Professional Documents

Culture Documents

Accounting P1a Level InfoBook 2016

Uploaded by

Wonder Bee NzamaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting P1a Level InfoBook 2016

Uploaded by

Wonder Bee NzamaCopyright:

Available Formats

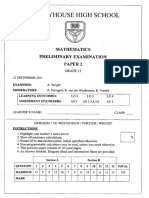

NATIONAL SENIOR CERTIFICATE EXAMINATION

NOVEMBER 2016

ACCOUNTING: PAPER I

Time: 2 hours 200 marks

INFORMATION BOOKLET

Gross Profit 100 Gross Profit 100 Net Profit 100

× × ×

Sales 1 Cost of sales 1 Sales 1

Operating expenses 100 Operating profit 100 Operating profit 100

× × ×

Sales 1 Sales 1 Cost of sales 1

Net profit after tax 100 Net profit before tax + interest expense 100

× ×

Average shareholders' equity 1 Average capital employed 1

Current assets : Current liabilities (Current assets − inventories) : Current liabilities

Average debtors 365 or 12 Average creditors 365 or 12 Cost of sales

× ×

Credit sales 1 Credit purchases 1 Average inventories

Average inventories 365 or 12 Closing inventories 365 or 12

× × Current assets − Current liabilities

Cost of sales 1 Cost of sales 1

Non-current liabilities : Shareholders' equity Total assets : Total liabilities

Profit after tax Ordinary share dividends

No. shares in issue No. shares in issue

Fixed cost Total ordinary shareholders' equity

(Selling price per unit − Variable cost per unit) No. shares in issue

IEB Copyright © 2016 PLEASE TURN OVER

NATIONAL SENIOR CERTIFICATE: ACCOUNTING: PAPER I – INFORMATION BOOKLET Page ii of ix

QUESTION 1 INVENTORY SYSTEMS (32 marks, 19 minutes)

Information relating to Weighcomm Scales

Weighcomm Scales supplies seafood retailers with specialised electronic scales. They use the

periodic inventory system to record their stock, and the FIFO method to value it. The financial year

ends on 31 July 2016.

1. Below is the stock record of electronic scales purchases for the year. Prices exclude VAT.

Number of

units Unit cost Total cost

Opening stock (1 August 2015) 200 R2 100 R420 000

Purchases during the year 1 350 R2 942 000

November 2015 320 R2 180 R697 600

February 2016 540 R2 160 R1 166 400

July 2016 490 R2 200 R1 078 000

2. Gross sales for the year were R4 375 320 including VAT.

3. Debtors' returns amounted to R19 000 excluding VAT (5 units). These were all returns of

stock.

4. The following credit note for scales returned to a supplier was found in the clerk's desk

drawer. It has not been processed and related to stock bought in July 2016. There were no

other credit notes during the year.

Weighcomm Scales Ltd

17 Beviss Crescent

New Germany

Tel: (031) 703 2555 Fax: (031) 703 2566 e-mail: enquires@weighcommscales.co.za

<www.weighcommscales.com>

CREDIT NOTE: 5664/07 DATE: 31 JULY 2016

Address to: CROSSFIT SCALES

210 NORTH COAST ROAD

DURBAN

QUANTITY ITEM UNIT COST (Excl. VAT) TOTAL

12 Electronic scale ? ?

VAT ?

5. According to the physical stock count on 31 July 2016, the business had 510 units on hand.

IEB Copyright © 2016

NATIONAL SENIOR CERTIFICATE: ACCOUNTING: PAPER I – INFORMATION BOOKLET Page iii of ix

QUESTION 2 COMPANY FINANCIAL STATEMENTS (70 marks, 42 minutes)

Information relating to Impumelelo Limited

Impumelelo Limited

Pre-adjustment Trial Balance for the year ended 31 October 2016

R R

Balance Sheet Section

Ordinary share capital ?

Retained income ?

