Professional Documents

Culture Documents

Classroom Notes 6360 - Gross Profit, Retail Method

Classroom Notes 6360 - Gross Profit, Retail Method

Uploaded by

Mark ArceoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Classroom Notes 6360 - Gross Profit, Retail Method

Classroom Notes 6360 - Gross Profit, Retail Method

Uploaded by

Mark ArceoCopyright:

Available Formats

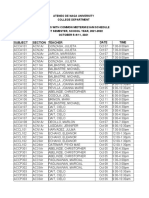

PAGE 1

FINANCIAL ACCOUNTING AND REPORTING

GROSS PROFIT AND RETAIL METHOD TO ESTIMATE INVENTORY

Common reasons to estimate the amount of inventory on hand are the following:

a) Inventory has been destroyed by an unforeseen event such as fire, typhoon and other

natural calamities and the value of the inventory that was lost is needed for claims

against insurance companies.

b) To verify the value of the inventory based on the physical count. If the difference

between the physical count and the estimate is significant, an investigation or a higher

degree of diligence shall be exerted on the count.

c) To determine the amount of inventory for interim reporting purposes. The actual

amount is not necessary and an estimate shall be sufficient.

Gross Profit Method – Based on the assumption that the gross profit applied by an entity

to its products remains approximately the same from period to period and therefore the

relationship between cost of goods sold and sales is constant.

Goods available for sale X

Less: Estimated cost of goods sold

Net sales* X

Less: Gross profit X X

Estimated ending inventory X

The cost of goods sold can also be computed if the net sale is multiplied by 1 less the GP

rate if the gross profit rate based on sales or net sales divided by 1 plus the gross profit

rate if the gross profit rate is based on cost.

*Net sales shall be gross sales less “sales returns and allowance” or “sales returns” only in

order for the estimate in ending inventory not to be overstated.

Retail Method – Employed by retailers dealing with numerous different items for sale with

varying mark up percentages to keep track unit cost.

Goods available for sale at retail X

Less: Net sales X

Employee discounts X

Normal losses X X

Estimated ending inventory X

Multiplied by the cost ratio %

Estimated ending inventory at cost X

Conservative Cost Ratio = GAS at cost divided by GAS at retail before net markdown

Average Cost Ratio = GAS at cost divided by GAS at retail (after net markdown)

FIFO Cost Ratio = Purchases at cost divided by Purchases at retail after net markdown

Net sales similar to the “gross profit method” of estimation is computed by ignoring the

sales discount and sales allowance if it is separated from sales returns.

- - END - -

6360

You might also like

- Ryan J. Warth, Peter J. Millett Auth. Physical Examination of The Shoulder An Evidence-Based ApproachDocument280 pagesRyan J. Warth, Peter J. Millett Auth. Physical Examination of The Shoulder An Evidence-Based ApproachAndrei R Lupu100% (1)

- Sunrise Medical MattressesDocument4 pagesSunrise Medical MattressesJulie SavoieNo ratings yet

- How To Master A Language EasilyDocument22 pagesHow To Master A Language EasilyCharmaine AlipayoNo ratings yet

- Accounting For Production Losses in A Job Order Costing SystemDocument7 pagesAccounting For Production Losses in A Job Order Costing Systemfirestorm riveraNo ratings yet

- Chapter 6 Activity Based CostingDocument20 pagesChapter 6 Activity Based CostingSVPSNo ratings yet

- Rhodoline 642 PDFDocument2 pagesRhodoline 642 PDFhemya7No ratings yet

- Lecture 5 - Distance Measuring DMEDocument12 pagesLecture 5 - Distance Measuring DMEzuliana100% (3)

- Reinforcement TheoryDocument1 pageReinforcement TheoryPatric MAckNo ratings yet

- CIE A Level NotesDocument104 pagesCIE A Level NotesMitul Kazi83% (6)

- (Intermediate Accounting 1A) : Lecture AidDocument25 pages(Intermediate Accounting 1A) : Lecture AidShe RC100% (2)

- Investment in Equity SecuritiesDocument4 pagesInvestment in Equity SecuritiesElaineJrV-IgotNo ratings yet

- Inventory Estimation MethodDocument14 pagesInventory Estimation Methodkrisha milloNo ratings yet

- Inventories (Ias 2)Document16 pagesInventories (Ias 2)Corinne GohocNo ratings yet

- Vallix QuestionnairesDocument14 pagesVallix QuestionnairesKathleen LucasNo ratings yet

- YP50A Syndicate3 Case Singapore IncDocument10 pagesYP50A Syndicate3 Case Singapore IncNadya FirstyaniNo ratings yet

- CobolDocument430 pagesCobolRuperto Calatayud100% (2)

- Ia1 - Chapter 13 - Gross Profit MethodDocument17 pagesIa1 - Chapter 13 - Gross Profit MethodKhezia Mae U. GarlandoNo ratings yet

- FARAP-4403 (Inventories)Document14 pagesFARAP-4403 (Inventories)Dizon Ropalito P.No ratings yet

- QUIZ 4.1 Investments PDFDocument4 pagesQUIZ 4.1 Investments PDFGirly CrisostomoNo ratings yet

