Professional Documents

Culture Documents

Real Otpions - Example: Probability Expected Cash Flows (MLN $) Scenario

Uploaded by

David BusinelliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Real Otpions - Example: Probability Expected Cash Flows (MLN $) Scenario

Uploaded by

David BusinelliCopyright:

Available Formats

Real Otpions – Example

• Biongen is a biotechnology firm that has patented a drug for the cure of the multiple

sclerosis called Avonex.

• The objective is to estimate the value of the patent with the following information:

– the value of the expected cash flows, without taking into account the development

cost, is 3.578 mln $ (discounted at t=1)

Scenario Expected cash flows (mln $) Probability

A 1900 0,6

B 8600 0,1

C 5500 0,3

– the investment in the current year to go ahead with the development of the drug is

290 mln$, the cost to complete the development is 2.585 mln$

– the patent will protect for the next 17 years and the risk free interest rate is 2%

1. Estimate the value of the patent using the traditional NPV technique

2. Estimate now the value of the patent using the real options analysis.

You might also like

- Exam SolutionDocument3 pagesExam SolutionDavid BusinelliNo ratings yet

- Interventional Med-Tech Primer (Atlanata)Document41 pagesInterventional Med-Tech Primer (Atlanata)divyabuni100% (1)

- Advance Sisay MFGDocument33 pagesAdvance Sisay MFGRamon ColonNo ratings yet

- Notes - SCMDocument96 pagesNotes - SCMDavid BusinelliNo ratings yet

- Notes - SCMDocument96 pagesNotes - SCMDavid BusinelliNo ratings yet

- Supply Chain ManagementDocument43 pagesSupply Chain ManagementDavid BusinelliNo ratings yet

- Case2 04 2Document9 pagesCase2 04 2writer topNo ratings yet

- 8 - Value Stream Mapping PDFDocument47 pages8 - Value Stream Mapping PDFDavid BusinelliNo ratings yet

- Managerial Economics Applications Strategies and Tactics 13th Edition McGuigan Moyer Harris Test BankDocument7 pagesManagerial Economics Applications Strategies and Tactics 13th Edition McGuigan Moyer Harris Test Bankrobert100% (23)

- Cost-Benefit Analysis AnswersDocument81 pagesCost-Benefit Analysis AnswersAnnNo ratings yet

- Investment Decision Rules: © 2019 Pearson Education LTDDocument22 pagesInvestment Decision Rules: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Integrated Nematode Management: State-of-the-Art and Visions for the FutureFrom EverandIntegrated Nematode Management: State-of-the-Art and Visions for the FutureNo ratings yet

- Possibili Domande Teoriche SCMDocument8 pagesPossibili Domande Teoriche SCMDavid BusinelliNo ratings yet

- Possibili Domande Teoriche SCMDocument8 pagesPossibili Domande Teoriche SCMDavid BusinelliNo ratings yet

- Risk Analysis Techniques and Concepts in Capital BudgetingDocument49 pagesRisk Analysis Techniques and Concepts in Capital Budgeting1986anu100% (2)

- Peter Navarro Memo - February 23, 2020Document4 pagesPeter Navarro Memo - February 23, 2020Eric L. VanDussenNo ratings yet

- Managerial Economics Applications Strategies and Tactics 13th Edition Mcguigan Test BankDocument26 pagesManagerial Economics Applications Strategies and Tactics 13th Edition Mcguigan Test BankMichaelJohnstonipwd100% (52)

- Dwnload Full Managerial Economics Applications Strategies and Tactics 13th Edition Mcguigan Test Bank PDFDocument36 pagesDwnload Full Managerial Economics Applications Strategies and Tactics 13th Edition Mcguigan Test Bank PDFowen4ljoh100% (7)

- Towse Et Al 2017Document6 pagesTowse Et Al 20172tbjcv7gyzNo ratings yet

- Full Download Managerial Economics Applications Strategies and Tactics 13th Edition Mcguigan Test BankDocument36 pagesFull Download Managerial Economics Applications Strategies and Tactics 13th Edition Mcguigan Test Bankthuyradzavichzuk100% (40)

- Global Market For Nanotechnology Products Used in Water Treatment To Grow To $2.2 Billion in 2015Document2 pagesGlobal Market For Nanotechnology Products Used in Water Treatment To Grow To $2.2 Billion in 2015BCC ResearchNo ratings yet

- Endogene A09tp - Pitch DeckDocument29 pagesEndogene A09tp - Pitch DeckJatan MudgalNo ratings yet

- Managerial Economics Problem Set 2Document2 pagesManagerial Economics Problem Set 2Kring JannNo ratings yet

- Test Bank For Managerial Economics Applications Strategies and Tactics 13Th Edition Mcguigan Moyer Harris 1285420926 9781285420929 Full Chapter PDFDocument28 pagesTest Bank For Managerial Economics Applications Strategies and Tactics 13Th Edition Mcguigan Moyer Harris 1285420926 9781285420929 Full Chapter PDFlynn.brickhouse665100% (12)

