Professional Documents

Culture Documents

TUTORIAL 6 The Cost of Capital PDF

Uploaded by

Brenda BernardOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TUTORIAL 6 The Cost of Capital PDF

Uploaded by

Brenda BernardCopyright:

Available Formats

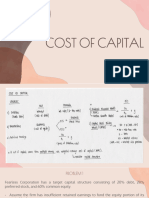

Tutorial 6: The cost of capital

1. After –tax cost of debt The Heuser Company’s currently outstanding bonds have a 10

percent coupon and a 12 percent yield to maturity. Heuser believes it could issue new bonds

at par that would provide a similar yield to maturity. If its marginal tax rate is 35 percent,

what is Heuser’s after-tax cost of debt?

2. Cost of preferred stock Tunney Industries can issue perpetual preferred stock at a price of

$47.50 a share. The stock would pay a constant annual dividend of $3.80 a share. What is the

company’s cost of preferred stock, rp?

3. Cost of common equity Percy Motors has a target capital structure of 40 percent debt and

60 percent common equity, with no preferred stock. The yield to maturity on the company’s

outstanding bonds is 9 percent, and its tax rate is 40 percent. Percy’s CFO estimates that the

company’s WACC is 9.96 percent. What is Percy’s cost of common equity?

4. Cost of common equity The earnings, dividends, and common stock price of Carpetto

Technologies Inc. are expected to grow at 7 percent per year in the future. Carpetto’s

common stock sells for $23 per share, its last dividend was $2.00, and it will pay a dividend

of $2.14 at the end of the current year.

a. Using the DCF approach, what is its cost of common equity?

b. If the firm’s beta is 1.6, the risk-free rate is 9 percent, and the average return on the market

is 13 percent, what will be the firm’s cost of common equity using the CAPM approach?

c. If the firm’s bonds earn a return of 12 percent, what will rs be based on the bond-yield-

plus-risk-premium approach, using the midpoint of the risk premium range?

d. Assuming you have equal confidence in the inputs used for the three approaches, what is

your estimate of Carpetto’s cost of common equity?

5. Cost of common equity with flotation Ballack Co.’s common stock currently sells for

$46.75 per share. The growth rate is a constant 12 percent, and the company has an expected

dividend yield of 5 percent. The expected long-run dividend payout ratio is 25 percent, and

the expected return on equity (ROE) is 16 percent. New stock can be sold to the public at the

current price, but a flotation cost of 5 percent would be incurred. What would the cost of new

equity be?

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Statistics For Business and Economics: Anderson Sweeney WilliamsDocument45 pagesStatistics For Business and Economics: Anderson Sweeney WilliamsBrenda BernardNo ratings yet

- Statistics For Business and Economics: Anderson Sweeney WilliamsDocument25 pagesStatistics For Business and Economics: Anderson Sweeney WilliamsBrenda BernardNo ratings yet

- Quiz - Stock ValuationDocument4 pagesQuiz - Stock ValuationMaria Anne Genette Bañez100% (1)

- Chapter 10 Practice ProblemsDocument5 pagesChapter 10 Practice ProblemsEvelyn RoldanNo ratings yet

- Test BDocument5 pagesTest Bhjgdjf cvsfdNo ratings yet

- Practice Questions - Cost of Capital - 2Document11 pagesPractice Questions - Cost of Capital - 2arun babuNo ratings yet

- Cost of Capital ExcercisesDocument3 pagesCost of Capital ExcercisesLinh Ha Nguyen Khanh100% (1)

- Cost of CapitalDocument2 pagesCost of Capitalkomal100% (1)

- Cost of CapitalDocument3 pagesCost of CapitalAfsana Mim JotyNo ratings yet

- Exercise Cost of CapitalDocument7 pagesExercise Cost of CapitalUmair Shekhani100% (2)

- Cost of Capital (Practice Questions)Document2 pagesCost of Capital (Practice Questions)Wais Deen NazariNo ratings yet

