Professional Documents

Culture Documents

ROI, Residual Income - Northern Division Manager

Uploaded by

Ishan0 ratings0% found this document useful (0 votes)

116 views1 pageThe ROI for the Northern Division last year was 21%. With the addition of a new product line, the ROI would decrease to 19.96%. The residual income last year was $570,000. With the addition of the new product line, the residual income would increase to $595,000. Therefore, the manager should accept the new product line based on the residual income analysis, even though ROI would decrease.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe ROI for the Northern Division last year was 21%. With the addition of a new product line, the ROI would decrease to 19.96%. The residual income last year was $570,000. With the addition of the new product line, the residual income would increase to $595,000. Therefore, the manager should accept the new product line based on the residual income analysis, even though ROI would decrease.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

116 views1 pageROI, Residual Income - Northern Division Manager

Uploaded by

IshanThe ROI for the Northern Division last year was 21%. With the addition of a new product line, the ROI would decrease to 19.96%. The residual income last year was $570,000. With the addition of the new product line, the residual income would increase to $595,000. Therefore, the manager should accept the new product line based on the residual income analysis, even though ROI would decrease.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

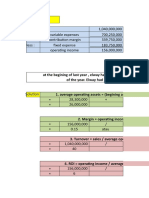

ROI = Net Operating Income / Average Operating Assets

1) Northern Division ROI for last year:

Net Operating Income Last year $ 1,995,000

Average divisional operating assets last year $ 9,500,000

ROI for Last year (1,995,000 / 9,500,000)

21.00%

Northern Division ROI for last year 21.00%

2) Northern Division ROI if New Product line added

Net Operating Income (1,995,000 + 400,000) $ 2,395,000

Average divisional operating assets (9,500,000 + 2,500,000) $ 12,000,000

ROI if new product line added (2,395,000 / 12,000,000) 19.96%

Northern Division ROI if new product line is added 19.96%

3) Manager should REJECT new product line based on ROI because overall ROI will decrease

from the last year if manager accepts the new product line

4) Northern Division residual income for Last year

Residual Income= (Net Operating Income - Minimum Required Return)

Minumum Required Return = (Average operating assets × Minimum acceptable rate of return)

Net Operating Income $ 1,995,000

Less: Minimum required return (9,500,000 × 15%) (1,425,000)

Residual Income $ 570,000

Northern Division residual income for last year $ 570,000

5) Northern Division residual income if the new product line is added

Net Operating Income $ 2,395,000

Less: Minimum required return (12,000,000 × 15%) (1,800,000)

Residual Income $ 595,000

Northern Division residual income if product line added $ 595,000

6) Northern Division manager should ACCEPT the new product line based on the residual

income. Because the residual income would increase if Manager accept the new product line

from the last year.

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Performance MGMT Discussion QuestionsDocument7 pagesPerformance MGMT Discussion QuestionsSritel Boutique HotelNo ratings yet

- Akmen Chapter 12 (Putri Ramadhani)Document22 pagesAkmen Chapter 12 (Putri Ramadhani)Putri RamadhaniNo ratings yet

- Exercise 1Document4 pagesExercise 1Nyster Ann RebenitoNo ratings yet

- Akmen CH 12 KelarDocument19 pagesAkmen CH 12 KelarFadhliyaFNo ratings yet

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeDocument3 pagesMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiNo ratings yet

- Chapter 12 ProblemsDocument40 pagesChapter 12 ProblemsInciaNo ratings yet

- Performance Measurement in Decentralized Organizations: ERLINDA SACHARISSA (201850021) CINDY (201850046)Document37 pagesPerformance Measurement in Decentralized Organizations: ERLINDA SACHARISSA (201850021) CINDY (201850046)cindy chandraNo ratings yet

- 13 Roi, Ri, EvaDocument32 pages13 Roi, Ri, EvaANSuciZahra100% (1)

- Reviewer MactwoDocument17 pagesReviewer MactwoJessa Iloso PerezNo ratings yet

- HM CH 10 ExerciseDocument2 pagesHM CH 10 ExerciseSean BeanNo ratings yet

- 2008 Acct 212 Chapter 10 Resp Accg NotesDocument6 pages2008 Acct 212 Chapter 10 Resp Accg NotesBrandon HookerNo ratings yet

- Absorption and Marginal CostingDocument4 pagesAbsorption and Marginal CostingTrya SalsabillaNo ratings yet

- GNB14 e CH 11 ExamDocument3 pagesGNB14 e CH 11 ExamLeneth AngtiampoNo ratings yet

- Garrison 14e Practice Exam - Chapter 6Document4 pagesGarrison 14e Practice Exam - Chapter 6Đàm Quang Thanh TúNo ratings yet

