Professional Documents

Culture Documents

CVP Analysis

CVP Analysis

Uploaded by

Nafisa Anika0 ratings0% found this document useful (0 votes)

3 views23 pagesOriginal Title

CVP ANALYSIS

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views23 pagesCVP Analysis

CVP Analysis

Uploaded by

Nafisa AnikaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 23

Chapter 6 HearevomPeath Hetatonships ow

, The Basics of Cost-Volume-Protit (CP) 1 hac

ob Luchinnis preparation for the Thursday meeting begins where our study of cost be

havior in the preceding chapter left off—with the contribution ineome statement, The

contribution income statement emphasizes thé behavior of conts and therefore is ex

‘tremely helpful to.a manager in judging the impact on profits of changes in setting price

cost, or volume, Bob will base, hi» analysis on the following contribution income slate-

ment he prepared Jast month: s

Notice that sales, variable expenses, and contribution margin are expressed on a per

unit basis as well as in total on this contribution income statement, The per unit figures

will be very helpful in the work we will be doing in the following. pages. Note that this

contribution income statement has been prepared for management's use inside the cony-

pany and would hot ordinarily be made available to those outside the company.

“contribution margin is used frst to cover Re mses, and then whateverre-

= ‘goes toward profits. If the contribution margin is not sufficient to cover the margin and net

thes alone oscars for ths pai5%-T6ThiSeate wiih ghee Gi uligcilicn °° vessin

“the middle of a particular month Acoustic Concepts has beerfablo to sell only one

If the company does not sell any more speakers during the month, the company's

income statement will appear as follows:

Chapter 6 Cost-Volume-Profit Relationships

Sales (2 speakers) . .-

Less variable expenses -

Contribution margin

Less fixed expenses -

Net operating loss.

If enough speakers can, be sold to generate $35,000 in contribution margin, then all of

the fixed costs will be covered and the company will have managed to at least break even

for the month—that is, te show neither profit nor loss but just cover all of its costs. To

reach the break-even point, tie company will have to sell 350 speakers in a month, since

each speaket sold yields $100 in contribution margin:

rotsi Per unit

» $87,500 ‘$250

52,500 _ 150,

Contribution margin's

Less fixed expenses

* Net operating incoms

Computation of the break-even point is discussed in detail later in the chs

nis dis apter; for the

moment, note that the break-even point is the level of sales at which profit is zero.

Osos cain ieg

In Business | Will eToys Make It?

T ste compan cTo}S:WRIGT Ss toye-over re irnet lei 100 mals sale’

i ‘ ant

S ___ $151 millon, Ong bia bet was averting: eToys spent abou $27 on adverong er eeow

é $100 of sales(Other e-tailérs ware spending even more—in some cases, up to $460.0n ad- i

‘erisng for each $10 in sale) :

+e eoys does have some advantages .

eee

Reet ne ayy ed ae

‘mortar fell spaces in malls and elsewhere do cost money—on average. about

However, e-failers such as eToys have their own set of disadval : 7% of sales.

: pack their Own items ata bicks-and-mortar outlet, bul eaters have to pey export

: carry ou ths task. This costs eToys about $33 for every $100 n sales, Andere een

‘sell over the net does not come free. eToys paid about $29 on its wet the technology to

neogy fo every $100%n sales However, many ofthese coe o seing over te ene here

are

‘Sales (951 speakers)...

Less variable expenses ..

‘Contribution margin

Less fixed expenses

Net operating income. .

1f 352 speakers are sold (2 speakers above the break-even point), then we can expect

that the net operating income for the month will be $200, and so forth. To know what the

profits will be at vartous-levels of activity, therefor, itis not necessary for a manager to

prepare a whole series of income statements. To estimate the profit at any point above the

break-even point, the manager can simply take the number of units to be sold over the

break-even point and multiply that number by the unit contribution margin. The result

represents the anticipated profits for the period. Or, to estimate the effect of a planned in~

crease in sales on profits, tne manager can simply multiply the increase in units sold by

the unit contribution margin. The result will be the expected tncrease in profits. To illus

trate, if Acoustic Concepts is currently selling 400 speakers’per monthrand plans (o in-

crease sales to-425 speakers per month. the anticipated impact on profits can be computed

as follows:

Increased number of speakers to be sold. .

Contribution margin per speaker ........

Increase in net operating income”...

‘These calculations can be verified as follows:

Less variable

$_5,000 $ 7,500 $2,500

‘To summarize these examples, if there were no sales, the company’s loss would equal

its fixed expenses. Each unit that is sold reduces the loss by the amount of the unit con=

iribution-margm. Once the break-even point has been reached, each additional unit sold

increases the company's profit by the amount of the unit contribution margin,

chapter 6 Cost-Volume-Proft Relationships

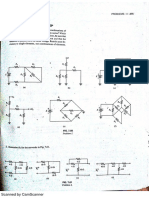

P called a break-even

the CVP Graph In a CVP graph (sometimes ¢al

hard. unit volume is commonly represented on the horizontal (X) axis and dollars on the

‘ertical(¥) axis. Preparing a CVP graph involves three steps. These steps Metered tothe

raph in Exhibit 6-1:+ : : Q

1. Draw a line parallel to the volume axis to represent total fixed expenses. For Acoustic

Concepts, total fixed expenses are $35,000. a

2. Choose some volume of sales and plot the patht representing total expenses (fixed

and variable) atthe activity level you have selected. In Exhibit 6-1, Bob Luchinni

chose a volume of 600 speakers. Total expenses at that activity level would be as

follows: zB

Fixed expenses...

