Professional Documents

Culture Documents

Financial Accounting and Reporting Volume 1a

Uploaded by

Hannahbea LindoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting and Reporting Volume 1a

Uploaded by

Hannahbea LindoCopyright:

Available Formats

lOMoARcPSD|6968211

Financial Accounting and Reporting - Volume 1A

Accounting (Cagayan State University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

ACCOUNTING PROCESS Usual Examples of Special Journals

2. Accounting Cycle 11. Sales Journal

It is a step-by-step process of recording, It is a special journal where only sales of

classification, and summarization of economic merchandise on account are recorded.

transactions of a business.

12. Cash Receipts Journal

3. Phases of the Accounting Cycle It is a special journal where all types of cash

receipts are recorded.

a. Recording (steps 1-3)

b. Summarizing (steps 4-10) 13. Purchases Journal

It is a special journal used to record all

3. Steps in the Accounting Cycle purchases on account of merchandise, equipment,

supplies, etc.

a. Analyzing the transaction

b. Journalizing 14. Cash Disbursements Journal

c. Posting It is a special journal where all payments of

d. Unadjusted trial balance cash for any purpose are recorded.

e. Adjusting entries

f. Adjusted trial balance Types of Journal Entries According to Form

g. Financial statements

h. Closing entries 16. Simple Journal Entry

i. Post-closing trial balance It is a type of journal entry which contains a

j. Reversing entries single debit and a single credit element.

4. Analyzing the Transaction 17. Compound Journal Entry

This is where the accountant gathers It is a type of journal entry which has two or

information from source documents and more elements in either or both debit and credit

determines the impact of the transaction on the sides and often represents two or more

financial position. transactions.

***

5. Journalizing

This is the process of recording the 18. Accounts

transactions in the appropriate journals. These are the storage units of accounting

information and are used to summarize changes in

6. Journal assets, liabilities, and equity including income and

It is a chronological record of transactions. expenses.

It is also known as the book of original entry.

Common Account Types

Kinds of Journals

20. Real Accounts

8. General Journal These are the statement of financial position

It is a journal where all transactions could be accounts or so-called permanent accounts which

recorded. are not closed and are carried over to the next

accounting period (i.e., assets, liabilities, and equity

9. Special Journals accounts).

These are journals used in recording large

numbers of like transactions.

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

21. Nominal Accounts 31. Trial Balance

These are the income statement accounts It is a list of general ledger accounts with

or temporary capital accounts which are closed at their respective debit or credit balances.

the end of the accounting period (i.e., income and

expense accounts). 32. Adjusting Entries

These are journal entries made at the end of

22. Mixed Account an accounting period to update certain revenue and

While still unadjusted, it represents a expense accounts and to make sure the entity

combination of real and nominal accounts (e.g., complies with the matching principle.

prepaid expenses).

33. Characteristics of Adjusting Entries

23. Control Account

It is the general ledger account that a. Usually refer to transactions that have

summarizes the detailed information in a subsidiary effects on more than one accounting

ledger. period;

24. Suspense Account b. Include at least one (1) nominal account

It is an account that holds temporarily and one (1) real account; and

certain information pending for disposition. c. Are generally not based on source

documents.

25. Reciprocal Account

It is an account that has a counterpart in 34. Classification of Adjusting Entries

another book within the entity or in another ledger

of another entity. a. Prepayments

*** b. Deferred Income

c. Accrued expenses

26. Posting d. Accrued income

It is the process of transferring data from the e. Estimates

journal to the appropriate accounts in the general f. Ending inventory

ledger and subsidiary ledger. This process

classifies all accounts that were recorded in the 35. Prepayments

journals. These are expense items already paid for but

not yet incurred.

27. Ledger

It is a book containing accounts in which the 36. Methods of Initially Recording Prepayments

classified and summarized information from the

journals is posted as debits and credits. It is also a. Asset method – Dr. Prepaid expense; Cr.

known as the book of final entry. Cash

b. Expense method – Dr. Expense; Cr. Cash

Kinds of Ledgers

37. Pro-Forma Adjusting Entries for Prepayments

29. General Ledger

It includes all the accounts appearing on the a. Asset method – Dr. Expense (expired

financial statements. portion); Cr. Prepaid expense

b. Expense method – Dr. Prepaid

30. Subsidiary Ledger expense (remaining portion); Cr.

It affords additional detail in support of Expense

certain general ledger accounts.

***

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

38. Deferred Income 49. Ending Inventory Adjustment

It refers to an income item that is already It is an adjustment used to set up the year-

collected in cash but not yet earned. end count of the inventory. This is only applied in

the periodic inventory system.

39. Methods of Initially Recording Deferred Income

50. Preparation of the Financial Statements

a. Liability method – Dr. Cash; Cr. It is the most important part of the

Unearned income summarizing phase. This is where the processed

b. Income method – Dr. Cash; Cr. Income information is communicated to users.

40. Pro-Forma Adjusting Entries for Deferred 51. Basic Financial Statements

Income

a. Statement of Financial Position (Balance

a. Liability method – Dr. Unearned income Sheet)

(earned portion); Cr. Income b. Statement of Comprehensive Income

b. Income method – Dr. Income (unearned (Income Statement)

portion); Cr. Unearned income c. Statement of Changes in Equity

d. Statement of Cash Flows

41. Accrued Expense e. Notes and Disclosures.

It occurs in a transaction where expense has

already been incurred but not yet paid for in cash. 52. Closing Entries

These are recorded and posted for the

42. Pro-Forma Adjusting Entry for Accrued Expense purpose of closing all nominal or temporary

Dr. Expense; Cr. Liability (i.e., payable) accounts to the income summary account and the

resulting net income or loss is afterwards closed to

43. Accrued Income the capital or retained earnings account.

It occurs in a transaction where income has

been already earned but not yet collected in cash. 53. Reversing Entries

These are made at the beginning of the new

44. Pro-Forma Adjusting Entry for Accrued Income accounting period to reverse certain adjusting

Dr. Asset (i.e., receivable); Cr. Income entries from the preceding accounting period.

45. Estimates 54. Adjusting Entries Subject for Reversal

These are items of adjusting entries that do

not involve cash flows. a. Prepayments under expense method

b. Deferred income under income method

Common Types of Estimates c. Accrued expense

d. Accrued income

47. Provision for Doubtful Accounts

It is the estimated amount of bad debts that 55. Optional Steps in the Accounting Cycle

will arise from accounts receivable that have been

issued but not yet collected. a. All trial balances

b. Reversing entries

48. Depreciation

It is the systematic allocation of the cost of

a fixed asset over its useful life.