- Lecture 27Document34 pagesLecture 27Riaz Baloch NotezaiNo ratings yet

- Sample ProblemDocument4 pagesSample ProblemLealyn CuestaNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- Cases 3 - Berlin Novanolo G (29123112)Document4 pagesCases 3 - Berlin Novanolo G (29123112)catatankotakkuningNo ratings yet

- Accounting ProblemsDocument1 pageAccounting ProblemstNo ratings yet

- Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manual 1Document15 pagesByrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manual 1laura100% (31)

- Problem1 - The Following Data Are From The Giant Oreo Division at Keebler CookiesDocument29 pagesProblem1 - The Following Data Are From The Giant Oreo Division at Keebler CookiesFerl ElardoNo ratings yet

- Metrillo - Comprehensive ProbDocument12 pagesMetrillo - Comprehensive ProbLordCelene C MagyayaNo ratings yet

- Segment Reporting, Decentralization and The Balanced ScorecardDocument20 pagesSegment Reporting, Decentralization and The Balanced ScorecardSneha SureshNo ratings yet

- Chapter 11Document8 pagesChapter 11yousufmeahNo ratings yet

- Responsibility and Segment Accounting CRDocument24 pagesResponsibility and Segment Accounting CRAshy LeeNo ratings yet

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Salco7 12Document3 pagesSalco7 12Einstein WilliamsNo ratings yet

- ACCTG7 Chap14 Exercise 1-3Document5 pagesACCTG7 Chap14 Exercise 1-3Tasarra Jergen Febb ANo ratings yet

- Group 3 StrataDocument22 pagesGroup 3 StrataJoebet DebuyanNo ratings yet

- Business ApplicationsDocument14 pagesBusiness Applicationsrommel legaspi100% (2)

- Sem Output Probs and AnswersDocument16 pagesSem Output Probs and AnswersMargie KeiNo ratings yet

- 8a. Responsibility and Segment Accounting CRDocument20 pages8a. Responsibility and Segment Accounting CRAngelica Gaspay EstalillaNo ratings yet

- PROBLEM 1. Duif Company: Under VariableDocument6 pagesPROBLEM 1. Duif Company: Under VariableUchayyaNo ratings yet

- Cost AccountingDocument15 pagesCost AccountingmeskiNo ratings yet

- Session 2 Practice Problem SolutionDocument15 pagesSession 2 Practice Problem SolutionRishika RathiNo ratings yet

- Return On InvestmentDocument5 pagesReturn On Investmentela kikay100% (1)

- MA Chap 5Document19 pagesMA Chap 5Lan Tran HoangNo ratings yet

- DECENTRALIZATIONDocument5 pagesDECENTRALIZATIONhashinekaymhe tarucNo ratings yet

- CH 14 Ex 9 1011Document7 pagesCH 14 Ex 9 1011tirol.d.cjNo ratings yet

- Chapter 14 Answer PDF FreeDocument24 pagesChapter 14 Answer PDF FreeAang GrandeNo ratings yet

- Segment Reporting RobiulDocument38 pagesSegment Reporting Robiulmizan_m100% (3)

- Engineering Economics LESSON 3bDocument4 pagesEngineering Economics LESSON 3bJohn Vincent BaylonNo ratings yet

- Cap 8 Performance CH09 SM 1Document61 pagesCap 8 Performance CH09 SM 1Lê Chấn PhongNo ratings yet

- COMPREHENSIVE PROBLEMS-lordyDocument8 pagesCOMPREHENSIVE PROBLEMS-lordyLordCelene C MagyayaNo ratings yet

- Last Assignment (Najeeb)Document7 pagesLast Assignment (Najeeb)Najeeb KhanNo ratings yet

- Case Study Accounting Oart2Document5 pagesCase Study Accounting Oart2Vero MinaNo ratings yet

- Chapter 14Document18 pagesChapter 14RenNo ratings yet

- Chapter 8 Performance Measurement Evaluation Nov2020 1Document113 pagesChapter 8 Performance Measurement Evaluation Nov2020 1Question BankNo ratings yet

- Book-Responsibility Actg-SolMan PDFDocument18 pagesBook-Responsibility Actg-SolMan PDFLordson RamosNo ratings yet

- Chapter 14 - Answer PDFDocument18 pagesChapter 14 - Answer PDFAldrin ZlmdNo ratings yet

- EXERCISE 12-2 (15 Minutes)Document9 pagesEXERCISE 12-2 (15 Minutes)Mari Louis Noriell MejiaNo ratings yet

- Chapter 4. Review of AccountingDocument49 pagesChapter 4. Review of AccountingMichenNo ratings yet

- Strategic Cost Management Practical Applications DagpilanDocument6 pagesStrategic Cost Management Practical Applications Dagpilancarol indanganNo ratings yet

