Professional Documents

Culture Documents

The Treasurer of The Larson Corporation Is Going To Bring

The Treasurer of The Larson Corporation Is Going To Bring

Uploaded by

Taimour HassanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Treasurer of The Larson Corporation Is Going To Bring

The Treasurer of The Larson Corporation Is Going To Bring

Uploaded by

Taimour HassanCopyright:

Available Formats

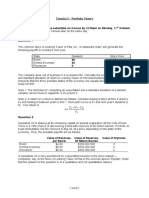

The treasurer of the Larson Corporation is going to bring

#2251

The treasurer of the Larson Corporation is going to bring an $8 million issue to the market in

120 days. It will be a 25-year issue. The interest rate environment is highly volatile, and even

though long-term interest rates are currently 10 1?4 percent, there is a fear that interest rates

will be up to 11 percent by the time the bonds get to the market.a. If interest rates go up by 3?4

point, what is the present value of the extra interest this increase will cost the corporation? Use

an 11 percent discount rate, and disregard tax considerations.b. Assume the corporation is

going to short September Treasury bonds as quoted near the top of Table 15–8 on page 404 for

the CBT (Chicago Board of Trade). Based on the settle price, how many contracts must they

sell to equal the $8 million exposed position? Round to the nearest whole number of

contracts.c. Based on your answer in part b, if Treasury bond prices increase by 2.8 percent of

par value in each contract in response to a 1?2 percent decline in interest rates over the next 45

days, what will be the total loss on the futures contracts?View Solution:

The treasurer of the Larson Corporation is going to bring

ANSWER

http://paperinstant.com/downloads/the-treasurer-of-the-larson-corporation-is-going-to-bring/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- American Chemical CompanyDocument7 pagesAmerican Chemical Companycmarshall22340% (5)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Paf Is A Small Country That Wishes To Control InternationalDocument1 pagePaf Is A Small Country That Wishes To Control InternationalTaimour HassanNo ratings yet

- International Finance Case Solution Chapter 13Document3 pagesInternational Finance Case Solution Chapter 13Al-Imran Bin Khodadad100% (1)

- Quiz1 PDFDocument45 pagesQuiz1 PDFShami Khan Shami KhanNo ratings yet

- Ej. 1 Fin CorpDocument3 pagesEj. 1 Fin CorpChantal AvilesNo ratings yet

- Disney Capital BudgetDocument17 pagesDisney Capital BudgetKeerat KhoranaNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Paul Regan Bookkeeper of Hampton Co Has Been Up HalfDocument1 pagePaul Regan Bookkeeper of Hampton Co Has Been Up HalfTaimour HassanNo ratings yet

- FIN3004 Tutorial 2 QuestionsDocument2 pagesFIN3004 Tutorial 2 QuestionsLe HuyNo ratings yet

- Lahore School of Economics: Final Semester Exam May 2021Document6 pagesLahore School of Economics: Final Semester Exam May 2021Muhammad Ahmad AzizNo ratings yet

- Coursework 2-Corporate FinanceDocument4 pagesCoursework 2-Corporate Financeyitong zhangNo ratings yet

- Mergers & AcquisionDocument2 pagesMergers & AcquisionAditya Patil0% (1)

- Toaz - Info Corpfinance Amchem PRDocument12 pagesToaz - Info Corpfinance Amchem PRs8a6jbkelmNo ratings yet

- Adm3350 - W4Document3 pagesAdm3350 - W4aba brohaNo ratings yet

- Exercise of Merger and AcquisitionDocument2 pagesExercise of Merger and AcquisitionzainabhayatNo ratings yet

- FIN5FMA Tutorial 2 SolutionsDocument7 pagesFIN5FMA Tutorial 2 SolutionsSanthiya MogenNo ratings yet

- CF 2Document2 pagesCF 2shahidameen2No ratings yet

- Soalan FinanceDocument27 pagesSoalan FinanceNur Ain SyazwaniNo ratings yet

- On September 1 2011 Park Rapids Lumber Company Issued 80Document1 pageOn September 1 2011 Park Rapids Lumber Company Issued 80Amit PandeyNo ratings yet

- Suppose You Have Been Hired As A Financial Consultant To Defense Electronics IncDocument3 pagesSuppose You Have Been Hired As A Financial Consultant To Defense Electronics IncCharlotteNo ratings yet