***

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

REVISED CONCEPTUAL FRAMEWORK 62. Financial Position

It refers to the financial condition of the

57. Missions of IASB in Developing Accounting reporting entity represented by the economic

Standards resources it owns and claims of other entities

against these.

a. Contribute to transparency – by

enhancing international comparability 63. Accrual Accounting

and quality of financial information. It means that the events should be reflected

b. Strengthen accountability – of the in the reports in the periods when the effects of

people entrusted with the entity. transactions occur, regardless the related cash

c. Contribute to economic efficiency – by flows.

helping investors identify opportunities

and risks across the world. a. Income shall be recognized when

earned, rather than when received in

58. Conceptual Framework cash.

b. Expenses shall be recognized when

a. It aims to assist the IASB in developing incurred, rather than when paid for in

standards. cash.

b. It helps financial statement preparers

and users to better understand and 64. Past Cash Flows

interpret the standards. These are considered important information

c. It can be used as a reference by used to assess the management’s ability to

preparers who are trying to develop generate future cash flows.

accounting policies but cannot find any

applicable standard currently in place. Chapter 2

d. It is not a standard by itself, and does not

override the provisions of any standard. Types of Qualitative Characteristics of Financial

Information

59. Objectives of Conceptual Framework 67. Fundamental Qualitative Characteristics

Their focus is on the content or substance of

a. To provide financial information about financial information.

reporting entities; and

b. To help investors, lenders and other 68. Enhancing Qualitative Characteristics

creditors (primary users) in decision Their focus is on the presentation or form of

making. financial information.

Chapter 1 Fundamental Qualitative Characteristics

61. Objective of General-Purpose Financial 70. Relevance

Reporting Financial information possessing this

qualitative characteristic is capable of making a

a. To provide financial information about difference in the users’ decisions.

reporting entities; and

b. Help investors, lenders and other 71. Faithful Representation

creditors (primary users) in decision It requires that accounting transactions and

making. events should be recorded in a manner that

represents their true economic substance.

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

Elements of Relevance Enhancing Qualitative Characteristics

73. Predictive Value 82. Comparability

It helps the users of financial statements in It asserts that information about a reporting

predicting future trends of the business. entity is more useful if it can be compared with a

similar information about other entities and with

74. Confirmatory Value similar information about the same entity for

It helps the users of financial statements in another period or another date.

confirming or correcting any past predictions they

have made. 83. Verifiability

*** It helps to assure users that information

represents faithfully the economic phenomena it

75. Materiality purports to represent.

It is the threshold above which missing or It means that different knowledgeable and

incorrect information in financial statements is independent observers could reach consensus,

considered to have an impact on the decision although not necessarily complete agreement, that

making of users. a particular depiction is a faithful representation.

It is an entity-specific aspect of relevance

based on the nature or magnitude (or both) of the Aspects of Comparability

items to which the information relates in the context

of an individual entity’s financial report. 85. Horizontal Comparability

It refers to comparison within an entity from

Underlying Characteristics Maximized by Faithful one period to the next.

Representation

86. Dimensional Comparability

77. Completeness It refers to comparison between two or more

It asserts that financial information must be entities in the same industry.

complete in all material respects, since omissions

of important data may be misleading. Methods of Verification

78. Neutrality 88. Direct Verification

It asserts that financial information must be It means verifying an amount or other

free from bias or not prepared with the purpose to representation through direct observation (e.g.,

influence certain decisions of the users. counting cash items).

89. Indirect Verification

79. Free from Error It is verifying the carrying amount of

It asserts that financial information must inventory by checking the inputs (quantities and

not contain any inaccuracies or omissions. costs) and recalculating the ending inventory using

*** the same cost flow assumption (e.g., computing

inventory using first-in, first-out or FIFO method).

80. Prudence / Conservatism ***

It is the exercise of caution when making

judgements under conditions of uncertainty such Chapter 3

that assets and income are not overstated and

expenses and liability are not understated. 91. Financial Statements

These are written records that convey the

business activities and position of a reporting

entity.

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

Complete Set of Financial Statements Types of Financial Statements as to Its Reporting

Entity

93. Statement of Financial Position

It contains information about the assets, 103. Consolidated

liabilities and equity of the reporting entity at a point It refers to financial statements prepared by

in time. a parent and its subsidiaries reporting as a single

entity.

94. Statements of Financial Performance

These contain information about the income 104. Unconsolidated

and expenses of the reporting entity over a period of It refers to financial statements provided by

time. one entity only (e.g., parent alone).

95. Statement of Cash Flows 105. Combined

It contains information about the flow of It refers to financial statements whose

cash to and out of the entity during a reporting reporting entity comprises of two or more entities

period. not linked by a parent-subsidiary relationship.

96. Statement of Changes in Equity Chapter 4

It contains information about the

contributions from and distributions to equity Elements of Financial Statements

holders.

108. Asset

97. Notes and Disclosures It is a present economic resource controlled

These statements contain information by the entity as a result of past events.

about the accounting methods, assumptions,

judgments used and their changes. 109. Liability

*** It is a present obligation of the entity to

transfer an economic resource as a result of past

98. Reporting Period events.

It is a specified period of time in which the

financial statements are prepared for. 110. Equity

It is the residual interest in the assets of the

99. Going Concern entity after deducting all its liabilities.

It means that an entity will continue to

operate for the foreseeable future (usually 12 111. Income

months after the reporting date). It refers to increases in assets or decreases

in liabilities resulting in increases in equity, other

100. Reporting Entity than contributions from equity holders.

It is an entity who must or chooses to

prepare financial statements. 112. Expense

It refers to decreases in assets or increases

101. Kinds of Reporting Entities in liabilities resulting in decreases in equity, other

than distributions to equity holders.

a. A single entity – e.g., one company

b. A portion of an entity – e.g., a division Types of Income

of one company

c. More than one entity – e.g., a parent 113. Revenue

and its subsidiaries reporting as a It refers to income from primary activities.

group

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

114. Gain Methods of Measuring Current Value

It refers to income from incidental activities.

*** 126. Fair Value

It is the price that would be received to sell

115. Loss an asset or paid to settle a liability in an orderly

It refers to expenses incurred from events transaction between market participants at

which are not part of operating activities. measurement date (based on exit price).

Chapter 5 127. Value in Use

It is the present value of cash flows

117. Recognition expected to be derived from the used and ultimate

It is the process of incorporating in the disposal of an asset (based on exit price).

balance sheet or income statement an item that

meets the definition of an element and satisfies the 128. Fulfillment Value

criteria for recognition. It is the present value of the cash expected

to be transferred for the payment of a liability

118. Criteria for Recognition (based on exit price).

a. It is probable that any future economic 129. Current Cost

benefit associated with the item will flow It is the cost that would be required to

to or from the entity; and replace an asset in the current period (based on

b. The item’s cost or value can be entry price).

measured with reliability.

Chapter 7

119. Derecognition

It means the removal of an asset or liability 131. Presentation

from the statement of financial position and It is the format in which the financial

normally it happens when the item no longer meets statements are communicated to users.

the definition of an asset or a liability.

132. Disclosure

Chapter 6 It refers to additional information attached

to an entity’s financial statements, usually as

121. Measurement explanation for activities which have significantly

It involves the assignment of monetary influenced the entity’s financial results.

amounts at which the elements of the financial

statements are to be recognized and reported. 133. Rules on Presentation of Items in the Financial

Statements

Bases of Measurement General rule: Group similar items and

separate dissimilar items.

123. Historical Cost Exceptions: Material items of the same

This measurement is based on the nature should be reported separately in financial

transaction price at the time of recognition of the statements and dissimilar items may be aggregated

element (based on entry price). if these are immaterial.

124. Current Value

It measures the element in a manner which

is updated to reflect the conditions at the

measurement date.

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

Chapter 8 issued after a buyer pays for the same with cash or

another form of guaranteed funds. If it is payable to

Concepts of Capital Maintenance the reporting entity, it is included in the books as

cash.

