Professional Documents

Culture Documents

Flextrola Inc An Electronics Systems Integrator Is Planning To Design

Uploaded by

Amit PandeyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Flextrola Inc An Electronics Systems Integrator Is Planning To Design

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: Flextrola Inc an electronics systems integrator is

planning to design

Flextrola, Inc., an electronics systems integrator, is planning to design a key component for their

next-generation product with Solectrics. Flextrola will integrate the component with some

software and then sell it to consumers. Given the short life cycles of such products and the long

lead times quoted by Solectrics, Flextrola only has one opportunity to place an order with

Solectrics prior to the beginning of its selling season. Flextrola's demand during the season is

normally distributed with a mean of 1,000 and a standard deviation of 600.

Solectrics' production cost for the component is $52 per unit and it plans to sell the component

for $72 per unit to Flextrola. Flextrola incurs essentially no cost associated with the software

integration and handling of each unit. Flextrola sells these units to consumers for $121 each.

Flextrola can sell unsold inventory at the end of the season in a secondary electronics market

for $50 each. The existing contract specifies that once Flextrola places the order, no changes

are allowed to it. Also, Solectrics does not accept any returns of unsold inventory, so Flextrola

must dispose of excess inventory in the secondary market. a. What is the probability that

Flextrola's demand will be within 25 percent of its forecast? b. What is the probability that

Flextrola's demand will be more than 40 percent greater than its forecast?

c. Under this contract, how many units should Flextrola order to maximize its expected profit?

For parts d through i, assume Flextrola orders 1,200 units. d. What are Flextrola's expected

sales?

e. How many units of inventory can Flextrola expect to sell in the secondary electronics market?

f. What is Flextrola's expected gross margin percentage, which is (Revenue - Cost)/Revenue?

g. What is Flextrola's expected profit?

h. What is Solectrics' expected profit?

i. What is the probability that Flextrola has lost sales of 400 units or more?

j. A sharp manager at Flextrola noticed the demand forecast and became wary of assuming that

demand is normally distributed.

She plotted a histogram of demands from previous seasons for similar products and concluded

that demand is better represented by the log normal distribution. Figure 12.7 plots the density

function for both the log normal

and the normal distribution, each with mean of 1,000 and standard deviation of 600. Figure 12.8

Reach out to freelance2040@yahoo.com for enquiry.

plots the distribution function for both the log normal and the normal. Using the more accurate

forecast (i.e., the log normal distribution), approximately how many units should Flextrola order

to maximize its expected profit?

ANSWER

https://solvedquest.com/flextrola-inc-an-electronics-systems-integrator-is-planning-to-design/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Vargas Inc Produces Industrial Machinery Vargas Has A Machining DepartmentDocument1 pageVargas Inc Produces Industrial Machinery Vargas Has A Machining DepartmentAmit PandeyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Seemule, M., Sinha, N. and Ndlovu, T. (2017) Comm Bank in BotswanaDocument23 pagesSeemule, M., Sinha, N. and Ndlovu, T. (2017) Comm Bank in BotswanacarltondurrantNo ratings yet

- Taking Risks and Making Profits Within The Dynamic Business EnvironmentDocument46 pagesTaking Risks and Making Profits Within The Dynamic Business EnvironmentMhmd KaramNo ratings yet

- IB Eco Paper SLDocument9 pagesIB Eco Paper SLSatyamBairoliyaNo ratings yet

- Case 02Document3 pagesCase 02SurainiEsa0% (1)

- Kanchan India BL 20mar2019Document7 pagesKanchan India BL 20mar2019aaravNo ratings yet

- BC HDFCDocument11 pagesBC HDFCMohmmedKhayyum100% (1)

- Andhra University SDE SyllabusDocument14 pagesAndhra University SDE Syllabusselimreza_862998017No ratings yet

- Eco 112 PDFDocument9 pagesEco 112 PDFElizabeth Sahonlay AguintoNo ratings yet

- Economics - Elasticity Grade 12 SHSDocument14 pagesEconomics - Elasticity Grade 12 SHSTanya MiyaNo ratings yet

- Ebook Contemporary Labor Economics 10Th Edition Mcconnell Test Bank Full Chapter PDFDocument30 pagesEbook Contemporary Labor Economics 10Th Edition Mcconnell Test Bank Full Chapter PDFfideliamaximilian7pjjf100% (11)

- Favorable Arguments For Profit MaximizationDocument1 pageFavorable Arguments For Profit Maximizationkawaljeet_cheema890% (1)

- AL Economics Notes (Ver 3) by A Karim LakhaniDocument33 pagesAL Economics Notes (Ver 3) by A Karim LakhaniAfnan Tariq100% (1)

- Quality Metal Service Center - FinalDocument5 pagesQuality Metal Service Center - FinalJerelleen Rodriguez100% (1)

- Beximco Pharma ValuationDocument25 pagesBeximco Pharma ValuationMidul KhanNo ratings yet

- Presentation On MCSDocument20 pagesPresentation On MCSMAHENDRA SHIVAJI DHENAKNo ratings yet

- Commodity Daily Briefing 102634710Document9 pagesCommodity Daily Briefing 102634710jasonkstearnsNo ratings yet

- CBRE Flex 2019Document62 pagesCBRE Flex 2019Nat LevyNo ratings yet

- IEO Economics MCQ 2022Document6 pagesIEO Economics MCQ 2022Mohammad Farhan NewazNo ratings yet

- Chapter 4 PowerpointDocument46 pagesChapter 4 Powerpointnisrina nursyianaNo ratings yet

- Cambridge International AS & A Level: Economics 9708/42 February/March 2022Document16 pagesCambridge International AS & A Level: Economics 9708/42 February/March 2022thabo bhejaneNo ratings yet

- Rivalry Among Existing CompetitorsDocument2 pagesRivalry Among Existing CompetitorsGabrielle TabarNo ratings yet

- Christos Pitelis, Edith Penrose's 'The Theory of The Growth of The Firm' Fifty Years Later, 2009Document2 pagesChristos Pitelis, Edith Penrose's 'The Theory of The Growth of The Firm' Fifty Years Later, 2009Teeo AmmNo ratings yet

- Priciples Chapter 4Document4 pagesPriciples Chapter 4Genner RazNo ratings yet

- Deca Start-Up Business Plan 1 Daniel DzialowskiDocument14 pagesDeca Start-Up Business Plan 1 Daniel Dzialowskiapi-564591035No ratings yet

- Mikro PS.7Document4 pagesMikro PS.7Öykü BayraktarNo ratings yet

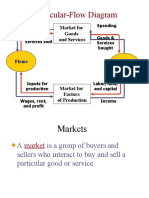

- Managerial Economics - Concepts and ToolsDocument20 pagesManagerial Economics - Concepts and ToolsBopzilla0911100% (1)

- MB 102Document2 pagesMB 102suryavamshirakeshNo ratings yet

- Business Economics Notes Lecture Notes Lectures 1 10Document55 pagesBusiness Economics Notes Lecture Notes Lectures 1 10Chirag8076No ratings yet

- Chapter 3 Flexible Budgets and StandardsDocument15 pagesChapter 3 Flexible Budgets and StandardsSuleyman TesfayeNo ratings yet

- FB Issue 183Document20 pagesFB Issue 183danielNo ratings yet