Professional Documents

Culture Documents

Chapter 14 Standard Costing and Variance Analysis

Uploaded by

Gift Simau0 ratings0% found this document useful (0 votes)

83 views10 pagesStandard costing

Original Title

Chapter 14 standard costing and variance analysis

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentStandard costing

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

83 views10 pagesChapter 14 Standard Costing and Variance Analysis

Uploaded by

Gift SimauStandard costing

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

pf

Standard costing

and variance

analysis

utcomes

autre enctor this chapter students should be able to

. ynderstand the use of a standard costing system

» calculate material, labour and overheads variances

* Calculate sales variances

oncile budgeted to actual profit.

+ rec

Chapter outline

141 Introduction 14.5 Production cost variances

142 Astandard costing system 145.1 Direct materials variances

1421 Advantages of standard 14.5.2. Direct labour variances

costing 14.53. Variable manufacturing

1422 Disadvantages of stan- overheads variances

| dard costing 14.5.4 Fixed manufacturing

143 Variance analysis overheads variances

144 Sales variances

144.1 Sales price variance

144.2 Sales quantity variance

14.1 Introduction

In Chapter 13, you were introduced to budgeting as a means of planning, con-

trolling and monitoring business activities. This chapter continues the theme

of control by the use of standard costing and variance analysis. £

Ina manufacturing environment, it can be difficult to track down the causes t

of variances unless a detailed analysis is carried out. These variances can be 4

identified and quantified by using a standard costing system. t

14.2 A standard costing system 253 }

* Used to improve planning and control, and to facilitate product costing. ii

* Forces planning, resulting in a more efficient operation with less waste, 2

climinating overspending, excessive inventory, wasted time, etc @

n

a

&

on

ounTING FOR NON-ACE OUNTANTS

rm for measurin,

8 Performance,

enchmark or ano

1 two ca tegories:

which allow for n° breakd

« Astandard is 4 be

standards fall int

- Ideal standards,

lowns or other work inte

Ty

ip.

standards, which can be reacheg

Unde,

tions.

thout extraordinary effort by pr

Operly

oI

rently attainable

g conditions wi

ced employees.

bes performance and minimum allowable

ken down and costed. Perens

ach

~ Practical or CU!

efficient operatin:

trained and experien!

A standard cost prescl E

Each element of cost of production is brol

product a standard cost card is drawn up.

Setting standards. Historical data provide a good starting point for der,

mining standards for materials, labour and overheads. This data a

be adapted for changes in technology, production methods, etc. Effecti st

standard setting requires combined effort and the experience of all a

cerned to predict future trends. These standards must be revised repulaly

14.2.1 Advantages of standard costing

* Provides a good basis for cost comparisons, in particular with the use of

flexible budgets.

Enables managers to use management by exception whereby their atten-

tion is focused only on those variances that are significant, thereby saving

management time.

Provides a basis for managerial performance evaluation and determining

bonuses.

Participation in settin,

g standards and assigning re: bili

S|

motivational effects on employees. ee

14.2.2 Disadvantages of standard costing

* Standard costii

ing systems tend to focus too heavily on cost minimisation.

May encourage c¢

‘ost reduction, whi

strategic importance. , Which can adversely affect other areas of

Controlling one di \,

ments partment's costs may increase costs in other depatt

7 :

Too much emphasis

is placed on the cost and efficiency of direct labour

which can be insignific: € face o utom:

be insi, the fe

ignificant in ce of increasi

ing automation.

Standard costs becom:

20 i

lutdated quickly due to short I

orter product life cy“l@

——————

STA

NDARD COSTING AND VARIANCE ANALYSIS 414.

v riance analysis

a * si

a variance aS learnt in flexible budgets can be broken down in

very 5

°° id entify the effects on the volume and price of resource inputs.

aes arise when the actual quantity or price of a production compon-

nce i

es from the standard quantity or price.

pt

vy production component a have a price (rate, budget or spending)

‘ eranee anda quantity (efficiency or usage) variance.

ts that should have been incurred at the actual level of activity accord-

” 4 the standard are compared with actual costs incurred. The differ-

anceis the variance.

\ favourable variance occurs when actual costs are less than the standard

costs at actual volume.

van unfavourable variance occurs when actual costs are more than the

standard costs at actual volume.

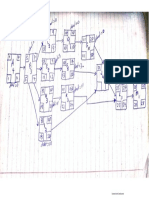

Operating profit variance

|

Seling and distribution

cost variances

| (not presented further)

Total production

cost variance

Total sales variance

| Total Total

a Total variable fixed Sales Sales

er direct || production || production } | Price volume

materials, labour ethead || overhead variance variance

variance || vanance earianice

variance

tee

| Variable Fixed J

Direct production Sales

| materials overhead f | mx

| price expenditure variance

| variance variance

Fixed

i Direct

| Direct \| production

{materials | 14 labour overhead 255

usage efficiency volume

variance variance variance 5

i

ie

o

Figure 14.1 Diagrammatic illustration of variances

y

ACCOUNTING FOR NON-ACC OUNTANTS

14.4 Sales variances

joned previously, variance analysis is used by an enterprise ,

its costs. It is, however, just as important to contro] ae

es a

Janned profits

‘As mentit

cise control ove

to ensure that p!

Sales variance:

represent income an

than the budgeted sal

cover only two sales variance:

are achieved.

s are the opposite of production variances, becaus,

d not costs. Therefore when the actual sales are © they

Jes, the variance is favourable and vice versa, Beater

s, namely sales price and sales quantity. © will

14.4.1 Sales price variance

he difference between the standard price per y

nit

The sales price variance ist

and the actual price per unit for the number of units sold in the period:

(AP - SP) x AQ

14.4.2 Sales quantity variance

ance is the difference between the budgeted number

The sales quantity vari

tual number sold valued at the standard gross profit

of units sold and the act

per unit. 7

Pre

(AQ - SQ) x Standard gross profit per unit

(Standard gross profit per unit = Standard selling price - Standard cost

price)

Explanation of abbreviations

AP - actual price

SP - standard price

AQ - actual quantity

SQ - standard quantity

ILLUSTRATIVE EXAMPLE

WG Ltd manufacture

s produ

to the two products: Products Widget and Gadget. The following information is releva"t

Budgeted | Budgeted | Standard | Actual Actual

(unin) we sales price | sales salesin |

it ba (units) rands

Widget : Unie) (R) |

Gadget = = 20 4100 19800

—__| 800 a" is

| Total p>————+ 5 1 i

uss | 2000 Oo} 70 Be:

ot 1.820 27720

MARIAN

© ania

for e¢

vie (010 wing variances for each product and in total:

ee tne variance

gall af round off to two decimal places.

$5!

wr

gto” ice variance

sae op) x AQ

yee ais — R20) x 1 100 units = R2200U

ee (ait® ~ R10) x 720 units = RT20F

ice variance = R1480U

- we

38

.pig600*! 100

jqroa0 = 720U = AN

yousold each unit of Widget for R2 less and you sold each unit of Gadget for R1

more 7

sales quantity variance

(ag- $Q) x Standard gross profit per unit

widget = (1 100-1 200) x (R20-R10) = 1 000U

Gadget = (720 - 800) x (R10 - R5) = R400U

Total sales quantity variance = R1400U

‘You sold fewer units than expected for both Widget and Gadget.

14.5 Production cost variances

145.1 Direct materials variances

Price variance measures the effect on the cost of purchasing at a price that is

different from standard. This variance can arise due to an unexpected price

‘ctease/decrease, inefficiency of purchasing department, quality of material

purchased, quantity of material purchased, etc.

The material price variance is the difference between t

“=sctual unit price of raw material multiplied by the actual quantity

ei

he standard and

of raw

§-AR) AQ

of using 2 different

ntity that

aterial ‘ with the standard qua!

in production compared whis variance can

ave been used fi 1 i -

yroduction ol Bl

‘or the actual p ie io ent, qual

Usa

(quantity) yar:

(quantity) variance measures the effect on the cost

“tant of m

sou

se dy

Yo ee the efficiency (or lack thereof) of a prodi Cnet

The = machine breakdowns, skill of workers, ee re between

“te acy ce variance is calculated by determining the diff ae have been

Quantity of material used and the quantity that show

on 1a

258

€

ACCOUNTANTS

FOR NON

OUNTING FO

used for actual production, according to the standard, Multiplie by th

dard price:

