0% found this document useful (0 votes)

163 views5 pagesSamson Enterprises 20X1 Tax Income Analysis

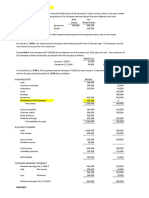

Samson Enterprises Ltd. had net income of $120,000 for tax purposes in 20X1. Certain additions and deductions were made to determine taxable income, including adding back donations of $3,000 and recaptured capital cost allowance of $20,000. Standard deductions included capital cost allowance of $22,300 and eligible capital property write-off of $2,441. The net income from business activities was $96,259. Taxable capital gains of $10,000 were also included, resulting in total net income for tax purposes of $106,259.

Uploaded by

Reema SajuCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

163 views5 pagesSamson Enterprises 20X1 Tax Income Analysis

Samson Enterprises Ltd. had net income of $120,000 for tax purposes in 20X1. Certain additions and deductions were made to determine taxable income, including adding back donations of $3,000 and recaptured capital cost allowance of $20,000. Standard deductions included capital cost allowance of $22,300 and eligible capital property write-off of $2,441. The net income from business activities was $96,259. Taxable capital gains of $10,000 were also included, resulting in total net income for tax purposes of $106,259.

Uploaded by

Reema SajuCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd