Professional Documents

Culture Documents

FAR - Module 2 - The Accounting Equation

Uploaded by

Eva Katrina R. LopezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR - Module 2 - The Accounting Equation

Uploaded by

Eva Katrina R. LopezCopyright:

Available Formats

Our Lady of the Pillar College – San Manuel, Inc.

District 3, San Manuel, Isabela

COLLEGE OF ACCOUNTANCY

THE ACCOUNTING EQUATION

Financial Accounting and Reporting

FAR - 02

BASIC ELEMENTS OF ACCOUNTING

a. Financial Position (Balance Sheet).

1. Assets. These are resources controlled by the enterprises as a result of past transactions or events and from

which future economic benefits are expected to flow to the enterprise.

2. Liabilities. These are present obligations of the enterprise arising from past transactions or events, the

settlement of which is expected to result in an outflow from the enterprise embodying economic benefits.

3. Equity. It is the residual interest in the assets of the enterprise after deducting all its liabilities.

b. Results of Operations (Income Statement).

1. Revenues. These are the gross inflows of economic benefits during the period arising in the course of

ordinary activities of an enterprise when those inflows result in increases in equity, other than those relating

to contribution from owners. They are inflows of future economic benefits that increase equity, other than

contributions or investment by owners.

2. Expenses. These are the gross outflows of economic benefits during the period arising in the course of

ordinary activities of an enterprise when those outflows result decreases in equity, other than those relating

to distribution to owners. They are consumption or outflows of future economic benefits that decrease

equity, other than distributions or dividends aid to owners.

3. Net Income. It is the amount by which total revenues exceed total expenses for the period. When expenses

exceed revenues, the result is a net loss.

TYPICAL ACCOUNT TITLES USED

Balance Sheet

1. Assets.

a. Current Assets. These are all assets that are expected to be realized, sold or consumed within the

enterprise’s normal operating cycle. Operating cycle is the interval time from the date of acquisition of

merchandise inventory; sell the inventory to customers and the ultimate collection of cash from the sale.

CASH. It is any medium of exchange that a bank will accept at face value. It includes coins,

currency, checks, money orders, bank deposits and drafts. The cash within the premises of the

business is CASH ON HAND while the cash deposited in the bank is CASH IN BANK.

PETTY CASH FUND. This represent money places and set aside for “petty” or small expenses.

CASH EQUIVALENTS. These are short-term, highly liquid investments that are readily

convertible to cash and with original maturities of three months or less.

ACCOUNTS RECEIVABLE. Claims from customers arising from goods sold or services

rendered on credit. It represents the debtor’s oral promises to pay a client.

NOTES RECEIVABLE. It is a written pledge that the customer will pay the business at fixed

amount of money on a certain date.

ALLOWANCE FOR DOUBTFUL ACCOUNTS. This is an “asset offset” or “contra asset”

account which provides for possible losses from uncollected accounts receivable.

MERCHANDISE INVENTORY. Goods purchased by the business to be sold at a profit.

SUPPLIES. Miscellaneous supplies that have been bought for office use but are still unused as of

the balance sheet date.

PREPAID INSURANCE. Already paid insurance premiums which are applicable in the future

periods.

b. Noncurrent Assets.

LAND. Land owned and used by the business entity.

BUILDING. Building owned and used by the business in its operation.

EQUIPMENT. It records the acquisition and disposition of office machines, desks, cars, trucks,

file cabinets and similar items.

FURNITURE AND FIXTURES. It includes office tables, chairs, etc.

2. Liabilities.

a. Current Liabilities. There are financial obligations of the enterprise which are expected to be settled in the

normal course of the operating cycle; due to be settled within one year from the balance sheet date.

ACCOUNTS PAYABLE. Amounts due to the creditors for the goods or service bought in credit.

NOTES PAYABLE. Amounts due to the creditors which are supported by a promissory note.

ACCRUED LIABILITIES. Amounts owed to other unpaid expenses. These include salaries

payable, interest payable and taxes payable.

FINANCIAL ACCOUNTING AND REPORTING 1

UNEARNED REVENUES. When the business entity receives payment before providing its

customers with goods or services, the amount received are recorded in the unearned revenue

account. When the goods or services are provided to the customer, the unearned is reduced and

revenue is recognized.

b. Noncurrent Liabilities. These are financial obligation of the enterprises which are due and payable for more

than one year.

MORTGAGE PAYABLE. This includes long-term debts for the business entity for which the

business entity has pledged certain assets as security to the creditor.

3. Owner’s Equity.

CAPITAL. Amount of capital contributions of the owner to the business.

WITHDRAWALS. Amount withdrawn by the owner from the assets of the business for personal

use.

INCOME SUMMARY. It is a temporary account used at the end of the accounting period to

close revenues and expenses.

Income Statement

1. Revenues.

SERVICE REVENUE. Revenues earned by performing services for a customer or client.

SALES. Revenues earned as a result of sale of merchandise.

2. Expenses.

COST OF SALES. Cost of goods purchased and sold or materials manufactured and sold.

SALARIES AND WAGES EXPENSE. Payments as a result of an employer-employee

relationship.

UTILITIES EXPENSE. Amount of telephone, light and water consumed by the business.

RENT EXPENSE. Expense for space, equipment or other asset rentals.

SUPPLIES EXPENSE. Expense of using supplies in the conduct of daily business.

INSURANCE EXPENSE. Premiums paid on insurance coverage.

DEPRECIATION EXPENSE. The portion of the cost of a tangible asset allocated or charged as

expense during the accounting period.

DOUBTFUL ACCOUNTS EXPENSE. The amount of receivable estimated to be doubtful of

collections and charged as expense during an accounting period.

TAXES AND LICENSES. The amount paid for business permits, licenses and other government

dues.

THE ACCOUNTING EQUATION

In a double entry system, for every debit, there must be a credit, and vice versa. This leads to the basic equation in

accounting. The relationship of assets, liabilities and owner’s equity of a business enterprise is expressed in the accounting

equation:

ASSETS = LIABILITIES + OWNER’S EQUITY

The equation shows that the ownership of the assets of the business is divided between the rights of the creditors and the

rights of the owners of the business. The creditors have first claim on the assets of the business.

The accounting equation could be stated in another way to emphasize the residual interest of the owner over the assets of the

business at the point of liquidation.

ASSETS – LIABILITIES = OWNER’S EQUITY

To include the income and expense as temporary accounts together with drawing, the accounting equation is expanded and

restated as follows:

ASSETS = LIABILITIES + OWNER’S EQUITY (- Drawing + Income – Expense)

Every time a transaction occurs, the elements of the accounting change, however, the basic equality remains.

To illustrate, consider the following different transactions of ABC Services, Inc.

1. Owner invests P150,000 cash in the business.

Assets = Liabilities + Equity

+150,000 = +150,000

2. Purchase office equipment at P40,000 on account.

Assets = Liabilities + Equity

+40,000 = +40,000

3. Received P12,000 cash for services rendered.

Assets = Liabilities + Equity

+12,000 = +12,000

FINANCIAL ACCOUNTING AND REPORTING 2

4. Paid P25,000 for the account in No. 2 transaction.

Assets = Liabilities + Equity

-25,000 = -25,000

5. Billed a customer for services rendered P16,000.

Assets = Liabilities + Equity

+16,000 = +16,000

6. Paid P8,000 for salaries of employee.

Assets = Liabilities + Equity

-8,000 = -8,000

FINANCIAL TRANSACTION WORKSHEET

Every financial transaction can be analyzed or expressed in terms of its effects on the accounting equation. A financial

transaction worksheet is used to analyze increases and decreases in assets, liabilities or owner’s equity.

Illustrative Problem

DEF decides to open a tailoring shop on July of the current year called DEF Tailoring.

1. On July 1 of the current year, he invested P760,000 cash to start his tailoring shop.

2. On July 3, DEF acquired equipment worth P450,000 from GHI Sewing Machine. Singer allows DEF to pay for the

acquisition later.

