Professional Documents

Culture Documents

Solved Lia Chen and Martin Monroe Formed A Partnership Dividing Income

Uploaded by

Anbu jaromiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Lia Chen and Martin Monroe Formed A Partnership Dividing Income

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) Lia Chen and Martin Monroe formed a

partnership dividing income

Lia Chen and Martin Monroe formed a partnership dividing income Lia Chen and Martin Monroe

formed a partnership, dividing income as follows: 1. Annual salary allowance to Chen of

$35,000. 2. Interest of 4% on each partner’s capital balance on January 1. 3. Any remaining net

income divided to Chen […]

Holly Renfro contributed a patent accounts receivable and 20 000 cash Holly Renfro contributed

a patent, accounts receivable, and $20,000 cash to a partnership. The patent had a book value

of $8,000. However, the technology covered by the patent appeared to have significant market

potential. Thus, the patent was appraised […]

Reynolds American Inc has numerous pages dedicated to describing contingent Reynolds

American, Inc., has numerous pages dedicated to describing contingent liabilities in the notes to

recent financial statements. These pages include extensive descriptions of multiple contingent

liabilities. Use the Internet to research Reynolds American, Inc., at www.reynoldsamerican.com.

a. What are […]

An employee earns 25 per hour and 2 times that An employee earns $25 per hour and 2 times

that rate for all hours in excess of 40 hours per week. Assume that the employee worked 48

hours during the week. Assume further that the social security tax rate was […]

GET ANSWER- https://accanswer.com/downloads/page/1892/

Bull City Industries is considering issuing a 100 000 7 note Bull City Industries is considering

issuing a $100,000, 7% note to a creditor on account. a. If the note is issued with a 45-day term,

journalize the entries to record: 1. The issuance of the note. 2. The payment […]

Ramsey Company issues an 800 000 45 day note to Buckner Company Ramsey Company

issues an $800,000, 45-day note to Buckner Company for merchandise inventory. Buckner

discounts the note at 7%. a. Journalize Ramsey’s entries to record: 1. The issuance of the

note. 2. The payment of the note at […]

The current assets and current liabilities for Apple Inc and The current assets and current

liabilities for Apple Inc. and HP, Inc., are as follows at the end of a recent fiscal period: * These

represent prepaid expense and other non-quick current assets. a. Determine the quick ratio for

both […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1892/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Solved The State Spartan Corporation Is Considering Two Mutually ExclusDocument1 pageSolved The State Spartan Corporation Is Considering Two Mutually ExclusM Bilal SaleemNo ratings yet

- Solved Other Things Held Constant Which of The Following Actions WouldDocument1 pageSolved Other Things Held Constant Which of The Following Actions WouldAnbu jaromiaNo ratings yet

- Solved Use The September Transaction Data For Taylor Moffat Veterinarian GivenDocument1 pageSolved Use The September Transaction Data For Taylor Moffat Veterinarian GivenAnbu jaromiaNo ratings yet

- Accounting Equation, Transaction Analysis and Preparation of Financial StatementDocument10 pagesAccounting Equation, Transaction Analysis and Preparation of Financial Statementশুভ MitraNo ratings yet

- Solved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsDocument1 pageSolved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsAnbu jaromiaNo ratings yet

- Solved Review The Transactions Listed in E3 1 For Wolfe LTD Instructions Classify EachDocument1 pageSolved Review The Transactions Listed in E3 1 For Wolfe LTD Instructions Classify EachAnbu jaromiaNo ratings yet

- BE 601 Class 2Document17 pagesBE 601 Class 2Chan DavidNo ratings yet

- Solved Charger Inc Has The Following Items For The Current Year PDFDocument1 pageSolved Charger Inc Has The Following Items For The Current Year PDFAnbu jaromiaNo ratings yet

- Solved Corporation R Signed A Contract To Undertake A Transaction ThatDocument1 pageSolved Corporation R Signed A Contract To Undertake A Transaction ThatAnbu jaromiaNo ratings yet

- Solved Three Machines Are Employed in An Isolated Area They EachDocument1 pageSolved Three Machines Are Employed in An Isolated Area They EachM Bilal SaleemNo ratings yet

- Solved Katrina Corp Is A Publicly Traded Company On A LargeDocument1 pageSolved Katrina Corp Is A Publicly Traded Company On A LargeAnbu jaromiaNo ratings yet

- Solved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500Document1 pageSolved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500Anbu jaromiaNo ratings yet

