Professional Documents

Culture Documents

Patricia Smith Recently Leased Space in The Southside Mall and

Patricia Smith Recently Leased Space in The Southside Mall and

Uploaded by

Amit PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Patricia Smith Recently Leased Space in The Southside Mall and

Patricia Smith Recently Leased Space in The Southside Mall and

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: Patricia Smith recently leased space in the

Southside Mall and

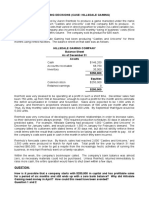

Patricia Smith recently leased space in the Southside Mall and opened a new business,

Smith’s Coin Shop. Business has been good, but Smith frequently runs out of cash. This

shortcoming has necessitated late payment on certain orders, which in turn is beginning to

cause a problem with suppliers. Smith plans to borrow from the bank to have cash ready as

needed, but first she needs to forecast how much she must borrow. Accordingly, she has asked

you to prepare a cash budget for the critical period around Christmas, when the business needs

will be especially high. Sales are made on a cash basis only. Smith’s purchases of materials

must be paid for during the month following the purchases. Smith pays herself a salary of

$4,800 per month, and the store’s rent is $2,000 per month. In addition, Smith must make a tax

payment of $12,000 in December. The current cash on hand (on December 1) is $400, but

Smith has agreed to maintain an average bank balance of $6,000—this amount is her target

cash balance. (Disregard till cash, which is insignificant because Smith keeps only a small

amount on hand to lessen the chances of robbery.) The firm’s estimated sales and purchases

for December, January, and February are shown in the following table. Purchases during

November amounted to $140,000.

a. Prepare a cash budget for December, January, and February.

b. Suppose that Smith started selling on a credit basis on December 1, giving customers 30

days to pay; all customers accept these terms (paying 30 days after purchases); and all other

facts in the problem remain unchanged. What would the company’s loan requirements be at

the end of February in thiscase?

Patricia Smith recently leased space in the Southside Mall and

ANSWER

https://solvedquest.com/patricia-smith-recently-leased-space-in-the-southside-mall-and/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- Hillsdale Gaming Case AnalysisDocument2 pagesHillsdale Gaming Case AnalysisIan Grey100% (7)

- The One Page Business Plan For Coaches and Consultants-ENTDocument8 pagesThe One Page Business Plan For Coaches and Consultants-ENTAjayMahajan100% (2)

- Indomie Noodles in Africa Lessons On Digital and Cultural BrandingDocument12 pagesIndomie Noodles in Africa Lessons On Digital and Cultural BrandingMuhammad Rizki Naufaldi100% (1)

- Business Purchase - Principles of AccountingDocument5 pagesBusiness Purchase - Principles of AccountingAbdulla MaseehNo ratings yet

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Ca$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondFrom EverandCa$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondNo ratings yet

- Chapter 2 - Assets Liablities and The Accounting EquationDocument51 pagesChapter 2 - Assets Liablities and The Accounting Equationshemida100% (7)

- Cash BudgetDocument45 pagesCash BudgetJoy Estela MangayaNo ratings yet

- Kim KiyosakiDocument4 pagesKim KiyosakiAlice Azucena FerreiraNo ratings yet

- Jesse Taylor Comprehensive Accounting ProblemDocument9 pagesJesse Taylor Comprehensive Accounting Problemapi-311367219No ratings yet

- Project Proposal For Selling UkoyDocument6 pagesProject Proposal For Selling UkoyChristine Dela Cruz100% (2)

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- Assignment # TopicDocument2 pagesAssignment # Topicashikur rahmanNo ratings yet

- Acc 101 - Module 1aDocument12 pagesAcc 101 - Module 1aPatricia CarreonNo ratings yet

- Exercises Chapter 23Document13 pagesExercises Chapter 23Le TrungNo ratings yet

- Prueba CostosDocument1 pagePrueba CostosMauge ReinosoNo ratings yet

- Double Entry Bookkeeping Part A HWDocument2 pagesDouble Entry Bookkeeping Part A HWMarcel JonathanNo ratings yet

- Assignment 6 1Document1 pageAssignment 6 1Quỳnh VânNo ratings yet

- BKPNG Activity 2Document4 pagesBKPNG Activity 2Michael John DayondonNo ratings yet

- TransactionDocument4 pagesTransactionapi-351243280No ratings yet

- Exercise Section 1Document2 pagesExercise Section 1ENG ZI QINGNo ratings yet

- Accounting Task 5Document11 pagesAccounting Task 5Mohamed Bilal HamoushNo ratings yet

- Acctg ReviewDocument3 pagesAcctg ReviewGil MontanoNo ratings yet

- FAR - Basic Concepts eDocument34 pagesFAR - Basic Concepts eAbinash MishraNo ratings yet

- Acct05 Case 2Document1 pageAcct05 Case 2qwert0987abcNo ratings yet

- FABM1TGhandouts L9 BooksOfAccts SupplementDocument2 pagesFABM1TGhandouts L9 BooksOfAccts SupplementKarl Vincent DulayNo ratings yet

- Journalizing Transactions: Transaction #1Document3 pagesJournalizing Transactions: Transaction #1Kazu YoshinagaNo ratings yet

- Journalize Following TransactionsDocument13 pagesJournalize Following TransactionsMD SAHIRNo ratings yet

- AssignmentDocument5 pagesAssignmentShar KhanNo ratings yet

- CH 29 - Business Finance - PresentationDocument126 pagesCH 29 - Business Finance - Presentationkuziva.jamesNo ratings yet

- Income Statement: Case 1: RevenuesDocument3 pagesIncome Statement: Case 1: RevenuesRajivNo ratings yet

- Kasus Dont Play GamesDocument4 pagesKasus Dont Play GamesSeptian YudhiantoNo ratings yet

- Financial AccountingDocument4 pagesFinancial Accountingkashifaslam022No ratings yet

- Fabm 1 CH 8Document12 pagesFabm 1 CH 8Jc GrandeNo ratings yet

- Conta FinancieraDocument21 pagesConta FinancieraAdrian TajmaniNo ratings yet

- SEC Distribution FileDocument21 pagesSEC Distribution Filethe kingfishNo ratings yet

- Accounting - The Recording ProcessDocument10 pagesAccounting - The Recording ProcessThuy TruongNo ratings yet

- ITDocument4 pagesITNamnam PacheNo ratings yet

- Mini Case - Cash Flows and Financial Statements at Sunset BoardsDocument2 pagesMini Case - Cash Flows and Financial Statements at Sunset BoardsKhoa ĐỗNo ratings yet

- Sea & Snow Sports, Inc.: Case No. 1 Financial ManagementDocument6 pagesSea & Snow Sports, Inc.: Case No. 1 Financial ManagementXhuliaNo ratings yet

- Double Entry Bookkeeping - T-AccountsDocument4 pagesDouble Entry Bookkeeping - T-AccountsAbdulla Maseeh100% (1)

- Um22ac142b 20230217121409Document21 pagesUm22ac142b 20230217121409Vismaya SNo ratings yet

- Financial Statement AnalysisDocument12 pagesFinancial Statement AnalysisMaha RehmanNo ratings yet

- Balance Sheet Note, Examples and PracticeDocument6 pagesBalance Sheet Note, Examples and PracticejshawNo ratings yet

- Ch-6 (Expenses, Sales, Drawing)Document16 pagesCh-6 (Expenses, Sales, Drawing)Kie RubyjaneNo ratings yet

- AssetsDocument2 pagesAssetsIgnite NightNo ratings yet

- Assignment 2 PFMDocument3 pagesAssignment 2 PFMWasif Imran RARE0% (1)

- Wright Company Deposits All Cash Receipts On The Day WhenDocument1 pageWright Company Deposits All Cash Receipts On The Day WhenCharlotteNo ratings yet

- Accounting Terms and ConceptsDocument4 pagesAccounting Terms and ConceptsNirajNo ratings yet

- ACCT - Ch2 Accounting ProblemsDocument3 pagesACCT - Ch2 Accounting ProblemsshigekaNo ratings yet

- Finance HWMDocument5 pagesFinance HWMmobinil1No ratings yet

- ExerciseDocument4 pagesExerciseICS TEAM50% (2)

- Value of The Building Was $300,000. The Company Paid $200,000 Cash and Issued A Note Payable For The BalanceDocument3 pagesValue of The Building Was $300,000. The Company Paid $200,000 Cash and Issued A Note Payable For The BalanceBushra NazNo ratings yet

- 22441accounting For ReceivablesDocument16 pages22441accounting For ReceivablesSEHAR NadeeM100% (1)

- Indian Institute of Management Kashipur MBA 2020-22 Term I Financial Accounting Session NotesDocument5 pagesIndian Institute of Management Kashipur MBA 2020-22 Term I Financial Accounting Session NotesUjjwalPratapSinghNo ratings yet

- Question BankDocument21 pagesQuestion BankIan ChanNo ratings yet

- Fdocuments - in Test BbaDocument5 pagesFdocuments - in Test Bbatop 10 infoNo ratings yet

- Janet Wooster Owns A Retail Store That Sells New andDocument2 pagesJanet Wooster Owns A Retail Store That Sells New andAmit PandeyNo ratings yet

- حل مسألة المعادلة المحاسبيةDocument12 pagesحل مسألة المعادلة المحاسبيةryoNo ratings yet

- Radisson Company Requires Additional Cash For Its Business RadiDocument1 pageRadisson Company Requires Additional Cash For Its Business RadiM Bilal SaleemNo ratings yet

- 1.why Do We Need Ledger Accounts?: Date Narrative Ref $ Date Narrative Ref $Document7 pages1.why Do We Need Ledger Accounts?: Date Narrative Ref $ Date Narrative Ref $Hikmət RüstəmovNo ratings yet