Land and buildings 4 064 000

Vehicles 1 850 000

Accumulated depreciation on vehicles 1 729 000

Fixed deposit: Rand Merchant at 10,5% p.a. 135 000

Trading stock 360 870

Debtors control 161 969

Bank 32 740

Loan: Capitec Bank 300 000

Creditors for salaries 25 100

SARS: PAYE 12 050

Unemployment insurance fund (UIF) 979

Creditors control 229 120

Provision for bad debts 7 930

SARS: Income tax 289 000

Nominal Accounts Section

Sales 2 435 000

Cost of sales 1 521 875

Debtors' allowances 3 725

Rent income 144 313

Audit fees 25 000

Directors fees 159 600

Sundry expenses 116 649

Bad debts 11 594

Salaries 240 000

Interest on fixed deposit 9 050

Loss on disposal of asset 6 000

Ordinary share dividends 140 000

9 085 282 9 085 282

IEB Copyright © 2016 PLEASE TURN OVER

NATIONAL SENIOR CERTIFICATE: ACCOUNTING: PAPER I – INFORMATION BOOKLET Page iv of ix

Additional information and adjustments that still need to be taken into account:

1. The following adjustments relate to their debtors:

1.1 A credit note dated 31 October 2016 was issued for defective stock with a selling

price of R2 256. The company consistently applies a mark-up of 60% on cost. These

goods were returned to the supplier.

1.2 Provision for bad debts needs to be adjusted to R8 200.

2. Rental income for November 2016 was received and recorded on 25 October 2016. The

premises were occupied for the entire year.

3. Impumelelo Limited paid a 40% deposit on their audit fees for the year. The balance will be

settled on 7 November 2016.

4. According to the physical stock count, trading stock on hand amounted to R358 240.

5. The creditors for salaries figure of R25 100 in the pre-adjustment trial balance reflected the

following 2 situations:

5.1 The salaries clerk had incorrectly processed the October salary of employee Jack

Jones who had left the company on 30 September 2016.

The details of his October salary are as follows:

GROSS

R28 000 DEDUCTIONS: CONTRIBUTIONS

SALARY

PAYE: R7 852

UIF: R148 UIF: R148

(Ignore the maximum for (Ignore the maximum for

UIF) UIF)

Contributions are debited to the salaries account.

5.2 The remaining salary was for an employee who requested that his October salary

only be paid on 1 November 2016.

5.3 Payments to SARS and the various funds will only be made on 1 November 2016.

6. The fixed deposit was increased by R25 000 on 1 July 2016. This has been recorded.

Interest is not capitalised. Outstanding interest needs to be accounted for.

7. Only one asset, a vehicle, was sold at the beginning of the year. The book value of this

vehicle on the date of sale was R20 000. It was sold for R24 000 cash. All the transactions

relating to the transfer of the cost price and accumulated depreciation of the asset were

correctly transferred to the asset disposal account, but the bookkeeper recorded the receipt

of cash in the CRJ and the asset disposal account as R14 000 instead of R24 000.

8. The remaining vehicles must be depreciated to a book value of R15 000.

IEB Copyright © 2016

NATIONAL SENIOR CERTIFICATE: ACCOUNTING: PAPER I – INFORMATION BOOKLET Page v of ix

9. Impumelelo Limited took out a loan from Capitec Bank on 1 November 2015 on the

agreement that they would pay back a fixed amount of the loan each year as well as any

interest expense for that year. The following table shows the transactions related to the loan

for the financial year ending 31 October 2016:

Opening balance at 1 November 2015 R420 000

Add: Interest capitalised ?

Less: Repayments and interest payments made during the year (166 200)

Closing balance at 31 October 2016 300 000

Impumelelo Limited has budgeted to repay the same capital portion of the loan next year.

10. The following share transactions took place during the year:

• On 31 October 2015 the company had shares in issue with a weighted average of R6,90

per share

• On 1 November 2015 the company issued a further 125 000 ordinary shares at R7,30

per share. This transaction has been recorded.

• On 30 September 2016 the company repurchased 37 500 shares at R8,50 per share from

the estate of a deceased shareholder

• On 31 October 2016 director A. Shaw was issued 2 500 ordinary shares at R7,40 each in

lieu of his outstanding directors fees. No entry has been made to record this.

11. On completion of the audit for the year it was calculated that Impumelelo Limited owed

SARS a further R11 450 for Income Tax.

12. On 31 October 2016, the directors declared a final dividend of 80 cents per share. The

shares issued to director A. Shaw DO NOT qualify for this dividend.

IEB Copyright © 2016 PLEASE TURN OVER

NATIONAL SENIOR CERTIFICATE: ACCOUNTING: PAPER I – INFORMATION BOOKLET Page vi of ix

QUESTION 3 CASH FLOW STATEMENTS (50 marks, 30 minutes)

Information relating to Claxton LTD.

1. Extract from the Statement of Comprehensive Income (Income Statement) for the year

ended 31 July 2016.

Loss on sale of equipment R3 250

Depreciation for the year R164 400

Interest on loan R110 000

Income tax R518 000

Net income before taxation R1 223 000

2. Extract from the Statement of Financial Position (Balance Sheet) as at:

31 July 2016 31 July 2015

Fixed Assets: 7 332 850 5 170 000

Land and buildings 6 100 000 4 220 000

Equipment at carrying value 1 232 850 950 000

Equity 5 865 750 5 690 000

Share capital ? 4 655 000

Retained income ? 1 035 000

Long-term liabilities 987 250 900 000

Mortgage loan: RFS Financial Bank (12% p.a.) 987 250 900 000

IEB Copyright © 2016

NATIONAL SENIOR CERTIFICATE: ACCOUNTING: PAPER I – INFORMATION BOOKLET Page vii of ix

3. Extract from the notes to the Financial Statements as at 31 July 2016

Note 5: Trade and other receivables

31 July 2016 31 July 2015

SARS – Income tax R22 700 ?

Note 6: Cash and cash equivalents

31 July 2016 31 July 2015

Bank R12 500

Petty cash R2 000 R1 500

Note 7: Trade and other payables

31 July 2016 31 July 2015

SARS – Income tax ?

Shareholders for dividends R113 000 R162 000

Bank ?

4. Additional information:

• The total dividends paid and declared for the year amounted to R338 000.

• The cash flow statement on 31 July 2016 reflected taxation paid of R557 050.

• The business bought new equipment during the year.

• They also disposed of obsolete equipment on 31 March 2016. The following

information relating to the disposal of this equipment was taken from the tangible asset

register:

Cost price of the equipment R180 000

Accumulated depreciation (1 August 2015) R87 500

Depreciation was calculated at 15% p.a. on the diminishing balance method.

• The business built an additional warehouse during the year.

• Claxton LTD had 931 000 ordinary shares in issue on 1 August 2015.

• On 1 August 2015, Claxton LTD decided to repurchase 50 000 ordinary shares from a

shareholder at R5,50 per share. The weighted average price per share on this date was

R5.

• During the financial year ended 31 July 2016, they issued further shares to the public at

a price of R5,55 per share.

• Claxton LTD took out a new loan of R218 000 during the year. Interest is capitalised

and loan repayments (including interest for the year) were made during the year.

• The net change in cash and cash equivalents for the year ended 31 July 2016 was

R119 000 (positive).

IEB Copyright © 2016 PLEASE TURN OVER

NATIONAL SENIOR CERTIFICATE: ACCOUNTING: PAPER I – INFORMATION BOOKLET Page viii of ix

QUESTION 4 MANUFACTURING (48 marks, 29 minutes)

This question consists of 2 parts; each is related to a completely different business.

PART A

Information relating to Thorndon Manufacturers

Thorndon Manufacturers are a medium-sized business that specialises in the production of security

alarms. They supply their products to various security companies, but also have an online store

where they have a call centre selling security alarms directly from the factory. 90% of all the

selling and distribution costs are incurred by the online call centre.

1. The following balances were found in the stock accounts:

30 September 2016 1 October 2015

Raw materials stock R70 000 R55 000

Indirect materials stock R2 730 R4 500

Work-in-progress stock ? R65 050

Finished goods stock R80 500 R101 450

2. Raw materials were purchased during the year, R1 135 000. The owner returned raw

materials costing R2 500 that he had previously taken for his own personal use. The return

of this stock has not been recorded.

3. A credit invoice for R3 500 had not yet been recorded. This was in respect of transporting

raw materials from the harbour to the factory.

4. After the creditor's reconciliation had been completed, it was discovered that a bulk

purchase discount of R6 000 on raw materials had not been granted. Thornton

Manufacturers is entitled to this discount.

5. Sales for the year were R6 282 375. (30% of these sales are through the call centre.) Cost of

sales for the year were R2 512 950.

6. Indirect material bought during the year was R260 000. Indirect material used is divided

between the factory, administration, and selling and distribution in the ratio of 1 : 1 : 3.

7. At the end of the year it was discovered that indirect material in the factory (packing boxes)

costing R1 750 had been stolen. The stock is insured and the insurance will pay out R1 130

in October 2016. No entries have been made to record this theft.

8. Monthly insurance has remained constant for the last two years. Insurance paid for the year

amounted to R121 520 and this included insurance paid in advance for October and

November 2016. Insurance of R59 520 was allocated to selling and distribution, and R7 440

to administration.

9. R490 000 is the total rent. 60% is for the factory, 5% for administration and the rest is for

selling and distribution.

IEB Copyright © 2016

NATIONAL SENIOR CERTIFICATE: ACCOUNTING: PAPER I – INFORMATION BOOKLET Page ix of ix

10. The following salary and wage expenses were incurred:

Gross salaries

Contributions

and wages

Indirect labour Medical aid UIF

Factory R312 850 R7 002 R2 428

Administration R80 000 R1 650 R1 600

Direct labour, including contributions, amounts to R790 000.

11. Transport costs to deliver alarms to online customers were R35 080.

12. Total selling and distribution costs as a percentage of sales for the year was 16%.

PART B

Information relating to Bags of Fun

Bags of Fun is a small manufacturing business that produces transparent pencil bags. This business

supplies these pencil bags to various school shops in the Durban area. Maria Martins, the owner, is

concerned about the profitability and sustainability of her business.

The following information was taken from the books of Bags of Fun at their year-end,

31 October 2016.

Every year they sell all the goods they produced:

31 October

31 October 2016

2015

Total costs Unit cost Fixed/Variable

Direct materials costs R607 750 R5,50

Direct labour costs R508 300 R4,60

Selling and distribution costs R182 325 R1,65 All variable

Factory overheads cost R548 410 All Fixed

Administration costs R247 500 All Fixed

Selling price per unit R18,85 R15

31 October 31 October

2016 2015

Units produced and sold ? 98 000 units

Break-even point ? 78 000 units

IEB Copyright © 2016

You might also like

- 2017 MEMORANDUM-ADMINISTRuATION OF LO CATDocument2 pages2017 MEMORANDUM-ADMINISTRuATION OF LO CATWonder Bee NzamaNo ratings yet

- Accounting A Level NSC Grade 12 Past Exam Papers 2013 p1 Question PaperDocument12 pagesAccounting A Level NSC Grade 12 Past Exam Papers 2013 p1 Question PaperWonder Bee NzamaNo ratings yet

- Accounting 2012iDocument39 pagesAccounting 2012iWonder Bee NzamaNo ratings yet

- DGC Trials Paper 1 2012Document9 pagesDGC Trials Paper 1 2012Wonder Bee NzamaNo ratings yet

- Gansbaai Academia: Grade 12 September 2014 Total: 150 Time: 3 Hours L. Havenga A. Van WykDocument12 pagesGansbaai Academia: Grade 12 September 2014 Total: 150 Time: 3 Hours L. Havenga A. Van WykWonder Bee NzamaNo ratings yet

- National Senior Certificate: Grade 12Document19 pagesNational Senior Certificate: Grade 12Wonder Bee NzamaNo ratings yet

- 2017 Grade 11 Paper 2 November Exam2Document25 pages2017 Grade 11 Paper 2 November Exam2Wonder Bee NzamaNo ratings yet

- 2012-09 GR 12 Exam Paper 1 MEMODocument18 pages2012-09 GR 12 Exam Paper 1 MEMOWonder Bee NzamaNo ratings yet

- 2016 GRADE 12 MATH TRIAL EXAM PAPER 2 WC MEMOtDocument11 pages2016 GRADE 12 MATH TRIAL EXAM PAPER 2 WC MEMOtWonder Bee NzamaNo ratings yet

- 2011 Trinityhouse Paper 2Document18 pages2011 Trinityhouse Paper 2Wonder Bee NzamaNo ratings yet

- Factors That Affect The Rate of A Chemical ReactionDocument18 pagesFactors That Affect The Rate of A Chemical ReactionWonder Bee NzamaNo ratings yet

- Grade 12: National Senior CertificateDocument7 pagesGrade 12: National Senior CertificateWonder Bee NzamaNo ratings yet

- UCT Maths Olympiad Junior Awards 2017jjDocument3 pagesUCT Maths Olympiad Junior Awards 2017jjWonder Bee Nzama100% (1)

- English HL P2 May-June 2020 MemoDocument24 pagesEnglish HL P2 May-June 2020 MemoWonder Bee NzamaNo ratings yet

- Udweshu Nokuvezwa KwabalingiswaDocument3 pagesUdweshu Nokuvezwa KwabalingiswaWonder Bee Nzama79% (24)

- 2016 Grade 12 Math Trial Exam Paper 1 GP MemoDocument15 pages2016 Grade 12 Math Trial Exam Paper 1 GP MemoWonder Bee NzamaNo ratings yet

- Business StudiesDocument9 pagesBusiness StudiesWonder Bee NzamaNo ratings yet

- Accn. Lockdown Worksheet 1Document3 pagesAccn. Lockdown Worksheet 1Wonder Bee NzamaNo ratings yet

- 2019 Prospectus (1rDocument31 pages2019 Prospectus (1rWonder Bee NzamaNo ratings yet

- Caps Fet Home Isizulu GR 10-12 Web 5d5aDocument114 pagesCaps Fet Home Isizulu GR 10-12 Web 5d5aWonder Bee NzamaNo ratings yet

- j1q92011 PDFDocument6 pagesj1q92011 PDFWonder Bee NzamaNo ratings yet

- Practical Examination Marking Guideline Grade 12 Physical Science 2019 PDFDocument5 pagesPractical Examination Marking Guideline Grade 12 Physical Science 2019 PDFWonder Bee Nzama100% (1)

- When Will Schools and Colleges Open PDFDocument1 pageWhen Will Schools and Colleges Open PDFWonder Bee NzamaNo ratings yet

- Grade 12 Mathematics Composite SBA Documents 2020 22 OctDocument26 pagesGrade 12 Mathematics Composite SBA Documents 2020 22 OctWonder Bee Nzama0% (1)

- Grade 12 2019 November Maths Paper 2Document15 pagesGrade 12 2019 November Maths Paper 2Wonder Bee Nzama100% (1)

- Life Sciences FETDocument102 pagesLife Sciences FETWonder Bee NzamaNo ratings yet

- Jun 2020 Timetable - FinalDocument2 pagesJun 2020 Timetable - FinalWonder Bee NzamaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Business FinanceDocument64 pagesBusiness FinanceJayar Dimaculangan100% (1)

- Finance - Exam 3Document15 pagesFinance - Exam 3Neeta Joshi50% (6)

- 1taxation of Miners LectureDocument81 pages1taxation of Miners LectureAshley TaruvingaNo ratings yet

- Tutorial 12Document72 pagesTutorial 12Irene WongNo ratings yet

- Taxation and Land Reform Final ExamDocument8 pagesTaxation and Land Reform Final ExamMeynard MagsinoNo ratings yet

- 2-5int 2002 Jun QDocument10 pages2-5int 2002 Jun Qapi-3728790No ratings yet

- Cost of Capital FYBAF Sem I Old F. M. 1644486598Document26 pagesCost of Capital FYBAF Sem I Old F. M. 1644486598maggiemali092No ratings yet

- Gitman Pmf13 Ppt07 GEDocument55 pagesGitman Pmf13 Ppt07 GEM Farhan Bhatti100% (1)

- English Question FTDocument12 pagesEnglish Question FTThảo Trần Thị ThuNo ratings yet

- Unit 5Document37 pagesUnit 5Rej HaanNo ratings yet

- Mvelaserve Prelisting StatementDocument154 pagesMvelaserve Prelisting StatementsizwehNo ratings yet

- Test: Points: Name: Score: - Date: Signature:: Question 1 of 86Document24 pagesTest: Points: Name: Score: - Date: Signature:: Question 1 of 86Kaname KuranNo ratings yet

- Question Sheet AFMDocument48 pagesQuestion Sheet AFMGoku SayienNo ratings yet

- Shezan Annual ReportDocument41 pagesShezan Annual Reportmudi201100% (2)

- Note: Answer Any FOUR Questions From Q.No.1 To Q.No.7Document4 pagesNote: Answer Any FOUR Questions From Q.No.1 To Q.No.7Swaathii SwathiNo ratings yet

- Copper Minera Las Piedras of Chile: Please Sit Close To Your Own Group, As We Will Do A GameDocument6 pagesCopper Minera Las Piedras of Chile: Please Sit Close To Your Own Group, As We Will Do A GameevdokiaaakNo ratings yet

- (Tax1) - Income Tax On Individuals - Discussion and ActivitiesDocument12 pages(Tax1) - Income Tax On Individuals - Discussion and ActivitiesKim EllaNo ratings yet

- Graded Quesions Complete Book0 PDFDocument344 pagesGraded Quesions Complete Book0 PDFFarrukh AliNo ratings yet

- Giverny Capital Annual Letter 2013Document16 pagesGiverny Capital Annual Letter 2013CanadianValueNo ratings yet

- By Sriram Parthasarathy, Director Prowis Corporate Services Private LTD.Document41 pagesBy Sriram Parthasarathy, Director Prowis Corporate Services Private LTD.riteshsharda767No ratings yet

- Tata Consultancy Services: Financial Statements AnalysisDocument13 pagesTata Consultancy Services: Financial Statements AnalysisChhaya ThakorNo ratings yet

- Financial Management: September/December 2017 - Sample QuestionsDocument6 pagesFinancial Management: September/December 2017 - Sample QuestionsVinny Lu VLNo ratings yet

- Zakat Ul MalDocument7 pagesZakat Ul MalshiraaazNo ratings yet

- Taxation 2 NIRCDocument84 pagesTaxation 2 NIRCEric GarciaNo ratings yet

- Unit III Cash Flow Statement: BenefitsDocument7 pagesUnit III Cash Flow Statement: BenefitsnamrataNo ratings yet

- ABC LTD Walter ModelDocument5 pagesABC LTD Walter ModelJeeshan IdrisiNo ratings yet

- Endeavour Twoplise LTDDocument4 pagesEndeavour Twoplise LTDHafiz WaqasNo ratings yet

- C Ujeniuc 2Document17 pagesC Ujeniuc 2cujeniucYAHOO.COMNo ratings yet

- Acfn 1031 Chapter One Introduction To Accounting & BusinessDocument62 pagesAcfn 1031 Chapter One Introduction To Accounting & BusinessKaleab ShimelsNo ratings yet

- Acorns Securities LLC 5300 California Avenue IRVINE, CA 92617Document12 pagesAcorns Securities LLC 5300 California Avenue IRVINE, CA 92617Nicole AndersonNo ratings yet