- INTACC1 Inventory ProblemsDocument3 pagesINTACC1 Inventory ProblemsButterfly 0719No ratings yet

- Gross Profit Method CVDocument18 pagesGross Profit Method CVRigine Pobe MorgadezNo ratings yet

- VALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutDocument5 pagesVALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutEllah RahNo ratings yet

- IA 3 ReviewDocument34 pagesIA 3 ReviewHell LuciNo ratings yet

- Investment in Associate-Mytha Isabel D. SalesDocument9 pagesInvestment in Associate-Mytha Isabel D. SalesMytha Isabel SalesNo ratings yet

- Chapter 1 Part 2Document10 pagesChapter 1 Part 2Vincent AbellaNo ratings yet

- Inter-Acct1Document6 pagesInter-Acct1.No ratings yet

- 1 Partnership SolutionsDocument34 pages1 Partnership SolutionsLuna SanNo ratings yet

- VALLEJOS ACCTG 301 Biological Assets Answer KeyDocument3 pagesVALLEJOS ACCTG 301 Biological Assets Answer Keyyes yesnoNo ratings yet

- Manufacturing - Actual Costing - JBJDocument9 pagesManufacturing - Actual Costing - JBJAlexis Jaina TinaanNo ratings yet

- Standard CostingDocument14 pagesStandard CostingRoselyn LumbaoNo ratings yet

- 2nd Week - The Master Budget ExercisesDocument5 pages2nd Week - The Master Budget ExercisesLuigi Enderez BalucanNo ratings yet

- Absorption Costing Vs Variable CostingDocument20 pagesAbsorption Costing Vs Variable CostingMa. Alene MagdaraogNo ratings yet

- Costing ModuleDocument7 pagesCosting ModuleJoneric RamosNo ratings yet

- Property Plant and Equipment: Ricky Boy B. LeonardoDocument14 pagesProperty Plant and Equipment: Ricky Boy B. LeonardoRodel Novesteras ClausNo ratings yet

- Merchadising MOCK QUIZDocument5 pagesMerchadising MOCK QUIZCarl Dhaniel Garcia SalenNo ratings yet

- Chapter 27 MachineryDocument20 pagesChapter 27 MachineryKendall JennerNo ratings yet

- Investment in Equity Securities Intacc1Document3 pagesInvestment in Equity Securities Intacc1GIRLNo ratings yet

- Joint and By-Product CostingDocument13 pagesJoint and By-Product CostingErlinda NavalloNo ratings yet

- Intacc Review Questions Micha 1Document3 pagesIntacc Review Questions Micha 1Christian ContadorNo ratings yet

- FARAP 4404 Property Plant EquipmentDocument11 pagesFARAP 4404 Property Plant EquipmentJohn Ray RonaNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Ratio 5Document5 pagesRatio 5Edgar LayNo ratings yet

- Business Taxation 3Document47 pagesBusiness Taxation 3Prince Isaiah JacobNo ratings yet

- 1909 Gross Profit and Retail MethodDocument3 pages1909 Gross Profit and Retail MethodCykee Hanna Quizo Lumongsod50% (4)

- Chapter 6C 2 24 Ex 26 PB 54Document5 pagesChapter 6C 2 24 Ex 26 PB 54ruqayya muhammedNo ratings yet

- Solutions To Quiz 1Document4 pagesSolutions To Quiz 1Chakri MunagalaNo ratings yet

- Multiple Choice - JOCDocument14 pagesMultiple Choice - JOCMuriel MahanludNo ratings yet

- Lower of Cost or Net Realizable ValueDocument2 pagesLower of Cost or Net Realizable ValueZeeNo ratings yet

- (01I) Lower of Cost and NRVDocument3 pages(01I) Lower of Cost and NRVGabriel Adrian ObungenNo ratings yet

- AC1203 Chapter 1 Cluster 1Document23 pagesAC1203 Chapter 1 Cluster 1Armyl Raul CanadaNo ratings yet

- AFAR-07 (Home-Office & Branch Accounting)Document7 pagesAFAR-07 (Home-Office & Branch Accounting)mysweet surrenderNo ratings yet

- ASR3 Materials - Auditing Equity and Debt InvestmentsDocument4 pagesASR3 Materials - Auditing Equity and Debt InvestmentsHannah Jane ToribioNo ratings yet

- Final Exam Finacc1Document11 pagesFinal Exam Finacc1Grace A. ManaloNo ratings yet

- Cost Chap 6Document24 pagesCost Chap 6Peter Paul DeiparineNo ratings yet

- AIS 01 - Handout - 1Document7 pagesAIS 01 - Handout - 1Melchie RepospoloNo ratings yet

- Multiple Choices - Quiz - Chapter 1-To-3Document21 pagesMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNo ratings yet

- Mon Exam.21221sDocument2 pagesMon Exam.21221sNicole Anne Santiago SibuloNo ratings yet

- Requirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksDocument7 pagesRequirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksJunzen Ralph YapNo ratings yet

