Professional Documents

Culture Documents

On March 1 2015 Zephur Winds LTD Purchased A Machine PDF

Uploaded by

hassan taimourOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

On March 1 2015 Zephur Winds LTD Purchased A Machine PDF

Uploaded by

hassan taimourCopyright:

Available Formats

On March 1 2015 Zephur Winds Ltd purchased a machine

#248

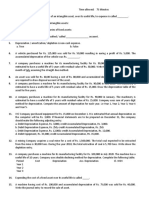

On March 1, 2015, Zephur Winds Ltd. purchased a machine for $80,000 by paying $20,000

down and issuing a note for the balance. The machine had an estimated useful life of nine years

and an estimated residual value of $8,000. Zephur Winds uses the straight-line-method of

depreciation and has a December 31 year end. On October 30, 2017, the machine was sold for

$62,000.Required:a. Prepare the journal entry to record the acquisition of the machine.b.

Assuming that the depreciation was correctly calculated and recorded in 2015 and 2016,

prepare the journal entries to update the depreciation and record the sale of the machine on

October 30, 2017.c. Assume instead that the company used the double-diminishing-balance

method to depreciate the cost of the machine:i. What amount of depreciation would be recorded

in 2015 and 2016?ii. What journal entries would be required to update the depreciation and

record the sale of the machine on October 30, 2017?View Solution:

On March 1 2015 Zephur Winds Ltd purchased a machine

ANSWER

http://paperinstant.com/downloads/on-march-1-2015-zephur-winds-ltd-purchased-a-machine/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- PPE QuizDocument6 pagesPPE QuizKristelle Mae Bautista100% (1)

- ICAEW Professional Level Financial Accounting & Reporting Question & Answer Bank March 2016 To March 2020 PDFDocument427 pagesICAEW Professional Level Financial Accounting & Reporting Question & Answer Bank March 2016 To March 2020 PDFOptimal Management Solution100% (4)

- AP - Ppe, Int. & Invest PropDocument15 pagesAP - Ppe, Int. & Invest PropJolina ManceraNo ratings yet

- IAS 16 Property Plant EquipmentDocument4 pagesIAS 16 Property Plant EquipmentMD Hafizul Islam HafizNo ratings yet

- Zumra Company S Annual Accounting Year Ends On December 31 It PDFDocument1 pageZumra Company S Annual Accounting Year Ends On December 31 It PDFhassan taimourNo ratings yet

- On January 1 2015 Bourgeois Company Purchased The Following TwoDocument1 pageOn January 1 2015 Bourgeois Company Purchased The Following TwoAmit PandeyNo ratings yet

- Extractor Company Leased A Machine On July 1 2015 UnderDocument1 pageExtractor Company Leased A Machine On July 1 2015 UnderMuhammad ShahidNo ratings yet

- Waylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Document1 pageWaylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Muhammad ShahidNo ratings yet

- On January 1 2015 Evers Company Purchased The Following Two: Unlock Answers Here Solutiondone - OnlineDocument1 pageOn January 1 2015 Evers Company Purchased The Following Two: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Phoenix Corp Purchased Machine No 201 On May 1 2014Document1 pagePhoenix Corp Purchased Machine No 201 On May 1 2014Let's Talk With HassanNo ratings yet

- On June 15 201 1 A Second Hand Machine Was Purchased For 77 000Document1 pageOn June 15 201 1 A Second Hand Machine Was Purchased For 77 000Let's Talk With HassanNo ratings yet

- AbdulSamad 12 15796 1 DepreciationDocument12 pagesAbdulSamad 12 15796 1 DepreciationSyed SumamaNo ratings yet

- The Savage Corporation Purchased Three Milling Machines On January 1Document1 pageThe Savage Corporation Purchased Three Milling Machines On January 1Let's Talk With HassanNo ratings yet

- On January 2 2012 Athol Company Bought A Machine For PDFDocument1 pageOn January 2 2012 Athol Company Bought A Machine For PDFFreelance WorkerNo ratings yet

- Jupiter Wells Corp Purchased Machinery For 315 000 On May 1Document2 pagesJupiter Wells Corp Purchased Machinery For 315 000 On May 1Let's Talk With HassanNo ratings yet

- Problem 1: Machinery Original Cost Date of Useful Life Salvage Value Depreciation Purchase MethodDocument1 pageProblem 1: Machinery Original Cost Date of Useful Life Salvage Value Depreciation Purchase Methodleshz zynNo ratings yet

- 2021 COAF 4201 GroupsDocument16 pages2021 COAF 4201 GroupsTawanda Tatenda HerbertNo ratings yet

- Problem NO. 1: Pengantar Akuntansi 2 (S1) PR: Aset Tetap - PenyusutanDocument2 pagesProblem NO. 1: Pengantar Akuntansi 2 (S1) PR: Aset Tetap - PenyusutanEka NlyNo ratings yet

