Professional Documents

Culture Documents

Table of Content Main PDF

Table of Content Main PDF

Uploaded by

Drubo Sobur0 ratings0% found this document useful (0 votes)

7 views5 pagesOriginal Title

Table of content Main.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views5 pagesTable of Content Main PDF

Table of Content Main PDF

Uploaded by

Drubo SoburCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

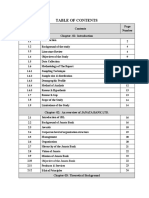

Table of contents

SL. Particulars Page

No.

Preface i

Letter of Transmittal ii

Declaration iii

Acceptance Letter iv

Acknowledgement v

Abstract 1

Chapter-1: Introduction 2-5

1.1 Background of the study 2

1.2 Origin of the report 3

1.3 Problem statement 4

1.4 Objectives of the Study 4

1.5 Scope of the Study 4

1.6 Limitations of the Study 5

Chapter- 2: Literature Review 6-8

Chapter- 3: Methodology 9-12

3.1 Methodology 9

3.2 Research Design 9

3.3 Study Area 9

3.4 Sample size selection/determination 10

3.5 Tools and technique of data collection 10

3.5.1 The Secondary Sources 10

3.6 Classification, analysis, interpretations and presentation of data 11

3.7 Findings of the study 11

Chapter- 4: Overview of SME 12-27

4.1 Introduction 12

4.2 Definition of Small Enterprise 12

4.3 Definition of Medium Enterprise 12

4.4 Current Status of SME Financing by Banks in Bangladesh 13

4.5 Factors that influence operations of SMEs. 13

4.6 Loan documents needed for SME financing by banks 15

4.7 Commercial Bank 16

4.8 List of banks in Bangladesh 16

4.9 About the Sample Banks 16

4.9.1 Sonali Bank Ltd 16

4.9.2 SME (Small & Medium Enterprise) Loan provided by Sonali Bank 17

4.10 Janata Bank Ltd 18

4.10.1 Functions of Janata Bank Ltd 19

4.10.2 SME loan of Janata Bank 19

4.10.3 Financing in SME Sector 19

4.11 Jamuna Bank Ltd. 20

4.11.1 Types of SMEs loan provided by jamuna Bank 20

4.12 Pubali Bank Limited 24

4.13 Types of SMEs loan provided by the Pubali Bank Limited 24

Chapter- 5: Data Analysis 27-36

5.1 Contribution of Commercial Banks by Providing SMEs loan 27

5.2 Contribution of two Government Banks towards SMEs Sector 28

5.3 Contribution of two Private Banks towards SMEs Sector 30

5.4 Comparison Between government banks and private banks 32

5.5 SME entrepreneur who take or not take SME loan 33

5.6 Sector wise contribution of SME in GDP of Bangladesh 34

5.7 Growth Pattern of SME 35

5.8 Growth Pattern of Manufacturing Sector 36

Chapter- 6: Findings 37-38

Chapter- 7: Recommendation and Conclusion 39-40

7.1 Recommendation 39

7.2 Conclusion 40

Reference 41-42

List of Figures

Figure No. Name Page

01 Business Type & Business Sector 27

02 Business Type & Business Sector (2) 28

03 Achievement of Target Given by Bangladesh Bank 29

04 Yearly Achievement of Target Given by Bangladesh 31

05 Comparison between Government Banks and Private Banks of 32

distributing SME loan

06 whether or not they take Bank loan to operate their SME 33

07 Sector wise contribution of SME 35

List of Tables

Table No. Name Page

01 Criteria for Small Enterprise 12

02 Criteria for Medium Enterprise 13

03 Industrial Origin Sector 15

04 Contribution of two Government Banks towards SME Financing 28

05 Contribution of two Private Banks towards SME Financing 29

06 Comparison between Government and Private Banks 32

07 Sector wise contribution of SME 34

08 Growth Pattern of SME 35

09 Growth Pattern of Manufacturing Sector 36

Abbreviations

ADB Asian Development Bank

BB Bangladesh Bank

BBS Bangladesh Bureau of Statistics

BIBM Bangladesh Institution of Bank Management

BSCIC Bangladesh Small and Cottage Industries Corporation

CIB Credit Information Bureau

FB Foreign Bank

FI Financial Institution

FY Financial Year

GDP Gross Domestic Products

MFI Micro finance Institutions

MIDAS Micro Industry Development Assistance and Services

MoF Ministry of Finance

NASCIB National Association of Small and Cottage Industries of Bangladesh.