- Stock Valuation - Practice QuestionsDocument6 pagesStock Valuation - Practice QuestionsKam YinNo ratings yet

- M8 AssignmentsDocument2 pagesM8 AssignmentsNJUENo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 10: Capital Structure and Leverage (Common Questions)Document4 pagesNanyang Business School AB1201 Financial Management Tutorial 10: Capital Structure and Leverage (Common Questions)asdsadsaNo ratings yet

- Quiz 3: Corporate Finance: Interest Coverage Ratio Rating Typical Default SpreadDocument18 pagesQuiz 3: Corporate Finance: Interest Coverage Ratio Rating Typical Default SpreadCindy MaNo ratings yet

- Exercise Solution Merger and AcquisitionDocument19 pagesExercise Solution Merger and Acquisitionzainabhayat100% (1)

- Summary Mankeu CH 14Document18 pagesSummary Mankeu CH 14Yoga Pratama Rizki FNo ratings yet

- Mishkin FMI9ge PPT C04Document65 pagesMishkin FMI9ge PPT C04kbica21No ratings yet

- Corpfinance AmchemDocument12 pagesCorpfinance AmchemSuyash JoshiNo ratings yet

- BFIN525 - Chapter 9 ProblemsDocument6 pagesBFIN525 - Chapter 9 Problemsmohamad yazbeckNo ratings yet

- RSM333 - Assignment 2 - Fall 2011Document2 pagesRSM333 - Assignment 2 - Fall 2011Jun GuoNo ratings yet

- Stock Valuation Practice QuestionsDocument6 pagesStock Valuation Practice QuestionsmushtaqNo ratings yet

- International Finanacial ManagementDocument6 pagesInternational Finanacial ManagementAyesha SiddikaNo ratings yet

- FIN3004 Tutorial 2 SolutionsDocument7 pagesFIN3004 Tutorial 2 SolutionsBích Đào Nguyễn ThịNo ratings yet

- We R Toys WRT Is Considering Expanding Into New GeographicDocument1 pageWe R Toys WRT Is Considering Expanding Into New GeographicAmit PandeyNo ratings yet

- Part 1 Tucker Company Has An Asset in The FormDocument1 pagePart 1 Tucker Company Has An Asset in The FormTaimour HassanNo ratings yet

- Homework 7 Problems and SolutionsDocument17 pagesHomework 7 Problems and Solutionswasif ahmedNo ratings yet

- Exercise Set 9Document2 pagesExercise Set 9Elia ScagnolariNo ratings yet

- Umar Farooq - FM AssignmentDocument5 pagesUmar Farooq - FM AssignmentUmar GondalNo ratings yet

- FM Mock C - Questions D21Document16 pagesFM Mock C - Questions D21g.d11gopalNo ratings yet

- ProblemSet1 PDFDocument5 pagesProblemSet1 PDFjeremy AntoninNo ratings yet

- Finance Exam Jan - 2017Document9 pagesFinance Exam Jan - 2017mrdirriminNo ratings yet

- PFRM - Final PPT - Group 3Document21 pagesPFRM - Final PPT - Group 3RAHUL DASNo ratings yet

- A Suppose You Are Considering Two Possible Investment Opportunities ADocument1 pageA Suppose You Are Considering Two Possible Investment Opportunities AMuhammad ShahidNo ratings yet

- Quiz 1Document46 pagesQuiz 1linerz0% (1)

- 2009T2 Fins1613 FinalExamDocument24 pages2009T2 Fins1613 FinalExamchoiyokbao100% (1)

- Cost of Capital ExcercisesDocument3 pagesCost of Capital ExcercisesLinh Ha Nguyen Khanh100% (1)

- Assume That You Recently Graduated With A Major in FinanceDocument2 pagesAssume That You Recently Graduated With A Major in FinanceAmit PandeyNo ratings yet

- Northern Forest ProductsDocument15 pagesNorthern Forest ProductsHương Lan TrịnhNo ratings yet

- Exam Practice QuestionsDocument6 pagesExam Practice Questionssir bookkeeperNo ratings yet

- 00-Text-Ch9 Additional Problems UpdatedDocument3 pages00-Text-Ch9 Additional Problems Updatedzombies_me0% (1)

- Commercial Real Estate Case StudyDocument2 pagesCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- Homework 10Document4 pagesHomework 10Gia Hân TrầnNo ratings yet

