Professional Documents

Culture Documents

Fad Gadget Has Never Worked So Hard in His Entire

Fad Gadget Has Never Worked So Hard in His Entire

Uploaded by

Amit PandeyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fad Gadget Has Never Worked So Hard in His Entire

Fad Gadget Has Never Worked So Hard in His Entire

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: Fad Gadget has never worked so hard in his entire

Fad Gadget has never worked so hard in his entire life. It is near midnight, and he is still poring

over statistics and tables. Fad recently joined Smashing Pumpkins, a relatively young but fast-

growing British firm that produces and distributes an intricate device that turns fresh pumpkins

into pumpkin pie in about 30 minutes. Recently, the firm has started exporting to Zooropa.

Some of the largest and tastiest pumpkins are grown in Zooropa, and its population boasts the

highest per capita pumpkin consumption in the world. A recent analysis of the pumpkin market

in Zooropa has left the company’s senior managers very impressed with the profit potential.

Although Zooropa consists of 10 politically independent countries, their currencies are linked

through a system called the Currency Rate Linkage System (CRLS) that works exactly like the

former Exchange Rate Mechanism (ERM) of the EMS before the currency turmoil started in

September 1992. The anchor currency is the banshee of Enigma, the leading country in

Zooropa. Initial contacts with importers in Zooropean countries indicated that they typically insist

on payment in their own local currency. About a week ago, Cab Voltaire, the CEO of Smashing

Pumpkins, expressed concerns about this development and asked Fad to lead a research team

to further examine the present state of the currency system of Zooropa. Cab viewed the outlook

for the banshee relative to the pound quite favorably and did not predict any substantial

depreciation of the banshee against any other major currency. However, the precarious

economic situation of some of the countries in Zooropa and the growing importance of

speculative pressures in Zooropa’s currency markets last week suddenly made him suspicious

about the possibility of realignments within the system. He even doubted the long-term viability

of the system. Cab instructed Fad to examine the following issues:

• Which currencies in the system exhibit the highest realignment risk?

• If a currency realigns and gets devalued, what are the effects on our sales and profit margins

in this particular country? Can we take the realignment possibility into account in our pricing?

• Suppose a currency is forced to leave the CRLS. What are the effects on exchange rates,

interest rates, and the outlook for sales in that country? What is the likelihood of this occurring

for the different countries? Fad Gadget felt nervous. A meeting was scheduled with Cab the day

after tomorrow. He wanted to write a thorough and insightful report. At the last management

meeting, he had the uneasy feeling that some senior managers doubted his abilities. Some

managers were naturally suspicious of a young Australian newcomer with his MBA. His earring

and punk hairdo did not exactly help either.

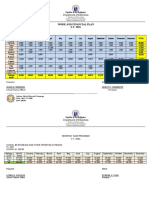

His team of analysts had already assembled a table with relevant macroeconomic and financial

data. “If only I could use this to rank the different countries according to realignment risk,” he

thought. Place yourself in Fad Gadget’s shoes and see what your ranking is.

a) Realignment rankings

b) Effects of Realignments/Exits for the Firm

c) Incorporating Realignment Risk into Pricing/Hedging

d) Effects of devaluation/exits on exchange and interest rates

Reach out to freelance2040@yahoo.com for enquiry.

Fad Gadget has never worked so hard in his entire

ANSWER

https://solvedquest.com/fad-gadget-has-never-worked-so-hard-in-his-entire/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Tax Invoice Vijay Sales (India) Private Limited: Delhi (Rohini) BRDocument1 pageTax Invoice Vijay Sales (India) Private Limited: Delhi (Rohini) BRRishabh jainNo ratings yet

- Matthew Lesko Free Money To Pay Your Utility BillsDocument14 pagesMatthew Lesko Free Money To Pay Your Utility BillsCarol100% (2)

- Slave States: The Practice of Kafala in the Gulf Arab RegionFrom EverandSlave States: The Practice of Kafala in the Gulf Arab RegionRating: 3.5 out of 5 stars3.5/5 (3)

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Looting in Ken Yak Roll Report Ha Pa Kenya VersionDocument18 pagesLooting in Ken Yak Roll Report Ha Pa Kenya VersionsaombekaNo ratings yet

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- 1 Is Madoff S Sentence Too Long 2 Some Sec PersonnelDocument2 pages1 Is Madoff S Sentence Too Long 2 Some Sec PersonnelAmit PandeyNo ratings yet