NBFI Non-Bank Financial Institutions

NGO Non-Government Organization

OECD Organization for Economic Co-operation and Development

PCB Private Commercial Bank

SB Specialized Bank

SE Small Enterprise

SME Small and Medium Enterprise

SOB State Owned Bank

TIN Tax Identification Number

You might also like

- CFA Level 1Document2 pagesCFA Level 1beta3737100% (4)

- Meghna Bank Retail Banking - Updated - Nov16Document47 pagesMeghna Bank Retail Banking - Updated - Nov16Md SayeedNo ratings yet

- Financial Statement Analysis of Janata Bank Limited: Internship Report OnDocument39 pagesFinancial Statement Analysis of Janata Bank Limited: Internship Report OnFahimNo ratings yet

- The Developmental Tasks and EducationDocument12 pagesThe Developmental Tasks and EducationPrecious BalgunaNo ratings yet

- Biology Chapter 1 Cornell Notes and GraphsDocument14 pagesBiology Chapter 1 Cornell Notes and Graphsapi-239353579No ratings yet

- IntrerShip Report On SME BankingDocument84 pagesIntrerShip Report On SME BankingZainab MaroofNo ratings yet

- 083 11 542.pdfp03782 PDFDocument67 pages083 11 542.pdfp03782 PDFSultana LaboniNo ratings yet

- Internship Report On General Banking of Islami Bank Bangladesh LimitedDocument85 pagesInternship Report On General Banking of Islami Bank Bangladesh LimitedM Rashedul Islam RashedNo ratings yet

- Internship Report (Ripa)Document66 pagesInternship Report (Ripa)Ripa AkterNo ratings yet

- Bangladesh University of Professionals: Term Paper On "General Banking Activities of Pubali Bank Limited"Document43 pagesBangladesh University of Professionals: Term Paper On "General Banking Activities of Pubali Bank Limited"Rifat AnjanNo ratings yet

- Internship ReportDocument82 pagesInternship ReportTasnuva TishaNo ratings yet

- BRAC Internship ReportDocument82 pagesBRAC Internship ReportSayeedMdAzaharulIslamNo ratings yet

- Cover PageDocument7 pagesCover PageAl AminNo ratings yet

- Serial No. Particulars Page No.: Chapter One 01-03Document2 pagesSerial No. Particulars Page No.: Chapter One 01-03যুবরাজ মহিউদ্দিনNo ratings yet

- IntrerShip Report On SME Banking PDFDocument81 pagesIntrerShip Report On SME Banking PDFBhavika MadaanNo ratings yet

- AN Internship Report On: Submitted byDocument16 pagesAN Internship Report On: Submitted byAbhishek ThakurNo ratings yet

- Credit Management Policy and PerformanceDocument82 pagesCredit Management Policy and PerformanceAlinur IslamNo ratings yet

- Dhaka Bank ProjectDocument68 pagesDhaka Bank ProjectMahmudul HasanNo ratings yet

- Internship Report 15303025 (Revised)Document61 pagesInternship Report 15303025 (Revised)Araf AfsahNo ratings yet

- Letter of TransmittalDocument8 pagesLetter of Transmittalmd.jewel ranaNo ratings yet

- Brac Bank LimitedDocument58 pagesBrac Bank Limitedsibgat ullahNo ratings yet

- Sonali Bank Remittance PDFDocument58 pagesSonali Bank Remittance PDFFahimNo ratings yet

- Rafiul Alam Khan 09.12.18Document72 pagesRafiul Alam Khan 09.12.18Rafiul Alam khanNo ratings yet

- Report Sample 1Document53 pagesReport Sample 1Khan KaifNo ratings yet

- Marketing Strategies On Mercantile BankDocument53 pagesMarketing Strategies On Mercantile BankMD. Zakir Hossain AntorNo ratings yet