- Gruman Company Purchased A Machine For 220 000 On JanuaryDocument1 pageGruman Company Purchased A Machine For 220 000 On JanuaryFreelance WorkerNo ratings yet

- Solved On July 15 2018 M W Morgan Distribution Sold Land ForDocument1 pageSolved On July 15 2018 M W Morgan Distribution Sold Land ForAnbu jaromiaNo ratings yet

- Depreciation Class WorkDocument5 pagesDepreciation Class WorkChaaru VarshiniNo ratings yet

- Accounting 102 Intermediate Accounting Depreciation QuizDocument6 pagesAccounting 102 Intermediate Accounting Depreciation QuizApril Mae Intong TapdasanNo ratings yet

- Additional Practical Problems-15Document5 pagesAdditional Practical Problems-15areet2701No ratings yet

- On July 1 2012 The Fitzgerald Corp Bought A Machine PDFDocument1 pageOn July 1 2012 The Fitzgerald Corp Bought A Machine PDFFreelance WorkerNo ratings yet

- The Following Transactions Related To A Machine Purchased by Vicario PDFDocument1 pageThe Following Transactions Related To A Machine Purchased by Vicario PDFTaimur TechnologistNo ratings yet

- At December 31 2014 Oteron Company S Noncurrent Operating Asset andDocument1 pageAt December 31 2014 Oteron Company S Noncurrent Operating Asset andMuhammad ShahidNo ratings yet

- A Building That Was Purchased December 31Document2 pagesA Building That Was Purchased December 31muhaNo ratings yet

- DEPRECIATION2Document2 pagesDEPRECIATION2PearlNo ratings yet

- University of Santo Tomas Amv College of Accountancy Intermediate Acccounting 2 NAMEDocument3 pagesUniversity of Santo Tomas Amv College of Accountancy Intermediate Acccounting 2 NAMEElaine AntonioNo ratings yet

- Solved On January 2 2018 David Corporation Purchased A Patent ForDocument1 pageSolved On January 2 2018 David Corporation Purchased A Patent ForAnbu jaromiaNo ratings yet

- On January 1 2017 Castlewood Company Purchased Machinery For ItsDocument1 pageOn January 1 2017 Castlewood Company Purchased Machinery For ItsMiroslav GegoskiNo ratings yet

- Consider The Following Transactions For Liner Company A CollectedDocument1 pageConsider The Following Transactions For Liner Company A Collectedhassan taimourNo ratings yet

- Acct CH.7 H.W.Document8 pagesAcct CH.7 H.W.j8noelNo ratings yet

- Practice Tests Final ExamDocument10 pagesPractice Tests Final Examgio gio0% (1)

- Solved Problems and Exercises-DepreciationDocument7 pagesSolved Problems and Exercises-DepreciationKaranNo ratings yet

- Review - Assets 2013Document12 pagesReview - Assets 2013Malou Almiro SurquiaNo ratings yet

- DepreciationDocument15 pagesDepreciationYash AggarwalNo ratings yet

- The Following Transactions Occurred During 2014 Assume That Depreciation ofDocument1 pageThe Following Transactions Occurred During 2014 Assume That Depreciation ofTaimour HassanNo ratings yet

- 9 Depreciation 08-2022 Regular Ca FoundationDocument6 pages9 Depreciation 08-2022 Regular Ca FoundationjahnaviNo ratings yet

- Capital and Revenue ExpendituresDocument5 pagesCapital and Revenue ExpendituresALI KHANNo ratings yet

- DsadadadawdadsadaDocument16 pagesDsadadadawdadsadaAaditya AgrawalNo ratings yet

- Assignment 2Document5 pagesAssignment 2Baburam AdNo ratings yet

- Provision For Depreciation & DisposalDocument3 pagesProvision For Depreciation & DisposalKristen NallanNo ratings yet

- Accounting For DepreciationDocument6 pagesAccounting For DepreciationKaran GNo ratings yet

- Short Form Questions: Winter Exam-2016Document7 pagesShort Form Questions: Winter Exam-2016Kashif NiaziNo ratings yet

- Reliable Classes / C.A.F.C. / Accounts / Depreciation: Prof. Bhambwani'sDocument4 pagesReliable Classes / C.A.F.C. / Accounts / Depreciation: Prof. Bhambwani'sRohit MathurNo ratings yet

- AIS16Exercises SCDocument6 pagesAIS16Exercises SCSarah GherdaouiNo ratings yet

- Topic: Depreciation (Cost of Machine) Made by Sir Hyder AliDocument4 pagesTopic: Depreciation (Cost of Machine) Made by Sir Hyder AliHaroon KhatriNo ratings yet

- The Records of Luci Company Reflected The Following Details For PDFDocument1 pageThe Records of Luci Company Reflected The Following Details For PDFTaimur TechnologistNo ratings yet

- Chapter 5 DepreciationDocument20 pagesChapter 5 DepreciationanuradhaNo ratings yet

