Professional Documents

Culture Documents

Project 5

Uploaded by

Maha RehmanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project 5

Uploaded by

Maha RehmanCopyright:

Available Formats

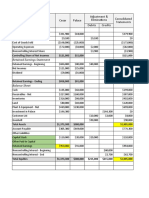

Year 0 1 2 3 4 5

$

Initial Investment (1,500,000)

$

Working Capital (150,000)

$ $ $ $ $

Revenues 1,600,000 1,600,000 1,600,000 1,600,000 1,600,000

$ $ $ $ $

Variable Cost (300,000) (300,000) (300,000) (300,000) (300,000)

$ $ $ $ $

Fixed Costs (700,000) (700,000) (700,000) (700,000) (700,000)

$ $ $ $ $

Depreciation (290,000) (290,000) (290,000) (290,000) (290,000)

$ $ $ $ $

EBIT 310,000 310,000 310,000 310,000 310,000

$ $ $ $ $

Income Taxes (93,000) (93,000) (93,000) (93,000) (93,000)

$ $ $ $ $

Net profit 217,000 217,000 217,000 217,000 217,000

$ $ $ $ $

Depreciation 290,000 290,000 290,000 290,000 290,000

$

Salvage Value 50,000

$

Working Capital 150,000

$ $ $ $ $ $

Net Cash Flow (1,650,000) 507,000 507,000 507,000 507,000 707,000

$ $ $ $ $ $

(1,650,000.00 452,678.5 404,177.3 360,872.5 322,207.6 401,170.7

PV of Cash Flow ) 7 0 9 7 9

$

NPV 291,106.91

IRR 19%

The company should go for the project at the IRR is higher than the cost of capital which means

that there is more return to this business. And the NPV is high and viable as well.

You might also like

- Case 1 Ocean Carriers Spreadsheet AnswerDocument9 pagesCase 1 Ocean Carriers Spreadsheet Answerpiyush aroraNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument4 pagesCapital Investment Model - NPV IRR Payback: Strictly Confidentialsh munnaNo ratings yet

- Consolidated financial statementsDocument3 pagesConsolidated financial statementsFarrell DmNo ratings yet

- Jawaban Soal Hitungan Bab 4Document16 pagesJawaban Soal Hitungan Bab 4Aheir lessNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument3 pagesCapital Investment Model - NPV IRR Payback: Strictly ConfidentialKrishna YagnamurthyNo ratings yet

- Latihan Balance SheetDocument10 pagesLatihan Balance SheetULAN BATAWENNo ratings yet

- Payback Schedule Year Beginning Unrecovered Investment Cash InflowDocument4 pagesPayback Schedule Year Beginning Unrecovered Investment Cash InflowMaisamNo ratings yet

- Assigment Week 6 Laila Fitriana 12030120120020 DDocument17 pagesAssigment Week 6 Laila Fitriana 12030120120020 DLaila FitrianaNo ratings yet

- Manufacturing Cash Flow ProjectionsDocument6 pagesManufacturing Cash Flow Projectionsmaran_navNo ratings yet

- Free Cash Flow $ 378,400.00 $ 416,240.00Document2 pagesFree Cash Flow $ 378,400.00 $ 416,240.00Raca DesuNo ratings yet

- Soal BaruDocument14 pagesSoal BaruDella Lina100% (1)

- Mónica - Valenzuela - Control 7Document9 pagesMónica - Valenzuela - Control 7Mónica ValenzuelaNo ratings yet

- Tugas Accounting IntermediateDocument1 pageTugas Accounting IntermediateYohanes PitherNo ratings yet

- Ocean Carriers - Case (Final)Document18 pagesOcean Carriers - Case (Final)Namit LalNo ratings yet

- Pacilio Securtiy Service Accounting EquationDocument11 pagesPacilio Securtiy Service Accounting EquationKailash KumarNo ratings yet

- 532-16-Isnaini Nur Fauziah (2.2)Document53 pages532-16-Isnaini Nur Fauziah (2.2)isnaininurfauziah123No ratings yet