- FinMan Unit 7 Tutorial Cost of Capital Revised Sep2021Document3 pagesFinMan Unit 7 Tutorial Cost of Capital Revised Sep2021Ajani McPhersonNo ratings yet

- Cost of CapitalDocument2 pagesCost of CapitalShota ChenebresNo ratings yet

- A Company Is 40Document2 pagesA Company Is 40muhammad farhanNo ratings yet

- Chapter1 ExercisesDocument4 pagesChapter1 ExercisesMinh Tâm Nguyễn0% (1)

- Chapter 11: Cost of Capital Self Test ProblemDocument2 pagesChapter 11: Cost of Capital Self Test ProblemAliza RajaniNo ratings yet

- Btap KTDNDocument16 pagesBtap KTDNleducNo ratings yet

- Debt PolicyDocument2 pagesDebt PolicyKathy Beth TerryNo ratings yet

- Weighted Average Cost of Capital and Company Valuation: Individual ExerciseDocument13 pagesWeighted Average Cost of Capital and Company Valuation: Individual ExerciseMarilou Olaguir SañoNo ratings yet

- Practice Questions (CAPM) : FIN 350 Global Financial ManagementDocument2 pagesPractice Questions (CAPM) : FIN 350 Global Financial Managementsarge19860% (1)

- Problem Solving 10Document6 pagesProblem Solving 10Ehab M. Abdel HadyNo ratings yet

- 02 - Cost of Capital Quizzer 1Document5 pages02 - Cost of Capital Quizzer 1Mary Grace MontojoNo ratings yet

- Finman - Q2 Cost Os CaptDocument2 pagesFinman - Q2 Cost Os CaptJennifer RasonabeNo ratings yet

- Islamic University of Gaza Advanced Financial Management Dr. Fares Abu Mouamer Final Exam Sat.30/1/2008 3 PMDocument7 pagesIslamic University of Gaza Advanced Financial Management Dr. Fares Abu Mouamer Final Exam Sat.30/1/2008 3 PMTaha Wael QandeelNo ratings yet

- Ch9Cost of CapProbset 13ed - MastersDFDocument4 pagesCh9Cost of CapProbset 13ed - MastersDFJaneNo ratings yet

- Financing Decisions - Practice Questions PDFDocument3 pagesFinancing Decisions - Practice Questions PDFAbrar0% (1)

- Financing Decisions - Practice QuestionsDocument3 pagesFinancing Decisions - Practice QuestionsAbrarNo ratings yet

- University of Tunis Tunis Business School: Corporate FinanceDocument3 pagesUniversity of Tunis Tunis Business School: Corporate FinanceArbi ChaimaNo ratings yet

- Homework 10Document4 pagesHomework 10Gia Hân TrầnNo ratings yet

- COST OF CAPITAL Exercises 1Document6 pagesCOST OF CAPITAL Exercises 1fatin syahiraNo ratings yet

- MAS Synchronous Discussion May 13Document7 pagesMAS Synchronous Discussion May 13Marielle GonzalvoNo ratings yet

- MAS02Document8 pagesMAS02andzie09876No ratings yet

- FINA 4383 Quiz 2Document9 pagesFINA 4383 Quiz 2Samantha LunaNo ratings yet

- Tutorial 8 Cost of CapitalDocument3 pagesTutorial 8 Cost of CapitalHiền NguyễnNo ratings yet

- Take Home QuizDocument8 pagesTake Home QuizJean CabigaoNo ratings yet

- Assignment 1Document1 pageAssignment 1AsadvirkNo ratings yet

- Online Test 3 - Cost of CapitalDocument16 pagesOnline Test 3 - Cost of CapitalShereena FarhoudNo ratings yet

- MCQSDocument3 pagesMCQSGhulam Mustufa AnsariNo ratings yet

- Exam 3 FinanceDocument8 pagesExam 3 FinanceJayNo ratings yet

- FM AssignmentDocument2 pagesFM AssignmentHananNo ratings yet

- MAS 2023 Module 10 - Risk Leverage and Cost of CapitalDocument9 pagesMAS 2023 Module 10 - Risk Leverage and Cost of CapitalPurple KidNo ratings yet

