Professional Documents

Culture Documents

Depreciation Solved

Uploaded by

Vivek kumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciation Solved

Uploaded by

Vivek kumarCopyright:

Available Formats

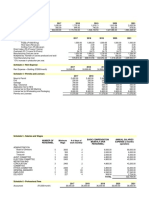

Question for Practice:Prepare depreciation statement for the financial year starting from 2016 to 2023 for the

following asset

DEPRECIATION STATEMENT

Particular Plant and Machinary Furniture

Date 1-May-16 8-Mar-16

Cost 2,500,000 170,000

Life (Year) 10.00 8.00

Salvage 50000.00 10000.00

Method SLN DB

Months 11 1

Period Financial Year Plant and Machinary Furniture

1 2016 - 2017 224583.333333333 4221.66666666667

2 2017 - 2018 245000 49401.9433333333

3 2018 - 2019 245000 34680.16422

4 2019 - 2020 245000 24345.47528244

5 2020 - 2021 245000 17090.5236482729

6 2021 - 2022 245000 11997.5476010876

7 2022 - 2023 245000 8422.27841596347

8 2023 - 2024 245000 5912.43944800636

9 2024 - 2025 245000 3804.65478479209

10 2025 - 2026 245000 0

11 2026 - 2027 20416.6666666667 0

12 2027 - 2028 0 0

6 to 2023 for the following assets

Computer Projector

12-Dec-16 1-Jan-17

285,000 100,000

9.00 3.00

15000.00 10000.00

SLN DB

4 3

Computer Projector

10000 13400

30000 46417.6

30000 21537.7664

30000 7495.142707

30000 0

30000 0

30000 0

30000 0

30000 0

20000 0

0 0

0 0

You might also like

- Chapter 3 Tax AnswersDocument55 pagesChapter 3 Tax Answersawby04100% (2)

- Ey Ficci Indian Pharma Report 2021Document87 pagesEy Ficci Indian Pharma Report 2021Sandesh ShettyNo ratings yet

- Week 3 SolutionDocument5 pagesWeek 3 SolutionI190006 Taimoor JanNo ratings yet

- UntitledDocument4 pagesUntitledDushmanta mishraNo ratings yet

- FAR Handout Depreciation Part 2Document7 pagesFAR Handout Depreciation Part 2Chesca Marie Arenal Peñaranda100% (1)

- Income & Cost SheetDocument2 pagesIncome & Cost SheetDidarul IslamNo ratings yet

- Chalapathi 123Document5 pagesChalapathi 123nagarajukarthikvarmaNo ratings yet

- Preference Shares - November 6 2019Document1 pagePreference Shares - November 6 2019Tiso Blackstar GroupNo ratings yet

- Zari Project 1Document11 pagesZari Project 1afroz khanNo ratings yet

- Annual Report CCSM 2022-2023 - FinaDocument73 pagesAnnual Report CCSM 2022-2023 - Finaavapsm621133No ratings yet

- Account Statement: STATE - FINANCE - COMM - GRANTS (8448001090001002000NVN) 18,904.00Document6 pagesAccount Statement: STATE - FINANCE - COMM - GRANTS (8448001090001002000NVN) 18,904.00Khaja Naseeruddin MuhammadNo ratings yet

- Class No. of Schools No. of Students Year (2019-20) Year (2020-21) Year (2021-22)Document5 pagesClass No. of Schools No. of Students Year (2019-20) Year (2020-21) Year (2021-22)Akhilesh JainNo ratings yet

- Income Tax Data 53001003 2023-2024Document4 pagesIncome Tax Data 53001003 2023-2024biswanathdas2888No ratings yet

- NPV MBADocument2 pagesNPV MBAViren PrajapatiNo ratings yet

- DebendraDocument4 pagesDebendraSHIELD LUCKYNo ratings yet

- Income Tax - VindfoDocument4 pagesIncome Tax - Vindfodafny glendaNo ratings yet

- BoqcomparativechartDocument35 pagesBoqcomparativechartakshith111222No ratings yet

- Document 1Document2 pagesDocument 1mylinhvtv69No ratings yet

- Mr. M S/o R Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Document9 pagesMr. M S/o R Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Santhosh Kumar BattaNo ratings yet

- Sanjulata MukhiDocument4 pagesSanjulata MukhiSHIELD LUCKYNo ratings yet

- BendcoDocument29 pagesBendcoJulie SalamonNo ratings yet

- Tugas 1 PIPDocument7 pagesTugas 1 PIPWika Maulany FatimahNo ratings yet

- Report ComissionDocument4 pagesReport ComissionHasanudin HasanudinNo ratings yet

- False Celing Status TrackerDocument10 pagesFalse Celing Status TrackerkowshickNo ratings yet

- HSD Consumption & Avg & Tracking Report August-2021Document335 pagesHSD Consumption & Avg & Tracking Report August-2021Surandra KukrejaNo ratings yet