136. Financial Capital Maintenance

It asserts that profit is earned only when the 144. Postdated Check

amount of net assets at the end of the period is It is a check written by the drawer (payor) for

greater than the amount of net assets in the a date in the future. it may only be cashed or

beginning, after excluding contributions from and deposited on or after the date written on it. If it is

distributions to equity holders (mandated by payable to the reporting entity, it is not included in

standards). the books as cash. If it is payable to a different

party, it should not be excluded in the total cash

137. Physical Capital Maintenance balance.

It asserts that profit is earned if the physical

productive capacity of the entity based on, for Cash Items Included in the Accounting Books

example, units of output per day, increases during

the period, after excluding movements with equity 146. Cash on Hand

holders. It includes undeposited cash collections and

other cash items awaiting deposit.

CASH AND CASH EQUIVALENTS 147. Cash in Bank

It includes demand deposit or checking

139. Money account and saving deposit which are unrestricted

It is the standard medium of exchange in as to withdrawal.

business transactions. it refers to the currency and

coins which are in circulation and legal tender. 148. Cash Fund Set Aside for Current Purposes

Examples of this include:

140. Cash

In the context of accounting, it includes a. Petty cash fund

money and any other negotiable instrument that is b. Dividend fund

payable in money and acceptable by the bank for c. Payroll fund

deposit and immediate credit. d. Revolving fund

e. Tax fund

141. Check f. Interest fund

It is a document that orders a bank to pay a ***

specific amount of money from the person's

account to the person in whose name the same has 149. Bond Sinking Fund

been issued. In general, it is included in the books It is a restricted asset of a corporation that

as cash provided that the same is payable to the was required to set aside money for redeeming or

reporting entity. buying back some of its bonds payable.

General rule: It is presented as a noncurrent

142. Bank Draft asset.

It is a check drawn by a bank on its own Exception: It is presented as a current asset

funds in another bank. If it is payable to the when the bonds associated to it become due within

reporting entity, it is included in the books as cash. 12 months after the end of the reporting period.

143. Money Order 150. Fund Held for Future Plant Expansion

It is a paper document, similar to a check, It is a noncash item always presented as a

used for making payments. it is prepaid, so it is only noncurrent asset.

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

160. Measurement of Cash

151. Preference Share Redemption Fund

It is a noncash item always presented as a a. In general – face value

noncurrent asset. b. Foreign currency – current exchange

rate

152. Cash Equivalents c. Cash held by a bank or financial

These are short-term and highly liquid institution under bankruptcy or financial

investments that are readily convertible into cash difficulty – estimated realizable value

and so near their maturity that they present

insignificant risk of changes in value because of 161. Foreign Exchange Restriction

changes in interest rates. Deposits in foreign banks which are subject

to foreign exchange restriction, if material, should

153. Criterion for an Item to Qualify as Cash be classified separately among noncurrent assets

Equivalent and the restriction clearly indicated.

Only highly liquid investments that are

acquired three months before maturity can qualify 162. Classification of Cash Fund Related to a

as cash equivalents. Liability

The classification should be parallel with

154. Equity Securities as Cash Equivalents such related liability (i.e., if the noncurrent liability is

General rule: Equity securities cannot qualify reclassified as current, the related noncurrent cash

as cash equivalents because shares do not have a fund shall also be reclassified as current asset).

maturity date.

Exception: Preference shares with specified 163. Classification of Cash Fund Set Aside for the

redemption date and acquired three months before Acquisition of a Noncurrent Asset

redemption date can qualify as cash equivalents. Such fund should be classified as

noncurrent asset regardless of the year of

Classification of Investments of Excess Cash disbursement.

156. Cash Equivalent 164. Bank Overdraft

See no. 152 for definition. It occurs when the cash in a bank account

has a credit balance resulting from the issuance of

157. Short-Term Financial Asset checks in excess of deposits.

It is an investment that matures in more

than three months but within one year from the end 165. Classification of Bank Overdraft

of the reporting period and is presented separately General rule: It shall be classified as a

as current asset. current liability and should not be offset against

other bank accounts with debit balances.

158. Long-Term Investments Exceptions:

It is an investment that matures in more

than one year from the end of the reporting period a. If there are other deposit accounts in the

and is classified as noncurrent asset. same bank as the account with the credit

*** balance, offsetting with such other

accounts is allowed.

159. Reclassification of Long-Term Investments b. If the amount is immaterial, offsetting is

If a long-term investment becomes due allowed.

within one year from the end of the reporting period,

the same shall be reclassified as current or 166. Compensating Balance

temporary investment. It generally takes the form of minimum

checking or demand deposit account balance that

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

must be maintained in connection with a borrowing 176. Adjustment Required for Issued Checks That

arrangement with a bank. Became Stale

Types of Compensating Balance a. If the amount is material - Dr. Cash in

bank; Cr. Accounts payable or

168. Informal Compensating Balance appropriate account

It refers to one that is not legally restricted b. If the amount is immaterial - Dr. Cash in

and shall be included as part of cash. If the problem bank; Cr. Miscellaneous income

is silent, the compensating balance is treated as

unrestricted. 177. Journal Entries for Cash Shortage

169. Formal Compensating Balance a. Initial entry – Dr. Cash short or over; Cr.

It refers to one that is legally restricted and Cash)

shall be classified as current or noncurrent asset b. If the cashier or cash custodian is held

depending on the terms of the related loan. responsible for the cash shortage – Dr.

*** Due from cashier; Cr. Cash short or over

c. If reasonable efforts fail to disclose the

170. Unreleased or Undelivered Checks cause of the shortage – Dr. Loss from

It is a check that is merely drawn and cash shortage; Cr. Cash short or over

recorded but not given to the payee before the end

of reporting period. 178. Journal Entries for Cash Overage

171. Adjustment Required for Undelivered or a. Initial entry – Dr. Cash; Cr. Cash short or

Unreleased Checks over

Dr. Cash in bank; Cr. Expense or liability – b. If there is no claim on the overage – Dr.

The entry made upon issuance of said check should Cash short or over; Cr. Miscellaneous

be reversed because in essence, no payment has income

really been made. c. If the cash overage is properly found to

be the money of the cashier – Dr. Cash

172. Postdated Check Delivered short or over; Cr. Payable to cashier

It is a check drawn, recorded and already

given to the payee but it bears a date subsequent to 179. Imprest System

the end of reporting period. It is a system of control of cash which

requires that all cash receipts should be deposited

173. Adjustment Required for Postdated Checks intact and all cash disbursements should be made

Delivered by means of check.

Dr. Cash in bank; Cr. Expense or liability –

The entry made upon issuance of said check should Methods of Handling the Petty Cash Fund

be reversed because in essence, no payment has

really been made. 181. Imprest Fund System

174. Stale Check or Check Long Outstanding a. A memorandum entry is simply prepared

It is a check not encashed by the payee in the petty cash journal for each

within a relatively long period of time. disbursement.

b. Replenishment of the fund is usually

175. Prescriptive Period for Checks equal to the petty cash disbursements.

In banking practice, a check becomes stale c. Replenishment should only be by means

if not encashed within 6 months from the time of of drawing checks and not from

issuance. undeposited collections.

