Professional Documents

Culture Documents

On May 1 Marty S Repair Shop Inc Commenced Operations The

Uploaded by

Miroslav GegoskiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

On May 1 Marty S Repair Shop Inc Commenced Operations The

Uploaded by

Miroslav GegoskiCopyright:

Available Formats

On May 1 Marty s Repair Shop Inc commenced operations

The #8502

On May 1, Marty's Repair Shop, Inc. commenced operations. The following transactions were

completed duringthe month:1. Issued common shares for $28,000 cash.2. Paid $1,280 for May

offi ce rent.3. Purchased equipment for $16,000, paying $4,000 cash and signing a bank loan

payable for the balance.4. Purchased supplies on account, $700.5. Received $4,200 from

customers for repair services provided.6. Paid for supplies purchased in transaction 4.7. Paid

May telephone bill of $200.8. Provided repair services on account to customers, $3,600.9. Paid

employee salaries, $2,000.10. Received $700 in advance for repair services to be provided next

month.11. Collected $1,600 from customers for services billed in transaction 8.12. Paid $500

dividends to shareholders.13. Paid $80 of interest on the bank loan obtained in transaction 3.14.

Paid income tax of $600.Instructions(a) Prepare a tabular analysis of the effects of the above

transactions on the expanded accounting equation.(b) Calculate total assets, liabilities, and

shareholders' equity at the end of the month and total profit for the month.View Solution:

On May 1 Marty s Repair Shop Inc commenced operations The

ANSWER

http://paperinstant.com/downloads/on-may-1-marty-s-repair-shop-inc-commenced-operations-

the/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- The Mountain Biking Corp Opened On April 1 The FollowingDocument1 pageThe Mountain Biking Corp Opened On April 1 The FollowingBube KachevskaNo ratings yet

- Exercise - Chapter 2Document8 pagesExercise - Chapter 2Mạnh HàNo ratings yet

- Lancet Engineering Completed The Following Transactions in The MDocument1 pageLancet Engineering Completed The Following Transactions in The MM Bilal SaleemNo ratings yet

- The Following Events Occurred For Mitka LTD A Received Investment PDFDocument1 pageThe Following Events Occurred For Mitka LTD A Received Investment PDFLet's Talk With HassanNo ratings yet

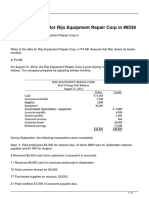

- Refer To The Data For Rijo Equipment Repair Corp inDocument2 pagesRefer To The Data For Rijo Equipment Repair Corp inMiroslav Gegoski0% (1)

- On December 1 Curt Walton Began An Auto Repair Shop PDFDocument1 pageOn December 1 Curt Walton Began An Auto Repair Shop PDFhassan taimourNo ratings yet

- Luis Madero After Working For Several Years With A LargeDocument1 pageLuis Madero After Working For Several Years With A LargeM Bilal SaleemNo ratings yet

- Rhaman Company Had The Following Transactions in Its First Month PDFDocument1 pageRhaman Company Had The Following Transactions in Its First Month PDFTaimour HassanNo ratings yet

- Balance Sheet Owner's Equity Statemen T Income Stateme NT Statement of Cash FlowsDocument2 pagesBalance Sheet Owner's Equity Statemen T Income Stateme NT Statement of Cash FlowsSesmaNo ratings yet

- On March 1 2008 Kara Frantz Established Mudcat Realty WhichDocument1 pageOn March 1 2008 Kara Frantz Established Mudcat Realty WhichAmit PandeyNo ratings yet

- Suppose That in A Year An American Worker Can ProduceDocument1 pageSuppose That in A Year An American Worker Can ProduceMiroslav GegoskiNo ratings yet

- Suppose A Technological Advance Reduces The Cost of Making CompuDocument1 pageSuppose A Technological Advance Reduces The Cost of Making CompuMiroslav GegoskiNo ratings yet

- Suppose That The Owner of Boyer Construction Is Feeling TheDocument1 pageSuppose That The Owner of Boyer Construction Is Feeling TheMiroslav GegoskiNo ratings yet

