Professional Documents

Culture Documents

Solutiondone 264

Solutiondone 264

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutiondone 264

Solutiondone 264

Uploaded by

trilocksp SinghCopyright:

Available Formats

The intangible assets section of Sappelt Company at

December 31

The intangible assets section of Sappelt Company at December 31

The intangible assets section of Sappelt Company at December 31, 2019, is presented

below.

Patents ($70,000 cost less $7,000 amortization)......................$63,000

Franchises ($48,000 cost less $19,200 amortization)..................28,800

Total........................................................................$91,800

The patent was acquired in January 2019 and has a useful life of 10 years. The franchise was

acquired in January 2016 and also has a useful life of 10 years. The following cash transactions

may have affected intangible assets during 2020.

Jan. 2 Paid $27,000 legal costs to successfully defend the patent against infringement by

another company.

Jan.-June Developed a new product, incurring $140,000 in research and development costs. A

patent was granted for the product on July 1. Its useful life is equal to its legal life.

Sept. 1 Paid $50,000 to an extremely large defensive lineman to appear in commercials

advertising the company's products. The commercials will air in September and October.

Oct. 1 Acquired a franchise for $140,000. The franchise has a useful life of 50 years.

Instructions

(a) Prepare journal entries to record the transactions above.

(b) Prepare journal entries to record the 2020 amortization expense.

(c) Prepare the intangible assets section of the balance sheet at December 31, 2020.

The intangible assets section of Sappelt Company at December 31

SOLUTION-- http://solutiondone.online/downloads/the-intangible-assets-section-of-sappelt-

company-at-december-31/

Unlock answers here solutiondone.online

You might also like

- The Financial Statements and Notes of ZETA Corporation Are Reproduced Over The Next Several PagesDocument5 pagesThe Financial Statements and Notes of ZETA Corporation Are Reproduced Over The Next Several PagesJesia DjaduNo ratings yet

- Practice Sheet 2Document4 pagesPractice Sheet 2Prerna AroraNo ratings yet

- Chapter 18Document10 pagesChapter 18Ali Abu Al Saud100% (2)

- Exam 1 SolutionDocument10 pagesExam 1 SolutionLucas GalingNo ratings yet

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- The Post Closing Trial Balance of Storey Corporation at December 31Document1 pageThe Post Closing Trial Balance of Storey Corporation at December 31trilocksp SinghNo ratings yet

- Toth Company Had The Following Assets and Liabilities On TheDocument1 pageToth Company Had The Following Assets and Liabilities On Thetrilocksp SinghNo ratings yet

- Mojakoe Ak2 Uts 2018 PDFDocument17 pagesMojakoe Ak2 Uts 2018 PDFRayhandi AlmerifkiNo ratings yet

- Exercises Chapter 11Document3 pagesExercises Chapter 11Fatima BeenaNo ratings yet

- Cima c02 Mock-2Document13 pagesCima c02 Mock-2Samiuddin Bukhari100% (1)

- 111Document7 pages111haerudinsaniNo ratings yet

- 2024.02.01FA ExerciseDocument2 pages2024.02.01FA ExerciseNgan Nguyen Ho KimNo ratings yet

- Practice Exercise - Pas 7Document4 pagesPractice Exercise - Pas 7Martha Nicole MaristelaNo ratings yet

- Chapter Four 4 Consolidated Financial Statements: Subsequent To Date of Business Combination Under Purchase AccountingDocument8 pagesChapter Four 4 Consolidated Financial Statements: Subsequent To Date of Business Combination Under Purchase AccountingN ENo ratings yet

- Practice Cash Flow ProblemDocument3 pagesPractice Cash Flow ProblemSid NairNo ratings yet

- FIN 220, Ch3, Selected Problems 2Document3 pagesFIN 220, Ch3, Selected Problems 23ooobd1234No ratings yet

- Final Revision 2022 For First YearDocument21 pagesFinal Revision 2022 For First YearRabie HarounNo ratings yet

- CH 1 & 14Document13 pagesCH 1 & 14Rabie HarounNo ratings yet

- Q3 2019 Standard Industries Financial StatementsDocument29 pagesQ3 2019 Standard Industries Financial StatementsMiguel RamosNo ratings yet

- Solutiondone 307Document1 pageSolutiondone 307trilocksp SinghNo ratings yet

- Practice Questions For BAAC 550 Question 1 Property, Plant and Equipment (15 Marks, 15 Minutes)Document19 pagesPractice Questions For BAAC 550 Question 1 Property, Plant and Equipment (15 Marks, 15 Minutes)Jasmine HuangNo ratings yet

- Consolidated Financial Statements Subsquint To Date of BCDocument4 pagesConsolidated Financial Statements Subsquint To Date of BCMisganaw DebasNo ratings yet

- Take Away Assignment Managerial AccountingDocument4 pagesTake Away Assignment Managerial AccountingawalebuuxNo ratings yet

- Extra Applications - Lecture Week 2Document5 pagesExtra Applications - Lecture Week 2Muhammad HusseinNo ratings yet