- Midterm Exam - Saeful Aziz (29118389) PDFDocument44 pagesMidterm Exam - Saeful Aziz (29118389) PDFSaeful AzizNo ratings yet

- Budget Summary Report1Document4 pagesBudget Summary Report1Evans mwenzeNo ratings yet

- Budget Summary Report Highlights Revenue GrowthDocument4 pagesBudget Summary Report Highlights Revenue GrowthEvans mwenzeNo ratings yet

- Evaluate Cost-Cutting Automation ProposalDocument5 pagesEvaluate Cost-Cutting Automation ProposalĐặng Thuỳ HươngNo ratings yet

- p4 2Document5 pagesp4 2Ernike SariNo ratings yet

- UntitledDocument22 pagesUntitledWild PlatycodonNo ratings yet

- Solutions Chapter 8Document6 pagesSolutions Chapter 8Carmella DismayaNo ratings yet

- Tagpuno, Riki Jonas - Capital BudgetingDocument9 pagesTagpuno, Riki Jonas - Capital BudgetingrikitagpunoNo ratings yet

- Group 2 - Answers To QuestionsDocument2 pagesGroup 2 - Answers To QuestionsJr Roque100% (4)

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- ARR Saas Revenue Forecast Field ServicesDocument25 pagesARR Saas Revenue Forecast Field Servicespankaj kumar100% (1)

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- 417 Assignment #1Document26 pages417 Assignment #1Gloria GuanNo ratings yet

- Latihan Soal Consolidation Worksheet With DiscussionDocument5 pagesLatihan Soal Consolidation Worksheet With DiscussionNicolas ErnestoNo ratings yet

- Budget Summary Report1Document4 pagesBudget Summary Report1MarvvvNo ratings yet

- Income Statement: IVAN IZO Law OfficeDocument4 pagesIncome Statement: IVAN IZO Law OfficeClaudio AbinenoNo ratings yet

- NPV Caselet Project AssessmentDocument4 pagesNPV Caselet Project AssessmentFurqanTariqNo ratings yet

- City Council Cost ComparisonDocument1 pageCity Council Cost ComparisonIndiana Public Media NewsNo ratings yet

- Details 4.1 - CIP 4.2 UIP: Home Earning Foreign EarningDocument2 pagesDetails 4.1 - CIP 4.2 UIP: Home Earning Foreign EarningShivakant UpadhyayaNo ratings yet

- Cost Acct Capital BudgetingDocument4 pagesCost Acct Capital BudgetingKerrice RobinsonNo ratings yet

- Sharukh Khan Capital Budgeting ModellingDocument4 pagesSharukh Khan Capital Budgeting ModellingOktariadie RamadhianNo ratings yet

- Calculating NPV, IRR, PBP and DPBP for an Investment ProjectDocument7 pagesCalculating NPV, IRR, PBP and DPBP for an Investment ProjectNgân NguyễnNo ratings yet

- 3310-Ch 10-End of Chapter solutions-STDocument30 pages3310-Ch 10-End of Chapter solutions-STArvind ManoNo ratings yet

- A-09.21.051 D .NAKUL Holmes BFDocument14 pagesA-09.21.051 D .NAKUL Holmes BFAustin GomesNo ratings yet

- Example Sensitivity AnalysisDocument4 pagesExample Sensitivity Analysismc lim100% (1)

- Corporate Finance TDDocument8 pagesCorporate Finance TDThiên AnhNo ratings yet

- Optimize Athena Cycle ProfitsDocument11 pagesOptimize Athena Cycle ProfitsJacob Sheridan100% (2)

- Initial Investment:: Solution A: 1) Particulars Press ADocument12 pagesInitial Investment:: Solution A: 1) Particulars Press AFernando Barreto GuzmanNo ratings yet

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- Account Excess FV Over BV $ 200,000 Allocations: TotalDocument6 pagesAccount Excess FV Over BV $ 200,000 Allocations: TotalMcKenzie WNo ratings yet

- W4 MonteCarloSimulationDocument133 pagesW4 MonteCarloSimulationChip choiNo ratings yet

- Sample Income StatementDocument1 pageSample Income StatementJason100% (34)