- 1chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDocument4 pages1chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- Responsibility Accounting: Chapter Study ObjectivesDocument7 pagesResponsibility Accounting: Chapter Study ObjectivesLive LoveNo ratings yet

- CHP 23Document19 pagesCHP 23lena cpaNo ratings yet

- Ch08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFDocument10 pagesCh08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFjdiaz_646247No ratings yet

- Chapter 11 PDFDocument12 pagesChapter 11 PDFJay BrockNo ratings yet

- Mayank Mani TripathiDocument1 pageMayank Mani TripathiIshanNo ratings yet

- 80 D PolicyDocument6 pages80 D PolicyIshanNo ratings yet

- Accumulated Expenditure, Capitalized Cost & Specific Interest Cost Method - Mason ManufacturingDocument9 pagesAccumulated Expenditure, Capitalized Cost & Specific Interest Cost Method - Mason ManufacturingIshanNo ratings yet

- Segment Reporting - Regal Cycle Manufacturing 2Document2 pagesSegment Reporting - Regal Cycle Manufacturing 2IshanNo ratings yet

- Review Problem: Budget Schedules: RequiredDocument8 pagesReview Problem: Budget Schedules: RequiredShafa AlyaNo ratings yet

- Days Sales Uncollected - Simon CompanyDocument2 pagesDays Sales Uncollected - Simon CompanyIshanNo ratings yet

- Acquisiton Cost - Internation Auto and GPDocument4 pagesAcquisiton Cost - Internation Auto and GPIshanNo ratings yet

- Acquisition by Marshal and Tucker - 2Document5 pagesAcquisition by Marshal and Tucker - 2IshanNo ratings yet

- Accounting Equation - New BusinessDocument2 pagesAccounting Equation - New BusinessIshanNo ratings yet

- Accounting EquationDocument2 pagesAccounting EquationIshanNo ratings yet

- Accounts Receivable Control Account in The General Ledger of Montgomery CompanyDocument2 pagesAccounts Receivable Control Account in The General Ledger of Montgomery CompanyIshanNo ratings yet

- Accounting Equation - R.FannieDocument2 pagesAccounting Equation - R.FannieIshanNo ratings yet

- Accounts Receivable Turnover and Days in Sales ReceivableDocument4 pagesAccounts Receivable Turnover and Days in Sales ReceivableIshanNo ratings yet

- Accounting Equation - Philips Truck RentalDocument2 pagesAccounting Equation - Philips Truck RentalIshanNo ratings yet

- Absorption Costing - Diego Company ManufacturesDocument2 pagesAbsorption Costing - Diego Company ManufacturesIshanNo ratings yet

- Accounting Equation - George LittlechildDocument2 pagesAccounting Equation - George LittlechildIshanNo ratings yet

- Accumulated Expenditure, Capitalized Cost & Specific Interest Cost Method - Mason ManufacturingDocument9 pagesAccumulated Expenditure, Capitalized Cost & Specific Interest Cost Method - Mason ManufacturingIshanNo ratings yet

- Accounts Receivable Turnover and Days in Sales ReceivableDocument4 pagesAccounts Receivable Turnover and Days in Sales ReceivableIshanNo ratings yet

- Absorption and Variable Costing - Burns CompanyDocument1 pageAbsorption and Variable Costing - Burns CompanyIshanNo ratings yet

- Accounts Receivable Control Account in The General Ledger of Montgomery CompanyDocument2 pagesAccounts Receivable Control Account in The General Ledger of Montgomery CompanyIshanNo ratings yet

- Accounts Receivable, Allowance For Doubtful Accounts - Halleran CompanyDocument4 pagesAccounts Receivable, Allowance For Doubtful Accounts - Halleran CompanyIshanNo ratings yet

- 1) Calculation of Activity RateDocument2 pages1) Calculation of Activity RateIshanNo ratings yet

- Accounting Equation - R.FannieDocument2 pagesAccounting Equation - R.FannieIshanNo ratings yet

- ABC and Traditional Costing - Dining Chairs and TablesDocument1 pageABC and Traditional Costing - Dining Chairs and TablesIshanNo ratings yet

- 1) Calculation of Activity RateDocument2 pages1) Calculation of Activity RateIshanNo ratings yet

- Harry Smith - BRSDocument2 pagesHarry Smith - BRSIshanNo ratings yet

- Absorption Costing - Diego Company ManufacturesDocument2 pagesAbsorption Costing - Diego Company ManufacturesIshanNo ratings yet

- ABC CostingDocument4 pagesABC CostingIshanNo ratings yet

- GL, TB, IS, BS, LedgersDocument8 pagesGL, TB, IS, BS, LedgersIshanNo ratings yet