTackle Your Payroll Tax Debt: Proven Strategies Every Sub-Contractor Business Owner Should Know While Dealing With the IRSNo ratings yet

- InvoiceId111031 PDFDocument1 pageInvoiceId111031 PDFshyamNo ratings yet

- Read The Following Instructions Carefully Before Proceeding To Enter The Investor DetailsDocument36 pagesRead The Following Instructions Carefully Before Proceeding To Enter The Investor DetailsrapscallionxxxNo ratings yet

- The Etsy Seller's Simple Guide to Taxes - A Time and Money Saving Guide for Makers and CraftersFrom EverandThe Etsy Seller's Simple Guide to Taxes - A Time and Money Saving Guide for Makers and CraftersNo ratings yet

- IA 1-3 IT Audit IntroductionDocument7 pagesIA 1-3 IT Audit IntroductionAdeyinkaAjagbeNo ratings yet

- Profession Tax Challan - MaharashtraDocument1 pageProfession Tax Challan - MaharashtraPaymaster Services80% (5)

- OLX Customer OLX Customer: Tax InvoiceDocument1 pageOLX Customer OLX Customer: Tax InvoiceaparajitNo ratings yet

- CF Qualitative CharacteristicsDocument8 pagesCF Qualitative Characteristicspanda 1No ratings yet

- COBIT 2019 Major Differences With COBIT 5Document12 pagesCOBIT 2019 Major Differences With COBIT 5Mhz RegNo ratings yet

- Managing Quality Integrating The Supply Chain 6th Edition Foster Solutions ManualDocument21 pagesManaging Quality Integrating The Supply Chain 6th Edition Foster Solutions Manualreumetampoeqnb100% (31)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)KALASH SHARMANo ratings yet

- Difference Between Income Tax & Sales TaxDocument1 pageDifference Between Income Tax & Sales TaxIrfan AnsariNo ratings yet

- Chapter 7: What is GST: Definition of GST GST की परिभाषाDocument8 pagesChapter 7: What is GST: Definition of GST GST की परिभाषाSandeep SinghNo ratings yet

- Sale 1 09-04-2020Document1 pageSale 1 09-04-2020VIVEK MBNo ratings yet

- Income Tax On BusinessDocument17 pagesIncome Tax On BusinesspiyushestartupNo ratings yet

- How To Get Chai Ops Franchise (Cost and Profit)Document1 pageHow To Get Chai Ops Franchise (Cost and Profit)yash banswaniNo ratings yet

- Chapter 14: Types of Purchase: Tally CourseDocument1 pageChapter 14: Types of Purchase: Tally CourseSagarNo ratings yet

- Types of Purchase in Tally PDFDocument1 pageTypes of Purchase in Tally PDFAnup gurungNo ratings yet

- Types of Purchase in Tally PDFDocument1 pageTypes of Purchase in Tally PDFAnup gurungNo ratings yet

- OD125723247460240000Document1 pageOD125723247460240000Mithlesh VermaNo ratings yet

- Mr. White Champion IndustriesDocument9 pagesMr. White Champion IndustriesPrabhuNo ratings yet

- Provisions GroupDocument3 pagesProvisions GroupSANDEEP SHARMANo ratings yet

- Return of Income & Itr FormsDocument11 pagesReturn of Income & Itr FormsJohanNo ratings yet

- How To Calculate Turnover For F&O TradingDocument5 pagesHow To Calculate Turnover For F&O TradingSb SharmaNo ratings yet

- Sell+on+Amazon Beginner's Guide E BookDocument17 pagesSell+on+Amazon Beginner's Guide E Bookkamal vithlaniNo ratings yet

- Sell+on+Amazon Beginner's Guide E BookDocument17 pagesSell+on+Amazon Beginner's Guide E Bookkri satNo ratings yet

- Sell+on+Amazon Beginner's Guide E BookDocument17 pagesSell+on+Amazon Beginner's Guide E BookVenkat GopuNo ratings yet