10

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

d. It is necessary to adjust the e. Decrease of the fund – Dr. Cash in bank;

unreplenished expenses at the end of Cr. Petty cash fund

the reporting period in order to state the

correct balance of the fund. 186. Demand Deposit

It is the current account or checking account

182. Fluctuating Fund System or commercial deposit where deposits are covered

by deposit slips and where funds are withdrawable

a. Disbursements are immediately on demand by drawing checks against the bank.

recorded in the general journal or cash

disbursements journal. 187. Savings Deposit

b. Replenishment of the fund may or may It is a bank account where the depositor is

not be the same amount as the petty given a passbook upon initial deposit. the passbook

cash disbursement. is required when making deposits and withdrawals.

c. No adjustment for unreplenished this type of bank deposit is interest bearing.

expenses is needed at the end of the

reporting period because of the outright 186. Time Deposit

recording of expenses. It is a bank deposit evidenced by a formal

agreement called certificate of deposit. it is interest

Journal Entries for the Handling of Petty Cash bearing and may be preterminated or withdrawn on

Fund demand or after a certain period of time agreed

upon.

184. Imprest Fund System

189. Journal Entry Used to Record Collection of

a. Establishment of the fund – Dr. Petty Cash in the Books of the Reporting Entity

cash fund; Cr. Cash in bank Dr. Cash or Cash in bank; Cr. Accounts

b. Payment of expenses out of the fund – receivable or any other appropriate account

memorandum entry in the petty cash

journal 190. Journal Entry Used by the Bank to Record

c. Replenishment of petty cash payments Collection of Cash by the Reporting Entity and

– Dr. Expenses; Cr. Cash in bank Subsequent Deposit to the Bank

d. Adjusting entry if no replenishment is Dr. Cash; Cr. Bank account of reporting

made at year-end – Dr. Expenses; cr. entity

Cash in bank

e. Increase in fund – Dr. Petty cash fund; 191. Journal Entry Used to Record Disbursements

Cr. Cash in bank of Cash in the Books of the Reporting Entity

f. Decrease in fund – Dr. Cash in bank; Cr. Dr. Expenses or any other appropriate

Petty cash fund account; Cr. Cash or Cash in bank

185. Fluctuating Fund System 192. Journal Entry Used by the Bank to Record

Withdrawals or Disbursements of Cash by the

a. Establishment of the fund – Dr. Petty Reporting Entity

cash fund; Cr. Cash in bank Dr. Bank account of reporting entity; Cr.

b. Payment of expenses out of the petty Cash

cash fund – Dr. Expenses; Cr. Petty cash

fund 193. Bank Reconciliation

c. Replenishment or increase of the fund – It is a statement which brings into

Dr. Petty cash fund; Cr. Cash in bank agreement the cash balance per book and cash

d. Adjusting entry if no replenishment is balance per bank.

made at year-end – no entry required

11

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

194. Bank Statement 200. NSF or DAIF Checks

It is a monthly report of the bank to the These are checks deposited but not returned

depositor showing data about the transactions of by the bank because of insufficiency of fund.

the reporting entity with the bank during the period

and the beginning and ending balances of its bank Bank Reconciling Items

account.

202. Deposits in Transit

195. Cancelled Checks These are collections already recorded by

These are the checks (attached to the bank the depositor as cash receipts but not yet reflected

statement upon receipt) issued by the depositor on the bank statement.

and paid by the bank during the month.

203. Outstanding Checks

Book Reconciling Items These are checks already recorded by the

depositor as cash disbursements but not yet

197. Credit Memos reflected on the bank statement.

These refer to items not representing

deposits credited by the bank to the account of the 204. Bank Errors

depositor but not yet recorded by the depositor as These refer to incorrect posting of cash

cash receipts. Examples: deposits or withdrawals resulting to either

overstatement or understatement of cash balance

a. Notes receivable collected by bank in in the bank account of the depositor.

favor of the depositor ***

b. Proceeds of bank loan

c. Matured time deposits transferred by the 205. Certified Check

bank to the current account of the It is a check for which the issuing bank

depositor guarantees availability of cash in the holder's

account.

198. Debit Memos

These refer to items not representing checks 206. Accounting Treatment for Certified Checks

paid by bank which are charged or debited by the Certified checks should be deducted from

bank to the account of the depositor but not yet the total outstanding checks (if included therein)

recorded by the depositor as cash disbursements. because they are no longer outstanding for bank

Examples: reconciliation purposes.

a. NSF checks or DAIF (drawn against Forms of Bank Reconciliation

insufficient fund) checks

b. Technically defective checks 208. Adjusted Balance Method

c. Bank service charges It is a form of bank reconciliation where the

d. Reduction of loan book balance and the bank balance are brought to

a current cash balance that must appear on the

199. Book Errors balance sheet.

These refer to incorrect recording of cash

receipts or disbursements resulting to either 209. Book to Bank Method

overstatement or understatement of cash balance It is a form of bank reconciliation where the

in the books of the entity. book balance is reconciled with the bank balance or

*** the book balance is adjusted to equal the bank

balance.

12

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

210. Bank to Book Method 217. Book Debits

It is a form of bank reconciliation where the These refer to cash receipts or all items

bank balance is reconciled with the book balance or debited to the cash in bank account.

the bank balance is adjusted to equal the book

balance. 218. Book Credits

*** These refer to cash disbursements or all

items credited to the cash in bank account.

211. Formula to Compute for the Adjusted Book

Balance under the Adjusted Balance Method of 219. Computation of End of Month Balance per

Bank Reconciliation Bank

Book balance + Credit memos - Debit Beginning of month balance per bank + Bank

Memos ± Effect of errors = Adjusted book balance credits during the month - Bank debits during the

month = End of month balance per bank

212. Formula to Compute for the Adjusted Bank

Balance under the Adjusted Balance Method of 220. Bank Credits

Bank Reconciliation These refer to all items credited to the

Bank balance + Deposits in transit - account of the depositor which include deposits

Outstanding checks (after excluding certified acknowledged by bank and credit memos.

checks) ± Effect of errors = Adjusted bank balance

221. Bank Debits

213. Formula Used Under the Book to Bank Method These refer to all items debited to the

of Bank Reconciliation account of the depositor which includes checks

Book balance + Credit memos + Outstanding paid by bank and debit memos.

checks (after excluding certified checks) - Debit

memos - Deposits in transit ± Effect of errors = Bank 222. Computation of End of Month Deposits in

balance Transit

Beginning of month deposits in transit +

214. Formula Used Under the Bank to Book Method Book debits - CM from previous month - Bank

of Bank Reconciliation credits + CM from current month = End of month

Bank balance + Deposits in transit + Debit deposits in transit

memos - Outstanding checks (after excluding

certified checks) - Credit memos ± effect of errors = 223. Computation of End of Month Outstanding

book balance Checks

Beginning of month outstanding checks +

215. Proof of Cash Book credits – DM from previous month + Bank

It is a reconciliation of the general ledger debits + DM from current month = End of month

cash balance at both the beginning and end of a outstanding checks

period, combined with a reconciliation of cash

deposited for the period with the cash receipts

journal, and a reconciliation of checks for the period

with the cash disbursements journal.