Variable expenses (600

Total expenses..........

After the point has been plotted, draw a line through it back to the point where.the

fixed expenses line intersects the dollars ax

3. Again choose some volume of sales and plot the point representing total sales dollars

at the activity level you have selected, ibit 6-1, Bob Luchinni again chose a

volume of 600 speakers. Sales at that acuvicy level total $150,000 (600 speakers

$250 per speaker). Draw a fine through this point back to the origin,

‘The interpretation 6f the completed CVP graph is given in Exhibit 6-2. The antici-

pated profit or loss at any given level of sales is measured by the vestical distance between

the total revenue line ales) andthe ial PENSE TNE Gable apo ey

ail

Tie ti eve foe Paes eas

break-even point of 350 speakers in Exhibit 6-2

puted earlier.

and total expenses lines cross. The

‘agrees with the break-even point com-

Chapter 6 Cost-Volume-Profit Relationships 239

\s diseunsed earliery when sales are below the break-even point—in this case, 350

jas the company suffers a loss. Note that the loss (represented by the vertical distance +

persseen thy al expense and total revenue lines) gets worse as sales decline. When Sales

‘ae abvse the break-even point, the company earns a profit and the size of the profit (rep-

resented by the vertical distance between the total revenue and total expense lines) in-

creases as sales increase.

Buying Your Groceries Online | In Business

OnindigieeeIs Such as 'Peapbd.com (uum peanod com), Webven (ut wabvan com), |

Sireemiine.com (wa. stceamlne.com); HorneFluns com (yw nomesuns com), Netgrocer com

(rnenatgiocercum), and HomeGrocer.com (wwriznomearacercom) have interesting cost

sructyres. Large investments in fixed costs are necessary o create appealing web pages and

for bricks-and-mortar infrastructure such as warehouses and delivery vans. Variable costs

‘come in atleast two varieties, One kind of variable cost is related to the number of deliveries

‘made. These variable costs include fuel, maintenance, and depreciation on vehicles. The other

‘ind of variable cost is related to the amount of gfoceries ordered by a customer,

With the cost structure in this industry, and the low margins prevalent in the grocery bust-

‘ess, itis very dificult for online grocers to break even. For example, Homeftuns.com’s pres-

‘dent Tom Furber says that the Somerville, Massachuselts-based grocer needs 8,000 orders,

lina week to break even. In a good week, it may get leas than a third that many orders,

Source: Timothy J. Mulaney and David Leontarct, “A Hard Sell Online? Guess Again" Gusiness Week,

iby 12, 1909, pp. 142-143, '

ik

ae hearer 5 6-2

$175 ‘The Completed CVP Graph

Total

revenue

~ \

ad Break-even point:

350 speaiers or

$87,500 in sales z

i a

8

ia aloe. = = a ei

6° Cost-Volume-Profit Relationships

, ae [$180,000 expected sales ~ $250 per unit = 520 units. 526 units x $150 per unit =

|

8

3

Chapler 6 CoshVolume:Profit Relationships ‘ Co

Some managers profer 1 jork with the CM Futio rather than the unit contribution

snp, The CNL tio iy patitilatly valuable in situations where trade-offs must be

enweet more shall oe ‘of ane produet eal ‘dollar sales of another. Generally

speaking. when trying (0 inetease Sales, products that yield the greutest amount of come

‘bution margin por dotlar ofuleshostdopemphgun ela ee San ’ hy

. 4 aes, oe

Some Applications of CVP Concepts

‘Bod Luchinnictheuccountant at Acoustic Foncepts, wanted to demonstfite 0 the com:

pany’ presihint Prent Narayan how the concepts developed on the preceding pages can ARMING OBEROI 6

‘be-usedl in planning adtdeeision making. Hob gathered the following basie dati: ‘Show ine etlecte-on

_contniution margin of

‘ Percent ‘changes in variable costa,

: Per Unit of Sales ‘ined costs, selling price,

‘Sating price 4 $260 100% ‘and volume,

‘Lees variable expanses . “150 60%

Contribution margin. $100 40%

eS =

Reeal}that tived expenses are $35,000 per moath, Bob Luchinni will use-these data to

shove the effects of changes in variable costs, fixe costs, salen price, al sales wolumie on

‘the company’s profitability in a variety of situations. *

‘Change in Fixed Cost and Sales Volume Acoustic Concepts is currently.

selling 400 speakers per manth (monthly sales of 81007000), The sales manager feels that ‘

a crease eitising by

is. Should the advertising budget be inereased”? The To

ing table shonss the eltect of the proposed change ithe monthly advertising budget: a}

‘apravedsince it would hea €9 am increase i

re 40 Shorter ways to present tis solution, The

follows: ¥ * » *

ite nies

i ome pte ei ie =

hos

58. ay

is case ony the fi

Since in the case oe porter forms, wx follows:

Notice that this approach does not depend on a knowledge of previous sales. Also notice

that it is unnecessary under either shorter approach to prepare an income statement. Both of

the solutions above involve an incremental analysis—they consider only those items of

revenue, cost, and volume that will change if the new program is implemented. Although i

teach case a new income statement could have been prepared, the incremental approach is

simpler and more direct and focuses attention on the specific items involved im the decision. .

cnaige meer aie Lee Sales Volume Refer to the original data.

{eval that Acoustic Concepts is currently selling 300 speakeTs per month. Management

is considering the use of higher-quality components, which would increase variable costs _

(and thereby reduce the contribution margin) by $10 per speaker. However, the sales man-

ager predicts that the higher overall quality would increase sales to 480 speakers per

month. Should the higher-quality components be used?

The $10 increase in variable costs will decrease the Unit contribution margin by

$10—from $100 down to $90. Z

lution ac ae

: Expected total contribution margin with higher-quality components:

¢ 480 speakers x $90 per speaker. ‘$43,200

* Present total contribution margin:

400 speakers x $100 per speaker, 3

Increase in total contribution margin

;

$3200

E_

According to this analysis, the higher-quality components should be used. Since fixed

costs will not change, the $3,200 ee peat ‘margin: an

sult ina $3,200 increase in net operating income. é #

‘A decrease if $20 per speaker is

margin to decrease fom $100 10 $80. tine Pree wil

See a eiponaes. 30.000

Contribution margin « 48,000 *

Less fixed expenses - ‘50,000"

Net operating

+ $_(2,000) $7,000)

income (088) --

735,000 + Additional monthly advertising budget of $15,000 = $50,000.

[Notice that the effect on net operating income is the same as that obtained by the in-

cremental analysis above.

Change in Variable Cost, Fixed Cost, and Sales Volume the

origina data, As belor®. the compaRy Ty CorreM iS per month, The

Sarde manager would fi (0 pay a sales Commission of $15 per speaker sold rather than

‘pay salespersons’ flat salaries tha now yotal $6,000 per month. The sales manager is con-

fident that the change wilh increase monthly sales by 15% to 460 speakers per month.

‘Should the change be made?

Solution - .. a He

Changing the sales si from a Salaried basis to a commission basis will affeot both fixed

‘and variable expenses. Fixed expetises will decrease by $6,000, from $35,000 to $29,000.

\Vaciable expenses will increase by $15,ftom $150 to $165, and the unit contribution mar-

‘gin will decrease from $100 to $85.

Expected total contribution margin with sales staff on commissions:

‘460 speakers x $85 par speaker. ... ‘i <+ $39,100 -

Present total contrbution margin: s

400 speakers x $100 pyr speaker......:..

Decrease in total contribution margin.

Change in xed expenses:

‘Add salaries avoided if a commission is pald. .....

Increase in net operating income. . roe

According to this analysis, the changes should be made. Again, the same answer can

be obtained by preparing comparative income statements:

| Break-Even Analysis

t

CChapteré CoBt-Volume-Profit Relationships

Change in Regular ic Com

ein Sales Price Refer the origivial data where Acoustic

Cage i nly eeling 400 speakers per moms The Company asa oppo te

re BO cpeskers wo a wholesaler Fin acceptable pice can he worked out

a topes the company's repr salex and would non affect the come

Tersd pensen What price per speak should he quoted to the wholesaler if

crease its monthly pats by $3,0007

This

pany’s ota

‘Acoustic Concepts wants to

Solution

Variable cost per speaker....... $150

Desired profit per speaker:

‘$3,000 + 150 speakers. . _20

Quoted price per speaker....... $170

Notice tha xed expenses ae ot include nth compotion Tis is Haase ed

expen are ot aeted hy he Buk ae soa ofthe adil revenvetht iin exces

Of variable costs inereases the profits of the company!

‘As stated in the introduction wo the chapter: CVP analysis can be used to help find the most

rofable conbinaion of vale cos kd conte eng pe ard ales Oe Te

ve examples show that theeffect of a decision of Ton margia is often crt-

ical. We have seen that profits can sometimet be improved by reducing the contribution

‘margin if fixed costs can be reduced by a greder amount. Mowe commonty: However. we

‘ave seen at me way to impeove rons Ts a rca vee amar Tnargin figure.

‘Sometimes this can be done by reducing the selling price and tiéreby increastag volute:

‘sometimes it can be done ty icreasing TR TS COR a aay ivertising) and thereby. in-

creasing volume; and sometimes it can be done by racing OMT vartabe and fixed costs with

appropriate changes in volume. Many otfiercomiiiiyions of factors are. possible.

~~ The size of the unit contribution margin (and thesize of the CM ratio) is very impor=

lant. For example, the greater the unit contribution itgin. the greater is the amount that

company will be willing spend fo Tacrease unitsiles. This explains iy part why come

aTTes wilh igh unit coniribution margins (suchas auto, manufacturers) advertise so

heavily. while companies with low unit contributict margins (such as dishware manufac

turers) tend to spend much is Tora if

{In short, the effect on the contribution margirholds the key to many decisions.

CYP analysis is sometimes referred to simply & break-even anal fortunate

s -ven analysis. This is uni

because break-even analysis is only one elemgt of CVP ‘analysis—although an important

Pronen. Break-even analysis is designed soanswer questions such as those-asked by

Prem Narayan, the president of Acoustie Cones, sales could drop’ *

before the company begins to lose money, re

o

Chapter 6 Cost-Volume-Profit Relationships

Hiotity = (Sales ~ Variable expenses) Fixed expenses

| Rearranging this equation slightly yields the following equation, which is widely uséd in

CVP analysis:

Salles = Variable expenses + Fixed expenses + Profits

Atthe break-even point, profits are zero. Therefore, the break-even point can be com- 3

phishing tet poet where sas oat ‘equal the total of the variable expenses plus

the fixed expenses. For Acoustic Concepts, the break-even poi Aron Bee cas 4

ra tows

Sales = Variable expenses + Fixed expenses + Profits

$250@ = $1509 + $35,000 + $0 ;

$1009 = $35,000"

Q = $35,000 + $100 per speaker

Q = 350 speakers

where

Q © Number (quantity) of speakers sold

$250 = Unitsales piice

sisi :

