Professional Documents

Culture Documents

Answer Key Pre Lesson Activity PFM 3

Answer Key Pre Lesson Activity PFM 3

Uploaded by

Vergel Martinez0 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

Answer-Key-Pre-Lesson-Activity-PFM-3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageAnswer Key Pre Lesson Activity PFM 3

Answer Key Pre Lesson Activity PFM 3

Uploaded by

Vergel MartinezCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

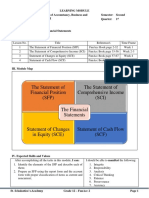

Pre-lesson Activity- Understanding Financial Statements

I. Classify the following statement of financial position items as current or noncurrent. (1 pt.

each for a total of 7 pts.)

1. Accounts Payable- Current 5. Bonds Payable- Noncurrent

2. Prepaid Expenses- Current 6. Accrued Wages Payable- Current

3. Plant and Equipment- Noncurrent 7. Accounts Receivable – Current

4. Inventory- Current

II. Fill in the blanks. The first two items are done for you to serve as an example on how the activity

goes. (Total of 24 pts.)

Indicate whether items is on If on Statement of Financial Item

Statement of Financial Position, Designate which

Position (SFP) or Income category

Statement (IS)

Ex. SFP Current asset Cash

Ex. IS N/A Sales

IS (1 pt.) N/A (1 pt.) Income Tax Expense

SFP Current asset Accounts Receivable

SFP Noncurrent liability Bonds Payable

SFP Current liability Notes Payable

IS N/A Net income

IS N/A Selling and Admin Expenses

SFP Current Asset Inventories

SFP Current Liability Accrued Expenses

SFP Noncurrent asset Plant and Equipment

IS N/A Operating Expenses

IS N/A Interest Expense

SFP Current Liability Income Tax Payable

III. True or false (4 pts.)

1. The total assets and the total liabilities and shareholders’ equity must be equal at all times.

True

2. To compute for the operating income, the interest and taxes must be deducted. False

3. A loss is incurred in the Income Statement when the expenses are greater than the income of

the company for a given period. True

4. The three primary activities in the cash flow statement are operating, investing, and

managing. False

You might also like

- Financial Statements Cheat SheetDocument1 pageFinancial Statements Cheat SheetjmbaezfNo ratings yet

- Cornerstones of Financial Accounting 4th Edition Rich Test BankDocument34 pagesCornerstones of Financial Accounting 4th Edition Rich Test Bankalanholt09011983rta100% (34)

- Cash Flow Statements and Warf Computers Mini CaseDocument6 pagesCash Flow Statements and Warf Computers Mini CaseAshekin MahadiNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Gross IncomeDocument45 pagesGross Incomeannyeongchingu80% (5)

- CF-A#1 - Waris - 01-322221-024Document8 pagesCF-A#1 - Waris - 01-322221-024Waris 3478-FBAS/BSCS/F16No ratings yet

- CFA二级 财务报表 习题 PDFDocument272 pagesCFA二级 财务报表 习题 PDFNGOC NHINo ratings yet

- Fundamentals of Accounting and Business Management 2 (Module 1 ABM2)Document13 pagesFundamentals of Accounting and Business Management 2 (Module 1 ABM2)AnonymousNo ratings yet

- CH 4 AssignmentDocument3 pagesCH 4 AssignmentMikulas HarvankaNo ratings yet

- FABM2 Module 01 (Q1-W1)Document7 pagesFABM2 Module 01 (Q1-W1)Christian ZebuaNo ratings yet

- Answer Key (Drills) - Understanding-Financial-StatementsDocument4 pagesAnswer Key (Drills) - Understanding-Financial-StatementsVergel MartinezNo ratings yet

- Tutoring Service Business PlanDocument45 pagesTutoring Service Business Plankevin gwenhureNo ratings yet

- Acc 124 - Chart of AccountsDocument6 pagesAcc 124 - Chart of AccountsAdam CuencaNo ratings yet

- ABM2 - FUNDAMENTALS OF ACCOUNING, BUSINESS AND MANAGEMENT Module 1 PDFDocument14 pagesABM2 - FUNDAMENTALS OF ACCOUNING, BUSINESS AND MANAGEMENT Module 1 PDFJeffrey AlcedoNo ratings yet