- Excercise Sheet Lectures 1 and 2 Spring 2022Document16 pagesExcercise Sheet Lectures 1 and 2 Spring 2022Mohamed ZaitoonNo ratings yet

- Quiz Chapter 1 Business Combinations Part 1Document6 pagesQuiz Chapter 1 Business Combinations Part 1Kaye L. Dela CruzNo ratings yet

- Basic AccountingDocument46 pagesBasic AccountingMD LeeNo ratings yet

- Solved From The List That Follows Identify The Accounts That ShouldDocument1 pageSolved From The List That Follows Identify The Accounts That ShouldAnbu jaromiaNo ratings yet

- Accounting for Business Combinations ExamDocument6 pagesAccounting for Business Combinations ExamCyrine Miwa Rodriguez100% (2)

- Solved Beacon Signals Company Maintains and Repairs Warning Lights Such As PDFDocument1 pageSolved Beacon Signals Company Maintains and Repairs Warning Lights Such As PDFAnbu jaromiaNo ratings yet

- Solved Nick S Enterprises Has Purchased A New Machine Tool That WillDocument1 pageSolved Nick S Enterprises Has Purchased A New Machine Tool That WillAnbu jaromiaNo ratings yet

- Solved Two Independent Random Samples of Annual Starting Salaries For IndividualsDocument1 pageSolved Two Independent Random Samples of Annual Starting Salaries For IndividualsAnbu jaromiaNo ratings yet

- Business Transactions: Review Sheet 2 Chapter 1/unit 2Document4 pagesBusiness Transactions: Review Sheet 2 Chapter 1/unit 2Rabia AhmadNo ratings yet

- Solved Robbins Inc Owns The Following Assets at The Balance SheetDocument1 pageSolved Robbins Inc Owns The Following Assets at The Balance SheetAnbu jaromiaNo ratings yet

- Weygandt Kimmel Keiso 9 EditionDocument11 pagesWeygandt Kimmel Keiso 9 EditionShuvro ChakravortyNo ratings yet

- Solved The Following Statement of Cash Flows For Shasta Inc WasDocument1 pageSolved The Following Statement of Cash Flows For Shasta Inc WasAnbu jaromiaNo ratings yet

- Solved Ellsworth Enterprises Borrowed 425 000 On An 8 Interest Bearing Note OnDocument1 pageSolved Ellsworth Enterprises Borrowed 425 000 On An 8 Interest Bearing Note OnAnbu jaromiaNo ratings yet

- Solved The Deweys Are Expecting To Save On Their Taxes ForDocument1 pageSolved The Deweys Are Expecting To Save On Their Taxes ForAnbu jaromiaNo ratings yet

- The Following Are Several Transactions of Ardery Company That OccurredDocument1 pageThe Following Are Several Transactions of Ardery Company That OccurredTaimur TechnologistNo ratings yet

- Multiple Choices and Exercises Chapter 2Document4 pagesMultiple Choices and Exercises Chapter 2Mi Đỗ Thị KhảNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument42 pagesInvesting and Financing Decisions and The Balance SheetNahla Ali HassanNo ratings yet

- Final Exam 10 PDF FreeDocument12 pagesFinal Exam 10 PDF FreeMariefel OrdanezNo ratings yet

- Full Download Financial Accounting 7th Edition Libby Solutions ManualDocument35 pagesFull Download Financial Accounting 7th Edition Libby Solutions Manuallarisaauresukus100% (35)

- Afar-01-Partnership Formation and OperationsDocument26 pagesAfar-01-Partnership Formation and OperationsRafael Renz DayaoNo ratings yet

- Ch. 1 Class Examples 2024 Sem2Document3 pagesCh. 1 Class Examples 2024 Sem2sina.rahdar2006No ratings yet

- Solved Discovered An Error in Computing A Commission Received Cash FromDocument1 pageSolved Discovered An Error in Computing A Commission Received Cash FromAnbu jaromiaNo ratings yet

- Mock Paper-3 (With Answer)Document19 pagesMock Paper-3 (With Answer)RNo ratings yet

- Darin Development Company Engaged in The Following Transactions During TheDocument1 pageDarin Development Company Engaged in The Following Transactions During TheTaimour HassanNo ratings yet

- Intermediate Accounting II Multiple Choice QuestionsDocument11 pagesIntermediate Accounting II Multiple Choice QuestionsDean Craig80% (5)