$35,000 = Total fixed expenses

‘The break-even point in sales dollars can be computed by multiplying the break-even

level of unit sales by the yelling price per unit

350 speakers x $250 per speaker = $87,500 : ;

‘The break-even in (otal sales dollars, X, can also be directly computed as follows:

Init Variable expenses

Sales = Variable expenses +-Fixed expenses + Profits

X= 0.00X + $39,000 + 30

0.40X = $35,000

X = $35,000 + 0.40

X = $87,500

Chapter 6 Cost-Volume-Proft Relationships i

é le

In Business | Buying on the Go—A Dot.com Tal

ng engineers, George Searle and Humphrey Che. 40

eco ce cider sie CDs on tet cel hones. Suppose you hear a cut from @ GD

aoe io tel you woud ike 1 own, Pek up your cel phone, punch “CD.” Set the

oo oo eteguaten end the te you Heard the 30M, and the CD wil soon be on Hs way

toyou

‘Star CD charges about $17 for @

about $13, leaving @ contnbution margin o

T star Chie @ company set up by two vou

CO. including shipping. The company pays its Supplier

¥ $4 per CD. Because of the fixed costs of running

the service, Searle expects the company to loge $1.5 milion on sales of $1.5 milion i its frst

year of operations. That assumes the company sells in excess of 88,000 CDs.

‘What is the company’s break-even point? Working backwards, the company's fixed ex-

penses would appear to be about $1,850,000 per year: Since the contribution margin per CD

is $4, the company would have to sell over 460,000 CDs per year just to break event

‘Source: Peter Katka, “Pay It Again,” Forbes, July 26. 1999. 9 94

{LRAT ‘The conten marzo mead i 26

f

tually just a shortcut version ofthe equation methoxtalready described. The approach cen-

ters on the idea discussed earlier that each unit sold provides a certain amount of

contribution margin that goes toward covering fixed costs. To find how many units must

be sold to break even, divide the total fixed costs by the unit contribution margin: |

i ee tere

Fixed expense

reak-even point in units sold =

Each speaker generates a contribution margin of $100 ($250 selling price, less $150

variable expenses). Since the total fixed expenses are $35,000, the break-even point is

computed as follows: |

Fixed expens $35,000 |

Unit contribution margin $100 per speaker

350 speakers

A variation of this method uses the CM ratio instead of the unit contribution margi

3 contribution margin,

The result is the break-even in total sales dollars rather than in total units sold.

Fived expenses

CM rai

Break-even point in total sales dtary

In the Acoustic Concepts example, the calculations are as follows:

Fixed expenses

CM ratio

‘This approach, based on the CM ratio is particularly useful in those situations where

‘a company has multiple product linesgand wishes to comput

the company as whole. Mori safon this poi in alse section lea ee

neces ited The Concept of

eae

rr

ler Cost-Volume:Profit Relationships

‘Sales = Variable expenses + Fixed expenses + Profits

$2509 = $1509 + $35,000 + $40,000

$1009 = $75,000 ; “

$75,000 + $100 per spéaker

Q = 750 speakers

where:

Q = Number of speakers sold -

$250 = Unit sales price 2

$150 = Unis variable expences

$535,000 = Total fixed expenses

$40,000 = Target profit

‘Thus, the target profit can be achieved by selling 750 speakers per month, which repre-

sents $187,500 in total sales ($250 per speaker X 750 speakers).

Thrift Shop Publishing | In Business

Hesh Kestin failed in his attempt at publishing an English-language newspaper in Israel in the

1980s! Mis conclusion: “Never start a business with too many people or too much furniture.”

Kestin's newest venture is The Ameri-.n. a Sunday-only newspaper for overseas Americans.

Hig Idea is to publish The American on the one day of the week that the well-established In-

ternational Herald Tribune (circulation, 190,000 copies) does not puolish. But folowing what

he learned from his fist failed venture, he is doing it on a shoestring.

In contrast to the Paris-based international Herald Tribune with its eight

and staff of 20, Kestin has set up business ina smal clapboard building on Lbng is =

ing at desks purchased from a thrit shop, Kestins staff of 12 assembles the tabloid from sites

pulled off wire services. The result ofthis trugaly is that The Americaris break-even point is

‘nly 14,000 copies. Sales topped 20,000 copies ust two montne after the papers fist issue.

‘Source: Jerry Useem, “American Hopes to Conquer the Worid—from Long Island,” Ine, December

1998, p. 23,

‘The

‘This approach gives the same answer as the equation method since its simply a shortcut

version of the equation method, Similarly, the dollar sales needed to attain the target profit,

can be computed as follows:

ot

> +

3

Ye

is

c

i fre Margin of Safety

actual} sales over the break-even vol

sanmwa OBIECTIVE budgeted (oF

: ess hich sales can dTop beTore loses begin w Dein=

ra. The “he lower the risk of not breaking even. The

Compute the ribirgin of safety yirréd. The higher the margin of safety.

indaxplain ts signiicance. formula for its calculation is:

— car acpi = iva ove eS

SracinaT matey 5 ona nlp ca acu =

~ angin of safey can als be expressed in percentage form THs Dorcel Aas saa

“The margin of safety

tained by dividing the margin of safety in dollar

: —— Maigin of sate

‘Catarginof saferypercenize = Fy buigeted (oF ae les 9

‘The calculations for the margin of safety for Acoustic Co

mncepts are as Tollow’

Sales (at the current volume of 400 speakers) (8) $100,000

Break-even sales (at 350 speakers) aa

Margin of safety (in dollars) (b) veces $42,500

Atargin chostety 6a’ percentage soles, (OL (0) ns ata

This margin of safety means shat at the current level of sales and with the company’s cur:

rent prices and cost structure, a reduction in sales of $12,500, or 12.5%, would result in

just breaking even.

