Professional Documents

Culture Documents

Notes On Estate Tax p2

Uploaded by

john randel0 ratings0% found this document useful (0 votes)

8 views2 pagesOriginal Title

Notes on Estate tax p2.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesNotes On Estate Tax p2

Uploaded by

john randelCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

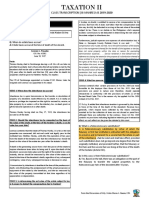

ILLUSTRATION OLD LAW NEW LAW

Date of accrual of estate tax? Upon death Upon death

Date when the right of Govt to impose estate Upon death Upon death

tax?

Notice of Death of decedent? In all cases of transfers subject to tax or "NO" under TRAIN.

where, though exempt from tax, the gross

value of the estate exceeds P 20,000, the

executor, administrator or any of the legal

heirs, as the case maybe, within two months

after the decedent’s death, or within a like

period after qualifying as such executor or

administrator, shall give a written notice

thereof to the commissioner.

Due date of filing Estate tax return? 6 months after death Within 1yr

Extension on FILING? 30days 30days

Taxpayer? Estate of Juan / Decedent (a Juridical person Estate of Juan / Decedent (a Juridical person

with separate TIN) with separate TIN)

Who will file/Personal Obligation to File? Order of priority: 1. Administrator OR Order of priority: 1. Administrator OR

Executor; IF NONE any heirs or any person in Executor; IF NONE any heirs or any person in

actual or constructive possession of any actual or constructive possession of any

property of the decedent. property of the decedent.

If there are two executors, they are severally

or solidarily liable. Heirs are subsidiarily

liable.

Where? the place of domicile of the decedent at the the place of domicile of the decedent at the

time of his death time of his death

BIR form 1801 1801

In case of a non-resident decedent with

executor or administrator in the Philippines,

the return shall be filed with the AAB of the

RDO where such executor/administrator is

registered or is domiciled, if not yet

registered with the BIR.

If the decedent has no legal residence in the

Philippines, the return shall be filed with the

Office of the Commissioner (RDO No. 39,

South Quezon City).

When to PAY? As the return is filed. As the return is filed.

Extension to PAY? 5yrs if judicially settled / 2 yrs if extrajudicial 5yrs if judicially settled / 2 yrs if extrajudicial

from last day of filing the return from last day of filing the return

Codicil-refers to supplemental or additional ok ok

instructions made by the testator-decedent

that modifies an existing will and testament.

Estate Tax Return supported with a (2M under the OLD LAW) The Estate Tax Returns showing a gross value

statement duly certified to by a CPA (Certified exceeding P 5M shall be supported with a

Public Accountant) statement duly certified to by a Certified

Public Accountant.

Can the heir withdraw the cash in bank No. untill payment of Tax. BUT, administrator Yes. Subj to 6% w/tax

or any heirs may withdraw upon

authorization of BIR Commissioner not

exceeding 20K

Estate Tax return filed may be amended? Yes. W/in 3 yrs Yes. W/in 3 yrs

Installment payment? Yes..within 2 yrs w/0 interest and penalty

You might also like

- Your StrawmanDocument81 pagesYour Strawmanwest_keys100% (21)

- My Big Fat Wonderfully Wealthy Life PDFDocument92 pagesMy Big Fat Wonderfully Wealthy Life PDFskunak7450No ratings yet

- Taxation Law 1994-2006Document242 pagesTaxation Law 1994-2006Zina CaidicNo ratings yet

- 02 - Estate TaxesDocument27 pages02 - Estate TaxesShiela MeiNo ratings yet

- Latin Legal Phrases, Terms and Maxims as Applied by the Malaysian CourtsFrom EverandLatin Legal Phrases, Terms and Maxims as Applied by the Malaysian CourtsNo ratings yet

- TAX-101 (Estate Tax)Document11 pagesTAX-101 (Estate Tax)Edith DalidaNo ratings yet

- Extrajudicial settlement of estate in the PhilippinesDocument6 pagesExtrajudicial settlement of estate in the PhilippinesMay YellowNo ratings yet