- Fredonia Repair Inc Was Started On May 1 A Summary: Unlock Answers Here Solutiondone - OnlineDocument1 pageFredonia Repair Inc Was Started On May 1 A Summary: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Barone S Repair Inc Was Started On May 1 A SummaryDocument1 pageBarone S Repair Inc Was Started On May 1 A SummaryM Bilal SaleemNo ratings yet

- Hermesch Window Washing Inc Was Started On May 1 HereDocument1 pageHermesch Window Washing Inc Was Started On May 1 HereM Bilal SaleemNo ratings yet

- Lynette Moss An Architect Opened An Office On April 1Document1 pageLynette Moss An Architect Opened An Office On April 1Amit PandeyNo ratings yet

- On May 1 2014 Leon Stoker Opened Stoker S Repair ServiceDocument1 pageOn May 1 2014 Leon Stoker Opened Stoker S Repair ServiceAmit PandeyNo ratings yet

- James Weicker A Mechanic Opened A Mobile Repair Business On PDFDocument1 pageJames Weicker A Mechanic Opened A Mobile Repair Business On PDFTaimur TechnologistNo ratings yet

- Individual AssignementDocument7 pagesIndividual Assignementgemechu67% (3)

- Chapter 2 Math For PracticeDocument3 pagesChapter 2 Math For Practiceehratul.bagNo ratings yet

- Tsunami Inc Entered Into The Following Transactions During One Month PDFDocument1 pageTsunami Inc Entered Into The Following Transactions During One Month PDFhassan taimourNo ratings yet

- Selected Transactions For The Decorators Mill LTD An Interior DecoratorDocument1 pageSelected Transactions For The Decorators Mill LTD An Interior DecoratorBube KachevskaNo ratings yet

- Hyman Inc Was Started On May 1 Here Is A: Unlock Answers Here Solutiondone - OnlineDocument1 pageHyman Inc Was Started On May 1 Here Is A: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Accounting Equation, Transaction Analysis and Preparation of Financial StatementDocument10 pagesAccounting Equation, Transaction Analysis and Preparation of Financial Statementশুভ MitraNo ratings yet

- On June 1 2014 Bob Lutz Opened Lutz Repair ServiceDocument1 pageOn June 1 2014 Bob Lutz Opened Lutz Repair ServiceAmit PandeyNo ratings yet

- Weygandt Kimmel Keiso 9 EditionDocument11 pagesWeygandt Kimmel Keiso 9 EditionShuvro ChakravortyNo ratings yet

- ACC 205 Complete Class HomeworkDocument41 pagesACC 205 Complete Class HomeworkAvicciNo ratings yet

- Assignment Qs 1 - Journalization and PostingDocument2 pagesAssignment Qs 1 - Journalization and PostingShehzad Qureshi100% (1)

- On April 1 Bill Taylor Established Taylor Made Travel AgencyDocument1 pageOn April 1 Bill Taylor Established Taylor Made Travel Agencytrilocksp SinghNo ratings yet

- Accounting Final SyllabusDocument8 pagesAccounting Final SyllabusRoufRobin0% (1)

- ACC101 Exercise Chap2Document4 pagesACC101 Exercise Chap2Pham Thi Que (K17 DN)No ratings yet

- Accounting With SolutionsDocument8 pagesAccounting With Solutions26 Athira S Nair CS1No ratings yet

- SPJIMR: PGMPW 2021: Financial Statement Analysis: Topic: Introduction To Financial AccountingDocument4 pagesSPJIMR: PGMPW 2021: Financial Statement Analysis: Topic: Introduction To Financial AccountingSmriti singhNo ratings yet

- The Transactions Completed by Am Express Company During March 2016Document1 pageThe Transactions Completed by Am Express Company During March 2016Muhammad ShahidNo ratings yet

- Amy Austin Established An Insurance Agency On March 1 Of: Unlock Answers Here Solutiondone - OnlineDocument1 pageAmy Austin Established An Insurance Agency On March 1 Of: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- FA Week 1Document8 pagesFA Week 1Azure JohnsonNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 07 Case StudiesDocument4 pages07 Case Studiesravitarun31No ratings yet

- Barone S Repair Shop Was Started On May 1 by Nancy PDFDocument1 pageBarone S Repair Shop Was Started On May 1 by Nancy PDFAnbu jaromiaNo ratings yet