- RE 04 Multifamily CreditDocument9 pagesRE 04 Multifamily Creditte fannyNo ratings yet

- Financial CasesDocument64 pagesFinancial CasesMarwan MikdadyNo ratings yet

- Practice Questions - Cost of Capital - 2Document11 pagesPractice Questions - Cost of Capital - 2arun babuNo ratings yet

- Lancaster Engineering Inc Lei Has The Following Capital Structure WhichDocument1 pageLancaster Engineering Inc Lei Has The Following Capital Structure WhichAmit PandeyNo ratings yet

- 1 What Is A Difference Between A Forward Contract and A Future ContractDocument6 pages1 What Is A Difference Between A Forward Contract and A Future ContractAlok SinghNo ratings yet

- E.I. Du Pont de Nemours and CompanyDocument9 pagesE.I. Du Pont de Nemours and CompanySachin Dhopre100% (1)

- Tutorial 3 - Portfolio Theory: The Problem Sets Must Be Submitted Via Canvas by 12:30pm On Monday, 11 OctoberDocument2 pagesTutorial 3 - Portfolio Theory: The Problem Sets Must Be Submitted Via Canvas by 12:30pm On Monday, 11 OctoberVivienLamNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- You Have Been Asked by The President of The CompanyDocument1 pageYou Have Been Asked by The President of The CompanyTaimour HassanNo ratings yet

- You Are The Management Accountant of Expand A Company IncorporatedDocument1 pageYou Are The Management Accountant of Expand A Company IncorporatedTaimour HassanNo ratings yet

- Yuma Arizona Resident Rosalind Setchfield Won 1 3 Million in AnDocument1 pageYuma Arizona Resident Rosalind Setchfield Won 1 3 Million in AnTaimour HassanNo ratings yet

- You Have Been Given The Following Information For Rpe ConsultingDocument1 pageYou Have Been Given The Following Information For Rpe ConsultingTaimour HassanNo ratings yet

- You Are The Management Accountant of A Manufacturing Company WhereDocument1 pageYou Are The Management Accountant of A Manufacturing Company WhereTaimour HassanNo ratings yet

- You Are Considering An Investment in A Christmas Tree FarmDocument1 pageYou Are Considering An Investment in A Christmas Tree FarmTaimour HassanNo ratings yet

- Outdoor S Best Pre Sells Yard Maintenance Packages For The Gardening SeasonDocument1 pageOutdoor S Best Pre Sells Yard Maintenance Packages For The Gardening SeasonTaimour HassanNo ratings yet

- Pacrim Careers Provides Training To Individuals Who Pay Tuition DirectlyDocument1 pagePacrim Careers Provides Training To Individuals Who Pay Tuition DirectlyTaimour HassanNo ratings yet

- You Are An Investment Banker Considering The Issuance of ADocument1 pageYou Are An Investment Banker Considering The Issuance of ATaimour HassanNo ratings yet

- Pablo and His Wife Bernita Are Both Age 45 PabloDocument1 pagePablo and His Wife Bernita Are Both Age 45 PabloTaimour HassanNo ratings yet

- Ontrack Company Produces Compasses For Cross Country Skiing The Production CapacityDocument1 pageOntrack Company Produces Compasses For Cross Country Skiing The Production CapacityTaimour HassanNo ratings yet

- Peeters Consulting Completed These Transactions During June 2014 A Trevor PeetersDocument1 pagePeeters Consulting Completed These Transactions During June 2014 A Trevor PeetersTaimour HassanNo ratings yet

- Parentis A Public Listed Company Acquired 600 Million Equity SharesDocument1 pageParentis A Public Listed Company Acquired 600 Million Equity SharesTaimour HassanNo ratings yet

- Pavillion Company Experienced The Following Events and Transactions During July JulyDocument1 pagePavillion Company Experienced The Following Events and Transactions During July JulyTaimour HassanNo ratings yet

- Paf Is A Small Country Its Currency Is The PifDocument1 pagePaf Is A Small Country Its Currency Is The PifTaimour HassanNo ratings yet

- Part 1 Tucker Company Has An Asset in The FormDocument1 pagePart 1 Tucker Company Has An Asset in The FormTaimour HassanNo ratings yet

- On October 1 A Swiss Investor Decides To Hedge ADocument1 pageOn October 1 A Swiss Investor Decides To Hedge ATaimour HassanNo ratings yet