- Composition Scheme (IDT) Revision Jan 23Document50 pagesComposition Scheme (IDT) Revision Jan 23CA Tushar GuptaNo ratings yet

- Jain Book Agency: Tax InvoiceDocument1 pageJain Book Agency: Tax InvoiceAtreya GanchaudhuriNo ratings yet

- Mivi Duopods D3 InvoiceDocument1 pageMivi Duopods D3 Invoicehemantgodara121No ratings yet

- Can I Make A Deductible IRA Contribution 2021Document1 pageCan I Make A Deductible IRA Contribution 2021JosephNo ratings yet

- GST NotesDocument20 pagesGST Notesadityaraj841423No ratings yet

- ST ST STDocument1 pageST ST STsamisantNo ratings yet

- Ca Inter GST Module 1Document46 pagesCa Inter GST Module 1sukritisuman2No ratings yet

- Realme 3 Pro Lightning Purple, 64 GB: Grand Total 15999.00Document3 pagesRealme 3 Pro Lightning Purple, 64 GB: Grand Total 15999.00Anujit JenaNo ratings yet

- Durga TilesDocument38 pagesDurga Tilestaxin haryanaNo ratings yet

- In Voice Id 193945Document1 pageIn Voice Id 193945Amit kumarNo ratings yet

- Print Challan Kapil VatsDocument1 pagePrint Challan Kapil VatsPankaj VatsaNo ratings yet

- Money Losing CompaniesDocument4 pagesMoney Losing CompaniesBhuwanNo ratings yet

- EBITDA Growth Incentive Scheme 1 April 2019: EffectiveDocument16 pagesEBITDA Growth Incentive Scheme 1 April 2019: Effectiveashi ashiNo ratings yet

- ASTY9868950Document1 pageASTY9868950Mansi AgarwalNo ratings yet

- Comparison Online Trading SitesDocument4 pagesComparison Online Trading SitesMithun WaghelaNo ratings yet

- NetflixDocument1 pageNetflixNiladree ShilNo ratings yet

- Boursa Kuwait Ownership 6 AugestDocument3 pagesBoursa Kuwait Ownership 6 AugestAbdo ElbannaNo ratings yet

- Infinitesimal Ganit Vol I & IIDocument310 pagesInfinitesimal Ganit Vol I & IInarendraNo ratings yet

- OD329525091849006100Document1 pageOD329525091849006100hg225949No ratings yet

- Tax Invoice: RS GroupDocument1 pageTax Invoice: RS Groupsurya sen pandeyNo ratings yet

- Composition SchemeDocument8 pagesComposition Schemeartinegi2211No ratings yet

- Three Ways M A Vallue Part TwoDocument5 pagesThree Ways M A Vallue Part TwoBhuwanNo ratings yet

- OD126171153286264000Document1 pageOD126171153286264000Robina KumariNo ratings yet

- SGF ProfileDocument12 pagesSGF ProfileAnjali Angel ThakurNo ratings yet

- Mi Basic Wired Headset With Mic: Grand Total 439.00Document1 pageMi Basic Wired Headset With Mic: Grand Total 439.00Ram BisoyeeNo ratings yet

- STAR LEGAL CONSULTANCY Intake FormDocument5 pagesSTAR LEGAL CONSULTANCY Intake Formstarlegalconsultancy4No ratings yet

- Daily Work Report: Date: - 05 - Sep-2018Document3 pagesDaily Work Report: Date: - 05 - Sep-2018rajasmudafaleNo ratings yet

- Od112745772415922000 PDFDocument1 pageOd112745772415922000 PDFchaitanya chaitanyaNo ratings yet

- GST PDFDocument16 pagesGST PDFSHASHWAT MISHRANo ratings yet

- Forms of Business Organization in NepalDocument10 pagesForms of Business Organization in Nepalsuraj banNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherYash ChaudharyNo ratings yet

- Generally Accepted Accounting PrinciplesDocument15 pagesGenerally Accepted Accounting Principlesjitin84rocksNo ratings yet