(SQ- AQ) « SP

| direct materials variance is the difference between

on at and the budgeted total materials cost, or the t

als 5 :

sum of the price and usage variance:

(AP x AQ) ~ (SP x SQ)

Actual toys) i:

Otal Variance ey

Sy

or

Price variance + Usage variance

14.5.2. Direct labour variances

Rate variance measures the effect on cost of Paying a different labouy

compared with the standard. This variance is caused by an

5 Unexpecteg ip

increase/decrease, incorrect standards established, skill of Worker; ployee

'S emy

etc. : : :

The direct labour rate variance is the difference be

hourly rate and the actual hourly rate multiplied by the

(GR- AR) x AH

tween the stan,

7 dard

actual time Used,

Efficiency variance measures the effect on cos

of direct labour hours, compared with the sta

been used for the actual production output.

skill of workers, quality of material, machi:

workers, incorrect standards established, etc,

The direct labour efficien

ference between the act

been worked to pi

the standard rate

(SH-AH) x sR

The total labour variance is the difference between actual total labour cos

and the budgeted total labour cos:

t, or the total variance is the sum of ther"

and efficiency variance:

(AR x AH) - (SR x SH) :

t of using a different Dumber

indard hours that should have

This variance is caused by the

ine breakdowns, supervision of

cy variance is calculated by determining the di

‘ual hours worked and the hours that should have

roduce the output, according to the standard, multiplied by

or

Rate variance + Efficiency variance

14.5.3 Variable manufacturing overheads variances a

s . act

Spending (rate) variance is a measure Of the difference between the *

ied

variable overheads and the standard variable overheads rate ™u!0?

ICE ANAL YS!

js variance 1s caused by incorrect standards establ

mse in the cost of variable overheads, efficient (or ine sat

ads ites, ei, efficient)

manufacturing overheads rate variance is the diffe

: standard rate and the actual rate multiplied by the ¢ vantiy

ye a 7 allocation basis, which can be labour hours, machine hoe ee

jot tt 2

{0 Ugre used aS basis)

yall

ee variable

gees! variance measures the difference between the actual activity and

: dard activity allowed, given the actual output multiplied by the stan

variable overhead rate. This variance is caused by efficient (or inefl-

t)use of time, quality of material used, machine breakdowns, supervision

s, incorrect standards established, etc. :

ble manufacturing overhead efficiency variance is calculated by

he difference between the actual hours worked and the hours

been worked to produce the output, according to the stan-

tandard rate (if the allocation base is time):

worker’

the varial

getermining

should have

dard, multiplied by the s'

(SH- AH) x SR

total variable manufacturing overhead variance is the difference between

actual total manufacturing overheads and the budgeted total variable over-

heads, or the total variance is the sum of the rate and efficiency variance:

(AR x AH) - (SR x SH)

or

Spending variance + Efficiency variance

14.5.4 Fixed manufacturing overheads variances

ed manufacturing overheads are not allocated to

Only a fixed overhead expenditure

Marginal costing system Fix

.d by actual overhead costs being

production, but written off as a period cost.

variance is calculated. This variance is cause

different from expected and can arise due to an increase/decrease 1n salaries

paid to supervisors Or other fixed overheads, overbudgeting for some fixed

expenses, etc. It is calculated as the difference between actual fixed overheads

and budgeted fixed overheads: \_

AFO - BFO

ture variance, a volume vari-

lisation of available facilities is calculated. The

andard hours allowed for actual output are

ity level planned for the period.

Absorption costing system Besides the expendi!

ance which measures the util

volume variance occurs when sti

different from the budgeted (normal) activi

(BH - SH) «SR

or

(actual units Budgeted units) x SR

——. .

