Professional Documents

Culture Documents

The Bank of Punjab: Product Key Fact Statement Low Cost Housing Finance

Uploaded by

Ali Azhar KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Bank of Punjab: Product Key Fact Statement Low Cost Housing Finance

Uploaded by

Ali Azhar KhanCopyright:

Available Formats

The Bank of Punjab

Product Key Fact Statement

LOW COST HOUSING FINANCE

A. Your financing need:

Name of the product, if specified BOP Low Cost Housing Finance

Type of the product Purchase of Constructed House/Apartment/Flat OR Purchase of Plot and construction thereon

Finance amount As per Repayment Schedule

Term of the finance As per Repayment Schedule

Mark-up type As per Repayment Schedule

Loan to value ratio As per Repayment Schedule

B. Estimated cost of this loan:

What Mark-up rate (fixed/variable)* approximately I As per Facility Offer Letter

will be Charged with?

As Per Schedule of Charges

What all other charges shall I be required to pay?

As per Repayment Schedule.

The monthly installment shall be revised after 05 Years reckoned from the date of finance

What shall be the amount of monthly installment? disbursement. In case finance tenure exceeds 10 Years, Installment amount shall vary with change

in KIBOR correspondingly and after completion of 10 year amount of installments shall be adjusted

annually till facility is fully paid.

What other Cost/Expenses will I have to pay? As per Facility Offer Letter.

As per Repayment Schedule

What total amount will I be required to pay for the It shall depend upon the tenure for which finance is being advanced. However total payable amount

finance availed? shall differ due to change in KIBOR / change in mark up if loan rate is revised for facilities of tenure

exceeding 10 years.

When existing variable markup rate will expire

The Variable Rate shall be reviewed annually, for loans where tenure exceeds 10 years.

according to finance agreement?

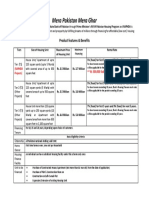

Tier 1 (T1) (NAPHDA) Tier 2 (T2) (NON-NAPHDA) Tier 3 (T3) (NON-NAPHDA)

First 5 years = 5% First 5 years = 5% First 5 years = 7%

When will the mark-up rate as per finance Next 5 years = 7% Next 5 years = 7% Next 5 years = 9%

agreement be revised ?

For loan tenures exceeding 10 years; Bank’s Housing Finance markup rates will be applicable for the

period exceeding 10 years.

What additional documents will be required for The House Finance is Term Finance Facility and does not require any additional document for

renewal of finance agreement? renewal.

C. Early payments:

Can finance facility be repaid before its maturity? YES, finance facility can be repaid & adjusted before maturity of the loan.

By payment of Principal & Markup amount and LPC (Late Payment Charges), if any, in addition to

How finance facility can be repaid before maturity? other payable amount determined by the bank in your account being maintained with the bank

under a written request for Early Loan Adjustment.

Will I have to pay any additional amount for Pre-

Payment (Partial or Full Adjustment) of the financing NO

facility?

How will I pay Monthly Installment? It will be the responsibility of customer to deposit Monthly Installment as per Repayment Schedule

in in his BOP account being maintained for the purpose on or before 5th of every month.

D. Default/late payment information:

Customer shall be marked defaulter, if

1. Customer account will be reported & reflected as default in ECIB report and will not

What if obligations of repayment are not be able to avail finance facility either from BOP or any other financial institution.

fulfilled?

2. Bank (BOP) would be entitled to initiate legal proceedings under relevant laws

including lodging F.I.R against the customers & guarantors under default.

What penalty will I be charged for not Rs. 1/- per thousand per day on payable amount shall be charged as penalty, if agreed

repaying on time? installment is not paid on time.

E. Other material information:

Insurance coverage in accordance with bank’s policy including:

What insurance avenues do I have? 1. Life Insurance of Borrower up to the Loan Amount

2. Insurance of House up to construction cost.

In case of misstatement of customer with regards to no low cost facility from other banks, BOP reserves the right to withdraw the facility immediately if such

information is sufficed.

How finance facility shall be adjusted in case of sudden The loan shall be adjusted from the proceeds of insurance policy.

death of the borrower?

What all shall be covered under insurance of Insurance policy will provide insurance cover up to full value in case of apartment & up to

Property/House Insurance? construction cost in case of house.

What are the guarantor’s obligations? Obligation of principal debtor & the guarantor would be severally and jointly.

What documents will be provided to customer? Facility Offer Letter + Repayment Schedule + Finance Agreement

Processing Time for Application The application processing time will be 30 days after submission/completion of all

documents/formalities by the borrower.