3. DEF acquired supplies by paying P45,000 cash.

4. On July 10, DEF paid GHI Sewing Machine P50,000.

5. On July 12, DEF received P48,000 cash from customers for tailoring services.

6. On July 14, DEF provided tailoring services of P70,600 to customers on account.

7. Expenses paid in cash for July are salaries of employees, P60,400.

8. The sum of P70,600 was received from customers who have been billed for services on July 14.

9. DEF withdraws P26,000 for personal use.

10. A count of supplies on July 31 indicates that P12,000 of sewing supplies have been used.

Required: Record the above transactions using the format below:

Transaction Cash Equipment Supplies Accounts Accounts DEF, Capital

Receivable Payable

1

2

3

4

5

6

7

8

9

10

TOTAL

Effects of Transactions on the Accounting Equation

Business transactions affect the assets, liabilities and owner’s equity of an enterprise. Each transaction always has a two-fold

effect and both of this should be recorded to keep the equation in balance. These transactions may be grouped into nine types

of effects as follows:

1. Increase in Asset = Increase in Owner’s Equity

2. Increase in Asset = Increase in Liability

3. Increase in One Asset = Decrease in Another Asset

4. Decrease in Asset = Decrease in Liability

5. Decrease in Asset = Decrease in Owner’s Equity

6. Increase in One Liability = Decrease in Owner’s Equity

7. Increase in One Liability = Decrease in Another Liability

8. Increase in Owner’s Equity = Decrease in Liability

9. Increase in One Owner’s Equity = Decrease in Another Owner’s Equity

THE T-ACCOUNT

Business transactions cause increases and decreases in the accounting values. To record these changes, a business firm makes

use of T-accounts. A T-account is an accounting device to summarize the increase and decrease in the asset, liability and

equity of the business.

ACCOUNT TITLE

Left Side Right Side

FINANCIAL ACCOUNTING AND REPORTING 3

The terms debit (Dr.) and credit (Cr.) mean left and right, respectively. These terms do not mean increase or decrease but

instead describe where a company makes entries in the recording process. That is, when a company enters an amount on the

left side of a T-account, it debits the account. When it makes an entry on the right side, it credits the account. When

comparing the totals of the two sides, an account shows a debit balance if the total of the debit amount exceeds the credits.

An account shows a credit balance if the credit balance exceeds the debits.

The equality of debits and credits provides the basis for the double-entry system of recording transactions (sometimes

referred to as double entry bookkeeping). Under the universally used double entry accounting system, a company records the

dual (two-sided) effect of each transaction in appropriate accounts. This system provides a logical method for recording

transactions. If a company records every transaction with equal debits and credits, then the sum of all debits to the accounts

must equal the sum of all the credits.

Rules of Debit and Credit

The rules on debits and credits are patterned after the accounting equation:

ASSETS = LIABILITIES + OWNER’S EQUITY (- Drawing + Income – Expense)

Assets. Since assets are on the left side of the accounting equation, its increases are recorded on the debit side and its

decreases are on the credit side. Asset accounts should normally have debit balances.

Rule: Debit to increase an Asset and credit to decrease an Asset.

Liabilities. Since liabilities and owner’s equity are recorded on the right side of the equation, their increases are recorded on

the credit side and their decreases are on the debit side. Liability accounts should normally have credit balances.

Rule: Credit to increase a Liability and debit to decrease a Liability.

Owner’s Equity (Capital). The owner’s equity account is used to determine the owner’s permanent investment in the

business. Since it is on the right side of the equation, it is increased by credits and decreased by debits. The capital account

should have a normal credit balance. However, the capital account may have a debit balance as a result of business losses.

Rule: Credit to increase an Owner’s Equity and debit to decrease an Owner’s Equity.

Owner’s Equity (Drawing). The owner of a business enterprise may withdraw cash or other asset for his personal use. The

owner who is considered a separate entity from the business decreases his equity whenever he makes a withdrawal of

business assets. Withdrawals decrease owner’s equity. Since withdrawals decrease owner’s equity, the drawing account is

increased by debits and decreased by credits. It has a normal debit balance.

Rule: Debit to increase Drawing and credit to decrease Drawing.

Revenues. Revenues are subdivision of owner’s equity that provides information as to why the owner’s equity is increased.