- The Topic Is:: - The Effects of Recruiting Qualified Emirati Woman in The Business SectorDocument1 pageThe Topic Is:: - The Effects of Recruiting Qualified Emirati Woman in The Business SectormmdadnanNo ratings yet

- Servo2006 02Document84 pagesServo2006 02Karina Cristina ParenteNo ratings yet

- Forbes - February 10 2014 USADocument116 pagesForbes - February 10 2014 USANgan Wei PinNo ratings yet

- Pacc ThesisDocument6 pagesPacc Thesislisamartinezalbuquerque100% (1)

- ? P Y G7N: WWW Youtube COM Watch V B I W ZPODocument43 pages? P Y G7N: WWW Youtube COM Watch V B I W ZPOkaren hudesNo ratings yet

- A Evaluate Each of These Alternatives On The Basis ofDocument2 pagesA Evaluate Each of These Alternatives On The Basis oftrilocksp SinghNo ratings yet

- If It's Raining in Brazil, Buy StarbucksFrom EverandIf It's Raining in Brazil, Buy StarbucksRating: 4.5 out of 5 stars4.5/5 (4)

- Congratulations Rezaul Karim, CAMS! - ACAMS TodayDocument7 pagesCongratulations Rezaul Karim, CAMS! - ACAMS TodayRezaul KarimNo ratings yet

- The Art of Trend Trading: Animal Spirits and Your Path to ProfitsFrom EverandThe Art of Trend Trading: Animal Spirits and Your Path to ProfitsNo ratings yet

- Data For Lozano Chip Company and Its Industry Averages Follow ADocument2 pagesData For Lozano Chip Company and Its Industry Averages Follow AAmit PandeyNo ratings yet

- Awake 30aug20 ManyDocument66 pagesAwake 30aug20 ManyhimNo ratings yet

- StockDocument2 pagesStockDan ButuzaNo ratings yet

- Idbi Am BankDocument26 pagesIdbi Am BanklavanyaNo ratings yet

- Citadel EFT, Inc. (CDFT) Congratulates Director Joseph Raid - News and Press Release Service TransWorldNewsDocument10 pagesCitadel EFT, Inc. (CDFT) Congratulates Director Joseph Raid - News and Press Release Service TransWorldNewsjaniceshellNo ratings yet

- State of Crvpto: DisclaimerDocument35 pagesState of Crvpto: DisclaimerilhamNo ratings yet

- Keeping Mac OS and Data On Separate Drives - MacworldDocument3 pagesKeeping Mac OS and Data On Separate Drives - MacworldFilipe SoaresNo ratings yet

- Meetings Scenarios2Document9 pagesMeetings Scenarios2Keith WilliamsNo ratings yet

- News Sheet 611: The First Class C.W. Operators' ClubDocument4 pagesNews Sheet 611: The First Class C.W. Operators' Clubkr3eNo ratings yet

- Amazon VA Lecture No 3Document19 pagesAmazon VA Lecture No 3Online Quran TuitionNo ratings yet

- Product Portfolio - HistoricalDocument7 pagesProduct Portfolio - HistoricalMee TootNo ratings yet

- The Rainbow Lottery - Supporting LGBTQ Good Causes - Vada MagazineDocument9 pagesThe Rainbow Lottery - Supporting LGBTQ Good Causes - Vada MagazineDog Horn PublishingNo ratings yet

- Hackforums HomeworkDocument5 pagesHackforums Homeworkjusyg1losih3100% (1)

- ?volume We Haven't Seen Since 2020 ?Document14 pages?volume We Haven't Seen Since 2020 ?Gabriel PatrascuNo ratings yet

- The Money Banking FinanceDocument1 pageThe Money Banking FinanceCharlotteNo ratings yet

- Flowslikeosmo Defillama FundamentalDocument5 pagesFlowslikeosmo Defillama FundamentallishengminNo ratings yet

- Xalaayaa BirooDocument1 pageXalaayaa BirootilmoNo ratings yet

- JFF Publications Website - Google SearchDocument2 pagesJFF Publications Website - Google SearchHAMMAD SHAHNo ratings yet

- VC-Seed Funding CompaniesDocument15 pagesVC-Seed Funding CompaniesqwertyNo ratings yet

- SFO Feb11Document96 pagesSFO Feb11AbgreenNo ratings yet

- Stock Market Project: United Parcel Service (SUMMARY)Document3 pagesStock Market Project: United Parcel Service (SUMMARY)sarfrazali12No ratings yet

- 2023 Group AssignmentDocument14 pages2023 Group AssignmentRavineshNo ratings yet

- Accounting Textbook Solutions - 10Document19 pagesAccounting Textbook Solutions - 10acc-expertNo ratings yet

- Wolf of Wall Street Research PaperDocument8 pagesWolf of Wall Street Research Papertrvlegvkg100% (1)

- Draw Something Is A Hit For OMGPOP CEO Dan Porter - Peter Kafka - Media - AllThingsDDocument5 pagesDraw Something Is A Hit For OMGPOP CEO Dan Porter - Peter Kafka - Media - AllThingsDsebapate6563No ratings yet

- PEN0065 Grammar Quiz - SampleDocument10 pagesPEN0065 Grammar Quiz - SampleSareen BharNo ratings yet

- The Crooks Who Refuse To Implement The Global Currency ResetTwitter4.13.19Document35 pagesThe Crooks Who Refuse To Implement The Global Currency ResetTwitter4.13.19Anonymous rv0urXXjNo ratings yet

- Why Are You Looking For: Opportunity?Document17 pagesWhy Are You Looking For: Opportunity?Sudeekssha Exports & ImportsNo ratings yet

- Catching Up to Crypto: Your Guide to Bitcoin and the New Digital EconomyFrom EverandCatching Up to Crypto: Your Guide to Bitcoin and the New Digital EconomyNo ratings yet

- Rap Research PaperDocument7 pagesRap Research Paperafnhbijlzdufjj100% (1)

- Oracle Corp: Price/Volume Data Zacks (1-5) Quantitative Score (1 Highest) EPS and SalesDocument1 pageOracle Corp: Price/Volume Data Zacks (1-5) Quantitative Score (1 Highest) EPS and Salesderek_2010No ratings yet

- Founder Institue Mentor Session - 051122Document49 pagesFounder Institue Mentor Session - 051122Founder InstituteNo ratings yet

- 1 Senior Discounts For Movies Your Movie Theater Charges ADocument2 pages1 Senior Discounts For Movies Your Movie Theater Charges Atrilocksp SinghNo ratings yet

- Forex Thread 1-15-08Document679 pagesForex Thread 1-15-08kisgobe100% (1)

- The Simple Path To Wealth Series (5 Books in 1) Get Rich or Die Poor The Choice Is Yours (Johnson, Omar) (Z-Library) - DataDocument6 pagesThe Simple Path To Wealth Series (5 Books in 1) Get Rich or Die Poor The Choice Is Yours (Johnson, Omar) (Z-Library) - DatagcastelloNo ratings yet

- Welcome To Another Complimentary Greentech Media Webinar, Provided byDocument16 pagesWelcome To Another Complimentary Greentech Media Webinar, Provided bycrikalaoNo ratings yet

- ZomatoDocument2 pagesZomatoVaibhav PrasadNo ratings yet

- GEO194 Test 5Document4 pagesGEO194 Test 5Dump AccNo ratings yet

- TheDeFinvestor STABLECOINSDocument7 pagesTheDeFinvestor STABLECOINSlishengminNo ratings yet

- Moving Abroad Checklist - 6 Months Before You Go - TransferWiseDocument7 pagesMoving Abroad Checklist - 6 Months Before You Go - TransferWiseNCY EditorNo ratings yet

- Imt 74Document4 pagesImt 74nirbhayNo ratings yet

- Dissertation Les Firmes MultinationalesDocument4 pagesDissertation Les Firmes MultinationalesWebsiteThatWritesPapersForYouSingapore100% (1)

- Stock Market Project: United Parcel Service (SUMMARY)Document3 pagesStock Market Project: United Parcel Service (SUMMARY)Sakshi RangrooNo ratings yet

- Are Singaporeans RichDocument6 pagesAre Singaporeans RichjimNo ratings yet

- Lesser Antilles Lines - The Island of San Huberto Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case StudiesDocument5 pagesLesser Antilles Lines - The Island of San Huberto Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case Studiesthetpainghein one0% (1)

- Week 3 Case Study Exercise Markets and MoralityDocument5 pagesWeek 3 Case Study Exercise Markets and MoralityLissette PlazaNo ratings yet

- Company IntroductionDocument10 pagesCompany Introductionprofessork063No ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- Vargas Inc Produces Industrial Machinery Vargas Has A Machining DepartmentDocument1 pageVargas Inc Produces Industrial Machinery Vargas Has A Machining DepartmentAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- BUS251.02 - Team Alpha - FInal Slides UpdatedDocument40 pagesBUS251.02 - Team Alpha - FInal Slides UpdatedFahim IslamNo ratings yet

- Riaz Ahmad S/O Muhammad Sharif 530 L Sabzazar: Web Generated BillDocument1 pageRiaz Ahmad S/O Muhammad Sharif 530 L Sabzazar: Web Generated BillMuhammad FasihNo ratings yet

- MCP - Work.and-Financial - Plan Malauli Word NewDocument2 pagesMCP - Work.and-Financial - Plan Malauli Word NewGhie Yambao SarmientoNo ratings yet

- Homework 8 Macroeconomi 1Document4 pagesHomework 8 Macroeconomi 1sebrina citraNo ratings yet

- sOURCES OF INCOMEDocument4 pagessOURCES OF INCOMERosemarie CruzNo ratings yet

- Make in India ppt111Document20 pagesMake in India ppt111Psrawat RawatNo ratings yet

- A Case Study of Transaction Cost of Export Business of The Indian ExporterDocument7 pagesA Case Study of Transaction Cost of Export Business of The Indian Exportervelan naveen natrajNo ratings yet

- تجربة سنغافورة في جذب الإستثمار الأجنبي المباشر 1Document17 pagesتجربة سنغافورة في جذب الإستثمار الأجنبي المباشر 1lafouinelaouni3No ratings yet

- H0070A0005731710 labelAndInvoiceMergeDocument2 pagesH0070A0005731710 labelAndInvoiceMergeAnupam SinghNo ratings yet

- Reforming State-Owned Enterprises in PNGDocument15 pagesReforming State-Owned Enterprises in PNGPacific Private Sector Development InitiativeNo ratings yet

- Per Capita Income of IndiaDocument2 pagesPer Capita Income of IndiaHenal ShahNo ratings yet

- Unit I - EXIM PolicyDocument30 pagesUnit I - EXIM Policypiyush khandelwalNo ratings yet

- Foreign Direct Investment 19Document15 pagesForeign Direct Investment 19Anilkumar A KurupNo ratings yet

- Stock ExchangesDocument18 pagesStock ExchangesNilesh MandlikNo ratings yet

- MM 0001Document3 pagesMM 0001belachew guwisoNo ratings yet

- Income Statement - FacebookDocument6 pagesIncome Statement - FacebookFábia RodriguesNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BSainath ReddyNo ratings yet

- 1176-Veermani Engineering Co.Document1 page1176-Veermani Engineering Co.NILAY VASANo ratings yet

- Sharma Coaching Centre: Class 10 Economics Chapter 2 Sectors of The Indian Economy MCQS 1 MarksDocument6 pagesSharma Coaching Centre: Class 10 Economics Chapter 2 Sectors of The Indian Economy MCQS 1 MarksShreshth SharmaNo ratings yet

- Sales Invoice RK Associates006 From RK ASSOCIATESDocument1 pageSales Invoice RK Associates006 From RK ASSOCIATESsasikumar durairajanNo ratings yet

- Turkey Ferro-Silicon (Si 55%) Import and Export Statistics 202301-Asian MetalDocument1 pageTurkey Ferro-Silicon (Si 55%) Import and Export Statistics 202301-Asian MetalHari BudiartoNo ratings yet

- Debt and Global Economy: The Challenges and The Way-OutDocument15 pagesDebt and Global Economy: The Challenges and The Way-Outbelayneh100% (1)

- A Reaction Paper Regarding Ra 10963 (Train Law)Document2 pagesA Reaction Paper Regarding Ra 10963 (Train Law)Jann Vic SalesNo ratings yet

- Committe and Its FormulationDocument2 pagesCommitte and Its FormulationRaushanYadavNo ratings yet

- G-8 & G-20Document17 pagesG-8 & G-20Meghna TripathiNo ratings yet

- Case Study On MicrofinanceDocument18 pagesCase Study On MicrofinanceTusharika RajpalNo ratings yet

- Forward Remittances: MT800's Deal WithDocument6 pagesForward Remittances: MT800's Deal WithSusmita JakkinapalliNo ratings yet

- Imposed Higher Tariffs - Forbade Colonies To Trade With Other Nations - Restricted Trade Routes - Subsidized ExportsDocument3 pagesImposed Higher Tariffs - Forbade Colonies To Trade With Other Nations - Restricted Trade Routes - Subsidized ExportsJim MangalimanNo ratings yet

- Globalization in South KoreaDocument6 pagesGlobalization in South KoreakaykiminkoreaNo ratings yet