Professional Documents

Culture Documents

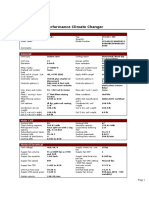

On December 31 2015 Turnball Associates Owned The Following Securities

Uploaded by

Amit PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

On December 31 2015 Turnball Associates Owned The Following Securities

Uploaded by

Amit PandeyCopyright:

Available Formats

On December 31 2015 Turnball Associates owned the

following securities

On December 31, 2015, Turnball Associates owned the following securities, held as a long-term

investment. The securities are not held for influence or control of the investee.On December 31,

2015, the total fair value of the securities was equal to its cost. In 2016, the following

transactions occurred.July 1 Received $1 per share semiannual cash dividend on Wooderson

Co. common stock.Aug. 1 Received $0.50 per share cash dividend on Gehring Co. common

stock.Sept. 1 Sold 1,500 shares of Wooderson Co. common stock for cash at $8 per share.Oct.

1 Sold 800 shares of Gehring Co. common stock for cash at $33 per share.Nov. 1 Received $1

per share cash dividend on Kitselton Co. common stock.Dec. 15 Received $0.50 per share cash

dividend on Gehring Co. common stock.31 Received $1 per share semiannual cash dividend on

Wooderson Co. common stock.At December 31, the fair values per share of the common stocks

were Gehring Co. $32, Wooderson Co. $8, and Kitselton Co. $18.Instructions(a) Journalize the

2016 transactions and post to the account Stock Investments. (Post in T-account form.)(b)

Prepare the adjusting entry at December 31, 2016, to show the securities at fair value. The

stock should be classified as available-for-sale securities.(c) Show the balance sheet

presentation of the investment-related accounts at December 31, 2016. At this date, Turnball

Associates has common stock $1,500,000 and retained earnings$1,000,000.

View Solution:

On December 31 2015 Turnball Associates owned the following securities

SOLUTION-- http://solutiondone.online/downloads/on-december-31-2015-turnball-associates-

owned-the-following-securities/

Unlock answers here solutiondone.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- On December 31 2014 Turnball Associates Owned The Following SecuritiesDocument1 pageOn December 31 2014 Turnball Associates Owned The Following SecuritiesAmit PandeyNo ratings yet

- On December 31 2010 Sauder Associates Owned The Following PDFDocument1 pageOn December 31 2010 Sauder Associates Owned The Following PDFAnbu jaromiaNo ratings yet

- The Following Securities Are in Frederick Company S Portfolio of Long TermDocument1 pageThe Following Securities Are in Frederick Company S Portfolio of Long TermAmit PandeyNo ratings yet

- At December 31 2015 Grand Company Reported The Following As: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt December 31 2015 Grand Company Reported The Following As: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- At December 31 2015 Hemington Company Had 320 000 Shares ofDocument1 pageAt December 31 2015 Hemington Company Had 320 000 Shares ofMuhammad ShahidNo ratings yet

- The Balance Sheet of Investtech Inc at December 31 2013Document1 pageThe Balance Sheet of Investtech Inc at December 31 2013Miroslav GegoskiNo ratings yet

- On December 31 2009 Brant Company Had 1 000 000 Shares ofDocument1 pageOn December 31 2009 Brant Company Had 1 000 000 Shares ofM Bilal SaleemNo ratings yet

- CH 16Document3 pagesCH 16vivienNo ratings yet

- Solved Kouchibouguac Inc Reports The Following Costs and Fair Values ForDocument1 pageSolved Kouchibouguac Inc Reports The Following Costs and Fair Values ForAnbu jaromiaNo ratings yet

- On December 31 2009 Milo Company Had 1 300 000 Shares ofDocument1 pageOn December 31 2009 Milo Company Had 1 300 000 Shares ofM Bilal SaleemNo ratings yet

- Rainy Day Umbrella Corporation Had The Following Balances at December PDFDocument1 pageRainy Day Umbrella Corporation Had The Following Balances at December PDFLet's Talk With HassanNo ratings yet

- P16-3A Journalize Transactions and Adjusting Entry For Stock InvestmentsDocument3 pagesP16-3A Journalize Transactions and Adjusting Entry For Stock InvestmentsRisky FernandoNo ratings yet

- On January 1 2015 Primo Corporation Had The Following StockholdersDocument1 pageOn January 1 2015 Primo Corporation Had The Following StockholdersAmit PandeyNo ratings yet