In a single-product firm like Acoustic Concepts, the margin of safety can also be ex-

pressed in terms of the number of units sold by dividing the margin of safety in dollars by

: the selling price per unit, In this case, the margin of safety is 50 speakers ($12,500 +

$250 per speaker =-50 speakers).

Soup Nutsy

Pak Melwani and Kumar Hathiraman, former sik merchants {fom Bombay, opened a soup

store in Manhattan etter watching a Seinfeld episode featuring the “soup Nazi The episode

paroled rene $up vendo. Al Yogonah, whoes loyal eatotions

: ; vatornere put up with

‘ines and “snarling customer service." Melwani and Hathiramani approached aaa

“ring his soup kitchen into chan, bu hey were rut rebuild, lend of ging tie)

swore a French eva wih seperti S00 soe and opened sine canes

For Sper serv, Saup Nas fre 12 mera oupe each toy such epee cee

bisque and Thai coconut shrimp. Melwani and Hathiramani report that in their first of

‘eration, they netied $210,000 on sales of $700,000. They report that it costs ma a

serving to make the soup. So their variable expense ratio is one-third ($2 cost + op

rice). It so, what are thier fixed expenses? We can answer that question @ equation

approach as follows: * “ie 5s

Sales = Variable expenses + Fixed expenses + Profits

Total current sales (a)

Break-even sales

Margin of satety in sales dollars (b)

Margin of safoty as a percentage of sales, (b) + (a)

$100,000

14.266

149%

This analysis makes it clear that Bogside Farm is less vulherable to downturns than Ste

ling Farm. We can identify two reasons why itis less vulnerable. First, de to its lower

fixed expenses, Bogside Farm has lower break-even point and a higher margin of safety.

as shown by the computations above. Therefore it will not incur losses as quickly as Ste

ling Farm in periods of sharply declining sales. Second, due o its lower CM ratio. Bog

side Farm will not lose contibution margin as rapidly as Sterling Farm when sales fall

off. Thus, Bogside Farm's income will be less volatile. We saw eaier that this is a draw

back when sales increase, bu it provides mora protection when sales drop.

To summarize;-without knowing the future, itis not obvious which cost structure is

better. Both have advantages and disadvantages. Sterling Farm, with its higher fixed costs

and lower variable costs, will experience wider swings in net income as changes take

place in sales, with greater profits in good years and greater losses in bad years. Bogside

Farm, with its lower fixed costs and higher variable costs, will enjoy greater stability in

ret operating income and will be more protected from losses during bad years, but atthe

cost of lower net operating income in good years.

A Tever is a tool for multiplying force. Using a lever, a massive object can be moved with

LEARNING ORJECTIVI

only a modest amount of force. In business, operating leverage serves a similar purpose.

Operating leverage is a measure of how sensitive net operating income'is to percentage

F multiplier{It operating leverage is high, a Compute he degren

‘operating overage at

changes in sales. Operating

small percentage Increase in sales can produce a much lafger percentage increase i?™wet

‘operating income particular level of sae

rage can be illustrated by returning to the data given above for the explain how the degre

Operating lev'

howed that a 10% increase in sales (from operating leverage ca

two blueberry farms. We previously s!

$100,000 to $110,000 in each farm) results in a 70% increase in the net operating in~ used to predict chang

‘000 to $17,000) and only a 40% inerease in the net —_perating income.

‘come of Sterling Farm (from $10\ a

‘operating income of Bogside Farm (from $10,000 to $14,000). Thus, for 10% in-

Farm experiences a much greater percentage increase in prof-

crease in sales, Sterling

its than does Bogside Farm, Therefore, Sterling Farm has greater operating leverage

than Bogside Farm.

“Theedegree of operating leverage at a given level of sales is computed by the fol-

lowing formula:

leverage isa measure, at

ts, To illustrate,

‘at a $100,000 sales level would be computed as follows:

‘centage change in sal

wverage Tor the two farms

i a

Bogside Farm: 576,999 = 4

In Business

Chapter 6 Cost-Volume-Proft Relationships:

athe net operating income of Strting Farm to inerease by seven times this

40%

amount-orby 70%.

¢ 2) °

Oy @

Increase in

Percent Degree of -_ Net Operating

Increase in Operating income

Sales Leverage (1) x (2)

40%

‘Bogside Farm + 10% 4

Stering Farm... 10% 7 70%

What is responsible forthe higher operating leverage at String Farm? The only di

ference between the two farms is their cost structure, If two companies have the same to-

tal revenue and same total expense but different cost structures, phen the “ity

higher proportion of fixed costs in ct av ting lever?

85 Referring back othe original example on page 249, when both farms have sales of

£000 and total expenses of $90,000, one-third of Bogside Farm's costs are fixed but

‘two-thirds of Sterling Farm’s costs are fixed. As a consequence, Sterling's degree of op-

crating leverage is higher than Bogside’s.

The degree of operating leverage is nota constant; itis greatest at sales levels near

the break-even pojnt and decreases as sales and profits rise. This can be seen from the tab-

Taio Below, which shovs Th depresafopemting leveige fr Bosse Eur et vanins

sales levels. (Data used earlier for Bogside Farm are shown in colon)

es

Sales . . $75,000 $80,000 $100,000 $150,000 $225,000

Less variable expenses 48,000 __60.000 90,000

Contribution margin (a) 32,000 40,000 60,000, 90,000

Less fixed expenses .. 30,000 30,000 30,000

[Net operating income (b)

Degree of operating leverage,

(@) + @). . 7

Thus. a 10% inorease in sales would increase profits by only: 15% (10% X 1.5) if the

Company were operating at a $225,000 sales level, as compared to the 40% increase we

a ae carter at the $100,000 sales level. The degree of operating leverage will eon

tn 10 deetease the farther the company moves from its break-even point. the break

even point, the degree of operatin, 's infinitely large ($30,000 contéibution

‘margin < $0 net operating income

o 16 4

Operating leverage can be a good thing when businessig booming but can turn the situation

ta ebrolessional baseball team, spent aver $100 miliorto cies ne zona

Chapter 6 Cost-Volume-Prott Relationships

2, Costs are linear und can be accurately divided into variable and fixed elements. The

variable element is constant per unit, and the fixed element is constant in total over

the e ranj

3, Inmulproder Compeieie sles miss constant

4 In manufactoring companes. inventories do not change. The numberof unis pro-

duced equals the number of units 5

While some of these assumptions may be violated in practice, the violations are usu-

Ally not serious enough to call into question the basic validity of CVP analysis. For ex-

ample, in most multiproduct companies, the sales mix. is constant enough so that the

‘results of CVP analysis are reasonably valid

Pechaps the greatest danger les in relying on simple CVP analysis when a manager

is comtemplating a large change in volume that lies outside of the relevant range. For ex-

ample, a manager might contemplate increasing the level of sales far beyond what the

company has ever experienced before. However. even in these situations a manager can

adjust the model as we have done in this chapter to take into account anticipated changes

in selling prices, fixed costs. and the sales mix that would otherwise violate the assump-

tions, For example, in a decision that would affect fixed costs. the change in fixed costs

can be explicitly taken into account as illustrated earlier in the chapter in the Acoustic

Concepts example on page 241

CVP analysis involves finding the most favorable combination of variable costs, fixed costs, sell-

ing price, sles volume, and mix of products sold. Trade-offs are possible between types of cost,

| ett been conan sting pr and etecn sling pie salt vlan, Somes

these trade-offs are desirable, and sometimes they are not. CVP analysis provides the manager with

1 powerful too! for identifying those courses of action that will improve profitability. =

: The conc developed nhs chp preset way of linger tha mechanical

sof acd Ta ho pope he pin conn of cling pean ee

“ume fc mangers bie hn eso ean sro mp,

| renin he CM ra, th me nnd he er one decayed

4

Voltar Company manufactures and sells telephone answering Wachis

tion format income statement for the most recent year is given below:

c Per Unit _ Percent of Sales.

«31200000, ‘ome

fees 900,000 "> 2%

2%.

‘The company's contribu

‘Management is anxious to improve the company’s performance

nays of agunberof tems, ae nee a

Required: oJ

1. Compute the company’s variable SIT,

2 Cones as cope rea a eee ‘sales dollars. Use the equation

method. ewe. 3

eet

OO lll—

Chapter6 Cost-Volume-Proft Relationships :

~ a that next year management wants the company team a

4. Robe i, ne peng

nw it aaa

ta, Compote the company’s prargin-of safety in Py

,. =e

2 centage form. a

Cor ‘ srage athe present level of sales,

oman

£ San cm ae

Hh Se

# Use the operating leverage concept to jour answer. oa

c._Venly your answer to (2) by preparing a new income statement showin an 8% increase

in sales.

Inan effort wo increase sales and profits, management x considering ihe us of high

< ‘quality speaker. The higher-quality speaker would increase variable costs by $3 per unit, but

‘anagement could eliminate one quality inspector whois paid a salary of $30,000 per year.

‘The sales manager estimates that the higher-quality speaker would inorease annual sales by

at least 208,

4 Assuming that changes are made as described above, prepare projected income state-

‘ment for next yea. Show data ona total, per unit, and percentage basis.

Compute the company's new break-even point in both units and dollars of sales. Use the

contribution margin method.

Would you recommend that the changes be made?”

+

9

Solution to Review Prob!

Variable expense ratio =

Selling price

© ‘Sales = Variable expenses + Fixed expenses + Profits

‘$600 ~ $459 + $240,000% $0

$15Q = $240,000

$240,000 # $15 pee unit a

aia

IX = 0.75x-+ $240,000 + $0

0.28x ='s240,000 ve .

X $240,000 + 0125 : a

X=$96000; oat $60 pe nit, 16000 nits

6,000 units; oF at $60 per unit $960,000

—<<. — ee

Chapter 6 Cost-Volume-Prott Relationships,

‘Contribution margin method:

Fined expenses + Target profit _ "$240,000 + 390.000

‘Contribution margin per unit S15 per unit

5. Mangin of safety in dollars = Total sales ~ Break-even sales

= $1,200,000 — $960,000 = $240,000

Margin/f safety in dollars $240,000

an Total sles '51200,000

= 22,000 units

= 20%

$300,000

Contribution margin.

Net operat

>

Degree of operating leverage =

b. Expected increase in sales. -

XE Degree of operating leverage.

Expected increase in net operating income .

If sales increase by 8%. then 21,600 units (20,000 X 1.08.

‘year. The new income siatement will be as Follows:

‘Sales (21,600 units) .

Less variable expenses.

Contribution margin.

Less fixed expenses...

Net operating income

‘Thus, the $84,000 expected net operating income for next year represents a 40% increase over

the $60,000 net operating income eared during the current year:

$984,000 ~ $60,000 _ $24,000

‘$60,000 360,000

[Note from the income statement above thatthe increase in sales from 20,000 to 21.600-units

thas resulted in i {in both total sales and total variable expenses. Iris a common error to

‘overlook the increase in variable expenses when preparing a projected income statement.

7. a A 209bincrease in sales Would result in 24,000 units being sold next year: 20,000 units >

40% increase

1.20 = 24,000 units, * a

Total PerUnit of Sales (ed

‘Sales (24,000 units)... .. $1,440,000 ‘$60 u _

Less variable expenses. 1,182,000 8 —Y@ Pahd

‘Contribution margin. 288,000 S12 20%

210,000" = ee

Net operating income . ye

© 1$45 + $3 = $48; $48 + $60= 80%.

"$240,000 ~ $30,000 = $210,000.

[Note that the change in per unit variable expenses resalts in a change

tribution margin and the CM ratio.

%

Chapter 6 Cost-Volume-Proft Relationships

260

Sateen,

Breat-even point in doller sakes = — areas

= £21000 - 1,050,000

«Yes, based of these data the changes should be made: The changes will increase the com

on net oie income from the present $61,000 to $78.000 per vear. Although the

anges wll aso result ina higher break-even point (17.500 units as compared to the pre-

“Sn 1:00 nis the company margin of sfc wil actually be wer than Before:

(Seatia t iy Se

Margin of safety in dollars = Toval sales — Break-even sales

= $1,440,000 = $1,050,000 = $340,000

a2 nee

{As shown in (5) above, the company’s present margin of safety i€ only $240,000. Thus, sev

cra benefits will sul from the proposed changes.

Se

Break-even point The evel of sales at which profit is zero. The break-even point can also be de~

fined asthe point where total sales equals total expenses of as the point where total contribu-

tion margin equals total fixed expenses. (p. 236) “s

Contribution margin method A method of computing the break-even point in which the fixed

expen eve bythe conrbuton magi pe nit (p 246)

Contribution margin ratio (CM ratio) The contribution margin as a percentage sales.

nate asa of total

Cost-volume-proft (CVP) graph The relations between revenues, cost and level of activity

2 zaiaion pst in graphic form (p27) s

Degree of operating leverage A measure, ata given evel of sales,

sa re il afl pts. The degree sng lenges compen annie

contribution margin by net operating income. (p. 251)

Eapintion method A method of computing the break-even point that relies i

= Variable expenses + Fined expenses + Profits. (p. sd) ?

Incremental analysis {it atsytcal approach that focuses only on those items of revenue

242) a

610 | What is meant by the margin of Stety?

641 Companies ‘is

6-12 What is meant by the term sales mix? What a

‘13° Explain how a shift in the sates mix could result in both a higher break-e

o

s

& Using & Contribution Format Income Sstement (101,10)

<= eon beacon beatin

Chapter 6 Cost-Volume-Prolt Relationships

[abla how the line onthe praph and the break-cven point would change (a)

ink Dice Per unit decreased, (>) fixed costs increased throughout the entire range of ast

‘Ny Portrayed on the graph, and (c) variable costs per unit increased,

(9 Als Auto Wash charges $4 tc ‘wash a ea, The vale cons of washing» car are 19% of

alee, Fixed expenses total $1,700 monthly. How many cars must he washed eas moot

for Alto break even?

il ¥ are im the same industry. Company X is highly automated. wheréas

Comipsiny ¥ relies primarily un labor to make its proxlacts. I sales and total expanses m the

two companies are about the same, which would you expect to have the lower margin of

safety? Why?

ition is usually made concerning sales

‘mix in CVP analysis?

point and a

lower net income.

ed

Total Per Unit

Sales (20,000 units)... $180,000

‘1088 variable expences

Contribution margin :

Less fixed expenses,

‘Net operating income...

Required: se! f eee

Prepare anew income satement under each ofthe following centions consice AGES TAS?

pendent

‘The sales volume increases by 15%.

‘The selling price decreases ny 50 ens per unit.and the sales volume increases by 209%

‘The selling price increases hy 50 cents er unit fixed expenses increase by $10,900, the

sales volume decreas by 5% ¢ :

Variable expenses increase by 20 cents per unit, the sling pre inerees by 12%, and the

sales volume decreases by 10% =

SENEROISH'6E=2"Breok-F.ven Analysis and CVP Graphing 11. LOS L02, rae

(Chi Omega Sorority is planning its annual Riverboat Extravaganza, The Extravaganca committee

has assembled the following expected cost forthe event:

Dinner (per person) ...

pale 1104,908,7

en and Target Prot Analy 110470550

“ mc rca Oe oy a ne

{er S50 por ont, Variable expenses are 863 pr later. and f

Tair a $135.00 per month

t + break-even point in number of lanterns and in total sales dalla,

tel bbe ea

2) i whigher ova lower break-even point? Why? (Assume thatthe fed expenses rmaia

cas nor ll

SCRE ee meng te clr a

Reg felon eminent rpms

Scere erro ee

paler

enna

4 separa Baer Ne may wm sate

Tat ga teate oat are area

ting Leverage [1.04.1 695/

or Doot Company sll prchung door 10 hom builders. The door are sold oe $60 each.

Variable cous ae $42 per door, and ied costs total $40.00 per year. The company is Fea

selling 30,000 doors per yar. a

Required:

1. Prepare a contribution format income statement for the company atthe present level of sales

and compute the degree of operating leverage.

2. Management is confident that the company can sel! 37.500 doors next year (an increase of

1,500 doots, or 25%, over current sales). Compute the following:

4. The expected percentage increase in net operating income for next year.

'% The expected ttaldollar:net operating income for next year (Do not prepare an income.

