Professional Documents

Culture Documents

This Exercise Continues The Graham S Yard Care Inc Exercise Begun PDF

Uploaded by

Ahsan Khan0 ratings0% found this document useful (0 votes)

24 views1 pageThis document continues an exercise for Graham's Yard Care, Inc. that was started in a previous chapter. It provides July transactions for the company, including services provided, purchases and sales of plants, and consulting fees. It asks the reader to prepare perpetual inventory records using FIFO, journalize and post the transactions, record adjusting entries, and make closing entries to prove the equality of debits and credits.

Original Description:

Original Title

this-exercise-continues-the-graham-s-yard-care-inc-exercise-begun.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document continues an exercise for Graham's Yard Care, Inc. that was started in a previous chapter. It provides July transactions for the company, including services provided, purchases and sales of plants, and consulting fees. It asks the reader to prepare perpetual inventory records using FIFO, journalize and post the transactions, record adjusting entries, and make closing entries to prove the equality of debits and credits.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views1 pageThis Exercise Continues The Graham S Yard Care Inc Exercise Begun PDF

Uploaded by

Ahsan KhanThis document continues an exercise for Graham's Yard Care, Inc. that was started in a previous chapter. It provides July transactions for the company, including services provided, purchases and sales of plants, and consulting fees. It asks the reader to prepare perpetual inventory records using FIFO, journalize and post the transactions, record adjusting entries, and make closing entries to prove the equality of debits and credits.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

This exercise continues the Graham s Yard Care Inc

exercise begun #565

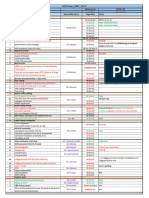

This exercise continues the Graham’s Yard Care, Inc. exercise begun in Chapter 1. Consider

the July transactions for Graham’s Yard Care that were presented in Chapter 5. Jul 2

Completed lawn service and received cash of $500.5 Purchased 100 plants on account for

inventory, $250, plus freight in of $10. 15 Sold 40 plants on account, $400.17 Consulted with a

client on landscaping design for a fee of $150 on account.20 Purchased 100 plants on account

for inventory, $300.21 Paid on account, $100.25 Sold 100 plants for cash, $700.31 Recorded

the following adjusting entries:Accrued salaries for the month of July equal $225Depreciation on

equipment $30Physical count of plant inventory, 50 plantsRefer to the T-accounts for Graham’s

Yard Care, Inc. from the continuing exercise in Chapter 3.Requirements1. Prepare perpetual

inventory records for July for Graham’s Yard Care, Inc. using the FIFO method.2. Journalize

and post the July transactions using the perpetual inventory record created in Requirement 1.

Omit explanations. Key all items by date. Compute each account balance, and denote the

balance as Bal.3. Journalize and post the adjusting entries. Denote each adjustment amount as

Adj.4. Journalize and post closing entries. After posting all closing entries, prove the equality of

debits and credits in the ledger.View Solution:

This exercise continues the Graham s Yard Care Inc exercise begun

ANSWER

http://paperinstant.com/downloads/this-exercise-continues-the-graham-s-yard-care-inc-exercise-

begun/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Outlook Group Written AssignmentDocument34 pagesOutlook Group Written Assignmentashish9dubey-1680% (10)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1 Programming Model (Algorithms 1.1)Document10 pages1 Programming Model (Algorithms 1.1)HarshaSharmaNo ratings yet

- The Greenock HangingsDocument5 pagesThe Greenock HangingsInverclyde Community Development Trust100% (2)

- Ghost Hawk ExcerptDocument48 pagesGhost Hawk ExcerptSimon and SchusterNo ratings yet

- This Problem Continues The Daniels Consulting Situation From Problem p5 45 PDFDocument1 pageThis Problem Continues The Daniels Consulting Situation From Problem p5 45 PDFAhsan KhanNo ratings yet

- This Problem Continues The Daniels Consulting Situation From Problem p25 33 PDFDocument1 pageThis Problem Continues The Daniels Consulting Situation From Problem p25 33 PDFAhsan KhanNo ratings yet

- Timothy Monroe Opened A Law Office On January 1 2017 PDFDocument1 pageTimothy Monroe Opened A Law Office On January 1 2017 PDFAhsan KhanNo ratings yet

- The Trial Balance of Learn For Life Child Care Does PDFDocument1 pageThe Trial Balance of Learn For Life Child Care Does PDFAhsan KhanNo ratings yet

- The Trial Balance of Creative Child Care Does Not Balance The PDFDocument1 pageThe Trial Balance of Creative Child Care Does Not Balance The PDFAhsan KhanNo ratings yet