- Solved As Part of Its Executive Compensation Plan Vertovec Inc Granted PDFDocument1 pageSolved As Part of Its Executive Compensation Plan Vertovec Inc Granted PDFAnbu jaromiaNo ratings yet

- At The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- At The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- CH 16Document8 pagesCH 16Saleh RaoufNo ratings yet

- On January 1 2015 Wirth Corporation A Publicly Traded CompanyDocument1 pageOn January 1 2015 Wirth Corporation A Publicly Traded CompanyMiroslav GegoskiNo ratings yet

- Comprehensive Oakwood Inc Is A Public Enterprise Whose Shares AreDocument1 pageComprehensive Oakwood Inc Is A Public Enterprise Whose Shares AreTaimur TechnologistNo ratings yet

- After The Books Have Been Closed The Ledger of SukiDocument1 pageAfter The Books Have Been Closed The Ledger of Sukihassan taimourNo ratings yet

- Delong Corporation Was Organized On January 1 2015 It IsDocument1 pageDelong Corporation Was Organized On January 1 2015 It Istrilocksp SinghNo ratings yet

- Riverbend Inc Was Organized in 2013 at December 31 2013Document1 pageRiverbend Inc Was Organized in 2013 at December 31 2013Bube KachevskaNo ratings yet

- At December 31 2015 The Records of Kozmetsky Corporation Provided PDFDocument1 pageAt December 31 2015 The Records of Kozmetsky Corporation Provided PDFFreelance WorkerNo ratings yet

- The Ledger of Giffin Corporation at December 31 2014 After: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Ledger of Giffin Corporation at December 31 2014 After: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Various Dividends Carlyon Company Listed The Following Items in ItsDocument1 pageVarious Dividends Carlyon Company Listed The Following Items in ItsTaimour HassanNo ratings yet

- A Partial Portion of The Balance Sheet at December 31Document1 pageA Partial Portion of The Balance Sheet at December 31hassan taimourNo ratings yet

- EifjifriirfjiifjldskfjwiejfidkejfeifdskfdrifjaikjdkDocument2 pagesEifjifriirfjiifjldskfjwiejfidkejfeifdskfdrifjaikjdkK P DewiNo ratings yet

- In January 2014 The Management of Kinzie Company Concludes ThatDocument1 pageIn January 2014 The Management of Kinzie Company Concludes Thattrilocksp SinghNo ratings yet

- The Ledger of Nakona Corporation at December 31 2011 AfterDocument1 pageThe Ledger of Nakona Corporation at December 31 2011 AfterM Bilal SaleemNo ratings yet

- 6Document5 pages6Carlo ParasNo ratings yet

- Homework Week 7Document147 pagesHomework Week 7Marjorie PalmaNo ratings yet

- Practice 5 InvestmentDocument12 pagesPractice 5 InvestmentParal Fabio MikhaNo ratings yet

- White Way Inc Produces and Sells Theater Set Designs andDocument1 pageWhite Way Inc Produces and Sells Theater Set Designs andM Bilal SaleemNo ratings yet

- On January 1 2011 Galactica Corporation Had The Following StocDocument1 pageOn January 1 2011 Galactica Corporation Had The Following StocM Bilal SaleemNo ratings yet

- Solved If A Company Declared Cash Dividends During The Year ofDocument1 pageSolved If A Company Declared Cash Dividends During The Year ofAnbu jaromiaNo ratings yet

- The Investment Portfolio of Morris Inc On December 31 2014Document1 pageThe Investment Portfolio of Morris Inc On December 31 2014Muhammad ShahidNo ratings yet

- Spice Land CH 12 InvestmentDocument23 pagesSpice Land CH 12 InvestmentTuongVNguyenNo ratings yet

- During 2015 Kakisa Financial Corporation Had The Following Trading Investment PDFDocument1 pageDuring 2015 Kakisa Financial Corporation Had The Following Trading Investment PDFBube KachevskaNo ratings yet

- Sloboda Corporation Was Organized in 2013 at December 31 2013Document1 pageSloboda Corporation Was Organized in 2013 at December 31 2013Bube KachevskaNo ratings yet

- Dakota Corporation Had The Following Shareholders Equity Account Balances atDocument1 pageDakota Corporation Had The Following Shareholders Equity Account Balances atTaimur TechnologistNo ratings yet