- Introduction To Accounting - Kartiks Case StudyDocument3 pagesIntroduction To Accounting - Kartiks Case Studynudetarzan1985No ratings yet

- Another Example of Band E ProfitDocument1 pageAnother Example of Band E Profitmaria isabellaNo ratings yet

- QuestionDocument3 pagesQuestionmaky mac macNo ratings yet

- Accounting and Balance Sheet - Not About Detailed Balance SheetsDocument8 pagesAccounting and Balance Sheet - Not About Detailed Balance Sheets183 Vithanage S. DNo ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- Video Technology PLC Was Established in 1987 To Assemble VideoDocument3 pagesVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyNo ratings yet

- ATOM Ride-Hailing AgreementDocument7 pagesATOM Ride-Hailing AgreementRaedNo ratings yet

- PPIC HandoutDocument131 pagesPPIC HandoutMuhammad Farrukh Hameed ChaudharyNo ratings yet

- CPA-Financial ReportingDocument158 pagesCPA-Financial Reportingjbah saimon baptisteNo ratings yet

- Full Download Advanced Financial Accounting 10th Edition Christensen Solutions ManualDocument35 pagesFull Download Advanced Financial Accounting 10th Edition Christensen Solutions Manuallienanayalaag100% (21)

- Counter Rust™ 268: Technical Data SheetDocument1 pageCounter Rust™ 268: Technical Data SheetFadhli KusumaNo ratings yet

- WGMTA Final (C) Brandtraction 2020Document44 pagesWGMTA Final (C) Brandtraction 2020ColinNo ratings yet

- WCM: Report On The Risks of The Proposed Kango Joint Venture With ATZDocument3 pagesWCM: Report On The Risks of The Proposed Kango Joint Venture With ATZNataliaNo ratings yet

- Entrep Activity 1.2Document2 pagesEntrep Activity 1.2Sheila Mae MalesidoNo ratings yet

- Company Profile Rajid Kreasindo DIGITAL AGENCYDocument8 pagesCompany Profile Rajid Kreasindo DIGITAL AGENCYrajid kreasindoNo ratings yet

- Receipt No.: Application Number: Applicant's Name: Transaction Ref: Transaction Date/Time: Receiver Bank Name: Mode of Payment: Transaction StatusDocument1 pageReceipt No.: Application Number: Applicant's Name: Transaction Ref: Transaction Date/Time: Receiver Bank Name: Mode of Payment: Transaction Statusprashant mhatreNo ratings yet

- Customer Experience Excellence - The Six Pillars of Growth-Kogan Page (2021)Document403 pagesCustomer Experience Excellence - The Six Pillars of Growth-Kogan Page (2021)yayangNo ratings yet

- CVP Analysis - Assignment 1Document2 pagesCVP Analysis - Assignment 1Cherrelyne AlmazanNo ratings yet

- Ajay Ahuja - ResumeDocument3 pagesAjay Ahuja - ResumemcocatanaNo ratings yet

- Chapter 6 - Consideration of Internal ControlDocument4 pagesChapter 6 - Consideration of Internal ControlDemafilasan, Khyro Paul G.No ratings yet

- SG BCM-240 Fundamentals of BCM With SS540Document1 pageSG BCM-240 Fundamentals of BCM With SS540Bob GohNo ratings yet

- Acc Theory PPT Sustainability and Environmental AccountingDocument25 pagesAcc Theory PPT Sustainability and Environmental AccountingidsuperkulNo ratings yet

- BCG-Manager-Extension-Communications - SAMPLE JOB QUALI AND KRA KPIDocument5 pagesBCG-Manager-Extension-Communications - SAMPLE JOB QUALI AND KRA KPICharmis TubilNo ratings yet

- Profile On The Production of Medical SyringeDocument25 pagesProfile On The Production of Medical Syringeعبداللطيف الحسوسة100% (1)

- SAP FI - Automatic Payment Run - TutorialspointDocument7 pagesSAP FI - Automatic Payment Run - TutorialspointsridharNo ratings yet

- Detailed ResultDocument8 pagesDetailed ResultAmit PalNo ratings yet

- Chapter 32 - Efficiency and Market FailureDocument24 pagesChapter 32 - Efficiency and Market FailurePhuong DaoNo ratings yet

- Business WorkshopDocument17 pagesBusiness WorkshopAliah Jeonelle RamosNo ratings yet

- Marketing Management 2016.2017Document7 pagesMarketing Management 2016.2017seyon sithamparanathanNo ratings yet

- Chapter 461Document17 pagesChapter 461anithaivaturiNo ratings yet

- Advantages and DisadvantagesDocument2 pagesAdvantages and DisadvantagesJuhi BhattacharjeeNo ratings yet

- 3-Income Statement (CM & YTD)Document4 pages3-Income Statement (CM & YTD)Utkarsh RishiNo ratings yet

- I Am Sharing 'Afar Quiz' With YouDocument20 pagesI Am Sharing 'Afar Quiz' With YouAmie Jane MirandaNo ratings yet