- Unit 4: Relative ValuationDocument47 pagesUnit 4: Relative ValuationMadhvendra BhardwajNo ratings yet

- Analysis of Reformulated Financial StatementsDocument46 pagesAnalysis of Reformulated Financial StatementsAkib Mahbub KhanNo ratings yet

- FK Kuliah 1 Laporan KeuanganDocument21 pagesFK Kuliah 1 Laporan KeuanganGrace HerlisNo ratings yet

- Elements: Capital Adequecy Operating Performance Ratio (OPR)Document3 pagesElements: Capital Adequecy Operating Performance Ratio (OPR)HMS DeedNo ratings yet

- Fam - 1Document20 pagesFam - 1shahidNo ratings yet

- Chapter 5 Review Questions and ProblemsDocument11 pagesChapter 5 Review Questions and ProblemsLars FriasNo ratings yet

- Formulae For RatiosDocument1 pageFormulae For Ratioskristishadelandro11No ratings yet

- Account Titles Classification and Sub-ClassificationDocument3 pagesAccount Titles Classification and Sub-ClassificationLorence Patrick LapidezNo ratings yet

- Category Item Formula: Evaluation Indicator (For An Increase in Indicated Item)Document2 pagesCategory Item Formula: Evaluation Indicator (For An Increase in Indicated Item)ab0cd0No ratings yet

- Topic I - Statement of Financial PositionDocument6 pagesTopic I - Statement of Financial PositionJianne Ricci GalitNo ratings yet

- Preparing SFP of Single Propriertorship BusinessDocument18 pagesPreparing SFP of Single Propriertorship Businessjudith100% (2)

- Statement of Cash FlowsDocument7 pagesStatement of Cash FlowsZance JordaanNo ratings yet

- Lesson #1 FabmDocument32 pagesLesson #1 FabmCZARINA ROSEANNE M. GIMENEZNo ratings yet

- TVL - ACCTG 2 - G12 - Q1 WORKSHEET WK1 7pagesDocument6 pagesTVL - ACCTG 2 - G12 - Q1 WORKSHEET WK1 7pagesEunise OprinNo ratings yet

- 4 - The Analytical Income Statement and Balance SheetDocument21 pages4 - The Analytical Income Statement and Balance SheetGioacchinoNo ratings yet

- Abm?Document11 pagesAbm?Honeybunch beforeNo ratings yet

- S06-07 - FA - Handout Before 1 - Cash Flow StatementDocument36 pagesS06-07 - FA - Handout Before 1 - Cash Flow Statementcharlesdegaulle594No ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionPrimosebastian TarrobagoNo ratings yet

- Company Name: (In Rs CRS) (In Rs CRS)Document9 pagesCompany Name: (In Rs CRS) (In Rs CRS)DineshNo ratings yet

- Fabm 2: Offline Activity #1Document4 pagesFabm 2: Offline Activity #1Anne Christine Dela CruzNo ratings yet

- Shs Fabm2 q3 Weeks 1 2 2ndreading Egs EditedfinalDocument20 pagesShs Fabm2 q3 Weeks 1 2 2ndreading Egs EditedfinalKrize Colene dela CruzNo ratings yet

- Balance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMDocument43 pagesBalance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMJhonatan Perez VillanuevaNo ratings yet

- Fundamentals of Accounting, Business and Management 2: Most Essential Learning CompetenciesDocument5 pagesFundamentals of Accounting, Business and Management 2: Most Essential Learning CompetenciesHazel ZabellaNo ratings yet

- Scrap-Module-2nd SemDocument7 pagesScrap-Module-2nd SemLAZARO III DILEMNo ratings yet

- ABM FABM 2 Q1 Course Guide PDFDocument58 pagesABM FABM 2 Q1 Course Guide PDFEarl Christian BonaobraNo ratings yet

- Review Questions and ProblemsDocument13 pagesReview Questions and ProblemsLalaina EnriquezNo ratings yet

- Workshop Financial StatementsDocument2 pagesWorkshop Financial Statementskajani nesakumarNo ratings yet

- CHART OF ACCOUNTS ClassificationsDocument2 pagesCHART OF ACCOUNTS Classificationsdashriel.hwasaNo ratings yet