- An Internship Report: "A Study of Credit Management of Sonali Bank LTD, College Gate Branch, Dhaka"Document80 pagesAn Internship Report: "A Study of Credit Management of Sonali Bank LTD, College Gate Branch, Dhaka"Light YagamiNo ratings yet

- Sonali Bank Limited: An Internship Report OnDocument11 pagesSonali Bank Limited: An Internship Report Onrana mumeNo ratings yet

- Internship Report On Credit Management System of National Credit and Commerce Bank LimitedDocument11 pagesInternship Report On Credit Management System of National Credit and Commerce Bank LimitedSukantaNo ratings yet

- SIP Report - 105 Mrunalini MunjDocument65 pagesSIP Report - 105 Mrunalini MunjPrashant KokareNo ratings yet

- In T e Rns H Ip R e P o R T On: Standard Bank Limited BUS-400Document45 pagesIn T e Rns H Ip R e P o R T On: Standard Bank Limited BUS-400imrul khanNo ratings yet

- Chapter 03Document49 pagesChapter 03Sumaya MonwarNo ratings yet

- Serial Number Number Chapter-01: Introduction: Objective of The Janata BankDocument3 pagesSerial Number Number Chapter-01: Introduction: Objective of The Janata BankMizanur RahamanNo ratings yet

- Intern Report On Southeast Bank Bangladesh LimitedDocument33 pagesIntern Report On Southeast Bank Bangladesh LimitedA S M SalehNo ratings yet

- Sadia Internship Report NewDocument61 pagesSadia Internship Report NewMd. Imran HossainNo ratings yet

- Internship PapanDocument59 pagesInternship PapanPapan Das SabujNo ratings yet

- Siddhartha NPDocument37 pagesSiddhartha NPshresthanikhil078No ratings yet

- Cover Pages For Final Print Jui SenDocument5 pagesCover Pages For Final Print Jui SenMamtazTalukderAkmNo ratings yet

- Particulars Numbe R: Janata Bank LTD: at A GalanceDocument52 pagesParticulars Numbe R: Janata Bank LTD: at A GalanceTareq AlamNo ratings yet

- Electronic Banking and Customer Satisfaction - A Case Study On NRB Commercial Bank Limited, Dhanmondi Mohila Branch PDFDocument81 pagesElectronic Banking and Customer Satisfaction - A Case Study On NRB Commercial Bank Limited, Dhanmondi Mohila Branch PDFShopnomoy Dip100% (2)

- Internship Report OnDocument34 pagesInternship Report OnVanshika HandaNo ratings yet

- Financial Performance Analysis of Dhaka Bank LimitedDocument9 pagesFinancial Performance Analysis of Dhaka Bank LimitedSharifMahmudNo ratings yet

- Commerce Bank LTD: South Bangla Agriculture &Document108 pagesCommerce Bank LTD: South Bangla Agriculture &FahimNo ratings yet

- MBL Internship ReportDocument66 pagesMBL Internship ReportMehedi HasanNo ratings yet

- Finscope MSME 2019 Survey Full ReportDocument56 pagesFinscope MSME 2019 Survey Full ReportBrightChidzumeni100% (1)

- Report On General Banking Activities of Janata Bank LimitedDocument57 pagesReport On General Banking Activities of Janata Bank LimitedRatul AhamedNo ratings yet

- General Banking Activities of SBL - Final Internship Report - Sadia MahajabeenDocument73 pagesGeneral Banking Activities of SBL - Final Internship Report - Sadia Mahajabeenimrul khanNo ratings yet

- Toaz - Info PNB Summer Internship Report PRDocument90 pagesToaz - Info PNB Summer Internship Report PRalpesh sakariaNo ratings yet

- Binder 1Document7 pagesBinder 1efraankhan6978No ratings yet

- 161GCMD096Document112 pages161GCMD096Akshay K RNo ratings yet

- Internship ReportDocument8 pagesInternship Reporteasy medicineNo ratings yet

- "Financial Product and Services of Prime Bank Limited": Internship Report ONDocument56 pages"Financial Product and Services of Prime Bank Limited": Internship Report ONIsmail HossainNo ratings yet

- A Study of Factors Affecting Selection of Financial Institution For Consumer Durable Loan - A Case Study On Emi-Card Offered by Bajaj FinservDocument43 pagesA Study of Factors Affecting Selection of Financial Institution For Consumer Durable Loan - A Case Study On Emi-Card Offered by Bajaj FinservShirish BagalNo ratings yet

- SolemanDocument83 pagesSolemanSolemanNo ratings yet

- Shamim Internship ReportDocument39 pagesShamim Internship Reporttania.r4006No ratings yet

- Internship: Loan Advancement ProcedureDocument75 pagesInternship: Loan Advancement ProcedureSunil Kumar MahatoNo ratings yet

- 3 - Table of ContentsDocument1 page3 - Table of ContentsSohelNo ratings yet

- Customers Perception On General Bamking Activities of Prime Bank Limited 3Document49 pagesCustomers Perception On General Bamking Activities of Prime Bank Limited 3Shuvo DeyNo ratings yet

- The Role of Commercial Banks in Financing Small, Medium and Microenterprises in The Greater SowetoDocument101 pagesThe Role of Commercial Banks in Financing Small, Medium and Microenterprises in The Greater SowetoMukesh KumarNo ratings yet

- CRM BCBLDocument60 pagesCRM BCBLHasnat ShakirNo ratings yet

- Akash CPDocument48 pagesAkash CPEr Aks PatelNo ratings yet

- Internship Report: Procedure of Letter of Credit (LC), Import, Export and Local Trade of Mutual Trust Bank.'Document84 pagesInternship Report: Procedure of Letter of Credit (LC), Import, Export and Local Trade of Mutual Trust Bank.'Suman AminNo ratings yet

- The Design of Micro Credit Contracts and Micro Enterprise Finance in UgandaFrom EverandThe Design of Micro Credit Contracts and Micro Enterprise Finance in UgandaNo ratings yet

- Financing TheoryDocument43 pagesFinancing TheoryDrubo SoburNo ratings yet

- A Dissertation On: SME Financing in Bangladesh: A Comparative Analysis of Banking Sectors in BangladeshDocument1 pageA Dissertation On: SME Financing in Bangladesh: A Comparative Analysis of Banking Sectors in BangladeshDrubo SoburNo ratings yet

- Dedicated To My Beloved pARENTSDocument8 pagesDedicated To My Beloved pARENTSDrubo SoburNo ratings yet

- Dedicated To My Beloved pARENTSDocument8 pagesDedicated To My Beloved pARENTSDrubo SoburNo ratings yet

- A Dissertation On: SME Financing in Bangladesh: A Comparative Analysis of Banking Sectors in BangladeshDocument1 pageA Dissertation On: SME Financing in Bangladesh: A Comparative Analysis of Banking Sectors in BangladeshDrubo SoburNo ratings yet

- SME Financing in Bangladesh NewDocument42 pagesSME Financing in Bangladesh NewDrubo Sobur100% (1)

- Page No. Chapter-1: Introduction 1-2: ReferencesDocument3 pagesPage No. Chapter-1: Introduction 1-2: ReferencesDrubo SoburNo ratings yet

- Dedicated To My Loving ParentsDocument7 pagesDedicated To My Loving ParentsDrubo SoburNo ratings yet

- The Impact of Corporate Governance On Firm Performance: A Review of Banking Sector in BangladeshDocument1 pageThe Impact of Corporate Governance On Firm Performance: A Review of Banking Sector in BangladeshDrubo SoburNo ratings yet

- 1st para NewDocument6 pages1st para NewDrubo SoburNo ratings yet

- Lesson 2 Culture and MoralityDocument17 pagesLesson 2 Culture and MoralityRevy CumahigNo ratings yet

- RMIP-21RMI56-Module 1Document10 pagesRMIP-21RMI56-Module 1apoorva.k2017No ratings yet

- Families Find Hope: Reclaim Dignity and Rebuild Their LivesDocument20 pagesFamilies Find Hope: Reclaim Dignity and Rebuild Their LivesAnonymous LVqu5HTQNo ratings yet

