100% found this document useful (1 vote)

625 views60 pagesEssential Guide to Trade Finance

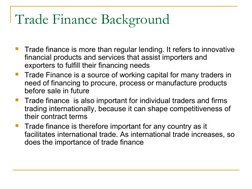

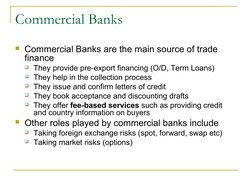

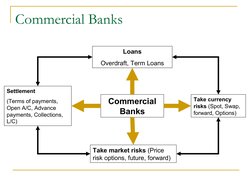

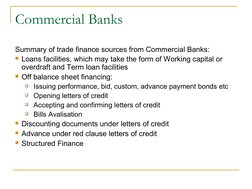

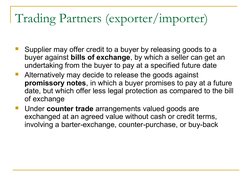

This document discusses trade finance, including its importance, sources, and instruments. Trade finance refers to financial products and services that assist importers and exporters in fulfilling their financing needs. It provides working capital and facilitates international trade. Sources of trade finance include commercial banks, trading partners, specialized institutions, and government organizations. Common instruments are letters of credit, bank guarantees, loans, letters of credit, bills acceptance, and structured finance. The document explains each instrument in 1-2 sentences.

Uploaded by

Sudershan ThaibaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

625 views60 pagesEssential Guide to Trade Finance

This document discusses trade finance, including its importance, sources, and instruments. Trade finance refers to financial products and services that assist importers and exporters in fulfilling their financing needs. It provides working capital and facilitates international trade. Sources of trade finance include commercial banks, trading partners, specialized institutions, and government organizations. Common instruments are letters of credit, bank guarantees, loans, letters of credit, bills acceptance, and structured finance. The document explains each instrument in 1-2 sentences.

Uploaded by

Sudershan ThaibaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Introduction to Trade Finance

- Objectives

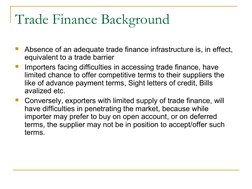

- Trade Finance Background

- Sources of Trade Finance

- Instruments of Trade Finance

- Types of Trade Finance

- Structured Trade Finance

- Leasing and Factoring

- Forfaiting

- Countertrade

- Challenges in Trade Finance

- Appendix