- Solman NRDocument13 pagesSolman NRMeeka CalimagNo ratings yet

- Basic Concepts and Job Order Cost CycleDocument15 pagesBasic Concepts and Job Order Cost CycleGlaiza Lipana Pingol100% (2)

- Standard Costing and Variance Analysis ProblemsDocument4 pagesStandard Costing and Variance Analysis ProblemsJoann RiveroNo ratings yet

- Answers Biological AssetsDocument4 pagesAnswers Biological AssetsJanella Gail ArenasNo ratings yet

- MAS04-06 - Standard Costing - MF - EncryptedDocument9 pagesMAS04-06 - Standard Costing - MF - EncryptedRachel FuentesNo ratings yet

- Inventory Cost FlowDocument4 pagesInventory Cost FlowMae LotoNo ratings yet

- Managerial Accounting Exercises Chapter 12Document6 pagesManagerial Accounting Exercises Chapter 12Angelica Lorenz100% (1)

- Sec Code of Corporate Governance AnswerDocument3 pagesSec Code of Corporate Governance AnswerHechel DatinguinooNo ratings yet

- Quiz 3 PDFDocument20 pagesQuiz 3 PDFGirly CrisostomoNo ratings yet

- Chapter 13: Gross Profit Method: Less: LessDocument1 pageChapter 13: Gross Profit Method: Less: LessKaryl FailmaNo ratings yet

- Week 08 - 02 - Module 19 - Accounting For InventoriesDocument17 pagesWeek 08 - 02 - Module 19 - Accounting For Inventories지마리No ratings yet

- Awp Presentation2Document14 pagesAwp Presentation2PawanNo ratings yet

- The Influenced of School Advertisement in Choosing School For Senior High School ProgramDocument6 pagesThe Influenced of School Advertisement in Choosing School For Senior High School ProgramJaysan SacbibitNo ratings yet

- Part A - Problem Set - SolvedDocument5 pagesPart A - Problem Set - SolvedKrrish BosamiaNo ratings yet

- Assignment No. 5 - Obt2308 - Kenneth Bryan VillagonezaDocument2 pagesAssignment No. 5 - Obt2308 - Kenneth Bryan VillagonezaKenneth Bryan VillagonezaNo ratings yet

- Micromax CEC MBA 1st SEMDocument22 pagesMicromax CEC MBA 1st SEMVinay SavaniNo ratings yet

- Quotation SS20230308 100KVAR APFC PANEL VIDHYA WIRESDocument4 pagesQuotation SS20230308 100KVAR APFC PANEL VIDHYA WIRESsunil halvadiyaNo ratings yet

- (MS-MDE2) : Mobile Device Enrollment Protocol Version 2: Open Specifications Promise Microsoft Community PromiseDocument102 pages(MS-MDE2) : Mobile Device Enrollment Protocol Version 2: Open Specifications Promise Microsoft Community PromiseSanjay KumarNo ratings yet

- Pros and Cons of Using Green BiotechnologyDocument19 pagesPros and Cons of Using Green BiotechnologyCat SkullNo ratings yet

- Bachelor of Technology-Livelihood Education Major in Home EconomicsDocument2 pagesBachelor of Technology-Livelihood Education Major in Home EconomicsAllan Paul RamosNo ratings yet

- How To Slave Hard DriveDocument6 pagesHow To Slave Hard DriveSibonakaliso HlambeloNo ratings yet

- Fordham Men's Basketball Off-Season Nutrition GuideDocument23 pagesFordham Men's Basketball Off-Season Nutrition GuideThineeshNo ratings yet

- CS3014 - Advance Web Design - LP - APDocument9 pagesCS3014 - Advance Web Design - LP - APannuNo ratings yet

- DR Arpit Agarwal Pharma Capsule 12 - Cholinergic DrugsDocument20 pagesDR Arpit Agarwal Pharma Capsule 12 - Cholinergic DrugsarpitsnmcNo ratings yet

- AnimatorsDocument6 pagesAnimatorsapi-297561383No ratings yet

- Unit 1 Feedback: ReflectionDocument8 pagesUnit 1 Feedback: ReflectionLeza FurCasNo ratings yet

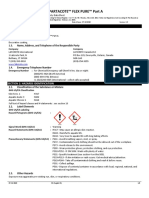

- Spartacote Flex Pure - Part ADocument8 pagesSpartacote Flex Pure - Part AValeNo ratings yet

- How Do Solar Panels WorkDocument6 pagesHow Do Solar Panels WorkprabuparthibanNo ratings yet

- Programming AssignmentsDocument88 pagesProgramming Assignmentsrtyunm0% (1)

- South Asian Archaeology: Istituto Italian"O Per L' Africa E L'Oriente Istituto Universitario OrientaleDocument17 pagesSouth Asian Archaeology: Istituto Italian"O Per L' Africa E L'Oriente Istituto Universitario OrientaleEce AyvazNo ratings yet

- Android Lab ProgramsDocument15 pagesAndroid Lab ProgramsSURESHNo ratings yet

- 2018 20721 Moesm1 EsmDocument6 pages2018 20721 Moesm1 EsmMaddyAndersonNo ratings yet