Professional Documents

Culture Documents

The Stockholders Equity Accounts of Hashmi Company at January 1 PDF

Uploaded by

Anbu jaromiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Stockholders Equity Accounts of Hashmi Company at January 1 PDF

Uploaded by

Anbu jaromiaCopyright:

Available Formats

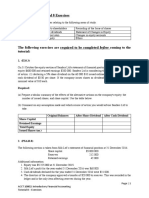

The stockholders equity accounts of Hashmi Company at

January 1

The stockholders’ equity accounts of Hashmi Company at January 1, 2010, are as

follows.Preferred Stock, 6%, $50 par ............ $600,000Common Stock, $5 par ...............

800,000Paid-in Capital in Excess of Par Value—Preferred Stock ... 200,000Paid-in Capital in

Excess of Par Value—Common Stock ... 300,000Retained Earnings .................. 800,000There

were no dividends in arrears on preferred stock. During 2010, the company had the following

transactions and events.July 1 Declared a $0.50 cash dividend on common stock.Aug. 1

Discovered $25,000 understatement of 2009 depreciation. Ignore income taxes.Sept. 1 Paid the

cash dividend declared on July 1.Dec. 1 Declared a 10% stock dividend on common stock when

the market value of the stock was $18 per share.15 Declared a 6% cash dividend on preferred

stock payable January 15, 2011.31 Determined that net income for the year was $355,000.31

Recognized a $200,000 restriction of retained earnings for plant expansion.Instructions(a)

Journalize the transactions, events, and closing entry.(b) Enter the beginning balances in the

accounts, and post to the stockholders’ equity accounts.(c) Prepare a retained earnings

statement for the year.(d) Prepare a stockholders’ equity section at December 31, 2010.View

Solution:

The stockholders equity accounts of Hashmi Company at January 1

SOLUTION-- http://accountinginn.online/downloads/the-stockholders-equity-accounts-of-hashmi-

company-at-january-1/

For Solutions Visit accountinginn.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- SBR - Mock C - QuestionsDocument9 pagesSBR - Mock C - Questionsriya_pramodNo ratings yet

- Problems: Set B: InstructionsDocument2 pagesProblems: Set B: InstructionsflrnciairnNo ratings yet

- Earn Hart Corporation Has Outstanding 3 000 000 Shares of Common PDFDocument1 pageEarn Hart Corporation Has Outstanding 3 000 000 Shares of Common PDFAnbu jaromiaNo ratings yet

- Problem Sets Finacc Chapter 9Document19 pagesProblem Sets Finacc Chapter 9Reg LagartejaNo ratings yet

- Credit Sales AR and Equity Chapters QuestionsDocument4 pagesCredit Sales AR and Equity Chapters QuestionsSakhawat HossainNo ratings yet

- Market Ratios - Practice QuestionsDocument16 pagesMarket Ratios - Practice QuestionsOsama Saleem0% (1)

- F3 Mock Questions 201603 PDFDocument14 pagesF3 Mock Questions 201603 PDFMD.Rakibul HasanNo ratings yet

- Accounting II Chapters 12, 13, 14 ReviewDocument10 pagesAccounting II Chapters 12, 13, 14 ReviewJacKFrost1889No ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- The Stockholders Equity Accounts of Holmes Inc at January 1 PDFDocument1 pageThe Stockholders Equity Accounts of Holmes Inc at January 1 PDFAnbu jaromiaNo ratings yet

- At The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- At The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Advanced Financial Accounting and ReportingDocument5 pagesAdvanced Financial Accounting and Reportingaccounting prob100% (1)

- The Ledger of Gamma Corporation at December 31 2010 AfterDocument1 pageThe Ledger of Gamma Corporation at December 31 2010 AfterM Bilal SaleemNo ratings yet

- 1 - Advanced Financial Accounting Individual Assignment IDocument6 pages1 - Advanced Financial Accounting Individual Assignment IEyasuNo ratings yet

- Akl Multiple ChocieDocument6 pagesAkl Multiple ChocieggeumNo ratings yet

- Tolbert Enterprises Inc Manufactures Bathroom Fixtures The Sto PDFDocument1 pageTolbert Enterprises Inc Manufactures Bathroom Fixtures The Sto PDFAnbu jaromiaNo ratings yet

- Full download Modern Advanced Accounting In Canada Canadian 8Th Edition Hilton Test Bank pdfDocument93 pagesFull download Modern Advanced Accounting In Canada Canadian 8Th Edition Hilton Test Bank pdfnancy.sanchez400100% (19)

- Audit of Shareholder's EquityDocument6 pagesAudit of Shareholder's EquityRosalie Colarte LangbayNo ratings yet

- Final Exam - Intermediate Accounting 2Document11 pagesFinal Exam - Intermediate Accounting 2Patricia EsplagoNo ratings yet

- Audit of Shareholder's EquityDocument4 pagesAudit of Shareholder's EquityRosalie Colarte LangbayNo ratings yet

- Assignment 01 Financial StatementsDocument5 pagesAssignment 01 Financial StatementsAzra MakasNo ratings yet

- Columbia Inc. financial data analysisDocument2 pagesColumbia Inc. financial data analysisYi QiNo ratings yet

- Accounting Textbook Solutions - 67Document19 pagesAccounting Textbook Solutions - 67acc-expertNo ratings yet

- Problem Sets Finacc Chapter 9Document19 pagesProblem Sets Finacc Chapter 9Reg Lagarteja100% (1)

- Solutions Guide: Please Do Not Present As Your Own. This Is Only Meant As A Solutions Guide For You To Answer The Problem On Your OwnDocument5 pagesSolutions Guide: Please Do Not Present As Your Own. This Is Only Meant As A Solutions Guide For You To Answer The Problem On Your OwnLai YanyanNo ratings yet

- 01 Chapter 1 Joint Venture and Public EnterpriseDocument11 pages01 Chapter 1 Joint Venture and Public EnterpriseTemesgen LealemNo ratings yet

- Chapter 13 14 Review QuestionsDocument6 pagesChapter 13 14 Review QuestionsHERSINo ratings yet

- ACCT10002 Tutorial 8 ExercisesDocument5 pagesACCT10002 Tutorial 8 ExercisesJING NIENo ratings yet

- The Following Selected Accounts Appear in The Ledger of EjDocument1 pageThe Following Selected Accounts Appear in The Ledger of EjMuhammad ShahidNo ratings yet

- Preweek ReviewDocument31 pagesPreweek ReviewLeah Hope CedroNo ratings yet

- ACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019Document11 pagesACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019nothingNo ratings yet

- Here and On Page 88 Are Financial Statements of EdmistonDocument1 pageHere and On Page 88 Are Financial Statements of EdmistonM Bilal SaleemNo ratings yet

- On January 1 2010 The Ledger of Glennon Company ContainedDocument1 pageOn January 1 2010 The Ledger of Glennon Company ContainedM Bilal SaleemNo ratings yet

- On January 1 2015 Primo Corporation Had The Following StockholdersDocument1 pageOn January 1 2015 Primo Corporation Had The Following StockholdersAmit PandeyNo ratings yet

- AFAR Exam Midterms 1Document4 pagesAFAR Exam Midterms 1CJ Hernandez BorretaNo ratings yet

- Accounting For Business Combinations Final Term ExaminationDocument3 pagesAccounting For Business Combinations Final Term ExaminationJasper LuagueNo ratings yet

- Separate and Consolidated QuizDocument6 pagesSeparate and Consolidated QuizAllyssa Kassandra LucesNo ratings yet

- Ffa Mock3 JS2020Document20 pagesFfa Mock3 JS2020alibanaylaNo ratings yet

- FAR ReviewDocument9 pagesFAR ReviewJude Vincent VittoNo ratings yet

- Module 5.3 Advanced Financial ReportingDocument31 pagesModule 5.3 Advanced Financial ReportingRonaly Nario DagohoyNo ratings yet

- Assignment AFA IDocument4 pagesAssignment AFA IAbebeNo ratings yet

- 1 - MB Group Assignment I 21727Document2 pages1 - MB Group Assignment I 21727RoNo ratings yet

- AFA Worksheet IIDocument7 pagesAFA Worksheet IIAbebeNo ratings yet

- The Stockholders Equity Accounts of Jajoo Corporation On JanuarDocument1 pageThe Stockholders Equity Accounts of Jajoo Corporation On JanuarM Bilal SaleemNo ratings yet

- ACT312 Quiz1 Online-1 PDFDocument6 pagesACT312 Quiz1 Online-1 PDFCharlie Harris0% (1)

- At The Beginning of 2011 Thompson Service Inc Showed The: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of 2011 Thompson Service Inc Showed The: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Workshop 5 QuestionsDocument3 pagesWorkshop 5 QuestionsJingwen YangNo ratings yet

- Business Combinations Midterm 2023 For LMSDocument4 pagesBusiness Combinations Midterm 2023 For LMSSarah Del teodoroNo ratings yet

- Financial Accounting: Sources of Capital - Equity and DebtDocument25 pagesFinancial Accounting: Sources of Capital - Equity and DebtJHANVI LAKRANo ratings yet

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument7 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualKellyMorenootdnj100% (81)

- Practice Exam: TEXT: PART A - Multiple Choice QuestionsDocument12 pagesPractice Exam: TEXT: PART A - Multiple Choice QuestionsMelissa WhiteNo ratings yet

- CXC Principles of Accounts Past Paper Jan 2009Document8 pagesCXC Principles of Accounts Past Paper Jan 2009lordNo ratings yet

- On January 1 2010 Weiser Corporation Had The Following Stockho PDFDocument1 pageOn January 1 2010 Weiser Corporation Had The Following Stockho PDFAnbu jaromiaNo ratings yet

- Partnership Operation Quiz 1 Combined OnlineDocument7 pagesPartnership Operation Quiz 1 Combined OnlineZyka SinoyNo ratings yet

- CSEC Principles of Accounts SEC. 9-Company Accounting (Balance Sheet)Document23 pagesCSEC Principles of Accounts SEC. 9-Company Accounting (Balance Sheet)Ephraim PryceNo ratings yet

- Mas DocumentsDocument12 pagesMas DocumentsLorie Grace LagunaNo ratings yet

- Assessment Tasks Jan 5 and 7 2022 InocencioDocument8 pagesAssessment Tasks Jan 5 and 7 2022 Inocencioalianna johnNo ratings yet

- 110.stockholders Equity ExercisesDocument4 pages110.stockholders Equity ExercisesRosalinda DacayoNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Your Colleague Picks Up The 2012 Annual Report of MicrosoftDocument1 pageSolved Your Colleague Picks Up The 2012 Annual Report of MicrosoftAnbu jaromiaNo ratings yet

- Solved You Have An Employee Who Has A Chemical Imbalance inDocument1 pageSolved You Have An Employee Who Has A Chemical Imbalance inAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved With The Recent Changes in The Tax Law Definition ofDocument1 pageSolved With The Recent Changes in The Tax Law Definition ofAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved White S Printing LTD S Year End Is February 28 The AccountingDocument1 pageSolved White S Printing LTD S Year End Is February 28 The AccountingAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet