Professional Documents

Culture Documents

++inner Circle Trader - Precision Trading Volume 1 PDF

++inner Circle Trader - Precision Trading Volume 1 PDF

Uploaded by

Cr Ht0 ratings0% found this document useful (0 votes)

59 views3 pagesOriginal Title

++Inner Circle Trader - Precision Trading Volume 1.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

59 views3 pages++inner Circle Trader - Precision Trading Volume 1 PDF

++inner Circle Trader - Precision Trading Volume 1 PDF

Uploaded by

Cr HtCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Precision Trading Volume 1

Sunday, April 20, 2014 9:04 PM

Order blocks occur on all time frames.

Low risk, high probability setups are derived from higher time frame perspectives.

Large institutions and banks are basing the majority of their trades from the higher time frame charts. Their

orders are so large that many times they need to be split up into modular blocks.

We want to be buying when the street money is selling and selling when the street money is buying.

Trends or order flow tend to remain for long periods and require more to change them.

If we see a pair moving higher on the weekly chart, it is going to take a very significant impact of some sort on a

fundamental level to cause this underlying trend to change course.

Blind luck tricks you into thinking that you are smarter than you really are and this is what really plagues a

neophyte trader that begins to see profits fall into their account.

Framing retail trading ideas on the basis of the macro perspective is conducive for profits.

The EMA's (period 9 and period 18) on weekly time frames will assist in higher odds order flow & order blocks.

Only judge and compare yourself to who you were the day before, do not compare yourself to other traders.

When the EMA starts to turn downwards do not view it as a potential crossover. It is only a crossover once they

actually cross over to the downside. An actual crossover has to happen before you want to abandon your

premise.

You do not want to use candles with big wicks as order blocks. The best order block candles are the ones with

large bodies.

When you see price continuously dip down into an order block and then snap away from it, then you know that

the smart money is really accumulating positions.

If the order blocks are being respected on the bullish side, then the support levels around that order block

should maintain.

You are investigating the market on a daily basis and asking yourself, "what is being respected?"

We are limiting our focus to one side of the market.

We don't like to trade on Sunday's, Monday's, or Friday's.

We are looking for speed moving away from a level and the amount of time it spent at that level. If price is

meandering around for a while then there was not a lot of institutional sponsorship involved.

When you are in bullish conditions and expecting higher pricing and you see prices dropping lower, that is not

indicative of smart money selling. In fact, it is just the lack of smart money buying.

If you see price rally and then start consolidating, the first question you will want to be asking yourself is,

"where are the stops located?" See the chart below for an example:

You might also like

- ICT Vids ExplainedDocument11 pagesICT Vids ExplainedIsrael Akinyemi39% (79)

- ICT Monthly Mentorship: Study NotesDocument121 pagesICT Monthly Mentorship: Study NotesEjide Omolara82% (17)

- ICT Mentorship Month 1 NotesDocument32 pagesICT Mentorship Month 1 NotesJoe Ledesma94% (99)

- September ICT Notes PDFDocument32 pagesSeptember ICT Notes PDFIrvin Chiroque Lucero84% (31)

- Inner Circle Trader - Precision Trading Volume 2Document3 pagesInner Circle Trader - Precision Trading Volume 2Steve Smith94% (17)

- ICT Mentorship - Month 6 NotesDocument92 pagesICT Mentorship - Month 6 NotesPG94% (16)

- Mark Douglas - Trading in The Zone PDFDocument52 pagesMark Douglas - Trading in The Zone PDFFibo Forex65% (23)

- Inner Circle Trader - The Power of ThreeDocument2 pagesInner Circle Trader - The Power of ThreeKagan Can100% (5)

- Keys To Directional BiasDocument29 pagesKeys To Directional Biasj93% (28)

- Glossary of ICT TermsDocument14 pagesGlossary of ICT TermsJuan Jose Martinez Sanchez100% (3)

- Month 8 PDFDocument85 pagesMonth 8 PDFDiana Gomez100% (10)