- Ch3 Review ProblemsDocument6 pagesCh3 Review ProblemsSylvia CioccaNo ratings yet

- Capital Budgeting Risk Analysis TechniquesDocument16 pagesCapital Budgeting Risk Analysis TechniquesShyam SunderNo ratings yet

- Tutorial 2Document2 pagesTutorial 2Bochra SassiNo ratings yet

- Econ Macro Canadian 1St Edition Mceachern Solutions Manual Full Chapter PDFDocument26 pagesEcon Macro Canadian 1St Edition Mceachern Solutions Manual Full Chapter PDFeric.herrara805100% (12)

- ECON Macro Canadian 1st Edition McEachern Solutions Manual 1Document36 pagesECON Macro Canadian 1st Edition McEachern Solutions Manual 1shawnmccartyjxqsknofywNo ratings yet

- Bioscan Group 2 11062023Document4 pagesBioscan Group 2 11062023Aditi KathinNo ratings yet

- ROV: Real Option ValuationDocument33 pagesROV: Real Option ValuationdNo ratings yet

- Fin370 Myfinancelab Week 3 New 2015Document4 pagesFin370 Myfinancelab Week 3 New 2015G JhaNo ratings yet

- Recent M & A in PharmaDocument9 pagesRecent M & A in PharmaSoumya KhanduriNo ratings yet

- R A C B: ISK Nalysis in Apital UdgetingDocument42 pagesR A C B: ISK Nalysis in Apital UdgetingMantosh SharmaNo ratings yet

- A#8 MLPDocument10 pagesA#8 MLPScribdTranslationsNo ratings yet

- Results of Competition: Biomedical Catalyst 2017 Round 3: Early Stage 1707 - CRD - HEAL - BMC2017 - R3 - ESDocument10 pagesResults of Competition: Biomedical Catalyst 2017 Round 3: Early Stage 1707 - CRD - HEAL - BMC2017 - R3 - ESJack PadiNo ratings yet

- lý thuyết vềcông nghệ genDocument5 pageslý thuyết vềcông nghệ gentrung hiếu trầnNo ratings yet

- Topic 8 Cost of Capital-StudentDocument28 pagesTopic 8 Cost of Capital-StudentlinhttisvnuNo ratings yet

- Sensitivity Analysis: Submitted by Muneeb Ul Haq Reg # 1684119 MPM 2 BDocument5 pagesSensitivity Analysis: Submitted by Muneeb Ul Haq Reg # 1684119 MPM 2 BSheikh Muneeb Ul HaqNo ratings yet

- 3-Min Pitch NGP - Jan 2022Document3 pages3-Min Pitch NGP - Jan 2022Cathy SkinnerNo ratings yet

- Finance FIN2704/FIN2704X: Lecture 8: Capital Budgeting 1Document67 pagesFinance FIN2704/FIN2704X: Lecture 8: Capital Budgeting 1oehiohiwegNo ratings yet

- Arbitrage Pricing TheoryDocument8 pagesArbitrage Pricing TheoryDushyant MudgalNo ratings yet

- Cost Benefit Analysis 2.11.2023Document24 pagesCost Benefit Analysis 2.11.2023Hassan ElmiNo ratings yet

- Chapter 14 - Multinational Capital Budgeting AnswersDocument9 pagesChapter 14 - Multinational Capital Budgeting Answersabdullah100% (1)

- Risk Analysis, Real Options and Capital Budgeting PDFDocument62 pagesRisk Analysis, Real Options and Capital Budgeting PDFAMIT SINHA MA ECO DEL 2022-24No ratings yet

- Biobanking - Equipments, 2009-2015 - BroucherDocument4 pagesBiobanking - Equipments, 2009-2015 - BroucherAxis ResearchMindNo ratings yet

- S 9 - Capital Investment DecisionDocument24 pagesS 9 - Capital Investment DecisionAninda DuttaNo ratings yet

- 878 Ch08ARQDocument5 pages878 Ch08ARQMaydawati Fidellia GunawanNo ratings yet

- Investor Presentation: Nasdaq: BdsiDocument30 pagesInvestor Presentation: Nasdaq: BdsicgiscgisNo ratings yet

- Capnia, Inc. (CAPN) A Highly Advantaged Product in A Huge, Under-Penetrated MarketDocument4 pagesCapnia, Inc. (CAPN) A Highly Advantaged Product in A Huge, Under-Penetrated MarketThe Focused Stock TraderNo ratings yet

- Question and Answer - 54Document31 pagesQuestion and Answer - 54acc-expertNo ratings yet

- Gugerell 16Document7 pagesGugerell 16Camilo Flores VerdugoNo ratings yet

- 3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveDocument4 pages3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveMinh NguyenNo ratings yet

- Session 5 Dealing With Risk and UncertaintiesDocument14 pagesSession 5 Dealing With Risk and UncertaintiesShabahul ArafiNo ratings yet

- Risk Analysis in Capital Bud PDFDocument32 pagesRisk Analysis in Capital Bud PDFbinu100% (1)

- Economic LetterDocument2 pagesEconomic LetterAmanullah Bashir GilalNo ratings yet

