100% found this document useful (2 votes)

505 views14 pagesIFRS 9 Financial Instruments

IFRS 9 Financial Instruments

Uploaded by

Sudershan ThaibaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (2 votes)

505 views14 pagesIFRS 9 Financial Instruments

IFRS 9 Financial Instruments

Uploaded by

Sudershan ThaibaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Project Summary: Introduces the project overview including IFRS 9, hedge accounting, and relevant amendments.

- At a Glance: Provides a brief introduction to amendments with an overview of significant changes in IFRS 9.

- Overview of Hedge Accounting: Explains the objectives of hedge accounting and reasons for its use in financial instruments.

- Why Change Hedge Accounting Requirements?: Discusses the reasons for changing hedge accounting requirements and benefits over the previous standard.

- Fundamental Review of Hedge Accounting: Visual representation of hedge accounting aspects reconsidered, such as objectives and instruments.

- What Does the New Hedge Accounting Model Achieve?: Highlights the alignment of risk management with financial statements provided through the new model.

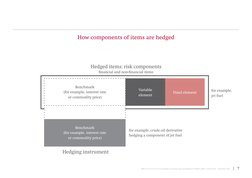

- How Components of Items are Hedged: Illustrates how different components of financial items are hedged under the new accounting system.

- Improved Information About Risk Management Activities: Describes enhancements in information disclosure concerning risk management and hedge retirement.

- Accounting for Macro Hedging: Discusses ongoing IASB projects related to macro hedge accounting propositions.

- Second Amendment: Own Credit: Covers the changes regarding accounting treatments of own credit on financial liabilities.

- Third Amendment: Mandatory Effective Date of IFRS 9: Details the mandatory effective date for adopting IFRS 9 and its significance.

- Where Are We at with IFRS 9?: Describes the current status and progress of IFRS 9 implementation and future plans.

- Important Information: Provides disclaimers and further reading links related to the reported IFRS changes.