216. Computation of End of Month Balance per

Book

Beginning of month balance per book +

Book debits during the month - Book credits during

the month = End of month balance per book

13

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

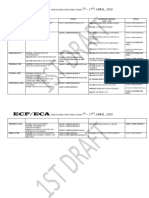

Summary of Proof of Cash Procedures for the Book Balance

Beginning Book Credits

Book Debits Ending Cash

Cash or Cash

Bank Reconciling Items or Cash Balance per

Balance per Disburse-

Receipts Book

Book ments

225. Credit memos from previous month’s

bank statement Add Deduct

226. Credit memos from current month’s bank

statement A A

227. Debit memos from previous month’s bank

statement D D

228. Debit memos from current month’s bank

statement A D

229. NSF check deposited last month

redeposited this month D A D A

230. NSF check deposited this month

redeposited this month A A

231. NSF check deposited this month to be

redeposited next month A D

232. Overstated recording of cash receipts in

the cash in bank account (committed during

the previous month, discovered in the current D D

month)

233. Overstated recording of cash receipts in

the cash in bank account (committed during

the current month, discovered upon the receipt D D

of bank statement)

234. Overstated recording of cash receipts in

the cash in bank account (committed and

discovered during the current month)

D D

235. Understated recording of cash receipts in

the cash in bank account (committed during

the previous month, discovered in the current A D

month)

236. Understated recording of cash receipts in

the cash in bank account (committed during

the current month, discovered upon the receipt A A

of bank statement)

237. Understated recording of cash receipts in

the cash in bank account (committed and No adjustment required

discovered during the current month)

238. Overstated recording of cash

disbursements in the cash in bank account

(committed during the previous month, A D

discovered in the current month)

239. Overstated recording of cash

disbursements in the cash in bank account D A

14

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

(committed during the current month,

discovered upon the receipt of bank statement)

240. Overstated recording of cash

disbursements in the cash in bank account

(committed and discovered during the current D D

month)

241. Understated recording of cash

disbursements in the cash in bank account

(committed during the previous month, D D

discovered in the current month)

242. Understated recording of cash

disbursements in the cash in bank account

(committed during the current month, A D

discovered upon the receipt of bank statement)

243. Understated recording of cash

disbursements in the cash in bank account

(committed and discovered during the current

No adjustment required.

month)

Summary of Proof of Cash Procedures for the Bank Balance

Beginning

Ending Cash

Cash Bank Credits Bank Debits

Balance per

Bank Reconciling Items Balance per or Cash or Cash

Bank

Bank Deposits Withdrawals

Statement

Statement

245. Deposits in transit as of beginning of the

current month A D

246. Deposits in transit as of end of the current

month A A

247. Outstanding checks as of beginning of the

current month D D

248. Outstanding checks as of end of the

current month A D

249. Cash collections disbursed instead of

being deposited intact A A

250. Overstated recording of cash deposit in

the bank account of reporting entity

(committed during the previous month, D D

corrected in the current month)

251. Overstated recording of cash deposit in

the bank account of reporting entity

(committed during the current month, still D D

uncorrected as per bank statement)

252. Overstated recording of cash deposit in

the bank account of reporting entity

(committed and corrected in the current D D

month)

15

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

253. Understated recording of cash deposit in

the bank account of reporting entity

(committed during the previous month, A D

corrected in the current month)

254. Understated recording of cash deposit in

the bank account of reporting entity

(committed during the current month, still A A

uncorrected as per bank statement)

255. Understated recording of cash deposit in

the bank account of reporting entity

(committed and corrected in the current No adjustment required.

month)

256. Overstated recording of cash withdrawal

in the bank account of the reporting entity

(committed during the previous month, A D

corrected in the current month)

257. Overstated recording of cash withdrawal

in the bank account of reporting entity

(committed during the current month, still D A

uncorrected as per bank statement)

258. Overstated recording of cash withdrawal

in the bank account of reporting entity

(committed and corrected in the current D D

month)

259. Understated recording of cash withdrawal

in the bank account of reporting entity

(committed during the previous month, D D

corrected in the current month)

260. Understated recording of cash withdrawal

in the bank account of reporting entity

(committed during the current month, still A D

uncorrected as per bank statement)

261. Understated recording of cash withdrawal

in the bank account of reporting entity

(committed and corrected in the current No adjustment required.

month)

RECEIVABLES 265. Accounts Receivable

These are open accounts arising from the

263. Receivables sale of goods and services in the ordinary course of

These are financial assets that represent a business and not supported by promissory notes.

contractual right to receive cash or another

financial asset from another entity. 266. Notes Receivable

These are receivables supported by formal

264. Trade Receivables promises to pay in the form of notes.

These refer to claims arising from sale of

merchandise or services in the ordinary course of

business (e.g., accounts receivable, notes

receivable, etc.).

16

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

267. Nontrade Receivables 275. Accrued Income

These represent claims arising from Examples: Dividends receivable, accrued

sources other than the sale of merchandise or rent, accrued royalties income, accrued interest on

services in the ordinary course of business. bond investments, etc.

Always classified as current asset.

268. Classification of Trade Receivables

276. Claims Receivable

a. Current asset – if expected to be realized Examples: Claims against common carriers

in cash within the normal operating for losses or damages, claim for rebates and tax

cycle or one year, whichever is longer; refunds, claims from insurance entities, etc.

default in case the problem is silent. Always classified as current asset.

b. Noncurrent asset – in case otherwise.

277. Customer’s Credit Balances

269. Classification of Nontrade Receivables These balances occur due to overpayments,

returns and allowances, and advanced payments

a. Current asset – if expected to be realized from customers.

in cash within one year, the length of the General rule: Current liability

operating cycle notwithstanding. Exception: If the amount is immaterial,

b. Noncurrent asset – in case otherwise. offset against customers’ accounts with debit

balances.

270. Advances to or Receivables from

Shareholders, Directors, Officers or Employees 278. Measurement of Accounts Receivable

General rule: Current asset

Exception: Noncurrent asset if stated to be a. Initial measurement – fair value (face

collectible beyond 1 year. amount or original invoice amount)

b. Subsequent measurement – amortized

271. Advances to Affiliates cost (net realizable value of accounts

Noncurrent (long-term investment). receivable or gross accounts receivable

less allowances)

272. Subscription Receivable

General rule: Deduction from subscribed 279. Allowances Against Accounts Receivable

share capital. These are usually deducted from accounts

Exception: Current asset if stated to be receivable to get the latter’s estimated recoverable

collectible within 1 year. amount or realizable value.

273. Debit Balances in Creditors' Accounts a. Allowance for freight charges

These balances occur due to overpayments b. Allowance for sales returns

and/or returns and allowances. c. Allowance for sales discounts

General rule: Current asset. d. Allowance for doubtful accounts

Exception: If the amount is immaterial,

offset against the creditors' accounts with credit 280. FOB Destination

balances. It is a shipping term which means that

ownership of the goods purchased is vested in the

274. Special Deposits on Contract Bids buyer upon receipt thereof. Under this shipping

General rule: Noncurrent asset. term, the seller (owner during the freight period) is

Exception: Current asset if stated to be responsible for the freight charges.

collectible within 1 year.

17

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

281. FOB Shipping Point of the product. No ledger account is opened for this

It is a shipping term which means that kind of discount.

ownership of the goods purchased is vested in the

buyer upon shipment thereof. Under this shipping 290. Cash Discount

term, the buyer (owner during the freight period) is It is a discount allowed to stimulate instant

responsible for the freight charges. payment of the goods purchased.

