Professional Documents

Culture Documents

101 Accounting

Uploaded by

elsana philipOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

101 Accounting

Uploaded by

elsana philipCopyright:

Available Formats

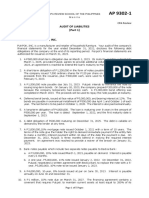

6. The auditor will send a standard bank confirmation to which of the following?

a. Financial institutions for which the client has a balance greater than P0 at the end of

the year.

b. Financial institutions with which the client has transacted during the year.

c. Financial institutions of customers using the lockbox.

d. Financial institutions used by significant shareholders.

ANSWER – B

7. An auditor who is engaged to examine the financial statements of a business

enterprise will request cutoff bank statement primarily in order to.

a. Verify the cash balance reported on the bank confirmation inquiry form.

b. Verify reconciling items on the client's bank reconciliation.

c. Detect lapping.

d. Detect kiting.

ANSWER – B

8. Which of the following cash transfers would appear as a deposit in transit on the

December 31, 2015 bank reconciliation?

Bank Account A Bank Account B

Disbursing Date (Month/Day) Receiving Date (Month/Day)

Per Bank Per Books Per Bank Per Books

a. 12/31 12/30 12/31 12/30

b. 1/2 12/30 12/31 12/31

c. 1/3 12/31 1/2 1/2

d. 1/3 12/31 1/2 12/31

ANSWER – D

9. Which of the following transfers would not appear as an outstanding check on the

December 31, 2015 bank reconciliation?

Bank Account A Bank Account B

Disbursing Date (Month/ Day) Receiving Date (Month/ Day)

Per Books Per Bank Per Books Per Bank

a. 12/31 12/30 12/31 12/30

b. 1/2 12/30 12/31 12/31

c. 1/3 12/31 1/2 1/2

d. 1/3 12/31 1/2 12/31

ANSWER – B

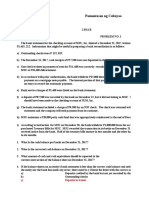

Use the following information for the next two questions.

The information below was taken from the hank transfer schedule prepared during the

audit of Khaye Ting Company's financial statements for the year ended December 31,

2015. Assume all checks are dated and issued on December 30, 2015.

Disbursements Receipts

No. From To Per Books Per Bank Per Books Per Bank

101 Pbcom HSBC 12/30 1/4 12/30 1/3

102 UCPB MBank 1/3 1/2 12/30 12/31

103 HSBC PSBank 12/31 1/3 1/2 1/2

104 MBank PNB 1/2 1/2 1/2 12/31

10. Which of the following checks might indicate kiting?

a. Check Nos. 101 and 103

b. Check Nos. 102 and 104

c. Check Nos. 101 and 104

d. Check Nos. 102 and 103

ANSWER – B

11. Which of the following checks illustrate deposits/transfers in transit at December 31?

a. Check Nos. 101 and 102

b. Check Nos. 101 and 103

c. Check Nos. 102 and 104

d. Check Nos. 103 and 104

ANSWER - B

12. Which of the following cash transfer results in a misstatement of cash at December

31, 2015?

Disbursements Receipts

From To Per Books Per Banks Per Books Per Banks

a. PBCOM HSBC 12/31/15 1/4/16 12/31/15 12/31/15

b. UCPB MB 1/4/16 1/5/16 12/31/15 1/4/16

c. HSBC PBANK 12/31/15 1/5/16 12/31/15 1/4/16

d. MBANK PNB 1/4/16 1/11/16 1/4/16 1/4/16

ANSWER - B

You might also like

- Whittington-Pany Principles of Auditing and Oth PDFDocument853 pagesWhittington-Pany Principles of Auditing and Oth PDFJoshua Josh67% (3)

- Ap-1402 CashDocument22 pagesAp-1402 Cashjulie anne mae mendozaNo ratings yet

- Cash Received From Customers During The YearDocument5 pagesCash Received From Customers During The Yearelsana philipNo ratings yet

- Disbursing Bank (Month/Day) Receiving Bank (Month/Day) Per Bank Per Books Per Bank Per Books AmountDocument4 pagesDisbursing Bank (Month/Day) Receiving Bank (Month/Day) Per Bank Per Books Per Bank Per Books AmountMaurice Agbayani0% (1)

- Assignment 3 Apple BlossomDocument21 pagesAssignment 3 Apple BlossomMonica NainggolanNo ratings yet

- Tugas Auditing II - TGL 30 Jan 2021Document2 pagesTugas Auditing II - TGL 30 Jan 2021Fara DinaNo ratings yet

- A. TheoryDocument10 pagesA. TheoryROMULO CUBID100% (1)

- Assignment No. 1 Audit of CashDocument5 pagesAssignment No. 1 Audit of CashMa Tiffany Gura RobleNo ratings yet

