Professional Documents

Culture Documents

Maria Selk and David Green Are Forming A Partnership To

Maria Selk and David Green Are Forming A Partnership To

Uploaded by

M Bilal SaleemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maria Selk and David Green Are Forming A Partnership To

Maria Selk and David Green Are Forming A Partnership To

Uploaded by

M Bilal SaleemCopyright:

Available Formats

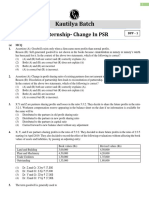

Maria Selk and David Green are forming a partnership to

Maria Selk and David Green are forming a partnership to which Selk will devote one-third time

and Green will devote full time. They have discussed the following alternative plans for sharing

income and loss:(a) In the ratio of their initial capital investments, which they have agreed will

be $208,000 for Selk and $312,000 for Green; (b) In proportion to the time devoted to the

business; (c) A salary allowance of $8,000 per month to Green and the balance in accordance

with the ratio of their initial capital investments; or(d) A salary allowance of $8,000 per month to

Green, 10% interest on their initial capital investments, and the balance shared equally. The

partners expect the business to perform as follows: Year 1, $72,000 net loss; Year 2, $152,000

net income; and Year 3, $376,000 net income.RequiredPrepare three tables with the following

column headings.Complete the tables, one for each of the first three years, by showing how to

allocate partnership income or loss to the partners under each of the four plans being

considered. (Round answers to the nearest wholedollar.)

View Solution:

Maria Selk and David Green are forming a partnership to

SOLUTION-- http://expertanswer.online/downloads/maria-selk-and-david-green-are-forming-a-

partnership-to/

See Answer here expertanswer.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Chapter 21 Dispositions of Partnership Interests and Partnership Distributions 2Document9 pagesChapter 21 Dispositions of Partnership Interests and Partnership Distributions 2Doreen0% (1)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- AC Sample Paper 3 Unsolved-1Document10 pagesAC Sample Paper 3 Unsolved-1Appharnha Rs0% (1)

- More Sample Exam Questions-Midterm2Document6 pagesMore Sample Exam Questions-Midterm2mehdiNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Fundamentals Class 12 Accountancy MCQs PDFDocument6 pagesFundamentals Class 12 Accountancy MCQs PDFAryan RawatNo ratings yet

- Chapter c10Document42 pagesChapter c10DrellyNo ratings yet

- CH 15Document21 pagesCH 15Ahmed Al Ekam100% (2)

- Review+Materials+Ch03 Managerial FinanceDocument32 pagesReview+Materials+Ch03 Managerial FinanceYee Sook YingNo ratings yet

- Solved Write in Algebraic Form A Calculation of U K Pounds PerDocument1 pageSolved Write in Algebraic Form A Calculation of U K Pounds PerM Bilal SaleemNo ratings yet

- Chapter c10Document48 pagesChapter c10bobNo ratings yet

- Dyer and Salinas Have Decided To Form A Partnership TheyDocument1 pageDyer and Salinas Have Decided To Form A Partnership TheyM Bilal SaleemNo ratings yet

- Lawford and Delgado Have Decided To Form A Partnership TheyDocument1 pageLawford and Delgado Have Decided To Form A Partnership TheyMiroslav GegoskiNo ratings yet

- Prentice Halls Federal Taxation 2015 Corporations Partnerships Estates and Trusts 28Th Edition Pope Test Bank Full Chapter PDFDocument65 pagesPrentice Halls Federal Taxation 2015 Corporations Partnerships Estates and Trusts 28Th Edition Pope Test Bank Full Chapter PDFDavidGarciaerfq100% (12)

- Prentice Halls Federal Taxation 2015 Comprehensive 28Th Edition Pope Test Bank Full Chapter PDFDocument65 pagesPrentice Halls Federal Taxation 2015 Comprehensive 28Th Edition Pope Test Bank Full Chapter PDFDavidGarciaerfq100% (11)

- Prentice Halls Federal Taxation 2015 Comprehensive 28th Edition Pope Test BankDocument44 pagesPrentice Halls Federal Taxation 2015 Comprehensive 28th Edition Pope Test Bankfarleyphedral0p100% (24)

- Prentice Halls Federal Taxation 2014 Comprehensive Rupert 27th Edition Test BankDocument43 pagesPrentice Halls Federal Taxation 2014 Comprehensive Rupert 27th Edition Test Bankhuyenquyen9eemjd100% (28)

- Pearsons Federal Taxation 2018 Comprehensive 31St Edition Rupert Test Bank Full Chapter PDFDocument66 pagesPearsons Federal Taxation 2018 Comprehensive 31St Edition Rupert Test Bank Full Chapter PDFWilliamDanielsezgj100% (10)

- Multiple Choice Questions 1 A Partner S Share of Ordinary Income orDocument2 pagesMultiple Choice Questions 1 A Partner S Share of Ordinary Income orFreelance WorkerNo ratings yet

- Chapter 15Document16 pagesChapter 15kylicia bestNo ratings yet

- Kendra Cogley and Mei Share Income and Loss in ADocument1 pageKendra Cogley and Mei Share Income and Loss in AM Bilal SaleemNo ratings yet

- Pearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32nd Edition Anderson Test BankDocument29 pagesPearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32nd Edition Anderson Test Bankalyssahoffmantbqfyjwszi100% (30)

- Pearsons Federal Taxation 2018 Corporations Partnerships Estates Trusts 31St Edition Anderson Test Bank Full Chapter PDFDocument66 pagesPearsons Federal Taxation 2018 Corporations Partnerships Estates Trusts 31St Edition Anderson Test Bank Full Chapter PDFWilliamDanielsezgj100% (11)

- Tim Snyder and Jay Wise Have Decided To Form ADocument1 pageTim Snyder and Jay Wise Have Decided To Form AM Bilal SaleemNo ratings yet

- Pearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32Nd Edition Anderson Test Bank Full Chapter PDFDocument50 pagesPearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32Nd Edition Anderson Test Bank Full Chapter PDFJesusEvansspaj100% (10)

- Lecture Note On Present Value by JTBDocument78 pagesLecture Note On Present Value by JTBshannon salvadorNo ratings yet

- Mid Fin 2 Full deDocument19 pagesMid Fin 2 Full deÁi Ly NguyễnNo ratings yet

- CH 3 MCQ AccDocument10 pagesCH 3 MCQ AccabiNo ratings yet

- ACTBFAR - Exercise Set #3Document6 pagesACTBFAR - Exercise Set #3Cha PampolinaNo ratings yet

- Finance Practice Sample QuizDocument5 pagesFinance Practice Sample QuizrickNo ratings yet

- Cbleacpu 02Document10 pagesCbleacpu 02mehtayogesh476No ratings yet

- Accounting For Partnerships: Study ObjectivesDocument42 pagesAccounting For Partnerships: Study ObjectivesGena DuresaNo ratings yet

- AdmissionDocument23 pagesAdmissionPawan TalrejaNo ratings yet

- Shenime Per Provime QuizDocument18 pagesShenime Per Provime Quizjola_cufe18No ratings yet

- PPDocument23 pagesPPshazarafiaNo ratings yet

- BA CH4 個人理財算式 (EAR - NPV)Document2 pagesBA CH4 個人理財算式 (EAR - NPV)Chun Kit LauNo ratings yet

- Crystal Glass Works LTD Provided You With The Following InformationDocument1 pageCrystal Glass Works LTD Provided You With The Following InformationTaimour HassanNo ratings yet

- Partnerships: Formation, Operation, and Ownership Changes: Multiple ChoiceDocument20 pagesPartnerships: Formation, Operation, and Ownership Changes: Multiple ChoiceLester AlpanoNo ratings yet

- 12th Sample Paper 6Document8 pages12th Sample Paper 6Amit ChaudhryNo ratings yet

- Practice Mid-Semester Exam WebDocument10 pagesPractice Mid-Semester Exam WebAston CheeNo ratings yet

- Accounting For PartnershipDocument38 pagesAccounting For Partnershippeterpark0903No ratings yet

- PPTXDocument16 pagesPPTXJenifer KlintonNo ratings yet

- Test Bank For Corporations Partnerships Estates and Trusts 2020 43th by RaabeDocument16 pagesTest Bank For Corporations Partnerships Estates and Trusts 2020 43th by Raabeclough.skinkeri5g9tv100% (48)

- Partnership Imp QDocument5 pagesPartnership Imp Qa4603488No ratings yet

- Chapter c9Document45 pagesChapter c9bobNo ratings yet

- Week07 - Acct - Quizlet04Document5 pagesWeek07 - Acct - Quizlet04Alenne FelizardoNo ratings yet

- Class 12 Pre Board SQP Accountancy 01Document21 pagesClass 12 Pre Board SQP Accountancy 01Mayank SharmaNo ratings yet

- Cbleacpu 01Document10 pagesCbleacpu 01tripatjotkaur757No ratings yet

- Practice FinalDocument8 pagesPractice FinalGrace CheungNo ratings yet

- 12 - Q. Paper - Exam Code FTEE-2005 - 22 - Class - K8 - AccountancyDocument14 pages12 - Q. Paper - Exam Code FTEE-2005 - 22 - Class - K8 - AccountancyShafali Aggarwal TanejaNo ratings yet

- Biboso&Racines WILEYDocument20 pagesBiboso&Racines WILEYLouise BattungNo ratings yet

- Week 13and14 Assignment FINALSDocument10 pagesWeek 13and14 Assignment FINALSkristelle0marisseNo ratings yet

- LWC13Document29 pagesLWC13Oshadharon PothochariNo ratings yet

- Chapter c4Document44 pagesChapter c4bobNo ratings yet

- Change in PSR 1 PDFDocument6 pagesChange in PSR 1 PDFNavya jainNo ratings yet

- Question 929893Document9 pagesQuestion 929893umangchh2306No ratings yet

- Exercise CH14 SolutionDocument11 pagesExercise CH14 SolutionThanawat PHURISIRUNGROJNo ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementDewanti Almeera100% (1)

- Accountancy MCQs For Class 12 With Answers Chapter 1 Accounting For Partnership Firms - Fundamentals - NCERT BooksDocument34 pagesAccountancy MCQs For Class 12 With Answers Chapter 1 Accounting For Partnership Firms - Fundamentals - NCERT Booksbabaaijaz01No ratings yet

- Methods of Redemption-2Document11 pagesMethods of Redemption-2Akash RanjanNo ratings yet

- Solved Your Local Fast Food Chain With Two Dozen Stores UsesDocument1 pageSolved Your Local Fast Food Chain With Two Dozen Stores UsesM Bilal SaleemNo ratings yet

- Solved You Should Never Buy Precooked Frozen Foods Because The PriceDocument1 pageSolved You Should Never Buy Precooked Frozen Foods Because The PriceM Bilal SaleemNo ratings yet

- Solved Zack and Andon Compete in The Peanut Market Zack IsDocument1 pageSolved Zack and Andon Compete in The Peanut Market Zack IsM Bilal SaleemNo ratings yet

- Solved You Want To Price Posters at The Poster Showcase ProfitablyDocument1 pageSolved You Want To Price Posters at The Poster Showcase ProfitablyM Bilal SaleemNo ratings yet

- Solved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25Document1 pageSolved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25M Bilal SaleemNo ratings yet

- Solved Your Company Sponsors A 401 K Plan Into Which You DepositDocument1 pageSolved Your Company Sponsors A 401 K Plan Into Which You DepositM Bilal SaleemNo ratings yet

- Solved Your Company Is Bidding For A Service Contract in ADocument1 pageSolved Your Company Is Bidding For A Service Contract in AM Bilal SaleemNo ratings yet

- Solved You Won A Free Ticket To See A Bruce SpringsteenDocument1 pageSolved You Won A Free Ticket To See A Bruce SpringsteenM Bilal SaleemNo ratings yet

- Solved You Have Been Hired by The Government of Kenya WhichDocument1 pageSolved You Have Been Hired by The Government of Kenya WhichM Bilal SaleemNo ratings yet

- Solved Why Should The Early Adopters of An Information Technology SystemDocument1 pageSolved Why Should The Early Adopters of An Information Technology SystemM Bilal SaleemNo ratings yet

- Solved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesDocument1 pageSolved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesM Bilal SaleemNo ratings yet

- Solved With A Purchase Price of 350 000 A Small Warehouse ProvidesDocument1 pageSolved With A Purchase Price of 350 000 A Small Warehouse ProvidesM Bilal SaleemNo ratings yet

- Solved You Are The Manager of A Monopoly A Typical Consumer SDocument1 pageSolved You Are The Manager of A Monopoly A Typical Consumer SM Bilal SaleemNo ratings yet

- Solved You Plan To Purchase A House For 115 000 UsingDocument1 pageSolved You Plan To Purchase A House For 115 000 UsingM Bilal SaleemNo ratings yet

- Solved You Are Driving On A Trip and Have Two ChoicesDocument1 pageSolved You Are Driving On A Trip and Have Two ChoicesM Bilal SaleemNo ratings yet

- Solved You Have 832 66 in A Savings Account That Offers ADocument1 pageSolved You Have 832 66 in A Savings Account That Offers AM Bilal SaleemNo ratings yet

- Solved You Are An Advisor To The Egyptian Government Which HasDocument1 pageSolved You Are An Advisor To The Egyptian Government Which HasM Bilal SaleemNo ratings yet

- Solved You Are A Usda Pork Analyst Charged With Keeping Up To DateDocument1 pageSolved You Are A Usda Pork Analyst Charged With Keeping Up To DateM Bilal SaleemNo ratings yet

- Solved Your Brother Calls You On The Phone Telling You ThatDocument1 pageSolved Your Brother Calls You On The Phone Telling You ThatM Bilal SaleemNo ratings yet

- Solved You Have Decided That You Are Going To Consume 600Document1 pageSolved You Have Decided That You Are Going To Consume 600M Bilal SaleemNo ratings yet

- Solved You Are Given The Production Function y Ak1 3n2 3 WhereDocument1 pageSolved You Are Given The Production Function y Ak1 3n2 3 WhereM Bilal SaleemNo ratings yet

- Solved You Can Either Take A Bus or Drive Your CarDocument1 pageSolved You Can Either Take A Bus or Drive Your CarM Bilal SaleemNo ratings yet

- Solved You and Your Roommate Have A Stack of Dirty DishesDocument1 pageSolved You and Your Roommate Have A Stack of Dirty DishesM Bilal SaleemNo ratings yet

- Solved You Are Considering Buying A New House and Have FoundDocument1 pageSolved You Are Considering Buying A New House and Have FoundM Bilal SaleemNo ratings yet

- Solved You Are Considering An Investment in 30 Year Bonds Issued byDocument1 pageSolved You Are Considering An Investment in 30 Year Bonds Issued byM Bilal SaleemNo ratings yet

- Solved Wilson Walks Into His Class 10 Minutes Late Because HeDocument1 pageSolved Wilson Walks Into His Class 10 Minutes Late Because HeM Bilal SaleemNo ratings yet

- Solved You Are Selling Two Goods 1 and 2 To ADocument1 pageSolved You Are Selling Two Goods 1 and 2 To AM Bilal SaleemNo ratings yet

- Solved With The Growth of The Internet There Are A LargeDocument1 pageSolved With The Growth of The Internet There Are A LargeM Bilal SaleemNo ratings yet

- Solved With Reference To Figure 14 4 Explain A Why There Will BeDocument1 pageSolved With Reference To Figure 14 4 Explain A Why There Will BeM Bilal SaleemNo ratings yet