282. Freight Collect Methods of Recording Credit Sales

It means that freight charge on the goods

shipped is not yet paid when the goods were 292. Gross Method

shipped (to be paid by the buyer). It is a method of recording credit sales

where the accounts receivable and sales are

283. Freight Prepaid recorded at gross amount of the invoice (more

It means that freight charge on the goods commonly used).

shipped was already paid (by the seller) when the

goods were shipped. 293. Net Method

It is a method of recording credit sales

284. Journal Entry to Record Shipment of where the accounts receivable and sales are

Merchandise Sold Freight Collect Under FOB recorded at net amount of the invoice, meaning the

Destination invoice price minus the cash discount.

Dr. Accounts receivable, Freight out; Cr. ***

Sales, Allowance for freight charge

294. Journal Entries Under the Gross Method of

285. Journal Entry to Record Shipment of Recording Credit Sales

Merchandise Freight Prepaid Under FOB

Destination a. Sale of merchandise on account – Dr.

Dr. Accounts receivable, Freight out; Cr. Accounts receivable (gross amount of

Sales, Cash invoice); Cr. Sales

b. Collection of customer’s account within

286. Journal Entry to Record Shipment of the discount period – Dr. Cash, Sales

Merchandise Sold Freight Collect Under FOB discount; Cr. Accounts receivable

Shipping Point c. Collection of customer’s account

Dr. Accounts receivable, Cr. Sales beyond the discount period – Dr. Cash;

Cr. Accounts receivable

287. Journal Entry to Record Shipment of

Merchandise Sold Freight Prepaid Under FOB 295. Journal Entries Under the Net Method of

Shipping Point Recording Credit Sales

Dr. Accounts receivable (invoice amount +

freight charge); Cr. Sales, Cash a. Sale of merchandise on account – Dr.

Accounts receivable (invoice price -

288. Journal Entry to Record Probable Return of cash discount); Cr. Sales

Merchandise Sold to Customers b. Collection of customer’s account within

Dr. Sales return; Cr. Allowance for sales the discount period – Dr. Cash; Cr.

returns Accounts receivable

c. Collection of customer's account

289. TRADE DISCOUNT beyond the discount period – Dr. Cash;

It is a discount that is allowed by the Cr. Accounts receivable, Sales discount

wholesaler to the retailer, calculated on the list price forfeited

18

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

296. Sales Discount Forfeited 304. Journal Entries Under the Allowance Method

It is a miscellaneous or other income of Recording Bad Debts or Doubtful Accounts

account credited whenever there is a collection of

accounts receivable beyond the discount period a. Provision for doubtful accounts – Dr.

under the net method of recording credit sales. Doubtful accounts expense; Cr.

Allowance for doubtful accounts

297. Journal Entry to Record Expected Sales b. Writeoff of accounts proved to be

Discount worthless or uncollectible – Dr.

Dr. Sales discount; Cr. Allowance for sales Allowance for doubtful accounts; Cr.

discount (this entry may be reversed at the Accounts receivable

beginning of the next period.) c. Recovery and collection of accounts

previously written off – Dr. Cash; Cr.

298. Bad Debt or Doubtful Account Allowance for doubtful accounts

It is an expense that a business incurs once

the repayment of credit previously extended to a 305. Journal Entries Under the Direct Writeoff

customer is estimated to be uncollectible. Method of Recording Bad Debts or Doubtful

Accounts

Methods of Accounting for Bad Debts

a. Writeoff of accounts proved to be

300. Allowance Method worthless or uncollectible – Dr. Bad

It is a method of accounting for bad debts debts expense; Cr. Accounts receivable

which requires the recognition of a bad debt loss if b. Recovery and collection of account

the accounts are doubtful of collection (i.e., a previously written off – Dr. Cash; Cr. Bad

provision for doubtful accounts is required at the debts expense

end of reporting period).

306. CLASSIFICATION OF DOUBTFUL ACCOUNTS

301. Direct Writeoff Method OR BAD DEBTS EXPENSE IN THE INCOME

It is a method of accounting for bad debts STATEMENT

which requires recognition of a bad debt loss only

when the accounts are proved to be worthless or a. Distribution cost - if the granting of

uncollectible. credit and collection of accounts are

*** under the charge of the sales manager.

b. Administrative expense - if the granting

302. Provision of credit and collection of accounts are

It is the amount of an expense that an entity under the charge of an officer other than

elects to recognize now, before it has precise sales manager.

information about the exact amount of the expense.

If the problem is silent, bad debts expense is

an administrative expense.

303. Writeoff

It is a reduction in the recorded amount of an Methods of Estimating Doubtful Accounts

asset which occurs upon the realization that an

asset no longer can be converted into cash, can 308. Aging of Accounts Receivable

provide no further use to a business, or has no It refers to the method of estimating

market value. doubtful accounts where the receivables are

classified by due date. The allowance is then

determined by multiplying the total of each

classification by the rate or percent of loss

experienced by the entity for each category

19

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

(accurate and scientific; presents fairly the 313. Rules on Assessment for Impairment of

accounts receivable at net realizable value). Accounts Receivable

a. It is one of the statement of financial a. Individually significant accounts

position approaches in estimating receivable – should be considered for

doubtful accounts. impairment separately and if impaired,

b. It provides the ending allowance for the impairment loss is recognized.

doubtful accounts. b. Not individually significant accounts

receivable – should be collectively

309. Percentage of Accounts Receivable assessed for impairment (use of a

It is a method of estimating doubtful composite rate that can appropriately

accounts where a certain rate is multiplied by the measure impairment on all accounts in

open accounts at the end of the period in order to the category).

get the required allowance balance. c. Individually significant accounts

receivable initially assessed to be

a. It is one of the statement of financial unimpaired – should be included with

position approaches in estimating other accounts receivable (those not

doubtful accounts. individually significant) with similar

b. It provides the ending allowance for credit risk characteristics and

doubtful accounts. collectively assessed for impairment.

310. Percentage of Sales 314. Journal Entry to Record Impairment Loss on

It is a method of estimating doubtful Accounts Receivable

accounts where the amount of sales for the year is Dr. Doubtful accounts expense; Cr.

multiplied by a certain rate to get the doubtful Allowance for doubtful accounts

accounts expense.

315. Negotiable Promissory Note

a. It is the only income statement approach It is an unconditional promise made in

in estimating doubtful accounts. writing made by one person to another, signed by

b. It provides the doubtful accounts the maker, engaging to pay on demand or at a fixed

expense for the period. or determinable future time a sum certain in money

*** to order or to bearer.

311. Journal Entry to Record Correction in 316. Dishonored

Allowance for Doubtful Account as a Change in It is the status of a promissory note that has

Accounting Estimate already matured but is still unpaid after its

presentment for payment.

a. Inadequate allowance - Dr. Doubtful

accounts expense; Cr. Allowance for 317. Treatment for Dishonored Notes Receivable

doubtful accounts These (face amount, interest and other

b. Excessive allowance - Dr. Allowance for charges) should be removed from the notes

doubtful accounts; Cr. Doubtful receivable account and transferred to accounts

accounts expense receivable.