- Fta Internal Control Self-Assessment ToolDocument47 pagesFta Internal Control Self-Assessment ToolDong-hoon Ryu100% (1)

- Resume - Loo Ying Xuan Dec 2019Document2 pagesResume - Loo Ying Xuan Dec 2019eddie pangNo ratings yet

- Apre 102 MidtermsDocument10 pagesApre 102 MidtermsMa Angelica BalatucanNo ratings yet

- PrAE 304 Auditing and Assurance - MidtermsDocument6 pagesPrAE 304 Auditing and Assurance - MidtermsJeryl AlfantaNo ratings yet

- Audit of Cash and Cash Equivalents: Problem No. 20Document6 pagesAudit of Cash and Cash Equivalents: Problem No. 20Robel MurilloNo ratings yet

- Revenue CycleDocument50 pagesRevenue CycleCardoza Ryan100% (1)

- College: of Business AdministrationDocument5 pagesCollege: of Business AdministrationAna Mae HernandezNo ratings yet

- Admas University College Faculty of Business Department of AccountingDocument3 pagesAdmas University College Faculty of Business Department of AccountingtemedebereNo ratings yet

- DocxDocument16 pagesDocxLeah Mae NolascoNo ratings yet

- CH 11 Question Book - Not ReconciliationDocument5 pagesCH 11 Question Book - Not Reconciliationahmed0% (1)

- CH 11 Question Book Not Reconciliation PDFDocument5 pagesCH 11 Question Book Not Reconciliation PDFRyan TamondongNo ratings yet

- Audit of Cash and Cash Equivalents PDFDocument4 pagesAudit of Cash and Cash Equivalents PDFRandyNo ratings yet

- BankrecDocument24 pagesBankrecehab_ghazallaNo ratings yet

- Audit of Cash PDFDocument11 pagesAudit of Cash PDFShaira UntalanNo ratings yet

- ASCA301 L1Cash - AdditionalProblemsDocument3 pagesASCA301 L1Cash - AdditionalProblemsJr Reyes PedidaNo ratings yet

- APC 4 Reviewer Before FinalsDocument38 pagesAPC 4 Reviewer Before Finalsjeremy groundNo ratings yet

- Audit of Cash and Cash EquivalentsDocument4 pagesAudit of Cash and Cash EquivalentsstillwinmsNo ratings yet

- Ap9208 Cash 2Document2 pagesAp9208 Cash 2Onids AbayaNo ratings yet

- p2 Quiz Acc 103Document4 pagesp2 Quiz Acc 103Ariane Grace Hiteroza Margajay100% (1)

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Champaran Gurukul: Banking Made EasyDocument5 pagesChamparan Gurukul: Banking Made EasybiplabmajumderNo ratings yet

- Auditing Problems Test Banks - LIABILITIES Part 1Document5 pagesAuditing Problems Test Banks - LIABILITIES Part 1Alliah Mae Arbasto0% (1)

- Exercises in Acctg 114-Applied Auditing: College of Business Management & AccountancyDocument4 pagesExercises in Acctg 114-Applied Auditing: College of Business Management & Accountancybjay chuyNo ratings yet

- Bank Reconciliation StatementDocument39 pagesBank Reconciliation StatementinnovativiesNo ratings yet

- ACC17-FAR Take Home Activities 1 and 2: Test IDocument19 pagesACC17-FAR Take Home Activities 1 and 2: Test IJustine Cruz67% (3)

- (Ap) 07 - ReceivablesDocument4 pages(Ap) 07 - ReceivablesCykee Hanna Quizo LumongsodNo ratings yet

- Pre-Q Acc T1 Exam 2022Document13 pagesPre-Q Acc T1 Exam 2022fzpoggtjvevbfkyagyNo ratings yet

- BANK RECONCILIATION NotesDocument9 pagesBANK RECONCILIATION NotesNicole DomingoNo ratings yet

- S3 MYE QP 2019-20 (Final)Document13 pagesS3 MYE QP 2019-20 (Final)XinYi ChenNo ratings yet

- Accounting 14 - Applied Auditing OkDocument12 pagesAccounting 14 - Applied Auditing OkNico evansNo ratings yet

- Audit of CashDocument4 pagesAudit of CashBromanineNo ratings yet

- 0452 s15 QP 22Document20 pages0452 s15 QP 22zuzoyopiNo ratings yet

- CA Zambia June 2022 Q ADocument394 pagesCA Zambia June 2022 Q AChanda LufunguloNo ratings yet

- Proof of Cash (Bank To Book Method)Document1 pageProof of Cash (Bank To Book Method)clothing shoptalkNo ratings yet

- From The Following Passbook and Cash Book For The Month of Jan, Prepare A Bank Reconciliation Statement For Max Ltd. On 31 JanDocument4 pagesFrom The Following Passbook and Cash Book For The Month of Jan, Prepare A Bank Reconciliation Statement For Max Ltd. On 31 Jancharu bishtNo ratings yet

- WT - 12 (25.09) Xi-AccDocument4 pagesWT - 12 (25.09) Xi-AccSrinivas VakaNo ratings yet

- Case 3 - Fernandez, Hisham - BSAc2B PDFDocument6 pagesCase 3 - Fernandez, Hisham - BSAc2B PDFHISHAM F. MAINGNo ratings yet

- ACC1002 Jan 2016 Mock Test 1Document14 pagesACC1002 Jan 2016 Mock Test 1edmund forgoatNo ratings yet

- Proof of Cash - Sample ProblemsDocument1 pageProof of Cash - Sample ProblemsFucio, Mark JeroldNo ratings yet

- Adobas Auditing FinalsDocument10 pagesAdobas Auditing FinalsMica BarrunNo ratings yet

- Ia 1 - Prelim ExamDocument8 pagesIa 1 - Prelim ExamYnah GarciaNo ratings yet

- FABM2 Q4 Module 2Document23 pagesFABM2 Q4 Module 2Jet Planes100% (1)

- Final Fall 2012Document14 pagesFinal Fall 2012Miruna CiteaNo ratings yet

- Bank ReconciliationDocument64 pagesBank ReconciliationmarkjohnmagcalengNo ratings yet

- Aud 1 Quiz PDFDocument12 pagesAud 1 Quiz PDFCassandra FigueroaNo ratings yet

- Quiz ReceivablesDocument6 pagesQuiz ReceivableswesNo ratings yet

- On December 1 2015 Fullerton Company Had The Account BalancesDocument2 pagesOn December 1 2015 Fullerton Company Had The Account BalancesAmit PandeyNo ratings yet

- Chapter 1 Audit of Cash and Cash EquivalentsDocument129 pagesChapter 1 Audit of Cash and Cash Equivalentsdeborah grace sagarioNo ratings yet

- Cash and Cash Equivalents (Problems)Document9 pagesCash and Cash Equivalents (Problems)IAN PADAYOGDOGNo ratings yet

- BU127 Midterm 2 Winter 2017 Final Version Including SolutionsDocument10 pagesBU127 Midterm 2 Winter 2017 Final Version Including SolutionsAdams BruinsNo ratings yet

- Public Financial Management Systems—Viet Nam: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Viet Nam: Key Elements from a Financial Management PerspectiveNo ratings yet

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Global Financial Development Report 2019/2020: Bank Regulation and Supervision a Decade after the Global Financial CrisisFrom EverandGlobal Financial Development Report 2019/2020: Bank Regulation and Supervision a Decade after the Global Financial CrisisRating: 5 out of 5 stars5/5 (2)

- Global Financial Development Report 2015/2016: Long-Term FinanceFrom EverandGlobal Financial Development Report 2015/2016: Long-Term FinanceNo ratings yet

- Use The Following Information For The Next Two QuestionsDocument7 pagesUse The Following Information For The Next Two Questionselsana philipNo ratings yet

- Tweak Corporation Determined The Value in Use of The Unit To Be P535Document6 pagesTweak Corporation Determined The Value in Use of The Unit To Be P535elsana philipNo ratings yet

- Investment in Equity SecuritiesDocument4 pagesInvestment in Equity Securitieselsana philipNo ratings yet

- Years Accounting 123Document7 pagesYears Accounting 123elsana philipNo ratings yet

- INVENTORIESDocument5 pagesINVENTORIESelsana philipNo ratings yet

- On December 31 Ae 201 AccountingDocument4 pagesOn December 31 Ae 201 Accountingelsana philipNo ratings yet

- Amount Owed by The Business AccountingDocument3 pagesAmount Owed by The Business Accountingelsana philipNo ratings yet

- Felicia Co Ae101 AccountingDocument4 pagesFelicia Co Ae101 Accountingelsana philipNo ratings yet

- For The Year Ended December 31Document2 pagesFor The Year Ended December 31elsana philipNo ratings yet

- Accountinf 101675824567Document3 pagesAccountinf 101675824567elsana philipNo ratings yet

- Costs of Market Research Activities 75Document3 pagesCosts of Market Research Activities 75elsana philipNo ratings yet

- The Immaterial Cost of The Leasehold Shall Be Amortized Over The LifeDocument3 pagesThe Immaterial Cost of The Leasehold Shall Be Amortized Over The Lifeelsana philipNo ratings yet

- 23 Accounintg AnswersDocument5 pages23 Accounintg Answerselsana philipNo ratings yet

- On March 31 Accounting 101732636556Document3 pagesOn March 31 Accounting 101732636556elsana philipNo ratings yet