- Finance 101 Cheat SheetDocument1 pageFinance 101 Cheat SheetMinyu LvNo ratings yet

- ch04.ppt - Income Statement and Related InformationDocument68 pagesch04.ppt - Income Statement and Related InformationAmir ContrerasNo ratings yet

- Fundamentals of Accountancy, Busin S and Management 2: 12Th GradeDocument11 pagesFundamentals of Accountancy, Busin S and Management 2: 12Th GradeDaren Joy Catubay DiazNo ratings yet

- ABM FABM 2 Q1 ModuleDocument56 pagesABM FABM 2 Q1 Modulejeromemallorca10No ratings yet

- Financial StatementsDocument4 pagesFinancial StatementsGhillian Mae GuiangNo ratings yet

- Fundamentals of Finance: Ignacio Lezaun English Edition 2021Document11 pagesFundamentals of Finance: Ignacio Lezaun English Edition 2021Elias Macher CarpenaNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- Lecture 5 - Understanding Financial Statements IIDocument52 pagesLecture 5 - Understanding Financial Statements IIolgaszczechuraNo ratings yet

- Key Differences Between US GAAP and IFRSDocument46 pagesKey Differences Between US GAAP and IFRSmohamedNo ratings yet

- Statement of Financial PositionDocument7 pagesStatement of Financial PositionJay KwonNo ratings yet

- Finman, FormulasDocument6 pagesFinman, FormulasSHAZNEI ALIAH NAGA SANGCAANNo ratings yet

- Lesson 1 The Statement of Financial PositionDocument11 pagesLesson 1 The Statement of Financial PositionFranchesca Calma100% (1)

- FM Raftar Module 2Document176 pagesFM Raftar Module 2bharathreddykatta13No ratings yet

- 1 - Fabm2 Pivot Word - LatestDocument48 pages1 - Fabm2 Pivot Word - LatestRoilene MelloriaNo ratings yet

- Topic 5: The Annual Accounts: Ana M Arias AlvarezDocument10 pagesTopic 5: The Annual Accounts: Ana M Arias AlvarezPablo Riquelme GonzálezNo ratings yet

- For With God, Nothing Shall Be Impossible. (Luke 1:37) : Accounting ReviewerDocument7 pagesFor With God, Nothing Shall Be Impossible. (Luke 1:37) : Accounting ReviewerDebbie Grace Latiban LinazaNo ratings yet

- AccountingDocument67 pagesAccountinggunanNo ratings yet

- Acf1 2024Document35 pagesAcf1 2024rodrigo.felix17012002No ratings yet

- 3 - The Reformulation of Financial Statements - UnlockedDocument33 pages3 - The Reformulation of Financial Statements - Unlockedchirag0% (3)

- Business ValuationDocument52 pagesBusiness ValuationAnand SubramanianNo ratings yet

- 2ndQExam FABM12Document1 page2ndQExam FABM12Christian ZebuaNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- Financial Forecasting For Strategic GrowthDocument3 pagesFinancial Forecasting For Strategic GrowthVergel MartinezNo ratings yet

- Ent El 2 Reviewer Notes For Final ExamDocument8 pagesEnt El 2 Reviewer Notes For Final ExamVergel MartinezNo ratings yet

- Entrep Elective 4 ReviewerDocument12 pagesEntrep Elective 4 ReviewerVergel MartinezNo ratings yet

- Service StrategyDocument3 pagesService StrategyVergel MartinezNo ratings yet

- Understanding Financial Statements PowerpointDocument18 pagesUnderstanding Financial Statements PowerpointVergel MartinezNo ratings yet

- Quiz in PFM 3 Understanding The Role Financial Markets and InstitutionsDocument1 pageQuiz in PFM 3 Understanding The Role Financial Markets and InstitutionsVergel MartinezNo ratings yet

- Bakery Shop: StrengthsDocument1 pageBakery Shop: StrengthsVergel MartinezNo ratings yet

- Presentation of Financial StatementsDocument5 pagesPresentation of Financial StatementsVergel MartinezNo ratings yet

- Entrepreneurial Character Traits Skills and CompetenciesDocument6 pagesEntrepreneurial Character Traits Skills and CompetenciesVergel MartinezNo ratings yet