___________________________________ _________________________________

Borrower’s Signature & Thumb Impression Authorized Banker’s Signature & Stamp

You might also like

- The Bank of Punjab Product Key Fact Statement Car Loan (Cargar)Document1 pageThe Bank of Punjab Product Key Fact Statement Car Loan (Cargar)Abu BakarNo ratings yet

- Purchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!From EverandPurchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!No ratings yet

- NBP Advance Salary PKFSDocument3 pagesNBP Advance Salary PKFSMuhammad Tauseef100% (1)

- National Bank of Pakistan Product Key Fact Statement: 2% of Adjustment Amount + FEDDocument3 pagesNational Bank of Pakistan Product Key Fact Statement: 2% of Adjustment Amount + FEDMuhammad TauseefNo ratings yet

- PNB Own a Philippine Home Loan FAQsDocument4 pagesPNB Own a Philippine Home Loan FAQsJasper CruzNo ratings yet

- Islamic Modes of Car FinancingDocument4 pagesIslamic Modes of Car FinancingMajid Shahzaad KharralNo ratings yet

- Kristine Joy Cabatino Lorenzoln340160000089056 - LninfoDocument3 pagesKristine Joy Cabatino Lorenzoln340160000089056 - LninfoTintin LorenzoNo ratings yet

- Terms & Conditions and Schedule of Charges - PL-SmartDocument2 pagesTerms & Conditions and Schedule of Charges - PL-SmartSunil DadhichNo ratings yet

- Housing Finance Prudential Regulations Frequently Asked QuestionsDocument4 pagesHousing Finance Prudential Regulations Frequently Asked QuestionsOvais HussaiinNo ratings yet

- LAP Sanction Letter FixedDocument3 pagesLAP Sanction Letter Fixedpydimukkala SunilNo ratings yet

- What Is A MortgageDocument6 pagesWhat Is A MortgagekrishnaNo ratings yet

- Ploan 2 PDFDocument2 pagesPloan 2 PDFmahavirNo ratings yet

- PUPGB housing loan schemeDocument3 pagesPUPGB housing loan schemeSaurabh KumarNo ratings yet

- SBI HOME LOAN TERMSDocument4 pagesSBI HOME LOAN TERMSdrgayen6042No ratings yet

- Most Important Document: CustomerDocument8 pagesMost Important Document: CustomermasumsojibNo ratings yet

- Get Housing Loans and End-to-End Assistance from Our Loan TeamDocument3 pagesGet Housing Loans and End-to-End Assistance from Our Loan Teamrahul_goel2No ratings yet

- Overdraft Against Property Loan AgreementDocument56 pagesOverdraft Against Property Loan Agreementkirubaharan2022No ratings yet

- Housing Loan AgreementDocument11 pagesHousing Loan AgreementJomy JoyNo ratings yet

- Most Important Terms and ConditionsDocument17 pagesMost Important Terms and ConditionsReddaiah YedotiNo ratings yet

- Home Loan Form IndividualsDocument6 pagesHome Loan Form IndividualsRahulNo ratings yet

- Sbi Home Loan MitcDocument4 pagesSbi Home Loan MitcfeeldboyNo ratings yet

- Settlement LetterDocument1 pageSettlement LetterAmrish VenkatesanNo ratings yet

- To Be Stamped As An AgreementDocument9 pagesTo Be Stamped As An AgreementManikumarNo ratings yet

- SBI Personal Loans ExplainedDocument2 pagesSBI Personal Loans ExplainedHumaid ShaikhNo ratings yet

- Uni Flex 120922Document12 pagesUni Flex 120922wilsonNo ratings yet

- Sbi Home Loan InfoDocument4 pagesSbi Home Loan InfoBhargavaSharmaNo ratings yet

- Shivesh Sanction LetterDocument11 pagesShivesh Sanction LetterRR RajNo ratings yet

- I. What Is This Product About?Document5 pagesI. What Is This Product About?RevelUp :3No ratings yet

- LBP6030Document4 pagesLBP6030ismadiNo ratings yet

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentNandini TiwariNo ratings yet

- CreditCard Sanction Letter 918217097145Document4 pagesCreditCard Sanction Letter 918217097145Maha RajaNo ratings yet

- Housing LoansDocument37 pagesHousing LoansHemant bhanawatNo ratings yet

- Aggr EmentDocument46 pagesAggr EmentMihir PanchalNo ratings yet

- Mera Pakistan Housing FAQsDocument4 pagesMera Pakistan Housing FAQsMuhammad Bilal AshrafNo ratings yet

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentJaggu NitheshNo ratings yet

- MHIL's Most Important Loan TermsDocument6 pagesMHIL's Most Important Loan TermsHemant Kumar RathodNo ratings yet

- Sanction Letter Capital FloatDocument2 pagesSanction Letter Capital FloatVinod GhadgeNo ratings yet