- Practice Problem Set #6: Stocks I Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)Document2 pagesPractice Problem Set #6: Stocks I Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)raymondNo ratings yet

- Capital Budgeting: Questions and ExercisesDocument4 pagesCapital Budgeting: Questions and ExercisesLinh HoangNo ratings yet

- Wacc QuestionsDocument5 pagesWacc Questionsmuhammad farhanNo ratings yet

- Individual Assignment Summer 2019Document3 pagesIndividual Assignment Summer 2019Natalie Godgotme RoseNo ratings yet

- Quiz 1 - Special Transactions: TheoriesDocument9 pagesQuiz 1 - Special Transactions: TheoriesRhejean LozanoNo ratings yet

- FIN222 Autumn2016 Tutorials Tutorial 8Document8 pagesFIN222 Autumn2016 Tutorials Tutorial 8HELENANo ratings yet

- The Cost of Capital HomeworkDocument2 pagesThe Cost of Capital HomeworkJasmin RabonNo ratings yet

- Indvi Assignment 2 Investment and Port MGTDocument3 pagesIndvi Assignment 2 Investment and Port MGTaddisie temesgen100% (1)

- WACC 2 qVRkBQB015Document3 pagesWACC 2 qVRkBQB015AravNo ratings yet

- WACCDocument1 pageWACCsauravNo ratings yet

- Capital Structure and Cost of CapitalVal Exercises StudentsDocument2 pagesCapital Structure and Cost of CapitalVal Exercises StudentsApa-ap, CrisdelleNo ratings yet

- FIN3004 Tutorial 2 QuestionsDocument2 pagesFIN3004 Tutorial 2 QuestionsLe HuyNo ratings yet

- Exam 2 PracticeDocument4 pagesExam 2 PracticeRaunak KoiralaNo ratings yet

- Homework 2 (Shcheglova M.)Document3 pagesHomework 2 (Shcheglova M.)Мария ЩегловаNo ratings yet

- Mock Exam Reviewer QuestionnaireDocument8 pagesMock Exam Reviewer QuestionnaireJerome BadilloNo ratings yet

- Test 092403Document10 pagesTest 092403Janice ChanNo ratings yet

- Tut 3Document2 pagesTut 3mihsovyaNo ratings yet

- Soal Manajemen KeuanganDocument3 pagesSoal Manajemen KeuanganASUS 14 A416No ratings yet

- Cost of Capital ProblemsDocument5 pagesCost of Capital ProblemsYusairah Benito DomatoNo ratings yet

- Statistics For Business and Economics: Anderson Sweeney WilliamsDocument43 pagesStatistics For Business and Economics: Anderson Sweeney WilliamsBrenda BernardNo ratings yet

- Online Tasks - Measure of Variability PDFDocument1 pageOnline Tasks - Measure of Variability PDFBrenda BernardNo ratings yet

- Online Task-Discrete ProbabilityDocument9 pagesOnline Task-Discrete ProbabilityBrenda BernardNo ratings yet

- Online ActivitiesDocument1 pageOnline ActivitiesBrenda BernardNo ratings yet

- Element Scale of Measurement Differentiation Between Scale of MeasurementDocument1 pageElement Scale of Measurement Differentiation Between Scale of MeasurementBrenda BernardNo ratings yet

- Tutorial 3 Time Value of MoneyDocument2 pagesTutorial 3 Time Value of MoneyBrenda BernardNo ratings yet

- Tutorial 1 EBW 1063 Managerial FinanceDocument1 pageTutorial 1 EBW 1063 Managerial FinanceBrenda BernardNo ratings yet

- TUTORIAL 7 Capital BudgetingDocument2 pagesTUTORIAL 7 Capital BudgetingBrenda BernardNo ratings yet