‘atement; use the degree of operating leverage to compute your answer)

(CISE 6-5 luct Break-Even Analysis |1.09) 4

ses sells two products, Model A100 and Mode! BOO0. Monthly sales and the con-

the two products follow:

as

Model A100 Model B=00 ;

sae Tana Meme ro

Srna) PO NRE 81S

‘The company's fied expenses total $598,500 per month

Required: = =

1 a ; a

‘Prepac a income statement or the company a whole. Use he et

2 a

5 3 Taner iapetet $m pon rie cappay sed on the cate sales.

wil i result

es remain

: convinced

of lanterns

operating

« both total

new selling

r $60 each,

is urently

el of sales

nerease of

the con-

Chapter 6 Cost-Volume:Prott Relationships

2) Without resorting to computations, what ithe total contribution margin atthe break-even pat?»

How many units would have to be sold each month to earm a mininiun target prott of

$$18.0007 Use the contribution margin method, Verily your answer by preparing & contribution

income tatement atthe target level of sles,

4, Refer to the original data. Compute the company's margin of safety in both dollar and per-

W centage terms .

5. Whats the company's CM ratio? If monthly sales increase by $80,000 and there is no change:

in fixed expenses, by how much would you expect monthly net operating income to increase?

0

ve distributor fora revolutionary bookbag. The product sel

‘of 405. The company’s fixed expenses are $360,000 per ye

24, + Sfasid

1." What are the variable expenses pe unit? % 60-26

2. Using the equation meth: . a

4. Whats the break-even point in unit and in sls dollars? ¢

4 What sales evel units ann sales dollar i reid to earn an snl profit of $90,007 26

‘Assume that through negotiation with the manufacturer the Super Sales Company is able

{0 reduce its variable expenses by $3 per unit, Wha is the company's new break-even

point in units and in sales doilars?

3. _ Repeat (2) above using the contribu

‘margin method, {

EXERCISE 6-8 Missing Data; Basic CVP Concepts |1.01, 1.09]

Fill in the missing amounts in each ofthe eight case situations below. Each case is independent of

‘the others. (Hint: One way o find the missing amounts would be to prepare a contribution income

‘statement for each case, enter the known dat, and then compute the missing items.)

‘4 Assume that only One product is being sold in each of the four following case situations:

Net

Contribution Operating

Units Variable Margin Fixed Income

Case Sold Sales. Expenses per Unit Expenses _ (Loss)

+ 4 9,000 $270,000 $162,000 $7 © $ 90,00 § 7

2i.. 7 350,000 2 18 170,000 40,000.

3.2.2 20,000 2 280,000 6 2 35,000

4 5,000 160,000 2 2 182,000 (12,000) 4

‘6. Assume that more than one producti being sold in cach ofthe four following case situations:

PROBLEM 6-9 Basics of CVP Analysis; Cost Structure [101,10

‘Memofax, Inc, produces memory enhancement kt fo fax

with some months showing a profit and some months showing &

‘staterpent for the most recent month is given below:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Design and Fabrication of Pneumatic Gripper For Robotic ManipulationDocument48 pagesDesign and Fabrication of Pneumatic Gripper For Robotic ManipulationNafisa AnikaNo ratings yet

- Introduction To ThermodynamicsDocument65 pagesIntroduction To ThermodynamicsNafisa AnikaNo ratings yet

- Second Law of ThermodynamicsDocument41 pagesSecond Law of ThermodynamicsNafisa AnikaNo ratings yet

- Otto Cycle & Diesel CycleDocument36 pagesOtto Cycle & Diesel CycleNafisa AnikaNo ratings yet

- Reversible and Irreversible ProcessDocument20 pagesReversible and Irreversible ProcessNafisa AnikaNo ratings yet

- Lecture06-Thin Film DepositionDocument18 pagesLecture06-Thin Film DepositionNafisa AnikaNo ratings yet

- Gas Power CycleDocument49 pagesGas Power CycleNafisa AnikaNo ratings yet

- Solution Manual A First Course in The FiDocument7 pagesSolution Manual A First Course in The FiNafisa AnikaNo ratings yet

- Carnot CycleDocument26 pagesCarnot CycleNafisa AnikaNo ratings yet

- Dr. MD Mahfuzur Rahman Assistant Professor, Dept. of IPE: IPE-425: Micromanufacturing (3 Credit Hours)Document21 pagesDr. MD Mahfuzur Rahman Assistant Professor, Dept. of IPE: IPE-425: Micromanufacturing (3 Credit Hours)Nafisa AnikaNo ratings yet

- PS9 - Nafisa Ali Anika - ME510 PDFDocument8 pagesPS9 - Nafisa Ali Anika - ME510 PDFNafisa AnikaNo ratings yet

- Presented by Priom Mahmud: Analyzing Consumer MarketsDocument25 pagesPresented by Priom Mahmud: Analyzing Consumer MarketsNafisa AnikaNo ratings yet

- Passenger-Disclosure & Attestation To The Usa FormDocument2 pagesPassenger-Disclosure & Attestation To The Usa FormNafisa AnikaNo ratings yet

- DC Set 1Document6 pagesDC Set 1Nafisa AnikaNo ratings yet

- Group No. 07 Product Name: Portable Desk Group MembersDocument1 pageGroup No. 07 Product Name: Portable Desk Group MembersNafisa AnikaNo ratings yet

- Collecting Information and Forecasting DemandDocument19 pagesCollecting Information and Forecasting DemandNafisa AnikaNo ratings yet

- Failure in MaterialsDocument28 pagesFailure in MaterialsNafisa AnikaNo ratings yet