- The Unadjusted Trial Balance of Clancy Inc at December 31 PDFDocument2 pagesThe Unadjusted Trial Balance of Clancy Inc at December 31 PDFTaimur TechnologistNo ratings yet

- Solved Castera Inc Reported A Net Income of 800 000 and A PDFDocument1 pageSolved Castera Inc Reported A Net Income of 800 000 and A PDFAnbu jaromiaNo ratings yet

- Latihan 2 Short-Term InvestmentsDocument13 pagesLatihan 2 Short-Term InvestmentsshanidaNo ratings yet

- Greyhawk Investments Inc S Articles of Incorporation Authorize The Company ToDocument2 pagesGreyhawk Investments Inc S Articles of Incorporation Authorize The Company ToCharlotteNo ratings yet

- ACCT551 - Week 7 HomeworkDocument10 pagesACCT551 - Week 7 HomeworkDominickdadNo ratings yet

- The Intangible Assets Section of Time Company at December 31 PDFDocument1 pageThe Intangible Assets Section of Time Company at December 31 PDFAnbu jaromiaNo ratings yet

- On December 1 2010 Sleezer Distributing Company Had The FollowDocument1 pageOn December 1 2010 Sleezer Distributing Company Had The FollowM Bilal SaleemNo ratings yet

- On December 31 2014 Andes Company Had 1 500 000 Shares ofDocument1 pageOn December 31 2014 Andes Company Had 1 500 000 Shares ofAmit PandeyNo ratings yet

- Computation of Basic and Diluted Eps Charles Austin of The PDFDocument1 pageComputation of Basic and Diluted Eps Charles Austin of The PDFAnbu jaromiaNo ratings yet

- Gorlin Corporation Was Chartered in The Commonwealth of Massachusetts TheDocument1 pageGorlin Corporation Was Chartered in The Commonwealth of Massachusetts Thetrilocksp SinghNo ratings yet

- The Following Securities Are in Pascual Company S Portfolio of L PDFDocument1 pageThe Following Securities Are in Pascual Company S Portfolio of L PDFAnbu jaromiaNo ratings yet

- Solved Cost and Fair Value For The Trading Investments of KootenayDocument1 pageSolved Cost and Fair Value For The Trading Investments of KootenayAnbu jaromiaNo ratings yet

- After The Books Have Been Closed The Ledger of RotanDocument1 pageAfter The Books Have Been Closed The Ledger of Rotanhassan taimourNo ratings yet

- On January 1 2015 Sturge Enterprises Inc Held The FollowingDocument1 pageOn January 1 2015 Sturge Enterprises Inc Held The FollowingMiroslav GegoskiNo ratings yet

- Solved An Analysis of The Transactions of Rutherford Company For The PDFDocument1 pageSolved An Analysis of The Transactions of Rutherford Company For The PDFAnbu jaromiaNo ratings yet

- Effective December 31 2013 Zintel Corporation Proposes To Issue AdditionalDocument1 pageEffective December 31 2013 Zintel Corporation Proposes To Issue AdditionalMuhammad ShahidNo ratings yet

- Donelson Corporation Was Organized On January 1 2010 It Is PDFDocument1 pageDonelson Corporation Was Organized On January 1 2010 It Is PDFAnbu jaromiaNo ratings yet

- Accounting For Business Combinations Part 2 - Course AssessmentDocument8 pagesAccounting For Business Combinations Part 2 - Course AssessmentArn KylaNo ratings yet

- The Following Information Relates To The 2014 Debt and EquityDocument1 pageThe Following Information Relates To The 2014 Debt and EquityTaimur TechnologistNo ratings yet

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Video Technology PLC Was Established in 1987 To Assemble VideoDocument3 pagesVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- BD Interest Rate Matrix PDFDocument1 pageBD Interest Rate Matrix PDFMukaddes HossainNo ratings yet

- Dividido Trane 30 TonsDocument23 pagesDividido Trane 30 TonsairemexNo ratings yet

- Strategic Cost ManagementDocument12 pagesStrategic Cost ManagementvionysusgoghNo ratings yet

- First Quarter Examination in PracticalDocument2 pagesFirst Quarter Examination in PracticalMark Anthony B. AquinoNo ratings yet

- English Compulsory (1) PrintDocument15 pagesEnglish Compulsory (1) PrintZakir KhanNo ratings yet

- Ecosystem ScriptDocument7 pagesEcosystem ScriptGeraldine Co TolentinoNo ratings yet