- Quiz in PFM 3 Understanding The Role Financial Markets and InstitutionsDocument1 pageQuiz in PFM 3 Understanding The Role Financial Markets and InstitutionsVergel MartinezNo ratings yet

- Customer Analysis The Right BehaviorDocument3 pagesCustomer Analysis The Right BehaviorVergel MartinezNo ratings yet

- Coa-Prescribed Account Codes Per Uacs Per Tax Type: Tax On Income and ProfitDocument10 pagesCoa-Prescribed Account Codes Per Uacs Per Tax Type: Tax On Income and ProfitCarlos Ryan RabangNo ratings yet

- Capital StructureDocument29 pagesCapital StructureNawazish KhanNo ratings yet

- JG Summit Holdings Inc. Comeprative Balance Sheet December 31 2018 and 2017Document20 pagesJG Summit Holdings Inc. Comeprative Balance Sheet December 31 2018 and 2017eath__No ratings yet

- Dealing With The Tax Issues: Discount and Premium BondsDocument4 pagesDealing With The Tax Issues: Discount and Premium BondsAntonio J FernósNo ratings yet

- Lecture 2 - Audit Plan PDFDocument24 pagesLecture 2 - Audit Plan PDFMoud KhalfaniNo ratings yet

- Chapter 3Document8 pagesChapter 3Eunice SerneoNo ratings yet

- Write The Required Information's - Maximum Mark Allotted: 50% - Feedback Provided To The Email Provided by The College On or Before The Time AllowedDocument7 pagesWrite The Required Information's - Maximum Mark Allotted: 50% - Feedback Provided To The Email Provided by The College On or Before The Time AllowedMwenda MongweNo ratings yet

- Risk Assessment Template - OdsDocument62 pagesRisk Assessment Template - OdsirfanNo ratings yet

- Logistics Service Enterprise Application FormDocument9 pagesLogistics Service Enterprise Application FormGabriel EmersonNo ratings yet

- 1ST Exam Fabm1Document3 pages1ST Exam Fabm1rose gabonNo ratings yet

- Laporan Keuangan PT Sritex 31 Dec 2019Document186 pagesLaporan Keuangan PT Sritex 31 Dec 2019Fitri Andika PutriNo ratings yet

- Financial Ratios of Hero Honda MotorsDocument6 pagesFinancial Ratios of Hero Honda MotorsParag MaheshwariNo ratings yet

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuNo ratings yet

- Financial Statements, Cash Flow AnalysisDocument41 pagesFinancial Statements, Cash Flow AnalysisMinhaz Ahmed0% (1)

- The Sustainability of The Lantern Industry in Pampanga (Facundo)Document24 pagesThe Sustainability of The Lantern Industry in Pampanga (Facundo)Leo Tolentino100% (1)

- How Important Is Investment To The Economy?Document1 pageHow Important Is Investment To The Economy?Miaka_Love_3310100% (1)

- Steel Industry Financial AnalysisDocument27 pagesSteel Industry Financial AnalysisPrakash Singh100% (1)

- Learning Guide: Accounts and Budget ServiceDocument22 pagesLearning Guide: Accounts and Budget ServicerameNo ratings yet

- Trust Bank Limited: Symbol: TRUSTBANK Sector: Bank Board: MainDocument2 pagesTrust Bank Limited: Symbol: TRUSTBANK Sector: Bank Board: MainMrittika SahaNo ratings yet

- Topic 4 - Share and Business ValuationDocument33 pagesTopic 4 - Share and Business ValuationSarannyaRajendraNo ratings yet

- PaySlip - December 2022Document1 pagePaySlip - December 2022Nisha KumariNo ratings yet

- Uttara Bank-Financial PerformenceDocument50 pagesUttara Bank-Financial Performencesumaiya sumaNo ratings yet

- Distribution Theory - ProfitDocument16 pagesDistribution Theory - ProfitsangeetagoeleNo ratings yet

- BUS 5110 Port. Act Unit 7Document3 pagesBUS 5110 Port. Act Unit 7christian allos100% (3)

- Consolated Balance Sheet: Advance Accounting-II (Chapter-3.4)Document8 pagesConsolated Balance Sheet: Advance Accounting-II (Chapter-3.4)Md Shah AlamNo ratings yet