™

259

c)

s

FoR NON-ACCOUNTANT

iG

260

Onan

ACCOUNTIN

————__xAMPLE

ILLUSTRATIVE ean = ig 7 Eee ee —

—————_—_———_ ‘ted from the records of :

following information has er Senayshia's Baa,

oa for the month of March 20x": iy

Standard cost card:

R

; 1,40 kg @ R4,10/kg 5,74

Materials

stole 0.90 hours @ R4,50/hour 4,05

Direct lat

Variable overheads R2,20/hour @ 0,90 hours 1,98

iable

Fixed overheads

Senayshia’s Beautiful Baskets

Performance report

Original Flexible Actual Variance

budget budget

Volume 240 000 220.000 220.000

ee ee ee

Sales 6000000 —-R5500000 —_-R5.060000 440000 u

Less: Cost ofsales 4346400 R4 111000 R4.049 698 R61902F

Direct materials 1377600 R1262800 1.252.240 R10 560 F

Direct labour R972 000 R891 000 R857 648 R33352 F

Variable overheads R475 200 R435 600 R438 570 2970 U

Fixed overheads R1521600 1521600 RI 501 240 20360 F

Profit

Rt 653 600 Rt 389 000 R1 010302 Rg78.698 U

erro Riotoso2 Raves

Vanable overheads allocation is based on direct labour hours, while faced manufac"?

Overheads are allocated ‘on the 1

based

'e basis of units produce stermined rates

on budgeted costs and volumes Produced, all at prede'

Actual production costs:

Material 313 060 kg at R4 per kg

Direct labour 194 920 hours at R4,40 per hour

Required

Prepare a complete variance analysis.

,

te” pice variance

28

&/ /

je usage variance

al

we material variance

pect abOur rate variance

pyect labour efficiency variance

Joa! labour variance

variable o/h expenditure variance

Variable o/h efficiency variance

Total variable overhead variance

Fixed overheads volume variance

Total fixed overhead variance

Sales price variance

Sales volume variance

Fixed overheads expenditure variance =

STANDARD co:

OSTING AND vari

ANCE ANALYSIS 14

=e iis an

= [R4,10 - R4,00] x 3

= R31 306 (F) ise 818 080,

= (SQ- AQ) x SP

= (220 000 x 1,40) - 31

= R20 746 (U) ) = 313 060] x R4,10

= Material price + Material

usage

= 31306 (F) + 20 746 (U) H

= R10 560 (F)

= (SR-AR) x AH

IR4,50 - R4, 40] x 194 920

= R19 492 (F)

= (SH-AH) x SR

= [220 000 x 0,90 194 920] x R4,50

= R13 860 (F)

= Labour rate + Labour efficiency

19 492 (F) + 13 860 (F)

= R33 352 (F)

(SR - AR) x AH

(R2,20 - R2,25) x 194 920

= R9746 (U)

= (Standard hours - Actual hours) x Standard rate

1.98 000 - 194 920] x R2,20

= RG 776 (F)

= (AH x AR) - (SH = SR)

494 920 x R2,25) - (220 000 x 0,90 x R2,20)

38 570 - 435 600

= R2970(U)

= Budgeted cost - Actual cost

521 600 - 1501 240

= R20 360 (F)

= (Actual units - Budget units) x Standard rate

220 000 - 240 000] x R6.34

= R126 800 (U)

= Actual cost - (Actual units x SR)

501 240 - (220 000 x R6.34)

501 240 - 1394 800

= R106 440 (U)

= (AP - SP) x AQ

(R23 - R25) x 220 000 261

= R440 000 U

= (AV - BV) x Standard profit i

(220 000 - 240 000) x (R25 - R18,11) 8

= R137 800 (U)

BASIC ACCOUNTING FOR NON-AC!

262

COUNTANTS

Senayshia’s Beautiful Baskets

Standard cost operating statement

Budgeted net profit 1653 =

‘Add: Sales volume variances 1a,

| standard profit (flexed budget profit) 15a,

‘Add/(less): Favourable/adverse variance 505, re :

Sales price variance 440 000 (U)

Material price 31-306 (F)

Material usage 20746 (U)

Labour rate 19492 (F)

Labour efficiency 13 860 (F)

Variable overhead rate 9746 (UY

| Variable overhead efficiency 6776 (F)

| Fixed overhead expenditure 20360 (F)

| Fixed overhead volume 126 800 (U)

| Actual profit 1010302

TUTORIAL EXERCISES

Exercise 1

Multiple-choice questions

1.1 Standard costs include the quantity and price of inputs for each unit of

product. These inputs include

a. delivery costs

b. marketing costs

. accounting costs

d. overhead costs

1.2 Variances indicate

a. the cause of the variance

b. who is responsible for the variance

that actual performance is not going according to plan

d. when the variance should be investigated

1,3 Price variances focus on the difference between

a. actual price and standard

actually produced

nits

Price for actual cuantity allowed for ¥

You might also like

- Model Framework For Achieving Gender Parity Combined With CoversDocument14 pagesModel Framework For Achieving Gender Parity Combined With CoversGift SimauNo ratings yet