- Midterm Test SumartiniDocument10 pagesMidterm Test SumartiniSumar tiniNo ratings yet

- Course Name: Introduction To Micro-Economics Level: Ma / MSCDocument14 pagesCourse Name: Introduction To Micro-Economics Level: Ma / MSCMuhammad NomanNo ratings yet

- Gsbs6385 Assignment Investment Decision t1 2023 1Document7 pagesGsbs6385 Assignment Investment Decision t1 2023 1vlad vladNo ratings yet

- Iata Ceiv-Pharma How20to20become20ceiv20pharma20certifiedDocument132 pagesIata Ceiv-Pharma How20to20become20ceiv20pharma20certifiedAdmin OPS APLOG KPNo ratings yet

- Chapter 3Document41 pagesChapter 3Cooper NormanNo ratings yet

- Adxs Update q4f10-2Document20 pagesAdxs Update q4f10-2jaxstrawNo ratings yet

- PM40 Risk Analysis andDocument101 pagesPM40 Risk Analysis andprincessmuneebashahNo ratings yet

- LectureDocument67 pagesLectureSara JaberNo ratings yet

- AntillaDocument5 pagesAntillaRicardo ArandaNo ratings yet

- Professional insect rearing: Strategical points and management methodFrom EverandProfessional insect rearing: Strategical points and management methodNo ratings yet

- New Frontiers for the Treatment of KeratoconusFrom EverandNew Frontiers for the Treatment of KeratoconusCésar CarriazoNo ratings yet

- David Intralogistics AssignmentDocument4 pagesDavid Intralogistics AssignmentDavid BusinelliNo ratings yet

- Optimizing BIO's R&D Project PortfolioDocument3 pagesOptimizing BIO's R&D Project PortfolioDavid BusinelliNo ratings yet

- Procurement KP IsDocument1 pageProcurement KP IsDavid BusinelliNo ratings yet

- Chapter 2: Ipad Menus at Mcdonald'SDocument2 pagesChapter 2: Ipad Menus at Mcdonald'SDavid BusinelliNo ratings yet

- Recap For Grammar Test 1: Fewer, Little, A Little, Few, A Few, Between, AmongDocument2 pagesRecap For Grammar Test 1: Fewer, Little, A Little, Few, A Few, Between, AmongDavid BusinelliNo ratings yet

- Homework report covers warehouse case studiesDocument11 pagesHomework report covers warehouse case studiesDavid BusinelliNo ratings yet

- David Playing Sports or Playing MusicDocument2 pagesDavid Playing Sports or Playing MusicDavid BusinelliNo ratings yet

- Recap For Grammar Test 1: Fewer, Little, A Little, Few, A Few, Between, AmongDocument2 pagesRecap For Grammar Test 1: Fewer, Little, A Little, Few, A Few, Between, AmongDavid BusinelliNo ratings yet

- MRP planning for components A, B, C, D and EDocument2 pagesMRP planning for components A, B, C, D and EDavid BusinelliNo ratings yet

- Project VSM: Analyze The Current SituationDocument4 pagesProject VSM: Analyze The Current SituationDavid BusinelliNo ratings yet

- General Purchasing Conditions: Frank Mubiri L5346 David Businelli N8841 Tristan Fonck N8842Document8 pagesGeneral Purchasing Conditions: Frank Mubiri L5346 David Businelli N8841 Tristan Fonck N8842David BusinelliNo ratings yet

- Industry 4.0 Implication in LogisticsDocument8 pagesIndustry 4.0 Implication in LogisticsPradeep RawatNo ratings yet

- Assignment VSMDocument4 pagesAssignment VSMDavid BusinelliNo ratings yet

- Industry 4.0 Implication in LogisticsDocument8 pagesIndustry 4.0 Implication in LogisticsPradeep RawatNo ratings yet

- Autocaffè coffee sales forecastDocument1 pageAutocaffè coffee sales forecastDavid BusinelliNo ratings yet

- OR2A TransportationDataDocument8 pagesOR2A TransportationDataDavid BusinelliNo ratings yet

- Assignment VSMDocument4 pagesAssignment VSMDavid BusinelliNo ratings yet

- OR2B ShippingWoodDataDocument6 pagesOR2B ShippingWoodDataDavid BusinelliNo ratings yet

- Define The Competitive and Market ScenarioDocument20 pagesDefine The Competitive and Market ScenarioDavid BusinelliNo ratings yet

- Exercises 1 1) (The Solution Is Not Given.) Given The Following Programming ProblemsDocument4 pagesExercises 1 1) (The Solution Is Not Given.) Given The Following Programming ProblemsDavid BusinelliNo ratings yet

- Define The Competitive and Market Scenario 1 LessonDocument13 pagesDefine The Competitive and Market Scenario 1 LessonDavid BusinelliNo ratings yet

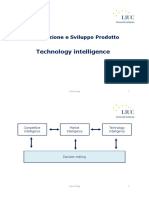

- Technology Intelligence ProcessDocument35 pagesTechnology Intelligence ProcessDavid BusinelliNo ratings yet