Since revenues increase owner’s equity, they are recorded on the right side or credit side. Decrease in revenues are recorded

on the debit side. Revenues have normal credit balances.

Rule: Credit to increase a Revenue and debit to decrease a Revenue.

Expenses. Expenses decrease owner’s equity. Decreases in owner’s equity are recorded on the debit side. It also follows that

increases in expenses are recorded on the debit side and decreases in expensed are recorded on the credit side. Expenses have

a normal credit balances.

Rule: Debit to increase an Expense and credit to decrease an Expense.

The rules of debit and credit can be summarized as follows:

Debit to: Credit to:

1. Increase Assets 1. Decrease Assets

2. Decrease Liabilities 2. Increase Liabilities

3. Decrease Owner’s Equity due to: 3. Increase Owner’s Equity due to:

- Withdrawal by the owner - Investment by the owner

- Increase in expenses and losses - Decrease in expenses and losses

- Decrease in income - Increase in income

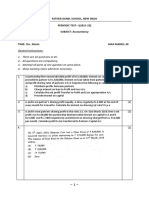

Illustrative Problem

JKL opened a catering services he called “Malinis Catering”.

FINANCIAL ACCOUNTING AND REPORTING 4

Dec 1 JKL invested P940,000 cash and equipment, P100,000.

4 He purchased kitchen utensils, tools and additional equipment from MNO Trading Credit, P240,000.

7 Paid for advertisement announcing the opening of his business, P15,000.

9 Paid one-half of the account due to MNO Trading.

11 Rendered catering service to PQR’s wedding and received cash of P125,000.

13 Paid for the food supplies used in PQR’s wedding party, P52,300.

17 Billed STU, P80,800 for catering service rendered in his birthday party.

20 Paid the salary of the assistant cook, P56,000.

22 Received from STU the amount of P45,000 as partial payment of the account due to him.

23 Withdrew P17,000 for his personal use.

Required: Record the above transactions using the format below:

Transaction Cash Accounts Equipment Accounts JKL, Capital JKL,

Receivable Payable Withdrawal

Dec. 1

Dec. 4

Dec. 7

Dec. 9

Dec. 11

Dec. 13

Dec. 17

Dec. 20

Dec. 22

Dec. 23

TOTAL

Required: With the aid of T-accounts, record the transaction listed above. Use the following accounts:

- Cash - Accounts Payable

- Accounts Receivable - JKL, Capital

- Equipment - JKL, Withdrawal

FINANCIAL ACCOUNTING AND REPORTING 5

You might also like

- Bank - Reconciliatio Statement PowerpointDocument61 pagesBank - Reconciliatio Statement PowerpointLoida Yare LauritoNo ratings yet

- The Accounting EquationDocument5 pagesThe Accounting EquationHuskyNo ratings yet

- Fabm1 PPT Q1W2Document89 pagesFabm1 PPT Q1W2giselleNo ratings yet

- MODULE 8 Closing and Reversing EntriesDocument5 pagesMODULE 8 Closing and Reversing EntriesChristian Cyrous AcostaNo ratings yet

- Financial Accounting: Tools For Business Decision Making (6th Ed.) .Document44 pagesFinancial Accounting: Tools For Business Decision Making (6th Ed.) .Avonda Lashell Trader67% (3)

- BPM Financial Modelling Fundamentals Practical Exercise SolutionsDocument19 pagesBPM Financial Modelling Fundamentals Practical Exercise SolutionsDaria YurovaNo ratings yet

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-IndJyznareth Tapia75% (4)

- Basic Accounting Level 1 Quiz Instructions: Started: Dec 26 at 5:20amDocument24 pagesBasic Accounting Level 1 Quiz Instructions: Started: Dec 26 at 5:20amVhia Rashelle GalzoteNo ratings yet

- Chapter 9 Basic Reconcillation StatementDocument11 pagesChapter 9 Basic Reconcillation StatementRon louise Pereyra100% (1)

- Activity Sheet in FABM2 Q1 W1 MELC1Document5 pagesActivity Sheet in FABM2 Q1 W1 MELC1Allyza Marielle P. AbreaNo ratings yet