- Slowhand Services Was Formed On May 1 2010 The Following PDFDocument1 pageSlowhand Services Was Formed On May 1 2010 The Following PDFAnbu jaromiaNo ratings yet

- Mba Zc415 Ec-2r Second Sem 2016-2017Document3 pagesMba Zc415 Ec-2r Second Sem 2016-2017ritesh_aladdinNo ratings yet

- CH 02Document4 pagesCH 02flrnciairnNo ratings yet

- Selected Transactions For The Basler Corporation During Its First MonthDocument1 pageSelected Transactions For The Basler Corporation During Its First MonthBube KachevskaNo ratings yet

- Transaction & Tabular AnalysisDocument18 pagesTransaction & Tabular AnalysisMahmudul Hassan RohidNo ratings yet

- Problems: Set C: InstructionsDocument4 pagesProblems: Set C: InstructionsRabie HarounNo ratings yet

- On August 31 2015 The Rijo Equipment Repair Corp S Post ClosingDocument1 pageOn August 31 2015 The Rijo Equipment Repair Corp S Post ClosingMiroslav GegoskiNo ratings yet

- The Following Occurred During June at Carter S Professional Counseling Instructions Analyze EachDocument1 pageThe Following Occurred During June at Carter S Professional Counseling Instructions Analyze EachMuhammad ShahidNo ratings yet

- Hillsborough Services Was Formed On May 1 2015 The FollowingDocument1 pageHillsborough Services Was Formed On May 1 2015 The Followingtrilocksp SinghNo ratings yet

- Test 01 Chapters 2 & 3 September 25Document8 pagesTest 01 Chapters 2 & 3 September 25barbara tamminenNo ratings yet

- Analyzing The Effects of Transactions in T Accounts Lisa FruelloDocument1 pageAnalyzing The Effects of Transactions in T Accounts Lisa Fruellohassan taimourNo ratings yet

- This Problem Continues The Accounting Process For Aqua Elite Inc PDFDocument1 pageThis Problem Continues The Accounting Process For Aqua Elite Inc PDFAhsan KhanNo ratings yet

- Financial Accounting (4-6) - Fall 2022Document90 pagesFinancial Accounting (4-6) - Fall 2022Saahil KarnikNo ratings yet

- Test 1Document3 pagesTest 1super manNo ratings yet

- Latihan Lab 3 - General Ledger and Adjusting EntriesDocument3 pagesLatihan Lab 3 - General Ledger and Adjusting EntriesErwin MainsteinNo ratings yet

- Trafflet Enterprises Incorporated On May 3 2011 The Company EngagedDocument1 pageTrafflet Enterprises Incorporated On May 3 2011 The Company EngagedAmit PandeyNo ratings yet

- RUBRICS (Ict - eXAM) Final ExaminationDocument4 pagesRUBRICS (Ict - eXAM) Final ExaminationEugene LoyolaNo ratings yet

- Home Work - 2017Document1 pageHome Work - 2017AA BB MMNo ratings yet

- Worksheet 1Document4 pagesWorksheet 1mahistudyaccNo ratings yet

- A First Year Co Op Student Working For Solutia Inc RecordedDocument1 pageA First Year Co Op Student Working For Solutia Inc Recordedtrilocksp SinghNo ratings yet

- CH 03 Alt ProbDocument8 pagesCH 03 Alt ProbMuhammad Usman25% (4)

- Suppose That A Market Is Described by The Following SupplyDocument1 pageSuppose That A Market Is Described by The Following SupplyMiroslav GegoskiNo ratings yet

- Suppose That Congress Imposes A Tariff On Imported Autos ToDocument1 pageSuppose That Congress Imposes A Tariff On Imported Autos ToMiroslav GegoskiNo ratings yet

- Suppose That Fixed Costs For A Firm in The AutomobileDocument1 pageSuppose That Fixed Costs For A Firm in The AutomobileMiroslav GegoskiNo ratings yet

- Suppose That People Consume Only Three Goods As Shown inDocument1 pageSuppose That People Consume Only Three Goods As Shown inMiroslav Gegoski0% (1)

- Suppose That A Perfectly Competitive Firm Has The Following TotaDocument1 pageSuppose That A Perfectly Competitive Firm Has The Following TotaMiroslav GegoskiNo ratings yet

- Suppose That Prior To The Passage of The Truth inDocument1 pageSuppose That Prior To The Passage of The Truth inMiroslav GegoskiNo ratings yet

- Suppose That Every Driver Faces A 1 Probability of AnDocument1 pageSuppose That Every Driver Faces A 1 Probability of AnMiroslav GegoskiNo ratings yet

- Suppose That Congress Passes A Law Requiring Employers To ProvidDocument1 pageSuppose That Congress Passes A Law Requiring Employers To ProvidMiroslav GegoskiNo ratings yet

- Suppose That A Firm S Production Function Is Given by TheDocument1 pageSuppose That A Firm S Production Function Is Given by TheMiroslav GegoskiNo ratings yet

- Suppose That A Paper Mill Feeds A Downstream Box MillDocument1 pageSuppose That A Paper Mill Feeds A Downstream Box MillMiroslav GegoskiNo ratings yet

- Royersford Knitting Mills LTD Sells A Line of Women S KnitDocument1 pageRoyersford Knitting Mills LTD Sells A Line of Women S KnitMiroslav GegoskiNo ratings yet

- Suppose That The Marshall Islands Does Not Trade With TheDocument1 pageSuppose That The Marshall Islands Does Not Trade With TheMiroslav GegoskiNo ratings yet

- Suppose That There Are 10 Million Workers in Canada andDocument1 pageSuppose That There Are 10 Million Workers in Canada andMiroslav GegoskiNo ratings yet

- Suppose An Appliance Manufacturer Is Doing A Regression AnalysisDocument1 pageSuppose An Appliance Manufacturer Is Doing A Regression AnalysisMiroslav GegoskiNo ratings yet

- Suppose A Computer Virus Disables The Nation S Automatic TellerDocument1 pageSuppose A Computer Virus Disables The Nation S Automatic TellerMiroslav GegoskiNo ratings yet

- Suppose Douglas and Ziffel Have Properties That Adjoin The FarmDocument1 pageSuppose Douglas and Ziffel Have Properties That Adjoin The FarmMiroslav GegoskiNo ratings yet

- Stowe Automotive Is Considering An Offer From Indula To BuildDocument1 pageStowe Automotive Is Considering An Offer From Indula To BuildMiroslav GegoskiNo ratings yet

- Structural Unemployment Is Sometimes Said To Result From A MismaDocument1 pageStructural Unemployment Is Sometimes Said To Result From A MismaMiroslav GegoskiNo ratings yet

- Sung Sam Inc Is Currently DesigningDocument1 pageSung Sam Inc Is Currently DesigningMiroslav GegoskiNo ratings yet

- Suppose An Economy Is in Long Run Equilibrium A Use TheDocument1 pageSuppose An Economy Is in Long Run Equilibrium A Use TheMiroslav GegoskiNo ratings yet

- Suppose Firms Become Very Optimistic About Future Business CondiDocument1 pageSuppose Firms Become Very Optimistic About Future Business CondiMiroslav GegoskiNo ratings yet

- Suppose An Enhanced Effectiveness of Cooperative Advertising OccDocument1 pageSuppose An Enhanced Effectiveness of Cooperative Advertising OccMiroslav GegoskiNo ratings yet

- Suppose That A Ceo S Goal Is To Increase Profitability andDocument1 pageSuppose That A Ceo S Goal Is To Increase Profitability andMiroslav GegoskiNo ratings yet

- Suppose One of Your Clients Is Four Years Away FromDocument1 pageSuppose One of Your Clients Is Four Years Away FromMiroslav GegoskiNo ratings yet

- Stamp Collecting Has Become An IncreasinglyDocument1 pageStamp Collecting Has Become An IncreasinglyMiroslav GegoskiNo ratings yet

- Refer To Table in This Chapter and Answer The FollowingDocument1 pageRefer To Table in This Chapter and Answer The FollowingMiroslav GegoskiNo ratings yet

- Suppose That A Fall in Consumer Spending Causes A RecessionDocument1 pageSuppose That A Fall in Consumer Spending Causes A RecessionMiroslav GegoskiNo ratings yet