- Solved Predict GDP Growth in India and Japan For 2017 Utilizing ADocument1 pageSolved Predict GDP Growth in India and Japan For 2017 Utilizing AAnbu jaromiaNo ratings yet

- Solved For The Year 2017 Dumas Company S Gross Profit Was 96 000Document1 pageSolved For The Year 2017 Dumas Company S Gross Profit Was 96 000Anbu jaromiaNo ratings yet

- Financial Accounting Workbook Version 2Document90 pagesFinancial Accounting Workbook Version 2Honey Crisostomo EborlasNo ratings yet

- Chapter 12 Review Updated 11th EdDocument13 pagesChapter 12 Review Updated 11th Edangelsalvador05082006No ratings yet

- The Elements That Are Most Directly Related To Measuring An PDFDocument1 pageThe Elements That Are Most Directly Related To Measuring An PDFFreelance WorkerNo ratings yet

- 1 A Current Liability Is Any Obligation of A BusinessDocument1 page1 A Current Liability Is Any Obligation of A Businesshassan taimourNo ratings yet

- Chapter 1 Lecture Notes: I. Forms of Business OrganizationDocument8 pagesChapter 1 Lecture Notes: I. Forms of Business OrganizationvirtualtadNo ratings yet

- Holes R Us A Blasting Services Company Has The FollowingDocument1 pageHoles R Us A Blasting Services Company Has The FollowingM Bilal SaleemNo ratings yet

- Basic Financial StatementsDocument50 pagesBasic Financial StatementsK KNo ratings yet

- CH 2 Accounting 2Document45 pagesCH 2 Accounting 2EmadNo ratings yet

- Chapter 12 - STATEMENT OF CASHFLOWSDocument14 pagesChapter 12 - STATEMENT OF CASHFLOWSDonna Mae HernandezNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Quarter 1 - Module Week 5Document11 pagesFundamentals of Accountancy, Business and Management 2: Quarter 1 - Module Week 5Joana Jean SuymanNo ratings yet

- Lee Delivery Company Inc Was Organized at The Beginning of PDFDocument1 pageLee Delivery Company Inc Was Organized at The Beginning of PDFTaimour HassanNo ratings yet

- The Following Data Were Taken From The Financial Statements ofDocument1 pageThe Following Data Were Taken From The Financial Statements ofMiroslav GegoskiNo ratings yet

- Solved Parvis Bank and Trust Co Has Calculated Its Daily AverageDocument1 pageSolved Parvis Bank and Trust Co Has Calculated Its Daily AverageM Bilal SaleemNo ratings yet

- Solved Pain Free Dental Group Inc Purchased Dental Supplies of 18 200 DuringDocument1 pageSolved Pain Free Dental Group Inc Purchased Dental Supplies of 18 200 DuringAnbu jaromiaNo ratings yet

- Solved The Quality Office Furniture Company Has Compiled The Year S RevenueDocument1 pageSolved The Quality Office Furniture Company Has Compiled The Year S RevenueM Bilal SaleemNo ratings yet

- Solved Mchale Company Does Business in Two Customer Segments Retail andDocument1 pageSolved Mchale Company Does Business in Two Customer Segments Retail andAnbu jaromiaNo ratings yet

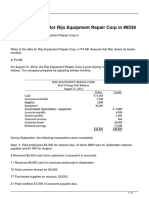

- Refer To The Data For Rijo Equipment Repair Corp inDocument2 pagesRefer To The Data For Rijo Equipment Repair Corp inMiroslav Gegoski0% (1)

- Chapter 4 Statement of Financial PositionDocument4 pagesChapter 4 Statement of Financial PositionDaniel Tan KtNo ratings yet

- FAR ReviewDocument9 pagesFAR ReviewJude Vincent VittoNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Your Colleague Picks Up The 2012 Annual Report of MicrosoftDocument1 pageSolved Your Colleague Picks Up The 2012 Annual Report of MicrosoftAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved You Have An Employee Who Has A Chemical Imbalance inDocument1 pageSolved You Have An Employee Who Has A Chemical Imbalance inAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved With The Recent Changes in The Tax Law Definition ofDocument1 pageSolved With The Recent Changes in The Tax Law Definition ofAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved White S Printing LTD S Year End Is February 28 The AccountingDocument1 pageSolved White S Printing LTD S Year End Is February 28 The AccountingAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Red Markets A Game of Economic Horror PDFDocument497 pagesRed Markets A Game of Economic Horror PDFVassilis Tsipopoulos100% (2)

