Professional Documents

Culture Documents

CHAPTER 10. Compensation Income 2019

CHAPTER 10. Compensation Income 2019

Uploaded by

CJ GranadaCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCHAPTER 10. Compensation Income 2019

CHAPTER 10. Compensation Income 2019

Uploaded by

CJ Granada ea re me 29 na emt

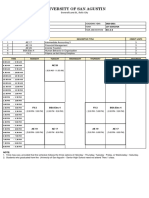

amounting to not more than P2,000 Femetsed unused vacation eavecredlis days

ee raed ee tee

alte met tr ae nce] Seeman” Sl

aicare needs anual medial/executve checkup, maternity assist

{ndroutine consitatons not exceeding P10,000 per annum

Aequlred: Determine the taxable amount of de-inimis benefits.

7. Laundry allowance no exceeding P300 per month

8 Employee achievement award, eg. for length of service or sia) sou:

achievement which must bein the form of tangible property other than a fot _Eme_

or git cericates, with an annual monetary value not exceeding PIU yonzed unused VL PgA00 P60 Po

received ty the employee under an established written plan which does] tess unused Sc 5400 05.400

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- College of Commerce General Luna ST., Iloilo City: University of San AgustinDocument19 pagesCollege of Commerce General Luna ST., Iloilo City: University of San AgustinCJ GranadaNo ratings yet

- 2200-M Jan 2018 ENCS Final VersionDocument2 pages2200-M Jan 2018 ENCS Final VersionCJ GranadaNo ratings yet

- Pre 12 QuizDocument9 pagesPre 12 QuizCJ GranadaNo ratings yet

- Module 1 For PrE 1 - Auditing and Assurance PrinciplesDocument21 pagesModule 1 For PrE 1 - Auditing and Assurance PrinciplesCJ GranadaNo ratings yet

- Quiz 6 Chap 5Document2 pagesQuiz 6 Chap 5CJ GranadaNo ratings yet

- Course Title: College of CommerceDocument6 pagesCourse Title: College of CommerceCJ GranadaNo ratings yet

- Installment Liquidation: Schedule of Safe PaymentsDocument22 pagesInstallment Liquidation: Schedule of Safe PaymentsCJ GranadaNo ratings yet

- Value Added Tax, Customs and Excise Duties and Energy TaxesDocument18 pagesValue Added Tax, Customs and Excise Duties and Energy TaxesCJ GranadaNo ratings yet

- College of Commerce General Luna ST., Iloilo City: University of San AgustinDocument12 pagesCollege of Commerce General Luna ST., Iloilo City: University of San AgustinCJ GranadaNo ratings yet

- University of San Agustin: General Luna ST., Iloilo CityDocument1 pageUniversity of San Agustin: General Luna ST., Iloilo CityCJ GranadaNo ratings yet

- University of San Agustin College of Commerce General Luna ST., Iloilo CityDocument14 pagesUniversity of San Agustin College of Commerce General Luna ST., Iloilo CityCJ GranadaNo ratings yet

- Slides - Lump Sum LiquidationDocument67 pagesSlides - Lump Sum LiquidationCJ GranadaNo ratings yet

- Cash Priority Program Acctg For Special Transactions ReportDocument11 pagesCash Priority Program Acctg For Special Transactions ReportCJ GranadaNo ratings yet

- Instructions - Government Accounting 3b - University of San AgustinDocument3 pagesInstructions - Government Accounting 3b - University of San AgustinCJ GranadaNo ratings yet

- PrE6 Module 4 Partnership Liquidation Schedule of Safe PaymentsDocument9 pagesPrE6 Module 4 Partnership Liquidation Schedule of Safe PaymentsCJ GranadaNo ratings yet

- Module 2, Assessment 1: Perceived Benefits of Goods and Services InstructionsDocument2 pagesModule 2, Assessment 1: Perceived Benefits of Goods and Services InstructionsCJ GranadaNo ratings yet

- How To Build, Deploy, and Operationalize AI AssistantsDocument13 pagesHow To Build, Deploy, and Operationalize AI AssistantsCJ GranadaNo ratings yet

- Welcome Message To AE 26 Students PDFDocument1 pageWelcome Message To AE 26 Students PDFCJ GranadaNo ratings yet

- Paglipat 2 (Modyul 1 Fil 2)Document3 pagesPaglipat 2 (Modyul 1 Fil 2)CJ GranadaNo ratings yet

- Cambodia TeamDocument9 pagesCambodia TeamCJ GranadaNo ratings yet

- Gawain 1 (Modyul2)Document1 pageGawain 1 (Modyul2)CJ GranadaNo ratings yet

- Module 7 Packet: College OF CommerceDocument13 pagesModule 7 Packet: College OF CommerceCJ GranadaNo ratings yet

- Gawain 1 (Modyul2)Document1 pageGawain 1 (Modyul2)CJ GranadaNo ratings yet

- Module 5 Packet: College OF CommerceDocument16 pagesModule 5 Packet: College OF CommerceCJ Granada100% (1)

- 11 MODULE 3 For AE 19 PDFDocument25 pages11 MODULE 3 For AE 19 PDFCJ GranadaNo ratings yet

- Module 6 Packet: College OF CommerceDocument18 pagesModule 6 Packet: College OF CommerceCJ GranadaNo ratings yet

- Lesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingDocument28 pagesLesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingCJ GranadaNo ratings yet

- Module 4 Packet: College OF CommerceDocument18 pagesModule 4 Packet: College OF CommerceCJ GranadaNo ratings yet

- 3 Module 3 - Notes To Financial Statements AE 17 Intermediate Accounting 3Document14 pages3 Module 3 - Notes To Financial Statements AE 17 Intermediate Accounting 3CJ Granada100% (1)

- Module 2 Packet: College OF CommerceDocument22 pagesModule 2 Packet: College OF CommerceCJ Granada100% (1)