- PropertyFinancing BaitiSingleTierDocument5 pagesPropertyFinancing BaitiSingleTierTaraqallah SalehNo ratings yet

- Home Loan and Loan Against PropertyDocument4 pagesHome Loan and Loan Against PropertyPraveen KumarNo ratings yet

- AFFIN Home Invest-i Product Disclosure SheetDocument8 pagesAFFIN Home Invest-i Product Disclosure SheetMrHohoho97No ratings yet

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentRohit chavanNo ratings yet

- docSanctionLetterForm BL240205040100109Document7 pagesdocSanctionLetterForm BL240205040100109chawllarohitNo ratings yet

- Frequently Asked Questions - Markup Subsidy Scheme For Housing FinanceDocument3 pagesFrequently Asked Questions - Markup Subsidy Scheme For Housing FinanceAshfaq AhmedNo ratings yet

- Applicable MCLR Three-Month MCLRDocument2 pagesApplicable MCLR Three-Month MCLRZaibNo ratings yet

- ECB Practical ApproachDocument4 pagesECB Practical ApproachCryosave100% (1)

- PDS PF-i PrivateDocument4 pagesPDS PF-i Privatekiki8894No ratings yet

- Retail Banking AdvancesDocument38 pagesRetail Banking AdvancesShruti SrivastavaNo ratings yet

- PNB Doctor - S DelightDocument18 pagesPNB Doctor - S DelightNishesh KumarNo ratings yet

- 004 - NRI - Main Application Form - FillableDocument6 pages004 - NRI - Main Application Form - FillableAnkur MishRraNo ratings yet

- RFP For Firm UnderWritten Syndicated LoansDocument9 pagesRFP For Firm UnderWritten Syndicated Loansoratschilde.aiNo ratings yet

- Chapter-1: N.R.K&K.S.R Gupta Degree College, TenaliDocument58 pagesChapter-1: N.R.K&K.S.R Gupta Degree College, TenaligupthaNo ratings yet

- Annexure - 1: Mode of RepaymentDocument2 pagesAnnexure - 1: Mode of RepaymentJyoti SharmaNo ratings yet

- Product Disclosure Sheet-Vehicle Financing-IDocument4 pagesProduct Disclosure Sheet-Vehicle Financing-IZainurul Farah ZainolNo ratings yet

- Form 1Document11 pagesForm 1Kar Yan HNo ratings yet

- Housing LoanDocument36 pagesHousing LoanHabeeb UppinangadyNo ratings yet

- General Purpose Loan - FillableDocument2 pagesGeneral Purpose Loan - Fillablenemo_nadalNo ratings yet

- Chandra Babu Sajja: Page 1 of 3Document3 pagesChandra Babu Sajja: Page 1 of 3Chandra Babu SajjaNo ratings yet

- MHA - HAMP Supplemental Directive 09-01Document38 pagesMHA - HAMP Supplemental Directive 09-01SoCal ForeclosuresNo ratings yet

- List of Branches - LCHDocument14 pagesList of Branches - LCHAli Azhar KhanNo ratings yet

- Entitlement and Absence Quota Are Showing "No Data" in My Leave Request - Fiori AppDocument2 pagesEntitlement and Absence Quota Are Showing "No Data" in My Leave Request - Fiori AppAli Azhar KhanNo ratings yet

- Simu Revalu ProcessDocument2 pagesSimu Revalu ProcessAli Azhar KhanNo ratings yet

- FAQs - Markup Subsidy Scheme-Housing FinanceDocument2 pagesFAQs - Markup Subsidy Scheme-Housing FinanceAli Azhar KhanNo ratings yet

- Mera Pakistan Mera Ghar: Product Features & BenefitsDocument1 pageMera Pakistan Mera Ghar: Product Features & BenefitsAli Azhar KhanNo ratings yet

- Help Desk PDFDocument1 pageHelp Desk PDFAli Azhar KhanNo ratings yet

- New Tax Certi PDFDocument1 pageNew Tax Certi PDFAli Azhar KhanNo ratings yet

- BOP Application Form A5 Flyer (16th October) Final PagesDocument10 pagesBOP Application Form A5 Flyer (16th October) Final PagesAli Azhar KhanNo ratings yet

- Documentation Requirements for Salaried and Self-Employed Mortgage ApplicantsDocument3 pagesDocumentation Requirements for Salaried and Self-Employed Mortgage ApplicantsAli Azhar KhanNo ratings yet

- S4Q0000023905 1 PDFDocument16 pagesS4Q0000023905 1 PDFAli Azhar KhanNo ratings yet