- Nyse NC 2021Document142 pagesNyse NC 2021Human GrootNo ratings yet

- SESSIONDocument12 pagesSESSIONtanvi gargNo ratings yet

- The Following Balance Sheet Has Been Produced For Litz CorporatiDocument1 pageThe Following Balance Sheet Has Been Produced For Litz CorporatiAmit PandeyNo ratings yet

- Only For Students Who Have Problem With AbsencesDocument2 pagesOnly For Students Who Have Problem With Absencesusman akbarNo ratings yet

- You Hold A 25 Common Stock Interest in Youownit A: Unlock Answers Here Solutiondone - OnlineDocument1 pageYou Hold A 25 Common Stock Interest in Youownit A: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Jawaban Quiz 3 AKM Kelas C - Amanda G Erari - F0320007Document2 pagesJawaban Quiz 3 AKM Kelas C - Amanda G Erari - F0320007Amanda Givelline ErariNo ratings yet

- Act05 MultinationalDocument7 pagesAct05 MultinationalIgnacioNo ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument11 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- Math ProblemsDocument12 pagesMath ProblemsForhad Ahmad100% (1)

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- The Following Data Were Taken From The Records of SkateDocument1 pageThe Following Data Were Taken From The Records of SkateM Bilal SaleemNo ratings yet

- Statement of Cash Flows - ProblemsDocument2 pagesStatement of Cash Flows - ProblemsMiladanica Barcelona BarracaNo ratings yet

- The Stockholders Equity Section of Peter Corporation S Balance Sheet atDocument1 pageThe Stockholders Equity Section of Peter Corporation S Balance Sheet attrilocksp SinghNo ratings yet

- 3512 Chapter 23 Cash Flows HW Exercises ProblemsDocument12 pages3512 Chapter 23 Cash Flows HW Exercises ProblemsM MustafaNo ratings yet

- Exhibit 7.1: Financial Statement AnalysisDocument2 pagesExhibit 7.1: Financial Statement AnalysisYean SoramyNo ratings yet

- MIMIYUHHDocument2 pagesMIMIYUHHRogin Erica AdolfoNo ratings yet

- 1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Document11 pages1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Raisul Ma'arif100% (1)

- Fundamentals of Accounting IDocument7 pagesFundamentals of Accounting IDawit TilahunNo ratings yet

- Problem Set 6 BS CS 6Document3 pagesProblem Set 6 BS CS 6Rubab MirzaNo ratings yet

- This Information Is For Paulo Company For The Year Ended: Unlock Answers Here Solutiondone - OnlineDocument1 pageThis Information Is For Paulo Company For The Year Ended: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

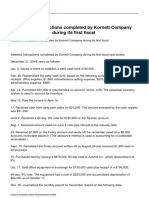

- Selected Transactions Completed by Kornett Company During Its First FiscalDocument4 pagesSelected Transactions Completed by Kornett Company During Its First FiscalAmit PandeyNo ratings yet

- Exercises Noreen BudgetDocument2 pagesExercises Noreen BudgetnoursfoodforthoughtNo ratings yet

- 7877960_1_financial---managerial-acc-assignment-mba-weekend-Document3 pages7877960_1_financial---managerial-acc-assignment-mba-weekend-adabotor7No ratings yet

- Catapang Hazel Ann E.Document4 pagesCatapang Hazel Ann E.Johnlloyd BarretoNo ratings yet

- Inghamton ILM Orporation Xpected ASH Ollections UgustDocument15 pagesInghamton ILM Orporation Xpected ASH Ollections UgustIsra' I. SweilehNo ratings yet

- The Preliminary Draft of The Balance Sheet at The End: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Preliminary Draft of The Balance Sheet at The End: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Solution CH.8Document10 pagesSolution CH.8Thanawat PHURISIRUNGROJNo ratings yet

- Chapter 9-1Document5 pagesChapter 9-1jou20220354No ratings yet

- Presentation of FS With AnsDocument19 pagesPresentation of FS With AnsMichael BongalontaNo ratings yet

- Exam Review Problem 13-H1Document2 pagesExam Review Problem 13-H1Kim HangNo ratings yet

- Jawaban Laporan Arus Kas Dan Laba Rugi KomprehensifDocument4 pagesJawaban Laporan Arus Kas Dan Laba Rugi KomprehensifAksit RistiyaningsihNo ratings yet

- The Following Data Were Taken From The Records of Surf SDocument1 pageThe Following Data Were Taken From The Records of Surf SM Bilal SaleemNo ratings yet

- Accounting For Merchandising Businesses: Problems Prob. 5-1ADocument22 pagesAccounting For Merchandising Businesses: Problems Prob. 5-1ARheino WahyuNo ratings yet

- Corrections To The Financial Section of Annual Report For The Year Ended March 2010 (Based On US GAAP)Document3 pagesCorrections To The Financial Section of Annual Report For The Year Ended March 2010 (Based On US GAAP)buddyNo ratings yet

- Solutiondone 2-372Document1 pageSolutiondone 2-372trilocksp SinghNo ratings yet

- 2017 Sem1 Final Revision QuestionsDocument4 pages2017 Sem1 Final Revision Questionsbrip selNo ratings yet

- Institutional Investment in Infrastructure in Emerging Markets and Developing EconomiesFrom EverandInstitutional Investment in Infrastructure in Emerging Markets and Developing EconomiesNo ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet