Professional Documents

Culture Documents

On July 1 2006 Cougar Corporation A Wholesaler of Used

On July 1 2006 Cougar Corporation A Wholesaler of Used

Uploaded by

M Bilal Saleem0 ratings0% found this document useful (0 votes)

11 views1 pageCougar Corporation, a wholesaler of used robotic equipment, issued $7,500,000 of 10-year bonds at 10% interest when the market rate was 13%. The bonds pay interest semiannually on December 31 and June 30. The fiscal year is the calendar year. Students are asked to calculate the bond discount, record entries for cash received and interest payments, and determine total interest expense for 2006. They are also asked whether bond proceeds will always be less than face value when the contract rate is below market rate.

Original Description:

o

Original Title

On July 1 2006 Cougar Corporation a Wholesaler of Used

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCougar Corporation, a wholesaler of used robotic equipment, issued $7,500,000 of 10-year bonds at 10% interest when the market rate was 13%. The bonds pay interest semiannually on December 31 and June 30. The fiscal year is the calendar year. Students are asked to calculate the bond discount, record entries for cash received and interest payments, and determine total interest expense for 2006. They are also asked whether bond proceeds will always be less than face value when the contract rate is below market rate.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageOn July 1 2006 Cougar Corporation A Wholesaler of Used

On July 1 2006 Cougar Corporation A Wholesaler of Used

Uploaded by

M Bilal SaleemCougar Corporation, a wholesaler of used robotic equipment, issued $7,500,000 of 10-year bonds at 10% interest when the market rate was 13%. The bonds pay interest semiannually on December 31 and June 30. The fiscal year is the calendar year. Students are asked to calculate the bond discount, record entries for cash received and interest payments, and determine total interest expense for 2006. They are also asked whether bond proceeds will always be less than face value when the contract rate is below market rate.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

On July 1 2006 Cougar Corporation a wholesaler of used

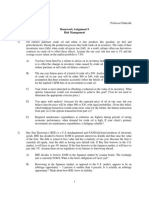

On July 1, 2006, Cougar Corporation, a wholesaler of used robotic equipment, issued

$7,500,000 of 10-year, 10% bonds when the market rate of interest was 13%. Interest on the

bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is

the calendar year.Instructions1. Calculate the selling price and the amount or discount of

premium of the bond issue. Use the present value tables in Appendix A.2. Record the entry for

the amount of the cash proceeds from the sale of the bonds.3. Record the entries for the

following:a. The first semiannual interest payment on December 31, 2006, and the amortization

of the bond discount, using the straight-line method. (Round to the nearest dollar.)b. The

interest payment on June 30, 2007, and the amortization of the bond discount, using the straight-

line method.4. Determine the total interest expense for 2006.5. Will the bond proceeds always

be less than the face amount of the bonds when the contract rate is less than the market rate of

interest? Explain.View Solution:

On July 1 2006 Cougar Corporation a wholesaler of used

SOLUTION-- http://expertanswer.online/downloads/on-july-1-2006-cougar-corporation-a-

wholesaler-of-used/

See Answer here expertanswer.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- The Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesFrom EverandThe Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesNo ratings yet

- Bonds MCQDocument2 pagesBonds MCQRian ChiseiNo ratings yet

- The University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16Document5 pagesThe University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16ana rosemarie enaoNo ratings yet

- Problems - BPDocument11 pagesProblems - BPDM MontefalcoNo ratings yet

- Quiz - Chapter 3 - Bonds Payable Other ConceptsDocument7 pagesQuiz - Chapter 3 - Bonds Payable Other ConceptsRica Jane Oraiz Lloren89% (9)

- Quiz 3 - Bonds PayableDocument9 pagesQuiz 3 - Bonds PayableJam SurdivillaNo ratings yet

- MGMT 3053 Exam 2018 PaperDocument8 pagesMGMT 3053 Exam 2018 PaperSamanthaNo ratings yet

- Disney: Sleeping Beauty BondsDocument3 pagesDisney: Sleeping Beauty Bondschamp10100% (1)

- Quiz Chapter+3 Bonds+PayableDocument3 pagesQuiz Chapter+3 Bonds+PayableRena Jocelle NalzaroNo ratings yet

- Promoting Green Local Currency Bonds for Infrastructure Development in ASEAN+3From EverandPromoting Green Local Currency Bonds for Infrastructure Development in ASEAN+3No ratings yet

- Rodgers Corporation Produces and Sells Football Equipment On July 1Document1 pageRodgers Corporation Produces and Sells Football Equipment On July 1Amit PandeyNo ratings yet

- Fabulator Inc Produces and Sells Fashion Clothing On July 1Document1 pageFabulator Inc Produces and Sells Fashion Clothing On July 1M Bilal SaleemNo ratings yet

- Atlantis Inc Produces and Sells Voltage Regulators On July 1Document1 pageAtlantis Inc Produces and Sells Voltage Regulators On July 1M Bilal SaleemNo ratings yet

- On July 1 2015 Ashlock Chemical Company Issued 4 000 000 10Document1 pageOn July 1 2015 Ashlock Chemical Company Issued 4 000 000 10Amit PandeyNo ratings yet

- Homework Assignment 8 Risk ManagementDocument5 pagesHomework Assignment 8 Risk ManagementJorge SmithNo ratings yet

- ch3 Not EditedDocument14 pagesch3 Not EditedDM MontefalcoNo ratings yet

- Tugas Bab 14 Ak IntermediateDocument2 pagesTugas Bab 14 Ak IntermediateSiti MulyaniNo ratings yet

- Wishaw Inc Produces and Sells Outdoor Equipment On July 1Document1 pageWishaw Inc Produces and Sells Outdoor Equipment On July 1Amit PandeyNo ratings yet

- 4 5953918248238974494Document8 pages4 5953918248238974494Muktar jibo0% (1)

- Bonds ReviewerDocument7 pagesBonds ReviewerDM MontefalcoNo ratings yet

- Quiz Chapter 3 Bonds Docx CompressDocument7 pagesQuiz Chapter 3 Bonds Docx CompressKurumi KunNo ratings yet

- Week 7 Homework SP 20Document4 pagesWeek 7 Homework SP 20Michael OlsonNo ratings yet

- Kornet Co Produces and Sells Graphite For Golf Clubs TheDocument1 pageKornet Co Produces and Sells Graphite For Golf Clubs TheM Bilal SaleemNo ratings yet

- Bonds Payable & Other ConceptsDocument7 pagesBonds Payable & Other ConceptsChristine Jean MajestradoNo ratings yet

- For The Year Ended June 30 2009 A e G Enterprises PresentedDocument1 pageFor The Year Ended June 30 2009 A e G Enterprises PresentedM Bilal Saleem100% (1)

- Determine The Bond Issue Proceeds For Each of The BondsDocument1 pageDetermine The Bond Issue Proceeds For Each of The BondsTaimour HassanNo ratings yet

- Chapter Test 2Document2 pagesChapter Test 2Charmaine MagyayaNo ratings yet

- Beaufort Vaults Corporation Produces and Sells Burial Vaults On JulyDocument1 pageBeaufort Vaults Corporation Produces and Sells Burial Vaults On Julytrilocksp SinghNo ratings yet

- On January 1 2009 Branagh Company Issued For 1 075 230 ItsDocument1 pageOn January 1 2009 Branagh Company Issued For 1 075 230 ItsM Bilal SaleemNo ratings yet

- Sample Exam 2013Document2 pagesSample Exam 2013Ljubica MedićNo ratings yet

- On January 1 2009 Pace Corporation Issued 500 000 Par ValueDocument1 pageOn January 1 2009 Pace Corporation Issued 500 000 Par ValueMuhammad ShahidNo ratings yet

- Freiberg Associates Issued 700 000 Par Value Four Year ZeroDocument1 pageFreiberg Associates Issued 700 000 Par Value Four Year ZeroTaimur TechnologistNo ratings yet

- 5 6071033631214665766Document3 pages5 6071033631214665766Monny MOM0% (1)

- Yosemite Bike Corp Manufactures Mountain Bikes and Distributes Them ThroughDocument1 pageYosemite Bike Corp Manufactures Mountain Bikes and Distributes Them ThroughAmit PandeyNo ratings yet

- The Following Information Is Available For Bott Company Additional Information ForDocument1 pageThe Following Information Is Available For Bott Company Additional Information ForTaimur TechnologistNo ratings yet

- Soal Kuis Minggu 11Document7 pagesSoal Kuis Minggu 11Natasya ZahraNo ratings yet

- Assignment 6 2020Document7 pagesAssignment 6 2020林昀妤100% (1)

- HW NongradedDocument4 pagesHW NongradedAnDy YiMNo ratings yet

- Southern Exposure LTD Begins Operations On January 2 2016 During PDFDocument1 pageSouthern Exposure LTD Begins Operations On January 2 2016 During PDFLet's Talk With HassanNo ratings yet