- Tax 1 PDFDocument16 pagesTax 1 PDFAli Azhar KhanNo ratings yet

- New Tax Certi PDFDocument1 pageNew Tax Certi PDFAli Azhar KhanNo ratings yet

- Tax 1 PDFDocument16 pagesTax 1 PDFAli Azhar KhanNo ratings yet

- Tax 1 PDFDocument16 pagesTax 1 PDFAli Azhar KhanNo ratings yet

- Low Cost Housing Finance Application Form: 2 LakhDocument10 pagesLow Cost Housing Finance Application Form: 2 LakhAli Azhar KhanNo ratings yet

- It 000019390317 2012 00Document3 pagesIt 000019390317 2012 00Ali Azhar KhanNo ratings yet

- No. It Is Not Deductible From His Gross Income. The Chapel Is Owned by ADocument12 pagesNo. It Is Not Deductible From His Gross Income. The Chapel Is Owned by Aadarose romaresNo ratings yet

- Financial Accounting Assignment - 1Document17 pagesFinancial Accounting Assignment - 1Yosef MitikuNo ratings yet

- MSID1800288Document11 pagesMSID1800288trifemilNo ratings yet

- Insurance Law Project PDFDocument17 pagesInsurance Law Project PDFSukrit GandhiNo ratings yet

- For Jansen and DJ PDFDocument14 pagesFor Jansen and DJ PDFMae Jansen DoroneoNo ratings yet

- Module 4 Adjusting EntriesDocument41 pagesModule 4 Adjusting EntriesXiavNo ratings yet

- Guaranty and Suretyship: Kuenzle & Streiff vs. Jose Tan Sunco, Et AlDocument3 pagesGuaranty and Suretyship: Kuenzle & Streiff vs. Jose Tan Sunco, Et AlLara DelleNo ratings yet

- Disaster PreparednessDocument43 pagesDisaster PreparednessskyeNo ratings yet

- تأمين سفرDocument4 pagesتأمين سفرbuthayna abdullahNo ratings yet

- Max New York Life Insurance Study on WomenDocument6 pagesMax New York Life Insurance Study on WomenShubham JindalNo ratings yet

- Wolfe v. VA 2020-1958Document20 pagesWolfe v. VA 2020-1958FedSmith Inc.No ratings yet

- I-Great Aman: Stamp Duty of RM 10 Is Payable, Where It Is Inclusive Under Upfront ChargeDocument12 pagesI-Great Aman: Stamp Duty of RM 10 Is Payable, Where It Is Inclusive Under Upfront ChargeRakeesh VeeraNo ratings yet

- Bfsi - Icici Direct (Su - Oct 2020)Document14 pagesBfsi - Icici Direct (Su - Oct 2020)Debjit AdakNo ratings yet

- Final Bio 10Document4 pagesFinal Bio 10Naol GetachewNo ratings yet

- CompLetter FY2223Document2 pagesCompLetter FY2223Varadha rajanNo ratings yet

- Case DigestDocument5 pagesCase DigestJesa FormaranNo ratings yet

- En AR Group Annual Report Allianz 2019Document180 pagesEn AR Group Annual Report Allianz 2019Sabina MunteanuNo ratings yet

- Zurich Captive Guide 2022Document39 pagesZurich Captive Guide 2022david.russellNo ratings yet

- Agriculture DirectivesDocument38 pagesAgriculture DirectivesLaxmi Bir MathemaNo ratings yet

- Philippine Health Care Providers, Inc.: Commissioner of Internal RevenueDocument17 pagesPhilippine Health Care Providers, Inc.: Commissioner of Internal RevenuePatricia Ann Nicole ReyesNo ratings yet

- JAY NEPAL IMPEX INDEMNITY BONDDocument4 pagesJAY NEPAL IMPEX INDEMNITY BONDrajat aggarwallNo ratings yet

- Direct Line Group 2021 Annual ReportDocument262 pagesDirect Line Group 2021 Annual ReportArpita PriyadarshiniNo ratings yet

- Notes - Insurance PresentationDocument8 pagesNotes - Insurance PresentationMaulik PanchmatiaNo ratings yet

- Stanbic Bank Payment ReportDocument2 pagesStanbic Bank Payment ReportTadiwanashe ChikoworeNo ratings yet

- Product Liability Insurance Policy - AxaDocument4 pagesProduct Liability Insurance Policy - AxaAbhishekNo ratings yet

- Contract EssentialsDocument81 pagesContract EssentialsZain GhummanNo ratings yet

- Social Forestry 3Document1 pageSocial Forestry 3maneesh sharmaNo ratings yet

- Institute of Management Studies Davv Indore Mba (Financial Administration) Ii ND Semester - Fa 303C Insurance and Bank ManagementDocument2 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Ii ND Semester - Fa 303C Insurance and Bank ManagementjaiNo ratings yet

- ReacoexDocument13 pagesReacoexArturoCuéllarHuérfanoNo ratings yet