- CashflowsDocument5 pagesCashflowshar maNo ratings yet

- H.W ch4q7 Acc418Document4 pagesH.W ch4q7 Acc418SARA ALKHODAIRNo ratings yet

- Profit and Loss Summary: Budget Summary ReportDocument6 pagesProfit and Loss Summary: Budget Summary ReportIslam Ayman AbdelwahabNo ratings yet

- EVA, VPL e CVA 2003Document4 pagesEVA, VPL e CVA 2003Pedro CoutinhoNo ratings yet

- Sales Price: Recovered DepreciationDocument4 pagesSales Price: Recovered DepreciationjefpoyNo ratings yet

- Property & Liability Renewal ComparisonDocument58 pagesProperty & Liability Renewal Comparisonpalanisamy744100% (1)

- Case Study - Discounted Cash FlowDocument14 pagesCase Study - Discounted Cash FlowSalman AhmadNo ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentAtka chNo ratings yet

- Cost Benefit Analysis Dashboard Template: Employee SalariesDocument10 pagesCost Benefit Analysis Dashboard Template: Employee SalariesKarthik HegdeNo ratings yet

- FDDGDocument7 pagesFDDGlistenkidNo ratings yet

- IPPTChap 007Document53 pagesIPPTChap 007Khaled BarakatNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Balanced Scorecard & Economic Value Added 1Document3 pagesBalanced Scorecard & Economic Value Added 1Maha RehmanNo ratings yet

- Anomalies of The Existing Work Engagement MeasuresDocument4 pagesAnomalies of The Existing Work Engagement MeasuresMaha RehmanNo ratings yet

- Financial Statement AnalysisDocument12 pagesFinancial Statement AnalysisMaha RehmanNo ratings yet

- LanguageDocument5 pagesLanguageMaha RehmanNo ratings yet

- Economics of Risk and Uncertainty Applied ProblemsDocument6 pagesEconomics of Risk and Uncertainty Applied ProblemsMaha RehmanNo ratings yet

- Global WarmingDocument11 pagesGlobal WarmingMaha RehmanNo ratings yet

- Last NameDocument8 pagesLast NameMaha RehmanNo ratings yet

- Role of Bloggers in Social Media and Food PostingDocument15 pagesRole of Bloggers in Social Media and Food PostingMaha RehmanNo ratings yet

- Purpose of LifeDocument5 pagesPurpose of LifeMaha RehmanNo ratings yet

- Fortune 500 Company From The Service Industry 1Document9 pagesFortune 500 Company From The Service Industry 1Maha RehmanNo ratings yet

- Compare and Contrast HondaDocument5 pagesCompare and Contrast HondaMaha RehmanNo ratings yet

- Academic and Business WritingDocument5 pagesAcademic and Business WritingMaha RehmanNo ratings yet

- MGT 470 - Strategic Management: Final Project Link CablesDocument14 pagesMGT 470 - Strategic Management: Final Project Link CablesMaha RehmanNo ratings yet

- Comparison Honda A & BDocument3 pagesComparison Honda A & BMaha RehmanNo ratings yet

- MGT 470- How Honda's Peripheral Vision and Flexible Strategy Led to SuccessDocument4 pagesMGT 470- How Honda's Peripheral Vision and Flexible Strategy Led to SuccessMaha RehmanNo ratings yet

- Maha Rehman: Fig 1. Strategy and TacticDocument4 pagesMaha Rehman: Fig 1. Strategy and TacticMaha RehmanNo ratings yet

- Comparison Honda A & BDocument3 pagesComparison Honda A & BMaha RehmanNo ratings yet

- Maha Rehman BBA 2k16 B: Fig 1. Corporate Social Responsibility ContinuumDocument5 pagesMaha Rehman BBA 2k16 B: Fig 1. Corporate Social Responsibility ContinuumMaha RehmanNo ratings yet

- Form16 Parta AQLPK9881A 2018-19Document2 pagesForm16 Parta AQLPK9881A 2018-19Rakesh KumarNo ratings yet

- Rev SKBPP Forms1 3Document3 pagesRev SKBPP Forms1 3Naka Ng TetengNo ratings yet

- 5 - Profit and Loss WorksheetDocument8 pages5 - Profit and Loss WorksheetMarc Joshua VillordonNo ratings yet

- C.M. Hoskins & Co., Inc. vs. Commissioner of Internal RevenueDocument1 pageC.M. Hoskins & Co., Inc. vs. Commissioner of Internal RevenueAlljun SerenadoNo ratings yet

- (Intermediate Accounting 3) : Lecture AidDocument17 pages(Intermediate Accounting 3) : Lecture AidClint Agustin M. RoblesNo ratings yet

- Uk Payslip PDFDocument3 pagesUk Payslip PDFJhonel PauloNo ratings yet

- CHP 3Document23 pagesCHP 3Laiba SadafNo ratings yet

- Gross To Nett - Yarra VlogDocument2 pagesGross To Nett - Yarra VlogRichardo Putra SiahaanNo ratings yet

- Byrd and Chens Canadian Tax Principles 2018 2019 1st Edition Byrd Test BankDocument39 pagesByrd and Chens Canadian Tax Principles 2018 2019 1st Edition Byrd Test Bankhumidityhaygsim8p100% (16)

- Post Test Regular Income Taxation For PartnershipsDocument6 pagesPost Test Regular Income Taxation For Partnershipslena cpaNo ratings yet

- Hypermass Online Storage Salary Report Ch. 2Document2 pagesHypermass Online Storage Salary Report Ch. 2Edgard MoralesNo ratings yet

- Barangay Appropriation OrdinanceDocument5 pagesBarangay Appropriation OrdinanceArman BentainNo ratings yet

- Ex. 3-171-Adjusting EntriesDocument2 pagesEx. 3-171-Adjusting EntriesEli KrismayantiNo ratings yet

- 23062600636313KKBK ChallanReceiptDocument2 pages23062600636313KKBK ChallanReceiptshaik saifulla lNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusAndyTomas100% (1)

- Form No 49BDocument5 pagesForm No 49BVedant DistributorsNo ratings yet

- High Potential Wound Care ProductsDocument27 pagesHigh Potential Wound Care ProductsIsabel HigginsNo ratings yet

- Kpi - Report6 - 8 - 2021 3 - 41 - 41 PMDocument2 pagesKpi - Report6 - 8 - 2021 3 - 41 - 41 PMtajwalNo ratings yet

- BIO - AME - 002 - WOIBNPWR-01 - 2024 Otjikoto Biomass EPC - 19sept23 - IssuedDocument6 pagesBIO - AME - 002 - WOIBNPWR-01 - 2024 Otjikoto Biomass EPC - 19sept23 - Issuedamyma66889No ratings yet

- XII ACC 1st Online Pre-Board Exam QP 2020-21Document11 pagesXII ACC 1st Online Pre-Board Exam QP 2020-21Melvin CristoNo ratings yet

- Tally Prime Syllabus 2021Document12 pagesTally Prime Syllabus 2021bvsaisuraj100% (1)

- Local Government Taxation and Real Property Taxation GuideDocument6 pagesLocal Government Taxation and Real Property Taxation GuideRnemcdgNo ratings yet

- Taxation Law Review Case ListDocument18 pagesTaxation Law Review Case ListSabritoNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNITIN KUMARNo ratings yet

- GST - A Game Changer: 2. Review of LiteratureDocument3 pagesGST - A Game Changer: 2. Review of LiteratureInternational Journal in Management Research and Social ScienceNo ratings yet

- GST Interest Liability U/Sec - 50 of CGST Act 2017Document6 pagesGST Interest Liability U/Sec - 50 of CGST Act 2017Saurabh JunejaNo ratings yet

- Fardibad RentDocument3 pagesFardibad RentSatya Vamsi DorapalliNo ratings yet

- Solution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverDocument57 pagesSolution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverToddNovakmekfw100% (33)

- Numeracy and Money: Guião de Trabalho 04Document11 pagesNumeracy and Money: Guião de Trabalho 04Lena Maria LimaNo ratings yet

- B. Daftar Akun Neraca SaldoDocument2 pagesB. Daftar Akun Neraca SaldoRidha Laelatul SilviNo ratings yet