- Batscpar Far3Document9 pagesBatscpar Far3Krizza MaeNo ratings yet

- Individual AssignmentDocument2 pagesIndividual AssignmentmuhaNo ratings yet

- DepreciationDocument3 pagesDepreciationAdnan ShabeerNo ratings yet

- Depreciation: Illustration 1 (Journal Entries)Document3 pagesDepreciation: Illustration 1 (Journal Entries)Navnidh KaurNo ratings yet

- 3 - (Ppe)Document3 pages3 - (Ppe)fbaabgfgbfdNo ratings yet

- Accounting of DepreciationDocument2 pagesAccounting of DepreciationAkshay KawadeNo ratings yet

- Depreciation UDDocument20 pagesDepreciation UDrizwan ul hassanNo ratings yet

- AFAB233 Tutorial - PPE - 021819Document7 pagesAFAB233 Tutorial - PPE - 021819Leshiga GunasegarNo ratings yet

- Acctg21 Midterm L1 Exercise: Multiple ChoiceDocument3 pagesAcctg21 Midterm L1 Exercise: Multiple ChoiceGarp BarrocaNo ratings yet

- Practice ProblemsDocument14 pagesPractice ProblemsJeselle HyungSikNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Zippy A Regional Convenience Store Chain Maintains Milk Inventory by PDFDocument1 pageZippy A Regional Convenience Store Chain Maintains Milk Inventory by PDFhassan taimourNo ratings yet

- Your Best Friend From Home Writes You A Letter About PDFDocument1 pageYour Best Friend From Home Writes You A Letter About PDFhassan taimourNo ratings yet

- You Ca Have Been Working For Plener and Partners Chartered PDFDocument4 pagesYou Ca Have Been Working For Plener and Partners Chartered PDFhassan taimourNo ratings yet

- You Manage A 13 5 Million Portfolio Currently All Invested PDFDocument1 pageYou Manage A 13 5 Million Portfolio Currently All Invested PDFhassan taimourNo ratings yet

- Your Supervisor Has Asked You To Research The Following Situation PDFDocument1 pageYour Supervisor Has Asked You To Research The Following Situation PDFhassan taimourNo ratings yet

- Yangzi International Inc Uses The Aging of Accounts Receivable Method PDFDocument1 pageYangzi International Inc Uses The Aging of Accounts Receivable Method PDFhassan taimourNo ratings yet

- You Own 10 000 Shares 1 of The Outstanding Shares of PDFDocument1 pageYou Own 10 000 Shares 1 of The Outstanding Shares of PDFhassan taimourNo ratings yet

- Windmere Corporation S Statement of Financial Position at December 31 2016 PDFDocument1 pageWindmere Corporation S Statement of Financial Position at December 31 2016 PDFhassan taimourNo ratings yet

- You Ca Have Recently Been Assigned As Audit Senior For PDFDocument2 pagesYou Ca Have Recently Been Assigned As Audit Senior For PDFhassan taimourNo ratings yet

- Xanadu LTD Has Accounts Receivable Totalling 142 800 and A 3 640 PDFDocument1 pageXanadu LTD Has Accounts Receivable Totalling 142 800 and A 3 640 PDFhassan taimourNo ratings yet

- You Are A Senior Manager at Poeing Aircraft and Have PDFDocument1 pageYou Are A Senior Manager at Poeing Aircraft and Have PDFhassan taimourNo ratings yet

- Wright Oil Company S Balance Sheet Includes Three Assets Natural Gas PDFDocument1 pageWright Oil Company S Balance Sheet Includes Three Assets Natural Gas PDFhassan taimourNo ratings yet

- Whistler Blackcomb Holdings Inc Has A 75 Interest in Whistler PDFDocument1 pageWhistler Blackcomb Holdings Inc Has A 75 Interest in Whistler PDFhassan taimourNo ratings yet

- Wood Work LTD Sells Home Furnishings Including A Wide Range PDFDocument1 pageWood Work LTD Sells Home Furnishings Including A Wide Range PDFhassan taimourNo ratings yet

- Wright Fishing Charters Has Collected The Following Data For The PDFDocument1 pageWright Fishing Charters Has Collected The Following Data For The PDFhassan taimourNo ratings yet

- Your Friend Is Celebrating Her 30th Birthday Today and Wants PDFDocument1 pageYour Friend Is Celebrating Her 30th Birthday Today and Wants PDFhassan taimourNo ratings yet

- Whitley Company Is Considering Two Capital Investments Both Investments Have PDFDocument1 pageWhitley Company Is Considering Two Capital Investments Both Investments Have PDFhassan taimourNo ratings yet

- While Pursuing His Undergraduate Studies Bruno Clarke Needed To Earn PDFDocument1 pageWhile Pursuing His Undergraduate Studies Bruno Clarke Needed To Earn PDFhassan taimourNo ratings yet

- Whiskey Industries LTD A Nanaimo British Columbia Based Company Has A PDFDocument1 pageWhiskey Industries LTD A Nanaimo British Columbia Based Company Has A PDFhassan taimourNo ratings yet