- The Practice of Market Research Ebook An Introduct... - (The Importance of Good Design)Document7 pagesThe Practice of Market Research Ebook An Introduct... - (The Importance of Good Design)Gift SimauNo ratings yet

- Example: A Question of Roles: Pursuing The MeaningDocument10 pagesExample: A Question of Roles: Pursuing The MeaningGift SimauNo ratings yet

- Women's Experience in The 2018 Zimbabwe Election CycleDocument31 pagesWomen's Experience in The 2018 Zimbabwe Election CycleGift SimauNo ratings yet

- The Practice of Market Research Ebook An Introduct... - (The Contribution of Good Design)Document1 pageThe Practice of Market Research Ebook An Introduct... - (The Contribution of Good Design)Gift SimauNo ratings yet

- The Practice of Market Research Ebook An Introduct... - (The Questionnaire Design Process)Document1 pageThe Practice of Market Research Ebook An Introduct... - (The Questionnaire Design Process)Gift SimauNo ratings yet

- Comparing free trade areas and single marketsDocument12 pagesComparing free trade areas and single marketsGift SimauNo ratings yet

- Final Assessment: How To GuideDocument8 pagesFinal Assessment: How To GuideGift SimauNo ratings yet

- The Practice of Market Research Ebook An Introduct... - (Question Content)Document6 pagesThe Practice of Market Research Ebook An Introduct... - (Question Content)Gift SimauNo ratings yet

- Assessment One World of MarketingDocument10 pagesAssessment One World of MarketingGift SimauNo ratings yet

- BOCR - Module 4 - Booklet - FinalDocument43 pagesBOCR - Module 4 - Booklet - FinalGift SimauNo ratings yet

- The Practice of Market Research Ebook An Introduct... - (The Questionnaire Design Process)Document1 pageThe Practice of Market Research Ebook An Introduct... - (The Questionnaire Design Process)Gift SimauNo ratings yet

- Electricity and MagnetismDocument14 pagesElectricity and MagnetismGift SimauNo ratings yet

- Practical Guide To Market ResearchDocument200 pagesPractical Guide To Market Researchsarahmahdy50% (2)

- Interlocking Soil Cement Blockmaking Machines & Accessories: 2019 Dollar PricelistDocument8 pagesInterlocking Soil Cement Blockmaking Machines & Accessories: 2019 Dollar PricelistGift SimauNo ratings yet

- L6 Dip in BM - Qual Spec - v3.1 - FinalDocument50 pagesL6 Dip in BM - Qual Spec - v3.1 - FinalRodrigues SambangoNo ratings yet

- N00784 PPM101DDocument8 pagesN00784 PPM101DGift SimauNo ratings yet

- Marketing MIx StrategyDocument8 pagesMarketing MIx StrategyGift SimauNo ratings yet

- Maths Test 1Document10 pagesMaths Test 1Gift SimauNo ratings yet

- Assessment 2Document9 pagesAssessment 2Gift SimauNo ratings yet

- Critical Path AnalysisDocument1 pageCritical Path AnalysisGift SimauNo ratings yet

- Motivating Sales Teams Through Likert's Management ModelsDocument3 pagesMotivating Sales Teams Through Likert's Management ModelsGift SimauNo ratings yet

- Maths TestDocument13 pagesMaths TestGift SimauNo ratings yet

- Chapter 8 VatDocument7 pagesChapter 8 VatGift SimauNo ratings yet

- Project Activity 1 Gift SimauDocument10 pagesProject Activity 1 Gift SimauGift SimauNo ratings yet

- DG2ECMDocument112 pagesDG2ECMGift SimauNo ratings yet

- Social Media Marketing - IntroductionDocument17 pagesSocial Media Marketing - IntroductionGift SimauNo ratings yet

- SAM101B - S01328: by Gift SimauDocument11 pagesSAM101B - S01328: by Gift SimauGift SimauNo ratings yet

- FM101B S01328Document11 pagesFM101B S01328Gift SimauNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)