312. Allowance for Impairment 318. Initial Measurement of Notes Receivable

It is the loss allowance required to be The initial measurement should be fair value

recognized for expected credit losses on financial plus transaction costs which is equal to:

assets measured at amortized cost.

a. General rule: Present value

20

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

b. Exception: Short-term notes receivable 326. Treatment for Noninterest-Bearing Note

shall be measured at face value. Receivable

It is measured at present value which is the

319. Present Value discounted value of future cash flows using the

It is the sum of all future cash flows effective interest rate.

discounted using the prevailing market rate of

interest for similar notes. 327. Implicit Interest Rate

It is an interest rate that is not explicitly

320. Nominal Interest Rate stated in a debt agreement.

It is the interest rate written on the face of an

instrument (form). 328. Subsequent Measurement of Notes Receivable

It is subsequently measured at amortized

321. Effective Interest Rate cost using the effective interest method.

It is the prevailing market rate of interest

(substance). 329. Formula for Amortized Cost of Note Receivable

(Effective Interest Method)

322. Classification of Notes Receivable Initial measurement of note receivable -

Principal repayment ± Cumulative amortization -

a. Interest-bearing note with nominal rate Reduction for impairment or uncollectibility =

is equal to effective interest rate Amortized cost of note receivable

b. Interest-bearing note with nominal rate

is greater than effective interest rate 330. Loan Receivable

c. Interest-bearing note with (nominal rate It is a financial asset arising from a loan

is less than effective interest rate granted by a bank or other financial institution to a

d. Noninterest-bearing note borrower or client.

323. Treatment for Interest-Bearing Note 331. Initial Measurement of Loan Receivable

Receivable with Nominal Rate Equal to the Effective It is initially measured at fair value plus

Interest Rate transaction costs that are directly attributable to

It is recorded at face value (which is equal to the acquisition of the financial asset (transaction

its present value upon issuance). price + direct origination costs - origination fee).

324. Treatment for Interest-Bearing Note 332. Direct Origination Costs

Receivable with Nominal Rate Greater than the These are incremental direct costs of loan

Effective Interest Rate origination resulting from dealings with

It is recorded at face value (which is equal to independent third parties for that loan and various

its present value upon issuance). direct costs from specific activities of the lender for

that loan such as evaluating the prospective buyer’s

325. Treatment for Interest-Bearing Note economic condition, evaluating and recording

Receivable with Nominal Rate Less than the guarantees, etc.

Effective Interest Rate

It is measured at present value which is the 333. Treatment for Direct Origination Costs

discounted value of future cash flows using the General rule: These are included in the initial

effective interest rate. measurement of loan receivable.

Exception: These are expensed outright if

the loan did not materialize.

21

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

334. Indirect Origination Costs ***

These are operating costs of a lending

institution not directly incurred for a specific loan 343. Credit Losses

such as administrative cost, rent, depreciation and These are the present value of all cash

all other occupancy and equipment costs. shortfalls from a loan receivable or any similar

financial asset.

335. Treatment for Indirect Origination Costs

These are expensed as incurred. 344. Credit Risk

It is the risk that one party to a financial

336. Origination Fee instrument will cause a financial loss for the other

It is an upfront fee charged by a lender for party by failing to discharge an obligation.

processing of a new loan application.

345. Impairment Loss on Loan Receivable Under

337. Treatment for Origination Fee the Incurred Loss Model

It is recognized as unearned interest income It is measured as the difference between the

and amortized over the term of the loan. carrying amount and the present value of estimated

future cash flows discounted at the original

338. Subsequent Measurement of Loan Receivable effective rate.

It is subsequently measured at amortized

cost using the effective interest method. Measurement Bases Under the Expected Credit

Loss Model

339. Formula for Amortized Cost of Loan

Receivable (Effective Interest Method) 347. 12-Month Expected Credit Loss (Stage 1)

Initial measurement of loan receivable - It is the portion of the lifetime expected

Principal repayment ± Cumulative amortization - credit losses that represent the expected credit

Reduction for impairment or uncollectibility = losses that result from default events on a financial

Amortized cost of loan receivable instrument that are possible within the 12 months

after the reporting date. It applies to all items (from

Models for the Provision for Credit Losses from initial recognition) as long as there is no significant

Financial Instruments deterioration in credit quality

341. Incurred Loss Model (IAS 39 – Old) 348. Lifetime Expected Credit Loss (Stages 2 and 3)

It assumes that all loans will be repaid until It is the expected credit loss that results

evidence to the contrary (known as a loss or trigger from all possible default events over the expected

event) is identified. Only at that point is the impaired life of the financial instrument. It applies when a

loan (or portfolio of loans) written down to a lower significant increase in credit risk has occurred on an

value. individual or collective basis

***

342. Expected Credit Loss Model (IFRS 9 – New)

It allows entities to take into account 349. Loss Given Default

expectations of future credit losses. It results in the It is the amount of money a bank or other

earlier recognition of credit losses as it will no financial institution loses when a borrower defaults

longer be appropriate for entities to wait for an on a loan.

incurred loss event to have occurred before credit

losses are recognized.

Stages of the General Approach (Expected Credit Loss Model)

350. Stage 1 Stage 2 Stage 3

22

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

Loss allowance updated 12-month expected Lifetime expected credit Lifetime expected credit

at each reporting date credit losses losses losses

Lifetime expected credit Credit risk has increased Credit risk has increased

losses criteria significantly since initial

significantly since initial

recognition (whether on recognition (whether on

an individual or collective

an individual or collective

basis). basis).

+

Credit impairment

Interest income Effective interest rate on Effective interest rate on Effective interest rate on

calculated based on gross carrying amount gross carrying amount amortized cost (gross

carrying amount less

loss allowance)

Change in credit risk

since initial recognition

Improvement ↔

Deterioration

351. Computation of Impairment Loss Under the 354. Receivable Financing

Stage 1 of General Approach It is the financial flexibility or capability of an

Carrying amount, reporting date entity to raise money out of its receivables.

- Present value of expected cash flows

= Expected credit loss 355. Forms of Receivable Financing

* Probability of default within 12 months or

LGD a. Pledge of accounts receivable

= 12-month expected credit loss allowance b. Assignment of accounts receivable

- Expected credit loss allowance, previous c. Factoring of accounts receivable

year d. Discounting of notes receivable

= Impairment loss

356. Pledge of Accounts Receivable

352. Computation of Impairment Loss Under Stage It is a form of receivable financing where a

2 of General Approach business uses its accounts receivable as collateral

Carrying amount, reporting date on a loan, usually a line of credit.

- Present value of expected cash flows

= Expected credit loss 357. Line of Credit

* Probability of default within the remaining It is the preset borrowing limit that a

term or LGD borrower can use at any time.

= Lifetime expected credit loss allowance

- Expected credit loss allowance, previous 358. Discount on Loan

year It exists when the interest for the term of the

= Impairment loss loan is deducted in advance.

353. Computation of Impairment Loss Under the 359. Journal Entries Related to the Pledge of

Stage 3 of General Approach Accounts Receivable

Carrying amount, reporting date

- Present value of expected cash flows a. Commencement of loan in which the

= Lifetime expected credit loss accounts receivable have been pledged

- Expected credit loss allowance, previous – Dr. Cash, Discount on note payable (if

year discounted); Cr. Note payable

= Impairment loss b. Amortization of discount on note

payable at the end of reporting period or

23

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

at the date of settlement – Dr. Interest assigned with service charge – Dr.

expense; Cr. Discount on note payable Cash, Service charge; Cr. Note payable

c. Payment of bank loan – Dr. Note – bank

payable; Cr. Cash c. Issuance of credit memo for sales

return to a customer whose account

360. Formula for Carrying Amount of Discounted was assigned – Dr. Sale return; Cr.

Note Payable Accounts receivable – assigned

Note payable – Discount on note payable = d. Collection of cash from assigned

Carrying amount of note payable accounts receivable less cash discount

– Dr. Cash, Sales discount; Cr. Accounts

361. Assignment of Accounts Receivable receivable – assigned

It is a form of receivable financing where a e. Remittance of collections from

borrower called the assignor transfer rights in some assigned accounts receivable to the

accounts receivable to a lender called the assignee bank (assignee) plus interest – Dr. Note

in consideration for a loan. payable – bank, Interest expense; Cr.