- Od 116705815912325000Document1 pageOd 116705815912325000SunnyNo ratings yet

- Increase Your Savings Rate: It Determines When You Can Retire: Financial Freedom, #98From EverandIncrease Your Savings Rate: It Determines When You Can Retire: Financial Freedom, #98No ratings yet

- Airport - WikipediaDocument109 pagesAirport - WikipediaAadarsh LamaNo ratings yet

- Buddhist Tenet System by Rigpa WikiDocument3 pagesBuddhist Tenet System by Rigpa WikiAadarsh LamaNo ratings yet

- Income Tax ReturnDocument4 pagesIncome Tax ReturnAadarsh LamaNo ratings yet

- Journal Practice NotesDocument1 pageJournal Practice NotesAadarsh LamaNo ratings yet

- Mba FinalDocument14 pagesMba FinalVivek MugdalNo ratings yet

- Lesson #2 - PhilGEPS, GPPB and Procurement PlanningDocument13 pagesLesson #2 - PhilGEPS, GPPB and Procurement PlanningRewel Jr. MedicoNo ratings yet

- Experience, Appointment and Releiving LetterDocument3 pagesExperience, Appointment and Releiving LetterPema KotaNo ratings yet

- Accenture ZBSC Zero Based Supply Chain FINALDocument14 pagesAccenture ZBSC Zero Based Supply Chain FINALsnNo ratings yet

- Cooperativism As A Way of LifeDocument48 pagesCooperativism As A Way of LifeZebulun DocallasNo ratings yet

- 1 Rfid Contract PDFDocument176 pages1 Rfid Contract PDFLoraMorrisonNo ratings yet

- Customer-Defined Service StandardsDocument23 pagesCustomer-Defined Service StandardsAitm Mba BelagaviNo ratings yet

- Marketing TextbookDocument708 pagesMarketing Textbooktatiana.kuzina8No ratings yet

- Zekarias YohannesDocument88 pagesZekarias YohannesadamNo ratings yet

- Form 9 Cash Advances For Payroll and Petty Cash FundDocument1 pageForm 9 Cash Advances For Payroll and Petty Cash FundShaira BalindongNo ratings yet

- ROLAND CEPA Certified Protocol Presentation BIPCC Feb2015 Edits RHDocument20 pagesROLAND CEPA Certified Protocol Presentation BIPCC Feb2015 Edits RHarrazolaNo ratings yet

- Question 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireDocument5 pagesQuestion 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireLaud ListowellNo ratings yet

- Panaflex DataDocument7 pagesPanaflex DataMuhammad Hassan SarfrazNo ratings yet

- IsraDocument5 pagesIsraKalkayeNo ratings yet

- Canara Bank ProjectDocument20 pagesCanara Bank ProjectSarika Sharma100% (1)

- Agile For Pharma Devices - PPTDocument18 pagesAgile For Pharma Devices - PPTsivaNo ratings yet

- Coal India Annual Report 2010 11Document210 pagesCoal India Annual Report 2010 11Bharathi KamathNo ratings yet

- Vishi ProjectDocument36 pagesVishi Projectparmindersingh072No ratings yet

- TBChap 010Document23 pagesTBChap 010alaamabood6No ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingvimalaNo ratings yet

- Proposal Eta Theke BanaisiDocument109 pagesProposal Eta Theke BanaisiMaruf Hasibul IslamNo ratings yet

- Online Accrual - A White PaperDocument48 pagesOnline Accrual - A White Paper1lvlup100% (3)

- A Study On Material Management and Inventory Control at Karnataka Soap and Detergents LimitedDocument68 pagesA Study On Material Management and Inventory Control at Karnataka Soap and Detergents LimitedjefrinNo ratings yet

- SUPERB Application Form 1Document7 pagesSUPERB Application Form 1michi13No ratings yet

- Unit 6: Direct Mail Campaigns: Week 1: CRM and Marketing OverviewDocument10 pagesUnit 6: Direct Mail Campaigns: Week 1: CRM and Marketing OverviewGaurab BanerjiNo ratings yet