- DavidS - PPT Affidavit Against Corruption V20.0-1Document156 pagesDavidS - PPT Affidavit Against Corruption V20.0-1bart100% (3)

- Financial Modelling HandbookDocument76 pagesFinancial Modelling Handbookreadersbusiness99No ratings yet

- Problem No. 1: Journal Entries PROBLEM NO. 5: JE and Statement of Financial Position Books of The Partnership Books of Fish R' UsDocument4 pagesProblem No. 1: Journal Entries PROBLEM NO. 5: JE and Statement of Financial Position Books of The Partnership Books of Fish R' UsJessa0% (1)

- Obligations Chapter 3 SummaryDocument20 pagesObligations Chapter 3 SummaryCHAZNAY MENORCA QUIROSNo ratings yet

- Subject: Document PDF / Word Format BilingualDocument29 pagesSubject: Document PDF / Word Format BilingualarunNo ratings yet

- Art. 1207-1222 Study GuideDocument3 pagesArt. 1207-1222 Study GuideChristine SuarezNo ratings yet

- Kreditwala A One-Stop Solution For All Your Financial NeedsDocument9 pagesKreditwala A One-Stop Solution For All Your Financial NeedskreditwalaofficialNo ratings yet

- A212 - Topic 2 - Slides (Part I)Document24 pagesA212 - Topic 2 - Slides (Part I)Teo ShengNo ratings yet

- Understanding the Maceda Law in the PhilippinesDocument3 pagesUnderstanding the Maceda Law in the PhilippinesERZZAHC SETERNo ratings yet

- Audit Observations and Recommendations for LGU Cebu CityDocument58 pagesAudit Observations and Recommendations for LGU Cebu CityKen AbabaNo ratings yet

- शिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiDocument4 pagesशिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiAshish ChNo ratings yet

- Law 3 - Negotiable InstrumentsDocument20 pagesLaw 3 - Negotiable InstrumentsALCEDO KelvinnNo ratings yet

- Project Finance SCDL Paper Solved Exam Paper - 9Document4 pagesProject Finance SCDL Paper Solved Exam Paper - 9Deepak SinghNo ratings yet

- Change face value shares documentDocument25 pagesChange face value shares documentParth GargNo ratings yet

- MINUTES-SCHEDULEAACCEPTANCEtemplateDocument6 pagesMINUTES-SCHEDULEAACCEPTANCEtemplateDusan VedaNo ratings yet

- Screenshot 2024-03-12 at 5.28.33 PMDocument8 pagesScreenshot 2024-03-12 at 5.28.33 PMchiraggajjar242No ratings yet

- Reconcilliation Part1Document25 pagesReconcilliation Part1019. Disha Das fybafNo ratings yet

- Double-Entry Bookkeeping BasicsDocument5 pagesDouble-Entry Bookkeeping BasicsVeronica BaileyNo ratings yet

- SC upholds CA ruling that transaction between Vives and Doronilla was commodatum loanDocument10 pagesSC upholds CA ruling that transaction between Vives and Doronilla was commodatum loanAbbygaleOmbaoNo ratings yet

- Bayer Et Al 2019 EconometricaDocument36 pagesBayer Et Al 2019 EconometricaabhishekNo ratings yet

- A211 MC4 MFRS108 Mfrs110-StudentDocument6 pagesA211 MC4 MFRS108 Mfrs110-StudentGui Xue ChingNo ratings yet

- Acc Q4Document9 pagesAcc Q4risvana rahimNo ratings yet

- Calculation of New Ratio and Gaining Ratio: Sunil Panda Commerce ClassesDocument25 pagesCalculation of New Ratio and Gaining Ratio: Sunil Panda Commerce ClassesNishant ShuklaNo ratings yet

- 05 Quiz 1Document2 pages05 Quiz 1lunaNo ratings yet

- Prepaire Operational BudgetsDocument29 pagesPrepaire Operational BudgetsAshenafi AbdurkadirNo ratings yet

- Oblicon Case Digest 2Document21 pagesOblicon Case Digest 2LAWRENCE EDWARD SORIANONo ratings yet

- BBA Financial Management OverviewDocument458 pagesBBA Financial Management Overviewdivya kalyaniNo ratings yet

- Stock Statement Format For Bank LoanDocument8 pagesStock Statement Format For Bank LoanAnkit SoniNo ratings yet

- Example - Summons Automatic Rent Interdict High CourtDocument8 pagesExample - Summons Automatic Rent Interdict High Courtkj5vb29ncqNo ratings yet