- Illustration: Bonds Issued at Premium - With Transaction CostsDocument2 pagesIllustration: Bonds Issued at Premium - With Transaction Costselsana philipNo ratings yet

- On January 1 Accounintg ProlbemDocument3 pagesOn January 1 Accounintg Prolbemelsana philipNo ratings yet

- Accounting Question Petty CashDocument2 pagesAccounting Question Petty Cashelsana philipNo ratings yet

- Loan From BDO BankDocument2 pagesLoan From BDO Bankelsana philipNo ratings yet

- PROBLEM NO. 2 - Computation of Adjusted Cash and Cash EquivalentDocument1 pagePROBLEM NO. 2 - Computation of Adjusted Cash and Cash Equivalentelsana philipNo ratings yet

- Book To Bank MethodDocument3 pagesBook To Bank Methodelsana philipNo ratings yet

- Auditing Theory QuizDocument2 pagesAuditing Theory Quizmot moctalNo ratings yet

- Chapter 1 NotesDocument8 pagesChapter 1 NotesmatthewNo ratings yet

- Ashish Rana 12538..Document3 pagesAshish Rana 12538..hiren4kachhadiyaNo ratings yet

- Internal Audit ChecklistDocument2 pagesInternal Audit ChecklistifyjoslynNo ratings yet

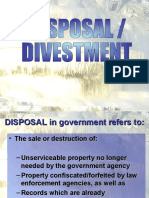

- Disposal and DivestmentDocument43 pagesDisposal and DivestmentIyay Calum BuhisanNo ratings yet

- مدى أهمية فارق التوحيد (الإدماج) الأول في توحيد حسابا... تقا لكل من النظام المحاسبي المالي الجزائري والمعايير المحاسبية الدوليةDocument8 pagesمدى أهمية فارق التوحيد (الإدماج) الأول في توحيد حسابا... تقا لكل من النظام المحاسبي المالي الجزائري والمعايير المحاسبية الدوليةLina LinaNo ratings yet

- SAFT System Application Doc Feb6 PDFDocument12 pagesSAFT System Application Doc Feb6 PDFsahil229No ratings yet

- Bank Charter of The Development Bank of MongoliaDocument7 pagesBank Charter of The Development Bank of MongoliakhishigbaatarNo ratings yet

- Od Proposal - SMLDocument32 pagesOd Proposal - SMLSheila May LantoNo ratings yet

- L4M4 Tutor Notes FINALDocument28 pagesL4M4 Tutor Notes FINALMohamed Elsir100% (2)

- PpeDocument5 pagesPpeRachel LeachonNo ratings yet

- Annex II E3h2 Gencond enDocument19 pagesAnnex II E3h2 Gencond ensdiamanNo ratings yet

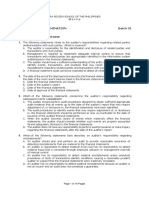

- Review Quiz No. 1Document6 pagesReview Quiz No. 1Charmaine CapaNo ratings yet

- Anhui Conch Cement Company LTD Annual Report 2013Document274 pagesAnhui Conch Cement Company LTD Annual Report 2013hnmdungdqNo ratings yet

- (Notes) Powers Functions and Responsibilities of Constitutional BodiesDocument29 pages(Notes) Powers Functions and Responsibilities of Constitutional BodiesSreekanth ReddyNo ratings yet

- Audit Revenue and Public Expenditure in NigeriaDocument19 pagesAudit Revenue and Public Expenditure in NigeriaMoses UmohNo ratings yet

- Ar2018ultrajaya PDFDocument205 pagesAr2018ultrajaya PDFAas astrianiNo ratings yet

- PiramalDocument411 pagesPiramalswarnaNo ratings yet

- AUDITDocument19 pagesAUDITJainam ShahNo ratings yet

- Audit & Assurance BibleDocument90 pagesAudit & Assurance BibleLionelNo ratings yet

- 2022 IOSA Awareness WorkshopDocument77 pages2022 IOSA Awareness WorkshopTrầnNgọcPhươngThảoNo ratings yet

- Canadian Offshore Lifting StandardsDocument63 pagesCanadian Offshore Lifting StandardsjohnsonpintoNo ratings yet

- BBVA Roadmap and Benefits Case Development V7 - FinalDocument47 pagesBBVA Roadmap and Benefits Case Development V7 - FinalchrisystemsNo ratings yet

- AUD Final Preboard Examination QuestionnaireDocument16 pagesAUD Final Preboard Examination QuestionnaireJoris YapNo ratings yet

- Checklistand Sample Forms FinalDocument46 pagesChecklistand Sample Forms FinalDK DalusongNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument7 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Tutorial 2Document5 pagesTutorial 2Kim Ngọc HuyềnNo ratings yet