- Bank Deposit DocumentsDocument20 pagesBank Deposit DocumentsAÑORA, Princess Aeyah M.No ratings yet

- Fabm Ii - Bank ReconciliationDocument41 pagesFabm Ii - Bank ReconciliationAvril OlivarezNo ratings yet

- Chapter 2: Accounting Equation and The Double-Entry SystemDocument15 pagesChapter 2: Accounting Equation and The Double-Entry SystemSteffane Mae SasutilNo ratings yet

- Fabm1 PPT Q2W3Document43 pagesFabm1 PPT Q2W3giselle100% (2)

- ACCT101 - Prelim - THEORY (25 PTS)Document3 pagesACCT101 - Prelim - THEORY (25 PTS)Accounting 201100% (1)

- Business Finance Summative Test 3Document3 pagesBusiness Finance Summative Test 3Juanito II Balingsat100% (1)

- The Basic Accounting Equation2018 PDFDocument4 pagesThe Basic Accounting Equation2018 PDFUba abednegoNo ratings yet

- Module 11 - Fabm 1 - Merchandising InventoryDocument20 pagesModule 11 - Fabm 1 - Merchandising Inventoryjosefh martin cruz100% (1)

- Understanding Cash FlowsDocument30 pagesUnderstanding Cash FlowsNocturnal Bee100% (1)

- South Asialink Finance Corporation (Credit Union)Document1 pageSouth Asialink Finance Corporation (Credit Union)Charish Kaye Radana100% (1)

- Fabm1 Quarter4 Module 10 Week 2Document16 pagesFabm1 Quarter4 Module 10 Week 2Princess Nicole EsioNo ratings yet

- Las q2 Fabm 2 Week 4Document10 pagesLas q2 Fabm 2 Week 4Mahika BatumbakalNo ratings yet

- Accounts Notes For BCA - IncompleteDocument56 pagesAccounts Notes For BCA - IncompleteSahil Kumar Gupta100% (1)

- FABM2 Q2W3 TaxationDocument9 pagesFABM2 Q2W3 TaxationDanielle SocoralNo ratings yet

- Merchandising Income StatementsDocument9 pagesMerchandising Income StatementsJaye RuantoNo ratings yet

- ADJUSTING ENTRIES FOR FINANCIAL STATEMENTSDocument32 pagesADJUSTING ENTRIES FOR FINANCIAL STATEMENTSAyniNuyda100% (1)

- Accounting's Role in SocietyDocument3 pagesAccounting's Role in SocietyEva Katrina R. Lopez67% (3)

- q4 Abm Fundamentals of Abm1 11 Week 3Document6 pagesq4 Abm Fundamentals of Abm1 11 Week 3Judy Ann Villanueva100% (1)

- Worksheet Multiple ChoiceDocument11 pagesWorksheet Multiple ChoiceiamjnschrstnNo ratings yet

- ACTBAS 2 - Lecture 1 Merchandising Business and Inventory SystemDocument7 pagesACTBAS 2 - Lecture 1 Merchandising Business and Inventory SystemJason Robert MendozaNo ratings yet

- Multiple ChoiceDocument6 pagesMultiple Choicetough mamaNo ratings yet

- Multiple choice and accounting problemsDocument3 pagesMultiple choice and accounting problemssamuel debebeNo ratings yet

- Financial Statement Analysis Part 2Document10 pagesFinancial Statement Analysis Part 2Kim Patrick VictoriaNo ratings yet

- Public Sector AccountingDocument9 pagesPublic Sector AccountingBekanaNo ratings yet

- Quiz Bee Final 2Document101 pagesQuiz Bee Final 2joshNo ratings yet

- Chapter 2 Bank Reconciliation (Gatdc)Document20 pagesChapter 2 Bank Reconciliation (Gatdc)Joan LeonorNo ratings yet

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- Accounting Concepts and PrinciplesDocument26 pagesAccounting Concepts and PrinciplesWindelyn Iligan100% (2)

- New Income and Business TaxationDocument72 pagesNew Income and Business TaxationGSOCION LOUSELLE LALAINE D.100% (1)