- 9709 Mathematics Paper6 Example Candidate ResponsesDocument30 pages9709 Mathematics Paper6 Example Candidate ResponsesWalid AamirNo ratings yet

- Course Outline CHEM-108Document2 pagesCourse Outline CHEM-108WAJEEHA FATIMANo ratings yet

- Lecture 3: Needs Analysis: 1. Brief Background and DefinitionDocument5 pagesLecture 3: Needs Analysis: 1. Brief Background and DefinitionDewaAsmara MencariCintaNo ratings yet

- Classical Work On Inflow TheoriesDocument2 pagesClassical Work On Inflow TheoriesBarrywarry27No ratings yet

- Cognitive-Behavior Therapy Vs Exposure Therapy in The Treatment of PTSD in RefugeesDocument15 pagesCognitive-Behavior Therapy Vs Exposure Therapy in The Treatment of PTSD in RefugeesAna CristeaNo ratings yet

- (1911) Standardized Barbers' Manual: Revised & Adopted by The National Educational CouncilDocument278 pages(1911) Standardized Barbers' Manual: Revised & Adopted by The National Educational CouncilHerbert Hillary Booker 2nd100% (2)

- Assistant Professor, Department of Human Performance Minnesota State University Mankato 2016-2017 Academic YearDocument5 pagesAssistant Professor, Department of Human Performance Minnesota State University Mankato 2016-2017 Academic Yearjessica albersNo ratings yet

- BCS BJS 70 - 23 JulyDocument112 pagesBCS BJS 70 - 23 JulyMM OrvinNo ratings yet

- AffirmativeDocument17 pagesAffirmativeMarijo Solange CandelariaNo ratings yet

- CKLA G6 U1 Flying-Lessons ABDocument165 pagesCKLA G6 U1 Flying-Lessons ABeka emmanuelNo ratings yet

- Grade 8 Lesson Plan - MeasurementDocument3 pagesGrade 8 Lesson Plan - Measurementapi-257672273No ratings yet

- Concept PaperDocument4 pagesConcept PaperLovely Joy DelacruzLavador SaludoNo ratings yet

- Basic English Dialogs Colds FluDocument3 pagesBasic English Dialogs Colds FluevaNo ratings yet

- Kasus Motivasi GoogleDocument2 pagesKasus Motivasi GoogleAnnie AvonleaNo ratings yet

- Architecture ExpectationsDocument5 pagesArchitecture ExpectationsPogpog ReyesNo ratings yet

- Partituradebanda - Band Folio - Book 2 - Bombardino BBDocument25 pagesPartituradebanda - Band Folio - Book 2 - Bombardino BBDennis FernandesNo ratings yet

- +MME100 Syllabus Fall 2014 - August 29Document5 pages+MME100 Syllabus Fall 2014 - August 29Tamer ElshayalNo ratings yet

- The Relationship Between Service Quality and Customer Satisfaction: A Case Study of Pizza HutDocument9 pagesThe Relationship Between Service Quality and Customer Satisfaction: A Case Study of Pizza HutAl AminNo ratings yet

- Investment+Readiness+Checklist UpdatedDocument33 pagesInvestment+Readiness+Checklist UpdatedNorman RivasNo ratings yet

- PE7 - Q3 - M1 - Monitoring My Physical Fitnesslevel - v5Document38 pagesPE7 - Q3 - M1 - Monitoring My Physical Fitnesslevel - v5Sittie Asnile MalacoNo ratings yet

- Final Edited Elearnig SystemDocument82 pagesFinal Edited Elearnig SystemTame PcAddictNo ratings yet

- Hybrid Sounds in Yoruba: Ihafa: A Journal of African Studies 7: 1 December 2015, 1-20Document20 pagesHybrid Sounds in Yoruba: Ihafa: A Journal of African Studies 7: 1 December 2015, 1-20aiajayiNo ratings yet

- Free Online Youth Work CourseDocument7 pagesFree Online Youth Work Courseafiwjkfpc100% (2)

- ResearchDocument3 pagesResearchfardz22computerNo ratings yet