- I CT Material ReferenceDocument75 pagesI CT Material Referencewanqi0885% (20)

- OTE FreemodelDocument20 pagesOTE Freemodelvadavada96% (24)

- ICT Monthly Mentorship - Not For Public DistributionDocument105 pagesICT Monthly Mentorship - Not For Public DistributionErick Kimasha96% (23)

- Festus Omoemu - BTMMvsICTDocument20 pagesFestus Omoemu - BTMMvsICTjcarlm201790% (20)

- Inner Circle Trader - 20 Pip Scalping Method PDFDocument5 pagesInner Circle Trader - 20 Pip Scalping Method PDFLê Bá Chí60% (10)

- Inner Circle Trader - WENT 01 PDFDocument2 pagesInner Circle Trader - WENT 01 PDFOJavier Mejia100% (4)

- Cities and The Health of The PublicDocument377 pagesCities and The Health of The PublicVanderbilt University Press100% (13)

- Inner Circle Trader - Inside The Range WebinarDocument3 pagesInner Circle Trader - Inside The Range WebinarKagan Can100% (6)

- ICT Free Strategy FSTDocument22 pagesICT Free Strategy FSTsolorzanoi100% (25)

- MM Sir ZoneDocument29 pagesMM Sir ZoneHai To Thanh100% (13)

- Month 9 NotesDocument106 pagesMonth 9 NotesDiana Gomez96% (28)

- Inner Circle Trader - The Asian RangeDocument2 pagesInner Circle Trader - The Asian RangeCr Ht100% (2)

- Inner Circle Trader - Sniper Course, Enlisting PDFDocument1 pageInner Circle Trader - Sniper Course, Enlisting PDFmajidy13% (8)

- Inner CircleDocument96 pagesInner Circlemr.ajeetsingh20% (5)

- Case StudyDocument2 pagesCase StudyThao NguyenNo ratings yet

- The Market MakersDocument13 pagesThe Market Makerssocio cursos93% (14)

- Inner Circle Trader - London Open TacticDocument3 pagesInner Circle Trader - London Open TacticMuhammad RandaNo ratings yet

- Inner Circle Trader - Search & Destroy ProfileDocument4 pagesInner Circle Trader - Search & Destroy ProfileEyad QarqashNo ratings yet

- Inner Circle Trader - Precision Trading Volume 3Document1 pageInner Circle Trader - Precision Trading Volume 3Steve Smith100% (1)

- Trading Major ReactionsDocument29 pagesTrading Major ReactionsAdhetya Pratama85% (13)

- The Market Maker's Edge: A Wall Street Insider Reveals How to: Time Entry and Exit Points for Minimum Risk, Maximum Profit; Combine Fundamental and Technical Analysis; Control Your Trading Environment Every Day, Every TradeFrom EverandThe Market Maker's Edge: A Wall Street Insider Reveals How to: Time Entry and Exit Points for Minimum Risk, Maximum Profit; Combine Fundamental and Technical Analysis; Control Your Trading Environment Every Day, Every TradeRating: 2.5 out of 5 stars2.5/5 (3)

- Inner Circle Trader - Precision Trading Volume 3Document1 pageInner Circle Trader - Precision Trading Volume 3Steve Smith100% (1)

- Inner Circle Trader - TPDS 3Document9 pagesInner Circle Trader - TPDS 3Kasjan MarksNo ratings yet

- Pivot Calculator 16044 16014 16037: High LOW CloseDocument2 pagesPivot Calculator 16044 16014 16037: High LOW CloseSekhar Reddy100% (1)

- Inner Circle Trader2Document4 pagesInner Circle Trader2Tri Nur Daya50% (2)

- ++inner Circle Trader - Trading The FigureDocument2 pages++inner Circle Trader - Trading The FigureCr Ht100% (1)

- Inner Circle Trader - Risk ManagementDocument3 pagesInner Circle Trader - Risk ManagementArkipNo ratings yet