- Accounting Cycle: 4. Preparation of The Trial BalanceDocument8 pagesAccounting Cycle: 4. Preparation of The Trial BalanceAda Janelle Manzano0% (1)

- Fabm 1 Quiz TheoriesDocument4 pagesFabm 1 Quiz TheoriesJanafaye Krisha100% (1)

- Bank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaDocument18 pagesBank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaPSHNo ratings yet

- Periodic and Perpetual Inventory SystemDocument19 pagesPeriodic and Perpetual Inventory SystemMichelle RotairoNo ratings yet

- Major Account Types (FAR by MillanDocument15 pagesMajor Account Types (FAR by MillanApril GumiranNo ratings yet

- Section 1: Accrued Revenue: Mastering Adjusting EntriesDocument4 pagesSection 1: Accrued Revenue: Mastering Adjusting EntriesMarc Eric Redondo50% (2)

- Quiz 2 Accounting Principles Without AnswerDocument4 pagesQuiz 2 Accounting Principles Without AnswerJazzy MercadoNo ratings yet

- Quiz On Sce and SFPDocument2 pagesQuiz On Sce and SFPMounicha AmbayecNo ratings yet

- Financial Statement Analysis TechniquesDocument38 pagesFinancial Statement Analysis TechniquesmercyvienhoNo ratings yet

- Book of Accounts Part 1. JournalDocument12 pagesBook of Accounts Part 1. JournalJace AbeNo ratings yet

- What Is Bank Reconciliation.Document11 pagesWhat Is Bank Reconciliation.Sabrena FennaNo ratings yet

- Financial Accounting & Reporting ReviewerDocument21 pagesFinancial Accounting & Reporting ReviewerRosemarie GoNo ratings yet

- Shs Abm Gr12 Fabm2 q1 m4-Statement-Of-cash-flow FinalDocument12 pagesShs Abm Gr12 Fabm2 q1 m4-Statement-Of-cash-flow FinalKye RauleNo ratings yet

- Exercise Cash ControlDocument6 pagesExercise Cash ControlYallyNo ratings yet

- MODULE 6 LESSON 1 - Operating Cycle and Cash Conversion CycleDocument6 pagesMODULE 6 LESSON 1 - Operating Cycle and Cash Conversion CycleJenina Augusta EstanislaoNo ratings yet

- ch04.ppt - Income Statement and Related InformationDocument68 pagesch04.ppt - Income Statement and Related InformationAmir ContrerasNo ratings yet

- Chapter 6 Accounting For PartnershipDocument19 pagesChapter 6 Accounting For PartnershipBiru EsheteNo ratings yet

- Business Finance - ACC501 Handouts PDFDocument194 pagesBusiness Finance - ACC501 Handouts PDFHamid Mahmood100% (1)

- Periodic and Perpetual Method Format 1Document5 pagesPeriodic and Perpetual Method Format 1Clemencia Eduria Masiba100% (1)

- Far Reviewer 1Document4 pagesFar Reviewer 1MARK JAYSON MANABATNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document62 pagesFundamentals of Accountancy, Business and Management 1giselle100% (1)

- Overview of Accounting (CFAS)Document9 pagesOverview of Accounting (CFAS)JennicaBailonNo ratings yet

- LAS Q1 - FABM 1 (Week 3)Document12 pagesLAS Q1 - FABM 1 (Week 3)Joana Jean SuymanNo ratings yet

- BFAR 09 - 09 - 2022 Double Entry SystemDocument5 pagesBFAR 09 - 09 - 2022 Double Entry SystemSheryl cornelNo ratings yet

- Account Titles T Account Rules of Debit and CreditDocument9 pagesAccount Titles T Account Rules of Debit and Creditignacio.dant3No ratings yet

- Ent M5Document5 pagesEnt M5Fransesca ReyesNo ratings yet

- Strategic Management Case Studies on Business Policy IssuesDocument5 pagesStrategic Management Case Studies on Business Policy IssuesEva Katrina R. LopezNo ratings yet

- Strategic Management - Module 7 - History of Strategic ManagementDocument4 pagesStrategic Management - Module 7 - History of Strategic ManagementEva Katrina R. Lopez100% (1)