- Macadamia Agribusiness FinancialsDocument18 pagesMacadamia Agribusiness FinancialsSiyabongaNo ratings yet

- Test 2Document7 pagesTest 2khowcatherine2000No ratings yet

- ManliftDocument8 pagesManliftAlankar Nana Ambwade/Infrastructure Solutions-MEP/MUMBAINo ratings yet

- Academic Global School, Gorakhpur Revised: Fee Structure For 2020-21 (4 Installments)Document1 pageAcademic Global School, Gorakhpur Revised: Fee Structure For 2020-21 (4 Installments)Ayush YadavNo ratings yet

- Book 1Document12 pagesBook 1rajeshwar devarajanNo ratings yet

- Test 1Document6 pagesTest 1khowcatherine2000No ratings yet

- Preference Shares - September 27 2017Document1 pagePreference Shares - September 27 2017Tiso Blackstar GroupNo ratings yet

- Etude FinanciereDocument28 pagesEtude Financieresalma elkeltoumiNo ratings yet

- AssignmentDocument23 pagesAssignmentVaish KiranNo ratings yet

- Preference Shares - August 7 2019Document1 pagePreference Shares - August 7 2019Lisle Daverin BlythNo ratings yet

- APRILDocument2 pagesAPRILHabby Maulana EffendyNo ratings yet

- Preference Shares - November 5 2019Document1 pagePreference Shares - November 5 2019Lisle Daverin BlythNo ratings yet

- Design Option ComparisonDocument19 pagesDesign Option ComparisonCamilo MasmelaNo ratings yet

- 4.form 3CDocument15 pages4.form 3CPeter ValentineNo ratings yet

- Accounting Equation: Under The Guidance ofDocument7 pagesAccounting Equation: Under The Guidance ofAcademic BunnyNo ratings yet

- Quarterly Estimated GDPDocument11 pagesQuarterly Estimated GDPb2023ankitkumar.singhNo ratings yet

- Preference Shares - November 4 2019Document1 pagePreference Shares - November 4 2019Lisle Daverin BlythNo ratings yet

- Diamond Energy Resources StudentDocument2 pagesDiamond Energy Resources StudentDonny BuiNo ratings yet

- Preference Shares - September 26 2019Document1 pagePreference Shares - September 26 2019Tiso Blackstar GroupNo ratings yet

- Consum (Recovered)Document15 pagesConsum (Recovered)Aileen Mifranum IINo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesMatshepo SeletswaneNo ratings yet

- SCHEDULE 1 - Revenue 2017 2018 2019 2020 2021Document7 pagesSCHEDULE 1 - Revenue 2017 2018 2019 2020 2021Nathalie PadillaNo ratings yet

- Preference Shares - September 18 2019Document1 pagePreference Shares - September 18 2019Anonymous MPsxhBNo ratings yet

- 011 September 2022Document21 pages011 September 2022John Louie LagunaNo ratings yet

- Ministry of Labour and EmploymentDocument5 pagesMinistry of Labour and EmploymentShubham SaxenaNo ratings yet

- AgeingDocument4 pagesAgeingkrishna aroraNo ratings yet

- Individual AssessmentDocument10 pagesIndividual AssessmentSaujanya PrasoonNo ratings yet

- NCT TESTING DeskDocument5 pagesNCT TESTING DeskNick Operario JrNo ratings yet

- Brain Drain2Document9 pagesBrain Drain2HaiderNo ratings yet

- MpsDocument2 pagesMpsSum WhosinNo ratings yet

- Spicy Malunggay CookiesDocument19 pagesSpicy Malunggay CookiesChristine Margoux SiriosNo ratings yet

- Issued Unless All The Arrears Applicable Till The Last Day in School and Due To The School Are Paid in FullDocument2 pagesIssued Unless All The Arrears Applicable Till The Last Day in School and Due To The School Are Paid in FullVijay PradeepNo ratings yet

- Itax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Document13 pagesItax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Rose CastilloNo ratings yet

- Profolis Technologies MCS Project, Cost Estimate Sl/No. Discription Up To Dec 2019 Jan-20 Feb-20Document4 pagesProfolis Technologies MCS Project, Cost Estimate Sl/No. Discription Up To Dec 2019 Jan-20 Feb-20Gangadhar BhiwmickNo ratings yet

- 5.1 Preoperational CostsDocument9 pages5.1 Preoperational CostsMonicah MuthokaNo ratings yet

- New Jayam Hyper MarketDocument2 pagesNew Jayam Hyper Marketsenthilkumar kNo ratings yet

- Transforming Bangladesh’s Participation in Trade and Global Value ChainFrom EverandTransforming Bangladesh’s Participation in Trade and Global Value ChainNo ratings yet

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

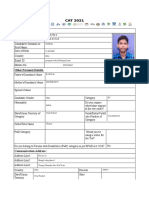

- Cat Registartion FormDocument9 pagesCat Registartion FormVivek kumarNo ratings yet

- DBMS 3Document2 pagesDBMS 3Vivek kumarNo ratings yet

- Book 1Document1 pageBook 1Vivek kumarNo ratings yet

- Cat Registartion FormDocument9 pagesCat Registartion FormVivek kumarNo ratings yet

- DBMS 3Document2 pagesDBMS 3Vivek kumarNo ratings yet

- DBMS 3Document2 pagesDBMS 3Vivek kumarNo ratings yet

- DBMS4Document3 pagesDBMS4Vivek kumarNo ratings yet

- DBMS5Document3 pagesDBMS5Vivek kumarNo ratings yet

- DBMS 2Document2 pagesDBMS 2Vivek kumarNo ratings yet

- Book 1Document8 pagesBook 1Vivek kumarNo ratings yet

- Book 1Document10 pagesBook 1Vivek kumarNo ratings yet

- Logical Function Example: 1: Roll No ITB Marks Eco MarksDocument4 pagesLogical Function Example: 1: Roll No ITB Marks Eco MarksVivek kumarNo ratings yet

- Case Study Contractor ProjectDocument31 pagesCase Study Contractor ProjectPurboRagilSaputroNo ratings yet

- Category Functions and CALL Routines DescriptionDocument18 pagesCategory Functions and CALL Routines DescriptionMANOJ PATELNo ratings yet

- Lease 12 AprilDocument32 pagesLease 12 Aprilr4vemaster100% (1)

- Simplified Costs Options (SCOs) PresentationDocument28 pagesSimplified Costs Options (SCOs) PresentationTonći JajićNo ratings yet

- Midterm - Ch. 4Document15 pagesMidterm - Ch. 4Cameron BelangerNo ratings yet

- Business Income Calculation UdomDocument23 pagesBusiness Income Calculation UdomMaster Kihimbwa100% (1)

- South Sudan Taxation SystemDocument16 pagesSouth Sudan Taxation SystemNoahIssa0% (1)

- Biological Treatment of Microbial Corrosion Opportunities and Challenges 1St Edition Reza Javaherdashti Full ChapterDocument68 pagesBiological Treatment of Microbial Corrosion Opportunities and Challenges 1St Edition Reza Javaherdashti Full Chapteroscar.gokey720100% (4)

- 032431986X 104971Document5 pages032431986X 104971Nitin JainNo ratings yet

- Profit, Planning and ControlDocument14 pagesProfit, Planning and ControlJigoku ShojuNo ratings yet

- FI ReportsDocument4 pagesFI Reportsshashwat4000No ratings yet

- Financial Accounting IDocument340 pagesFinancial Accounting IEmdadul HaqueNo ratings yet

- WAXCANDLES Candle ProductionDocument3 pagesWAXCANDLES Candle ProductionLeulNo ratings yet

- Application of HR MetricsDocument8 pagesApplication of HR MetricsDeepak GoswamiNo ratings yet

- Archdiocese Phila Off Finan Svcs FS 15 14 FinalDocument41 pagesArchdiocese Phila Off Finan Svcs FS 15 14 FinalKody LeibowitzNo ratings yet

- Mock 2Document14 pagesMock 2Arslan AlviNo ratings yet

- Other Comprehensive Income: Items That Will Not Be Reclassified Subsequently To Profit or LossDocument6 pagesOther Comprehensive Income: Items That Will Not Be Reclassified Subsequently To Profit or LossKeahlyn BoticarioNo ratings yet

- TB 02Document60 pagesTB 02Yvonne Totesora100% (1)

- Financial Analysis of Honda (With Special Reference To Working Capital Management) inDocument90 pagesFinancial Analysis of Honda (With Special Reference To Working Capital Management) inShadab HashmiNo ratings yet

- 7110 Y10 SP 2Document20 pages7110 Y10 SP 2mstudy123456No ratings yet

- Sugested May 2019 Group 2Document86 pagesSugested May 2019 Group 2priyanka jainNo ratings yet

- Correction of Error CTDIDocument15 pagesCorrection of Error CTDIKathleen Kate JimenezNo ratings yet

- Proc No 608 2008 Income Tax AmendmentDocument11 pagesProc No 608 2008 Income Tax AmendmentKassahunNo ratings yet

- AUDPROB CHPT 5 and 61Document30 pagesAUDPROB CHPT 5 and 61Jem ValmonteNo ratings yet

- Marketing SucksDocument41 pagesMarketing SucksJJ THOMPSONNo ratings yet

- ACCA F9 Revision Question Bank-49-51Document3 pagesACCA F9 Revision Question Bank-49-51rbaamba100% (1)

- Q Feb21 PDFDocument9 pagesQ Feb21 PDFuser mrmysteryNo ratings yet

- Objective Questions and Answers of Financial ManagementDocument22 pagesObjective Questions and Answers of Financial ManagementGhulam MustafaNo ratings yet