- Understanding Level 2 and Market MakersDocument4 pagesUnderstanding Level 2 and Market Makers5_percenter100% (14)

- Fx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerFrom EverandFx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerRating: 4 out of 5 stars4/5 (3)

- Supply and Demand - Inside The BreakoutDocument5 pagesSupply and Demand - Inside The BreakoutMichael Mario100% (3)

- ICT - Sniper Coarse - Basic InfantryDocument6 pagesICT - Sniper Coarse - Basic InfantryAzize MohammedNo ratings yet

- "Face The Trader Within" by Chris Lori CTA: Equity ManagementDocument23 pages"Face The Trader Within" by Chris Lori CTA: Equity ManagementBen Willmott100% (1)

- Steve BurnsDocument12 pagesSteve Burnsscarnose33% (3)

- Sam Seiden CBOT KeepItSimpleDocument3 pagesSam Seiden CBOT KeepItSimpleferritape100% (2)

- Live SessionDocument5 pagesLive SessionSteve SmithNo ratings yet

- Fox Games Is A U S Company That Manufacturers Computer GameDocument1 pageFox Games Is A U S Company That Manufacturers Computer Gametrilocksp SinghNo ratings yet

- Inner Circle Trader - Progressive Risk ReductionDocument2 pagesInner Circle Trader - Progressive Risk ReductionSteve Smith100% (1)

- Inner Circle Trader - TPDS 2Document3 pagesInner Circle Trader - TPDS 2Sonja Moran83% (6)

- Inner Circle Trader - TPDS 5Document18 pagesInner Circle Trader - TPDS 5Felix Tout Court100% (1)

- Notes 2014-12-11Document15 pagesNotes 2014-12-11Sandra GivensNo ratings yet

- March StudynotesDocument133 pagesMarch StudynotesHuế Trịnh100% (5)

- Inner Circle Trader - 20110201 PTC PDFDocument1 pageInner Circle Trader - 20110201 PTC PDFRory BrownNo ratings yet

- PDF September Ict Notespdf - CompressDocument14 pagesPDF September Ict Notespdf - CompressSagar BhandariNo ratings yet

- Inner Circle Trader - TPDS 4Document2 pagesInner Circle Trader - TPDS 4Felix Tout CourtNo ratings yet

- Trading Strategies Explained: A selection of strategies traders could use on the LMAX platformFrom EverandTrading Strategies Explained: A selection of strategies traders could use on the LMAX platformNo ratings yet

- Price Pattern TradingDocument59 pagesPrice Pattern TradingGajil Mariul84% (19)

- UntitledDocument121 pagesUntitledKAJOL CHANDRA ROY100% (1)

- Notes On The BooksDocument11 pagesNotes On The BooksMaricar San PedroNo ratings yet

- Introduction Successfull Trading Using The 50CCIDocument38 pagesIntroduction Successfull Trading Using The 50CCIPapy RysNo ratings yet

- An Introduction To Successful Trading Using The 50 CCI - Part 1Document38 pagesAn Introduction To Successful Trading Using The 50 CCI - Part 1alpepezNo ratings yet

- Sieve Burns PsychologyDocument63 pagesSieve Burns PsychologyHARDIK SHAHNo ratings yet

- Inner Circle Trader - WENT 03Document6 pagesInner Circle Trader - WENT 03kinglove194100% (1)

- MahadFX Course 5Document11 pagesMahadFX Course 5Tuong Nguyen100% (1)

- Inner Circle Trader - 20110208 PTC PDFDocument1 pageInner Circle Trader - 20110208 PTC PDFRory BrownNo ratings yet

- Asian Ses123321 StrasfDocument3 pagesAsian Ses123321 StrasfSteve SmithNo ratings yet

- Asian Ses123321 StrasfDocument3 pagesAsian Ses123321 StrasfSteve SmithNo ratings yet

