0% found this document useful (0 votes)

268 views5 pages2019 Audit Findings for PENRO Rizal

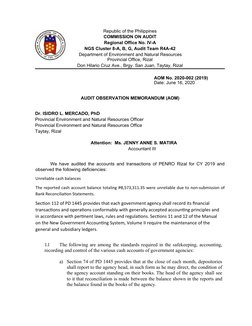

The Commission on Audit audited the accounts and transactions of the Provincial Environment and Natural Resources Office (PENRO) Rizal for 2019 and observed the following issues:

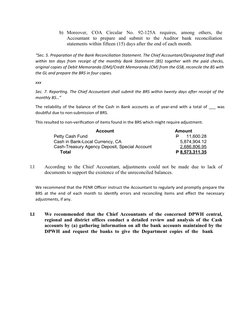

1) The reported cash account balance of P8.5 million was unreliable due to the non-submission of required monthly Bank Reconciliation Statements.

2) Interest income of P432,049.40 earned on cash accounts was not remitted to the Bureau of Treasury as required by law.

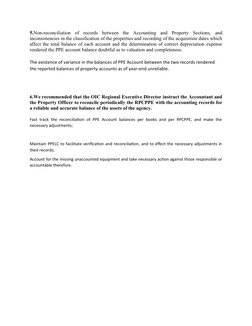

3) Variances totaling P2.28 million were noted between Property, Plant and Equipment account balances per the accounting records and the physical count/inventory as reported in the Required Physical Count of Property, Plant and Equipment form.

Uploaded by

oabeljeanmoniqueCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

268 views5 pages2019 Audit Findings for PENRO Rizal

The Commission on Audit audited the accounts and transactions of the Provincial Environment and Natural Resources Office (PENRO) Rizal for 2019 and observed the following issues:

1) The reported cash account balance of P8.5 million was unreliable due to the non-submission of required monthly Bank Reconciliation Statements.

2) Interest income of P432,049.40 earned on cash accounts was not remitted to the Bureau of Treasury as required by law.

3) Variances totaling P2.28 million were noted between Property, Plant and Equipment account balances per the accounting records and the physical count/inventory as reported in the Required Physical Count of Property, Plant and Equipment form.

Uploaded by

oabeljeanmoniqueCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- Audit Observation Memorandum (AOM)

- Recommendations for Accounting Adjustments

- Interest Income and Compliance

- Further Compliance Details and Sectional Reconciliation