- Financial Management: Professional Level Examination Tuesday 6 September 2016 (2 Hours)Document8 pagesFinancial Management: Professional Level Examination Tuesday 6 September 2016 (2 Hours)cima2k15No ratings yet

- In This Chapter You Learned About Equity Financing and inDocument1 pageIn This Chapter You Learned About Equity Financing and inMiroslav GegoskiNo ratings yet

- Ae16 Interm AccDocument15 pagesAe16 Interm Accana rosemarie enaoNo ratings yet

- 15.501/516 Problem Set 7 Long-Term Debt, Leases and Off-Balance Sheet Financing I. Accounting For BondsDocument2 pages15.501/516 Problem Set 7 Long-Term Debt, Leases and Off-Balance Sheet Financing I. Accounting For BondsRadhika KapurNo ratings yet

- FINA3323 Assignment 5Document2 pagesFINA3323 Assignment 5Yuhao GuNo ratings yet

- ACC 106 Final ExaminationDocument5 pagesACC 106 Final ExaminationJezz Culang0% (1)

- Year - M.B.A. (C.B.C.S. and Old Pattern) Sem-III Subject - PCB3EB2 - MBA236B - Risk Management and DerivativesDocument1 pageYear - M.B.A. (C.B.C.S. and Old Pattern) Sem-III Subject - PCB3EB2 - MBA236B - Risk Management and DerivativesSangam ChandekarNo ratings yet

- Long Term LiabilitiesDocument3 pagesLong Term Liabilitiescumar maxamuud samatarNo ratings yet

- Midterm Exam in Intermediate 2: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument9 pagesMidterm Exam in Intermediate 2: Identify The Choice That Best Completes The Statement or Answers The QuestionGolden KookieNo ratings yet

- C3A April 2008 ExamDocument16 pagesC3A April 2008 ExamOwen TongNo ratings yet

- On November 1 2007 Columbo Company Adopted A Stock OptionDocument1 pageOn November 1 2007 Columbo Company Adopted A Stock OptionM Bilal SaleemNo ratings yet

- Chapter 2 TB - Long Term Liabilities StudentsDocument7 pagesChapter 2 TB - Long Term Liabilities StudentsMohammed Al-ghamdiNo ratings yet

- Kontabiliteti I Obligacioneve (Anglisht)Document11 pagesKontabiliteti I Obligacioneve (Anglisht)Vilma HoxhaNo ratings yet

- Chapter 14Document54 pagesChapter 14wennstyleNo ratings yet

- Finance 1 For IBA - Tutorial 2: Pranav Desai Joren Koëter Lingbo ShenDocument11 pagesFinance 1 For IBA - Tutorial 2: Pranav Desai Joren Koëter Lingbo ShenLisanne Ploos van AmstelNo ratings yet

- Problem SetDocument105 pagesProblem SetYodaking Matt100% (1)

- Test Series: August, 2016 Mock Test Paper - 1 Final Course: Group - I Paper - 2: Strategic Financial ManagementDocument40 pagesTest Series: August, 2016 Mock Test Paper - 1 Final Course: Group - I Paper - 2: Strategic Financial ManagementMuhamed Muhsin PNo ratings yet

- On January 1 2010 Fair Company Issued 3 000 000 Face ValueDocument1 pageOn January 1 2010 Fair Company Issued 3 000 000 Face ValueM Bilal SaleemNo ratings yet

- Select The Best Answer For Each of The Following 1 OnDocument2 pagesSelect The Best Answer For Each of The Following 1 OnFreelance WorkerNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismFrom EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismNo ratings yet

- Toward a National Eco-compensation Regulation in the People's Republic of ChinaFrom EverandToward a National Eco-compensation Regulation in the People's Republic of ChinaNo ratings yet

- Solved Zack and Andon Compete in The Peanut Market Zack IsDocument1 pageSolved Zack and Andon Compete in The Peanut Market Zack IsM Bilal SaleemNo ratings yet

- Solved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25Document1 pageSolved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25M Bilal SaleemNo ratings yet

- Solved You Want To Price Posters at The Poster Showcase ProfitablyDocument1 pageSolved You Want To Price Posters at The Poster Showcase ProfitablyM Bilal SaleemNo ratings yet

- Solved You Should Never Buy Precooked Frozen Foods Because The PriceDocument1 pageSolved You Should Never Buy Precooked Frozen Foods Because The PriceM Bilal SaleemNo ratings yet

- Solved Your Company Sponsors A 401 K Plan Into Which You DepositDocument1 pageSolved Your Company Sponsors A 401 K Plan Into Which You DepositM Bilal SaleemNo ratings yet

- Solved Why Should The Early Adopters of An Information Technology SystemDocument1 pageSolved Why Should The Early Adopters of An Information Technology SystemM Bilal SaleemNo ratings yet

- Solved You Won A Free Ticket To See A Bruce SpringsteenDocument1 pageSolved You Won A Free Ticket To See A Bruce SpringsteenM Bilal SaleemNo ratings yet

- Solved Your Local Fast Food Chain With Two Dozen Stores UsesDocument1 pageSolved Your Local Fast Food Chain With Two Dozen Stores UsesM Bilal SaleemNo ratings yet

- Solved You Have Been Hired by The Government of Kenya WhichDocument1 pageSolved You Have Been Hired by The Government of Kenya WhichM Bilal SaleemNo ratings yet

- Solved Your Company Is Bidding For A Service Contract in ADocument1 pageSolved Your Company Is Bidding For A Service Contract in AM Bilal SaleemNo ratings yet

- Solved You Are Driving On A Trip and Have Two ChoicesDocument1 pageSolved You Are Driving On A Trip and Have Two ChoicesM Bilal SaleemNo ratings yet

- Solved You Are The Manager of A Monopoly A Typical Consumer SDocument1 pageSolved You Are The Manager of A Monopoly A Typical Consumer SM Bilal SaleemNo ratings yet

- Solved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesDocument1 pageSolved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesM Bilal SaleemNo ratings yet

- Solved With A Purchase Price of 350 000 A Small Warehouse ProvidesDocument1 pageSolved With A Purchase Price of 350 000 A Small Warehouse ProvidesM Bilal SaleemNo ratings yet

- Solved You Are Given The Production Function y Ak1 3n2 3 WhereDocument1 pageSolved You Are Given The Production Function y Ak1 3n2 3 WhereM Bilal SaleemNo ratings yet

- Solved Your Brother Calls You On The Phone Telling You ThatDocument1 pageSolved Your Brother Calls You On The Phone Telling You ThatM Bilal SaleemNo ratings yet

- Solved You Are A Usda Pork Analyst Charged With Keeping Up To DateDocument1 pageSolved You Are A Usda Pork Analyst Charged With Keeping Up To DateM Bilal SaleemNo ratings yet

- Solved You Are An Advisor To The Egyptian Government Which HasDocument1 pageSolved You Are An Advisor To The Egyptian Government Which HasM Bilal SaleemNo ratings yet

- Solved You Are Considering Buying A New House and Have FoundDocument1 pageSolved You Are Considering Buying A New House and Have FoundM Bilal SaleemNo ratings yet

- Solved You and Your Roommate Have A Stack of Dirty DishesDocument1 pageSolved You and Your Roommate Have A Stack of Dirty DishesM Bilal SaleemNo ratings yet

- Solved You Have Decided That You Are Going To Consume 600Document1 pageSolved You Have Decided That You Are Going To Consume 600M Bilal SaleemNo ratings yet

- Solved You Have 832 66 in A Savings Account That Offers ADocument1 pageSolved You Have 832 66 in A Savings Account That Offers AM Bilal SaleemNo ratings yet

- Solved You Plan To Purchase A House For 115 000 UsingDocument1 pageSolved You Plan To Purchase A House For 115 000 UsingM Bilal SaleemNo ratings yet

- Solved You Are Selling Two Goods 1 and 2 To ADocument1 pageSolved You Are Selling Two Goods 1 and 2 To AM Bilal SaleemNo ratings yet

- Solved Write in Algebraic Form A Calculation of U K Pounds PerDocument1 pageSolved Write in Algebraic Form A Calculation of U K Pounds PerM Bilal SaleemNo ratings yet

- Solved You Are Considering An Investment in 30 Year Bonds Issued byDocument1 pageSolved You Are Considering An Investment in 30 Year Bonds Issued byM Bilal SaleemNo ratings yet

- Solved With Reference To Figure 14 4 Explain A Why There Will BeDocument1 pageSolved With Reference To Figure 14 4 Explain A Why There Will BeM Bilal SaleemNo ratings yet

- Solved You Can Either Take A Bus or Drive Your CarDocument1 pageSolved You Can Either Take A Bus or Drive Your CarM Bilal SaleemNo ratings yet

- Solved With The Growth of The Internet There Are A LargeDocument1 pageSolved With The Growth of The Internet There Are A LargeM Bilal SaleemNo ratings yet

- Solved Wilson Walks Into His Class 10 Minutes Late Because HeDocument1 pageSolved Wilson Walks Into His Class 10 Minutes Late Because HeM Bilal SaleemNo ratings yet