Cash

Kinds of Assignment of Accounts Receivable f. Writeoff of assigned accounts

receivable – Dr. Allowance for doubtful

363. Nonnotification Basis accounts; Cr. Accounts receivable

It is a kind of assignment of accounts g. Transfer of assigned accounts

receivable where the customers are not informed receivable to accounts receivable after

that their accounts have been assigned (more making the last remittance of

commonly practiced). collections paying off the loan balance

plus interest – Dr. Accounts receivable;

364. Notification Basis Cr. Accounts receivable – assigned

It is a kind of assignment of accounts

receivable where the customers are notified that 368. Journal Entries Related to the Assignment of

their accounts have been assigned to have them Accounts Receivable Under Notification Basis

make their payments directly to the assignee

*** a. Separation of assigned accounts

receivable – Dr. Accounts receivable –

365. Service Charge, Financing Charge or assigned; Cr. Accounts receivable

Commission b. Receipt of notice from bank about

It is the interest for the loan that an assignee collection of accounts receivable

charges for the assignment agreement. assigned with cash discount – Dr. Note

payable – bank, Sales discount; Cr.

366. Equity in Assigned Accounts Receivable Cash

It is the difference between the accounts c. Sending of check to bank for interest

receivable assigned and the note payable from bank due on loan for which accounts

that shall be disclosed by the entity. receivable were assigned – Dr. Interest

expense; Cr. Cash

367. Journal Entries Related to the Assignment of d. Receipt of notice from bank about

Accounts Receivable Under Nonnotification Basis collection of assigned accounts

receivable allowing for the final

a. Separation of assigned accounts settlement of the loan (with interest)

receivable – Dr. Accounts receivable – and the remittance of excess

assigned; Cr. Accounts receivable collections and return of uncollected

b. Commencement of the loan for which assigned accounts – Dr. Cash, Interest

specific accounts receivable are

24

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

expense, Note payable – bank; Cr. 377. Factor's Holdback

Accounts receivable – assigned It is a predetermined amount withheld by the

factor as a protection against customer returns and

369. Factoring of Accounts Receivable allowances and other special adjustments.

It is the selling of accounts receivables to a

third party to raise cash under notification and 378. Journal Entries Related to the Factoring of

nonrecourse bases. Accounts Receivable as a Continuing Agreement

370. Factor a. Factoring where invoice is subject to

It is the bank or finance entity to which the credit terms allowing for availment of

accounts receivable are sold in factoring. cash discount with commission and

factor’s holdback – Dr. Cash, Sales

Forms of Factoring of Accounts Receivable discount, Commission (balancing

figure), Receivable from factor (factor’s

372. Casual Factoring holdback); Cr. Accounts receivable

It is a type of factoring which simply means b. Return of merchandise by customer

normal sale of accounts receivable. If an entity finds whose account was previously factored

in a critical cash position, it may be forced to factor – Dr. Sales return and allowances

some or all of its accounts receivable at a (invoice price of goods returned; Cr.

substantial discount to a bank or a finance entity to Sales discount (invoice price * discount

obtain the much needed cash. rate), Receivable from factor (balancing

figure)

373. Factoring in a Continuing Agreement c. Final settlement with the factor after all

It is an arrangement where a financing entity the receivables factored are collected –

purchases all of the accounts receivable of a certain Dr. Cash; Cr. Receivable from factor

entity. In this context, before the merchandise in

shipped to the customer, the company seeks for the 379. Credit Card

factor’s credit approval, if approved, the accounts It is a plastic card which enables the holder

are directly sold to the factor then assumes for its to obtain credit up to a predetermined limit from the

collections. issuer of the card for the purchase of goods and

services (somewhat similar to factoring).

374. Journal Entry to Record the Factoring of

Accounts Receivable (Casual) 380. Journal Entries Related to Credit Card

Dr. Cash, Allowance for doubtful accounts (if Transactions

any), Loss on factoring (balancing figure); Cr.

Accounts receivable a. Credit card sales – Dr. Accounts

receivable – credit card company; Cr.

375. Factor's Credit Approval Sales

It is required before a merchandise is b. Payment from credit card company – Dr.

shipped to a customer when the reporting entity's Cash, Credit card service charge; Cr.

accounts receivable are under a factoring as a Accounts receivable – credit card

continuing agreement. company

376. Factoring Fee or Commission 381. Discounting of Note Receivable

It is charged by the factor for its services of It is a form of receivable financing where a

credit approval, billing, collecting and assuming note receivable is converted into cash by selling

uncollectible factored accounts. them to a financial institution at a discount.

25

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211

Financial accounting and reporting VOL-1A

382. Endorsement 394. Discount

It is the transfer of right to a negotiable It is the amount of interest deducted by the

instrument by simply signing at the back of the bank in advance.

instrument.

395. Formula for Discount

383. Endorsement with Recourse Discount = Maturity value * Discount rate *

It means that the endorser shall pay the Discount period

endorsee if the maker dishonors the note (default in

case the problem is silent). 396. Discount Rate

It is the rate used by the bank in computing

384. Endorsement without Recourse the discount.

It means that the endorser avoids future

liability even if the maker refuses to pay the 397. Discount Period

endorsee on the date of maturity. It is the period of time from date of

discounting to maturity date (unexpired term of the

385. Net Proceeds note).

These refer to the discounted value of the

note received by the endorser from the endorsee. 398. Formula for Discount Period

Discount period = Term of the note – Expired

386. Formula for Net Proceeds portion of the term up to the date of discounting

Net proceeds = Maturity value – Discount

399. Journal for Discounting of Note Receivable

387. Maturity Value without Recourse

It is the amount due on the note at the date Dr. Cash, Loss on note receivable

of maturity. discounting; Cr. Note receivable, Interest income

(principal * interest rate * time from date of note to

388. Formula for Maturity Value date of discounting)

Maturity value = Principal + Interest over the

whole term of the note Accounting Treatments for Discounting of Notes

Receivable with Recourse

389. Maturity Date

It is the date on which the note should be 401. Conditional Sale

paid. It is a way of accounting for note receivable

discounting which treats the transaction as the sale

390. Principal of note receivable subject to a condition (the

It is the amount appearing on the face of the endorser has to refund the endorsee in case the

note (face value). note is subsequently dishonored).

391. Interest 402. Secured Borrowing

It is the amount of interest for the full term It is a way of accounting for note receivable

of the note. discounting which treats the transaction as the

borrowing of cash by the endorser from the

392. Formula for Interest endorsee with the note receivable held as security

Interest = Principal * Rate * Time by the latter for such borrowing.

***

393. Time

It is the period within which the interest shall

accrue (date of note to maturity date).

26

Downloaded by Hannah Bea Lindo (hannahbea0701@gmail.com)

lOMoARcPSD|6968211