- Strategic Management - Module 4 - Strategy ImplementationDocument4 pagesStrategic Management - Module 4 - Strategy ImplementationEva Katrina R. LopezNo ratings yet

- Strategic Management - Module 3 - Strategy FormulationDocument4 pagesStrategic Management - Module 3 - Strategy FormulationEva Katrina R. Lopez100% (1)

- Strategic Human Resource Management FrameworkDocument4 pagesStrategic Human Resource Management FrameworkEva Katrina R. LopezNo ratings yet

- Strategic Management - Module 1 - Basic Concepts in Business Policy and StrategyDocument4 pagesStrategic Management - Module 1 - Basic Concepts in Business Policy and StrategyEva Katrina R. LopezNo ratings yet

- Strategic Management - Module 2 - Envirnmental ScanningDocument4 pagesStrategic Management - Module 2 - Envirnmental ScanningEva Katrina R. LopezNo ratings yet

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document20 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Pdf FilesNo ratings yet

- Mantuano DeducDocument28 pagesMantuano DeducDonita MantuanoNo ratings yet

- Week #10 ACCT 3039 Decision MakingDocument3 pagesWeek #10 ACCT 3039 Decision MakingPriscella LlewellynNo ratings yet

- Budgeting and Variance AnalysisDocument43 pagesBudgeting and Variance AnalysisADITYAROOP PATHAKNo ratings yet

- Fifo MethodDocument6 pagesFifo MethodRachelle Isuan Tusi100% (1)

- Assignment 1 AFSDocument14 pagesAssignment 1 AFSSimra SalmanNo ratings yet

- Untitled Spreadsheet 1Document3 pagesUntitled Spreadsheet 1VALENCIA, JOSE JOREL E.No ratings yet

- Aicpa Draft-Inventory-Valuation-GuidanceDocument50 pagesAicpa Draft-Inventory-Valuation-GuidanceOmar OteroNo ratings yet

- Chap006 NewDocument52 pagesChap006 NewPhương ThùyNo ratings yet

- ABC Cash Flow StatementDocument1 pageABC Cash Flow StatementLps0625No ratings yet

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- Download ebook Financial Accounting Ii Paperback Hanif Mukherjee Pdf full chapter pdfDocument67 pagesDownload ebook Financial Accounting Ii Paperback Hanif Mukherjee Pdf full chapter pdfjulie.morrill858100% (26)

- Cafe Nikka Income StatementDocument4 pagesCafe Nikka Income StatementM-3308No ratings yet

- Steps to consolidate financial statements for PT A and PT BDocument5 pagesSteps to consolidate financial statements for PT A and PT BMega RefiyaniNo ratings yet

- Chapter 13 Solutions ManualDocument120 pagesChapter 13 Solutions ManualBasanta K SahuNo ratings yet

- F6mys 2007 Dec PPQDocument19 pagesF6mys 2007 Dec PPQAnslem TayNo ratings yet

- 06 Completing The Accounting CycleDocument26 pages06 Completing The Accounting CycleKristel Joy Eledia NietesNo ratings yet

- Assignment 6 PDFDocument2 pagesAssignment 6 PDFBilal BilalNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test BankDocument24 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bankmrsbrianajonesmdkgzxyiatoq100% (26)

- Broiler Accounting Spreed SheetDocument2 pagesBroiler Accounting Spreed SheetkakunguccNo ratings yet

- Assignment Questions CVP AmendedDocument4 pagesAssignment Questions CVP AmendedReynaldo BurgosNo ratings yet

- Your Best Friend From Home Writes You A Letter About PDFDocument1 pageYour Best Friend From Home Writes You A Letter About PDFhassan taimourNo ratings yet

- Hockey Canada: Financial StatementsDocument21 pagesHockey Canada: Financial StatementsBob MackinNo ratings yet

- Economical Balance Sheet AnalysisDocument7 pagesEconomical Balance Sheet AnalysisPrashant ChavanNo ratings yet

- Parts: Uniform System of AccountancyDocument36 pagesParts: Uniform System of AccountancyINFO STATIONERSNo ratings yet