- Live SessionDocument5 pagesLive SessionSteve SmithNo ratings yet

- 2 PDFDocument82 pages2 PDFSteve SmithNo ratings yet

- Case Analysis On Pizza HUT: Presented By-Ishika Khandelwal Sejal Garg Aanchal SinghDocument22 pagesCase Analysis On Pizza HUT: Presented By-Ishika Khandelwal Sejal Garg Aanchal Singhaanchal singhNo ratings yet

- M11 TodaroSmith013934 11 Econ C11Document38 pagesM11 TodaroSmith013934 11 Econ C11Ari DYNo ratings yet

- Guide To Acquiring Artworks 1Document66 pagesGuide To Acquiring Artworks 1Hamza AhmadNo ratings yet

- Define and Compare The Five Marketing Management PhilosophiesDocument5 pagesDefine and Compare The Five Marketing Management PhilosophiesSyed Usama ImamNo ratings yet

- M&a ValluationDocument11 pagesM&a ValluationSumeet BhatereNo ratings yet

- Transparency PDFDocument9 pagesTransparency PDFJoeNo ratings yet

- Tesco MDocument11 pagesTesco MAmmar KhanNo ratings yet

- Ketan MehtaDocument5 pagesKetan Mehtasourabh100ravNo ratings yet

- BhupiDocument251 pagesBhupiRaju PrasadNo ratings yet

- Assignment 2 - Financial Risk ManagementDocument2 pagesAssignment 2 - Financial Risk ManagementRabia Raiz 1386-FMS/BBAIT/F19No ratings yet

- Customer Relationship Management (CRM)Document21 pagesCustomer Relationship Management (CRM)Alok KumarNo ratings yet

- The Future of Banking Is Open PDFDocument52 pagesThe Future of Banking Is Open PDFhermestriNo ratings yet

- Video Vocab 002: Economy 1: The Business English Podcast For Professionals On The MoveDocument5 pagesVideo Vocab 002: Economy 1: The Business English Podcast For Professionals On The MoveashwinNo ratings yet

- Mini Project OnDocument4 pagesMini Project OnHemanth KumarNo ratings yet

- 110 B - 2 BR - 87.50 SQM - 2710AB - 10dpDocument1 page110 B - 2 BR - 87.50 SQM - 2710AB - 10dpNiño Marco LeeNo ratings yet

- ITC E Choupal PPT FinalDocument16 pagesITC E Choupal PPT Finalvigneshmba88No ratings yet

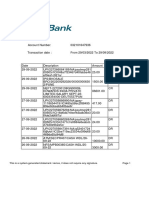

- Statement 1664469716655Document22 pagesStatement 1664469716655salunkheclNo ratings yet

- Session 16A Chapter 9 Chopra 5thedDocument15 pagesSession 16A Chapter 9 Chopra 5thedNIkhilNo ratings yet

- Modul EFB Unit 1Document7 pagesModul EFB Unit 1alziraanindia30No ratings yet

- Econ310 - Test 1Document6 pagesEcon310 - Test 1Jimmy TengNo ratings yet

- RevenueDocument13 pagesRevenueASSER AbdelrhmanNo ratings yet

- Hybrid Financial InstrumentDocument56 pagesHybrid Financial InstrumentChetan Godambe100% (5)

- IMC Report PDFDocument11 pagesIMC Report PDFjinal patadiyaNo ratings yet

- Segmenting and Targeting MarketsDocument39 pagesSegmenting and Targeting MarketsFarida NormaNo ratings yet

- Demand NumericalsDocument4 pagesDemand NumericalsSagar TayalNo ratings yet

- ChicagoGSB Math Models SyllabusDocument8 pagesChicagoGSB Math Models SyllabusNuggets MusicNo ratings yet

- XYLYS: Exploring Consumer Perception About Premium Watches in The Indian ContextDocument8 pagesXYLYS: Exploring Consumer Perception About Premium Watches in The Indian ContextSumit GauravNo ratings yet