- Estate Tax - ProblemsDocument6 pagesEstate Tax - ProblemsKenneth Bryan Tegerero Tegio100% (2)

- Transfer Tax GuideDocument35 pagesTransfer Tax GuideRaine DeLeonNo ratings yet

- Tax 2 Maniego NotesDocument32 pagesTax 2 Maniego NotesHaze Q.No ratings yet

- Estate TaxDocument10 pagesEstate Taxrandomlungs121223No ratings yet

- Tax 2 Notes Midterms LamosteDocument6 pagesTax 2 Notes Midterms LamosteRoji Belizar HernandezNo ratings yet

- Taxation Law 2 ReviewerDocument44 pagesTaxation Law 2 ReviewerShi MartinezNo ratings yet

- Estate Tax NotesDocument13 pagesEstate Tax NotesDonFrascoNo ratings yet

- Tax Rates Effective January 1, 1998 Up To PresentDocument8 pagesTax Rates Effective January 1, 1998 Up To PresentJasmin AlapagNo ratings yet

- Estate Tax RatesDocument5 pagesEstate Tax RatesJohn Carlos WeeNo ratings yet

- Review Notes For Taxation 2: Sequuntur Personam and Situs of Taxation)Document41 pagesReview Notes For Taxation 2: Sequuntur Personam and Situs of Taxation)JImlan Sahipa IsmaelNo ratings yet

- Transfer Taxes: SEC. 84 Rates of Estate Tax. - There Shall Be Levied, AssessedDocument16 pagesTransfer Taxes: SEC. 84 Rates of Estate Tax. - There Shall Be Levied, AssessedAster Beane AranetaNo ratings yet

- Business Tax MODULEDocument32 pagesBusiness Tax MODULEDanica GeneralaNo ratings yet

- Attachment To State Tax Including Cpa Cert PDFDocument4 pagesAttachment To State Tax Including Cpa Cert PDFBradNo ratings yet

- Transfer & Business Taxation, 3 Edition: Chapter 1 - Succession & Transfer TaxesDocument39 pagesTransfer & Business Taxation, 3 Edition: Chapter 1 - Succession & Transfer TaxesRachelle JoseNo ratings yet

- Elements of A Trust - Graphic IllustrationDocument68 pagesElements of A Trust - Graphic Illustrationsigma66No ratings yet

- Estate Tax Prelim OutlineDocument40 pagesEstate Tax Prelim OutlineRomz NuneNo ratings yet

- Gift DeedDocument22 pagesGift DeedVinod YbNo ratings yet

- Estate Tax: Class Transcription - Iii-Manresa B 2019-2020Document72 pagesEstate Tax: Class Transcription - Iii-Manresa B 2019-2020Ella CblNo ratings yet

- Introduction to Income Taxation: Basic Principles and LimitationsDocument82 pagesIntroduction to Income Taxation: Basic Principles and LimitationsAbby Gail Tiongson83% (6)

- Taxation Solutions Manual Chapters 1-2Document39 pagesTaxation Solutions Manual Chapters 1-2Pau CaisipNo ratings yet

- Extrajudicial Settlement of Estate in The PhilippinesDocument4 pagesExtrajudicial Settlement of Estate in The PhilippinesDon Astorga Dehayco0% (1)

- EJS MemoDocument3 pagesEJS MemoGigi AngNo ratings yet

- Commissioner of Internal Revenue vs. Carlos Palanca, Jr. G.R. No. L-16626 October 29, 1966 Regala, J.: FactsDocument2 pagesCommissioner of Internal Revenue vs. Carlos Palanca, Jr. G.R. No. L-16626 October 29, 1966 Regala, J.: FactsKrizzan Mariz ValdezNo ratings yet

- Tax 2 Reviewer Part 1Document23 pagesTax 2 Reviewer Part 1Boz DigayNo ratings yet

- Sample BrochureDocument7 pagesSample BrochureAzel FajaritoNo ratings yet

- Group 10Document41 pagesGroup 10mau nbsbNo ratings yet

- Tax Credit and AdministrationDocument20 pagesTax Credit and AdministrationedzateradoNo ratings yet