- How To Achieve A Rich Mindset PDFDocument11 pagesHow To Achieve A Rich Mindset PDFAsbo_Keno100% (1)

- Adenosine Deaminase: Quantitative Determination of Adenosine Deaminase (ADA) in Serum and Plasma SamplesDocument1 pageAdenosine Deaminase: Quantitative Determination of Adenosine Deaminase (ADA) in Serum and Plasma Samplesmark.zac1990No ratings yet

- EacdocDocument84 pagesEacdocJohanMonNo ratings yet

- What Is Splunk - (Easy Guide With Pictures) - Cyber Security KingsDocument9 pagesWhat Is Splunk - (Easy Guide With Pictures) - Cyber Security Kingsrokoman kungNo ratings yet

- Islamic Private Debt Securities (Ipds)Document37 pagesIslamic Private Debt Securities (Ipds)Sara IbrahimNo ratings yet

- Essay 1 DraftDocument1 pageEssay 1 Draftgdx3100% (3)

- Skoda Annual Report 2015Document128 pagesSkoda Annual Report 2015D'Invisible KatNo ratings yet

- Masoneilan 31000 Series Rotary Control ValvesDocument12 pagesMasoneilan 31000 Series Rotary Control ValvesJuan Manuel AcebedoNo ratings yet

- Periodic Trends Lesson PlanDocument6 pagesPeriodic Trends Lesson PlanWadé AzuréNo ratings yet

- The Essential Guide:: To HR ComplianceDocument16 pagesThe Essential Guide:: To HR ComplianceAtthrayyeNo ratings yet

- Mvo 1965Document113 pagesMvo 1965younisNo ratings yet

- Httpsauthors - Library.caltech - edu10520914TR000574 05 Chapter-5 PDFDocument41 pagesHttpsauthors - Library.caltech - edu10520914TR000574 05 Chapter-5 PDFKiệt LýNo ratings yet

- CSEC Spanish June 2011 P2Document9 pagesCSEC Spanish June 2011 P2AshleyNo ratings yet

- Type Approval Certificate: ABB AB, Control ProductsDocument3 pagesType Approval Certificate: ABB AB, Control ProductsDkalestNo ratings yet

- 360 Peoplesoft Interview QuestionsDocument10 pages360 Peoplesoft Interview QuestionsRaghu Nandepu100% (1)

- Cs Supply ChainDocument7 pagesCs Supply ChainJoy MartinezNo ratings yet

- IBP1941 14 Fatigue of Pipelines Subjecte PDFDocument10 pagesIBP1941 14 Fatigue of Pipelines Subjecte PDFAnjani PrabhakarNo ratings yet

- W1 8GEC 2A Readings in The Philippine History IPED ModuleDocument74 pagesW1 8GEC 2A Readings in The Philippine History IPED ModuleMico S. IglesiaNo ratings yet

- Quiz 4m PDF FreeDocument43 pagesQuiz 4m PDF FreeMohammed MinhajNo ratings yet

- The Yocum Library Online Database Passwords: All SubjectsDocument3 pagesThe Yocum Library Online Database Passwords: All SubjectsJHSNo ratings yet

- Tariq Ali 1Document62 pagesTariq Ali 1Hafeezullah ShareefNo ratings yet

- Behavioural Issues Associated With Long Duration Expedition Missions - NASADocument116 pagesBehavioural Issues Associated With Long Duration Expedition Missions - NASAJp VillalonNo ratings yet

- Module 3 Topic 1 Part 3 - Colonial Land Use PoliciesDocument31 pagesModule 3 Topic 1 Part 3 - Colonial Land Use PoliciesSamantha BaldovinoNo ratings yet

- PfroDocument4 pagesPfrobe3pNo ratings yet

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (32)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- The Value of a Whale: On the Illusions of Green CapitalismFrom EverandThe Value of a Whale: On the Illusions of Green CapitalismRating: 5 out of 5 stars5/5 (2)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- Risk Management: Concepts and Guidance, Fifth EditionFrom EverandRisk Management: Concepts and Guidance, Fifth EditionRating: 4.5 out of 5 stars4.5/5 (10)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursFrom EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursRating: 5 out of 5 stars5/5 (13)

- Data Analysis for Corporate Finance: Building financial models using SQL, Python, and MS PowerBIFrom EverandData Analysis for Corporate Finance: Building financial models using SQL, Python, and MS PowerBINo ratings yet

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (35)