- The Unadjusted Trial Balance of Newport Inn Company at December PDFDocument1 pageThe Unadjusted Trial Balance of Newport Inn Company at December PDFAhsan KhanNo ratings yet

- The Trial Balance of James Howe Cpa Is Dated March PDFDocument1 pageThe Trial Balance of James Howe Cpa Is Dated March PDFAhsan KhanNo ratings yet

- Hach - MWP (Plan Vs Actual) Status - 22 Oct-1Document1 pageHach - MWP (Plan Vs Actual) Status - 22 Oct-1ankit singhNo ratings yet

- Normalization ExercisesDocument2 pagesNormalization ExercisesAnh DiệuNo ratings yet

- Wall Panels Thesis PDFDocument161 pagesWall Panels Thesis PDFSanjay EvaneNo ratings yet

- Wimod Ic iC880A: DatasheetDocument26 pagesWimod Ic iC880A: DatasheetJulian CamiloNo ratings yet

- Dwnload Full Using Mis 9th Edition Kroenke Solutions Manual PDFDocument35 pagesDwnload Full Using Mis 9th Edition Kroenke Solutions Manual PDFpasakazinum100% (10)

- Electric Charges & Fields: Chapter-1 class-XIIDocument20 pagesElectric Charges & Fields: Chapter-1 class-XIIMohit SahuNo ratings yet

- Intelligent Platform Management Interface Firmware, Upgrade: Operational InstructionDocument23 pagesIntelligent Platform Management Interface Firmware, Upgrade: Operational InstructionLayth WaellNo ratings yet

- Ayesha Ali: 2Nd Year Software Engineering StudentDocument1 pageAyesha Ali: 2Nd Year Software Engineering StudentShahbazAliRahujoNo ratings yet

- 5990200Document551 pages5990200Basit Ahmad bhat0% (1)

- Euphoria 2021 F K Anyone Whos Not A Sea Blob Part 2 Jules Script Teleplay Written by Sam Levinson and Hunter SchaferDocument40 pagesEuphoria 2021 F K Anyone Whos Not A Sea Blob Part 2 Jules Script Teleplay Written by Sam Levinson and Hunter SchaferMadalena Duarte7No ratings yet

- How Does Texting Worsens Our Vocabulary & Writing Skills ?Document10 pagesHow Does Texting Worsens Our Vocabulary & Writing Skills ?Manvi GoelNo ratings yet

- The Three Dimensions of Belief Differentiating Religions: Jungguk Cho, Yang LeeDocument5 pagesThe Three Dimensions of Belief Differentiating Religions: Jungguk Cho, Yang LeeMauren NaronaNo ratings yet

- CV EnglishDocument1 pageCV EnglishVijay AgrahariNo ratings yet

- Johannes KepplerDocument2 pagesJohannes KepplermakNo ratings yet

- Kelompok 1 Recount TextDocument11 pagesKelompok 1 Recount TextElvina RahmayaniNo ratings yet

- Lindsey Position PaperDocument14 pagesLindsey Position PaperRamil DumasNo ratings yet

- Surfactants and Emulsifying Agents: January 2009Document7 pagesSurfactants and Emulsifying Agents: January 2009Jocc Dee LightNo ratings yet

- Writing Task 2 - Discussion - Opinion EssayDocument7 pagesWriting Task 2 - Discussion - Opinion EssayTonNo ratings yet

- CDBFRDDocument88 pagesCDBFRDmarcol99No ratings yet

- The Need For Culturally Relevant Dance EducationDocument7 pagesThe Need For Culturally Relevant Dance Educationajohnny1No ratings yet

- From St. Francis To Dante-Translations From The Chronicle of The Franciscan Salimbene, 1221-1288Document489 pagesFrom St. Francis To Dante-Translations From The Chronicle of The Franciscan Salimbene, 1221-1288Jake SalNo ratings yet

- Elite MindsDocument1 pageElite MindsShivaNo ratings yet

- Vestel Alva B Na-127vb3 Na-147vb3 SMDocument40 pagesVestel Alva B Na-127vb3 Na-147vb3 SMjoseNo ratings yet

- Biology-Activity-3 - Growth and Development of PlantDocument3 pagesBiology-Activity-3 - Growth and Development of PlantnelleoNo ratings yet

- Chapter 9 Formulation of National Trade Policies: International Business, 8e (Griffin/Pustay)Document28 pagesChapter 9 Formulation of National Trade Policies: International Business, 8e (Griffin/Pustay)Yomi BrainNo ratings yet

- PLDT Account No. 0193069916 PDFDocument4 pagesPLDT Account No. 0193069916 PDFEli FaustinoNo ratings yet