- CHAPTER 1 3 Bus - TaxDocument26 pagesCHAPTER 1 3 Bus - TaxMixx MineNo ratings yet

- ESTATE TAX and DONOR'S TAXDocument6 pagesESTATE TAX and DONOR'S TAXima funtanaresNo ratings yet

- Transfer TaxesDocument26 pagesTransfer TaxesAr Zel ArzelNo ratings yet

- Estate Tax Guide for BeginnersDocument10 pagesEstate Tax Guide for BeginnersGelyn CruzNo ratings yet

- Estate Tax Notes LimDocument5 pagesEstate Tax Notes LimAustine Clarese VelascoNo ratings yet

- Estate and Donors Tax NotesDocument24 pagesEstate and Donors Tax Notesmichelle_calzada_1No ratings yet

- Transfer Tax GuideDocument6 pagesTransfer Tax Guideangelli45No ratings yet

- Donor'S Tax Donor'S Tax: Payment ProcessDocument2 pagesDonor'S Tax Donor'S Tax: Payment ProcessPATRICIA ANGELICA VINUYANo ratings yet

- Revised Administrative Code: Accrual of Inheritance TaxDocument1 pageRevised Administrative Code: Accrual of Inheritance TaxHenri VasquezNo ratings yet

- Business and Transfer Taxes NotesDocument4 pagesBusiness and Transfer Taxes Noteslaur33n0% (1)

- Business Tax ReviewerDocument86 pagesBusiness Tax ReviewerJhoren RemolinNo ratings yet

- TRANSFER TAX-burden Imposed Upon The Right To Gratuitously Transfer or TransmitDocument2 pagesTRANSFER TAX-burden Imposed Upon The Right To Gratuitously Transfer or TransmitJohn Lester LantinNo ratings yet

- Sept 24 Notes Settlement of Estate ReportDocument19 pagesSept 24 Notes Settlement of Estate ReportgongsilogNo ratings yet

- Guidelines and Instructions For BIR FORM No. 2118-EA Estate Tax Amnesty ReturnDocument1 pageGuidelines and Instructions For BIR FORM No. 2118-EA Estate Tax Amnesty ReturnChaNo ratings yet

- Estate TaxDocument4 pagesEstate TaxWuwu WuswewuNo ratings yet

- Taxation On Estates and TrustsDocument31 pagesTaxation On Estates and TrustsAndrea Renice S. FerriolNo ratings yet

- Estate Tax: Difference With Income Tax (Ter)Document7 pagesEstate Tax: Difference With Income Tax (Ter)Equi TinNo ratings yet

- ESTATE TAXES AND TRUSTSDocument3 pagesESTATE TAXES AND TRUSTSRalph Christian UsonNo ratings yet

- TAX-101 (Estate Tax)Document11 pagesTAX-101 (Estate Tax)Princess ManaloNo ratings yet

- 03 Transfer Taxes: Clwtaxn de La Salle UniversityDocument35 pages03 Transfer Taxes: Clwtaxn de La Salle UniversityTrisha RuzolNo ratings yet

- Legal Accounting and The Law On SuccessionDocument3 pagesLegal Accounting and The Law On SuccessionPatrick CaldoNo ratings yet

- Estate Tax ReportDocument4 pagesEstate Tax ReportMAICA SELGUERANo ratings yet

- Activity No. 1: Estate Tax (Pages 440-461) : Multiple Choice QuestionsDocument5 pagesActivity No. 1: Estate Tax (Pages 440-461) : Multiple Choice QuestionsSara Andrea SantiagoNo ratings yet

- Tax 2 Seatwork Group 4Document11 pagesTax 2 Seatwork Group 4Maria CarlinaNo ratings yet

- Estate Tax Payable - 1625701751Document17 pagesEstate Tax Payable - 1625701751T-121-Gutierrez, GwynethNo ratings yet

- 1800 Bir ForDocument1 page1800 Bir Formijareschabelita2No ratings yet

- Extrajudicial Settlement of An EstateDocument4 pagesExtrajudicial Settlement of An EstatePAMELA DOLINA100% (1)

- Transfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGDocument61 pagesTransfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGethel hyugaNo ratings yet

- University of Baguio School of LawDocument11 pagesUniversity of Baguio School of LawMaria CarlinaNo ratings yet

- Estate Taxation GuideDocument154 pagesEstate Taxation GuidekekadiegoNo ratings yet

- Donor's Tax PDFDocument16 pagesDonor's Tax PDFJewel Francine PUDESNo ratings yet

- Gamilkisser ETDTDocument5 pagesGamilkisser ETDTKisser Gail GamilNo ratings yet

- Taxation TwoDocument66 pagesTaxation TwomashedpotatoaddictNo ratings yet

- Tax PresentationDocument17 pagesTax PresentationJulia Larisa LimNo ratings yet

- Estate Tax (Exercises)Document3 pagesEstate Tax (Exercises)dimpy dNo ratings yet

- Succession and Transfer TaxesDocument21 pagesSuccession and Transfer TaxesjetotheloNo ratings yet

- Reliability and Validity Standards for Effective Personnel SelectionDocument4 pagesReliability and Validity Standards for Effective Personnel Selectionjohn randelNo ratings yet

- HRM Lesson 4Document16 pagesHRM Lesson 4john randelNo ratings yet

- Preaching 7-12-20Document31 pagesPreaching 7-12-20john randelNo ratings yet

- Back To BasicDocument1 pageBack To Basicjohn randelNo ratings yet

- Preaching 7-12-20Document31 pagesPreaching 7-12-20john randelNo ratings yet

- Back To BasicDocument1 pageBack To Basicjohn randelNo ratings yet

- Estate tax essentialsDocument66 pagesEstate tax essentialsmoshi kpop cartNo ratings yet

- Trusts and Estates - Edmisten - Summer 2003 - 3Document6 pagesTrusts and Estates - Edmisten - Summer 2003 - 3champion_egy325No ratings yet

- Taxation On Estates and TrustsDocument31 pagesTaxation On Estates and TrustsAndrea Renice S. FerriolNo ratings yet

- PLM 2019 2020 Tax 2 Part 1 Transfer Taxes Re Estate Donors Taxes Complete LectureDocument39 pagesPLM 2019 2020 Tax 2 Part 1 Transfer Taxes Re Estate Donors Taxes Complete LectureJustine DagdagNo ratings yet

- Cases On PropertyDocument40 pagesCases On PropertyLaike16No ratings yet

- Calculate Vanishing DeductionDocument32 pagesCalculate Vanishing DeductionJayvee Felipe100% (1)

- Estate of Reyes v. CIRDocument31 pagesEstate of Reyes v. CIRCon ConNo ratings yet

- Estate Tax Amnesty FlyerDocument2 pagesEstate Tax Amnesty FlyerjdenilaNo ratings yet

- RMO - No. 33-2019 PDFDocument7 pagesRMO - No. 33-2019 PDFRedbutterfly Del Mundo GalindoNo ratings yet

- Civil LawDocument177 pagesCivil LawReizle Ann Bi CaddawanNo ratings yet

- 550 Vanderbilt Amendment 10 To Offering PlanDocument34 pages550 Vanderbilt Amendment 10 To Offering PlanNorman OderNo ratings yet

- MIAA v. CA (Dela Cruz)Document8 pagesMIAA v. CA (Dela Cruz)Carl IlaganNo ratings yet

- AUSL LMT TaxDocument16 pagesAUSL LMT TaxMaria GarciaNo ratings yet

- TRAIN Law Overview and OutlookDocument4 pagesTRAIN Law Overview and OutlookAdam Ross Toledo BrionesNo ratings yet

- Estate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaDocument38 pagesEstate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaRaymundo EirahNo ratings yet

- 40.MIAA Vs ParanaqueDocument25 pages40.MIAA Vs ParanaqueClyde KitongNo ratings yet

- Introduction to transfer taxes and succession conceptsDocument12 pagesIntroduction to transfer taxes and succession conceptsErica XaoNo ratings yet

- Gross Estate ReviewerDocument9 pagesGross Estate ReviewerAiziel OrenseNo ratings yet