Professional Documents

Culture Documents

Answered - Year Cash Flow - $650,000,000 80,000,000 - Bartleby

Uploaded by

Kwasi BoateyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answered - Year Cash Flow - $650,000,000 80,000,000 - Bartleby

Uploaded by

Kwasi BoateyCopyright:

Available Formats

5/28/2020 Answered: Year Cash Flow -$650,000,000 80,000,000… | bartleby

Q&A Sign in

Business / Finance / Q&A Library / Year Cash Flow -$650,000,000 80,000,000 1 2 121,000,000 162,000,000 3 4 221,00…

Year Cash Flow -$650,000,000 80,000,000 1 2 121,000,000 162,000,000 3 4 221,0…

50% off! Get your first month of bartleby learn for only $4.99

Asked Dec 2, 2019

Question 796 views

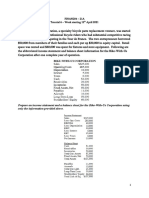

Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan

Dority, the company's geologist, has just finished his analysis of the mine site. He has estimated that

the mine would be productive for eight years, a er which the gold would be completely mined. Dan

has taken an estimate of the gold deposits to Alma Garrett, the company's financial o icer. Alma has

been asked by Seth to perform an analysis of the new mine and present her recommendation on

whether the company should open the new mine.

Alma has used the estimates provided by Dan to determine the revenues that could be expected from

the mine. She has also projected the expense of opening the mine and the annual operating

expenses. If the company opens the mine, it will cost $650 million today, and it will have a cash

outflow of $72 million nine years from today in costs associated with closing the mine and reclaiming

the area surrounding it. The expected cash flows each year from the mine are shown in the table on

this page. Bullock Gold Mining has a 12 percent required return on all of its gold mines.

Requirement

Construct a spreadsheet to calculate the payback period, internal rate of return, and net present

value of the proposed mine

https://www.bartleby.com/questions-and-answers/year-cash-flow-dollar650000000-80000000-1-2-121000000-162000000-3-4-221000000-210000000-… 1/1

You might also like

- Redacted 2019 Financial ReportDocument7 pagesRedacted 2019 Financial ReportDepDepFinancial100% (3)

- Finance Assignmnt 2Document6 pagesFinance Assignmnt 2Flourish edible Crockery100% (1)

- FINAN204-21A - Tutorial 6 Week 7Document10 pagesFINAN204-21A - Tutorial 6 Week 7Danae YangNo ratings yet

- Approval For Signing The Audit Report: M Jones 25.7.11Document52 pagesApproval For Signing The Audit Report: M Jones 25.7.11Kwasi Boatey100% (1)

- 2008-09-28 201134 BethesdaDocument4 pages2008-09-28 201134 BethesdaAfrianto Budi Aan100% (1)

- AC1025 Mock Exam Comm 2017Document17 pagesAC1025 Mock Exam Comm 2017Nghia Tuan NghiaNo ratings yet

- Seth Bullock The Owner of Bullock Gold Mining Is EvaluatingDocument1 pageSeth Bullock The Owner of Bullock Gold Mining Is Evaluatingtrilocksp SinghNo ratings yet

- CallReport5300 December-2006 NAVYDocument16 pagesCallReport5300 December-2006 NAVYLemonia Marina RempoutsikaNo ratings yet

- MKM704 - Finance For Marketers - Lab 4 Solution: MKM704 - DR Page 1 of 3 02/18/2022 at 22:03:08Document3 pagesMKM704 - Finance For Marketers - Lab 4 Solution: MKM704 - DR Page 1 of 3 02/18/2022 at 22:03:08VarunNo ratings yet

- Sunset BoardsDocument7 pagesSunset BoardsRoy Shourav100% (1)

- FIN 370 Week 4 Team Assignment Caledonia Products Integrative ProblemDocument7 pagesFIN 370 Week 4 Team Assignment Caledonia Products Integrative ProblemRambo GantNo ratings yet

- Jan 2022 Bus Unit 2 QPDocument24 pagesJan 2022 Bus Unit 2 QPabdulbashirshahriarNo ratings yet

- Starbucks Corporation (SBUX) Balance SheetDocument2 pagesStarbucks Corporation (SBUX) Balance Sheetstevan joeNo ratings yet

- World Investor NZDocument72 pagesWorld Investor NZAcorn123No ratings yet

- Accounting Project - EMBA Cohort 43 Group33 - FinalSubmissionDocument4 pagesAccounting Project - EMBA Cohort 43 Group33 - FinalSubmissionodlivingstonNo ratings yet

- Answers: ExerciseDocument107 pagesAnswers: ExerciseAisha MughalNo ratings yet

- UBFB3023 Tutorial 11 A Jan 10Document9 pagesUBFB3023 Tutorial 11 A Jan 10Phang Chen DeNo ratings yet

- Total Cost $15,000,000Document4 pagesTotal Cost $15,000,000Arianne Shae DomingoNo ratings yet

- Universitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Document3 pagesUniversitas Mercu Buana: Fakultas: Ekonomi Dan Bisnis Program Studi / Jenjang: Akuntansi / S1Yoga SiahaanNo ratings yet

- Solution CH 2Document14 pagesSolution CH 2razaffd410No ratings yet

- Pre-Q Accounting 2022 Answers Unit 4 Cash BookDocument16 pagesPre-Q Accounting 2022 Answers Unit 4 Cash BookfzpoggtjvevbfkyagyNo ratings yet

- NAME-Rahul ID - 103421 TEACHER - Alex Tsoy DATE - 07/02/21Document12 pagesNAME-Rahul ID - 103421 TEACHER - Alex Tsoy DATE - 07/02/21Ayush BakshiNo ratings yet

- Soal Soal Ekonomi Teknik KimiaDocument2 pagesSoal Soal Ekonomi Teknik KimiapratitatriasalinNo ratings yet

- Head For The Mountains - QuestionDocument6 pagesHead For The Mountains - QuestionAliyan AmjadNo ratings yet

- #GIR Investor Executive Summary V6-2018Document5 pages#GIR Investor Executive Summary V6-2018Neil GutierrezNo ratings yet

- BE8-3 Date Account Titles and Explanation Debit CreditDocument4 pagesBE8-3 Date Account Titles and Explanation Debit CreditMai Phương NguyễnNo ratings yet

- Racing Part Retail PlanDocument28 pagesRacing Part Retail Planutpal4mbaNo ratings yet

- Fundamental Research Corporation Feb 24 2011Document9 pagesFundamental Research Corporation Feb 24 2011Mariusz SkoniecznyNo ratings yet

- TestDocument8 pagesTestVimal GuptaNo ratings yet

- This Study Resource Was: Add Question HereDocument4 pagesThis Study Resource Was: Add Question HereJayvee Ramos RuedaNo ratings yet

- Cash Cost in MiningDocument7 pagesCash Cost in Miningbatman_No ratings yet

- Tutorial Sheet For Engineering EconomicsDocument12 pagesTutorial Sheet For Engineering EconomicsTinashe ChikariNo ratings yet

- EXAM#3 ADocument5 pagesEXAM#3 Ajunkemail8No ratings yet

- Chapter 6 - Capital BudgetingDocument40 pagesChapter 6 - Capital Budgetingsymtgywsq8No ratings yet

- WheatonPreciousMetals-AR 22Document136 pagesWheatonPreciousMetals-AR 22wigidas889No ratings yet

- The Role of Working Capital: Bordenk@unk - EduDocument7 pagesThe Role of Working Capital: Bordenk@unk - EduAntonio FrancoNo ratings yet

- Rockingham City Council Presentation by Pcm2Document14 pagesRockingham City Council Presentation by Pcm2savannahnow.com100% (1)

- Homework # 2 - 700Document3 pagesHomework # 2 - 700SuryaNo ratings yet

- FME520 Practice QuestionsDocument3 pagesFME520 Practice QuestionsMatende SimionNo ratings yet

- Assessment 2 - Winter - Student VersionDocument6 pagesAssessment 2 - Winter - Student VersionSkyHigh BeatzNo ratings yet

- Payback Period Year Beginning Unrecovered Investment Cash InflowDocument2 pagesPayback Period Year Beginning Unrecovered Investment Cash InflowNurul Badriah Anwar AliNo ratings yet

- Payback Period Year Beginning Unrecovered Investment Cash InflowDocument2 pagesPayback Period Year Beginning Unrecovered Investment Cash Inflowoverhear sbyNo ratings yet

- ACC290 Principles of Accounting IDocument25 pagesACC290 Principles of Accounting IG JhaNo ratings yet

- ADF Managerial Project - ReviewDocument4 pagesADF Managerial Project - ReviewLilly McAveeneyNo ratings yet

- Financial Accounting in An Economic Context 8Th Edition Pratt Solutions Manual Full Chapter PDFDocument48 pagesFinancial Accounting in An Economic Context 8Th Edition Pratt Solutions Manual Full Chapter PDFthomasowens1asz100% (9)

- Partnership Q1 To Q3 SolutionsDocument8 pagesPartnership Q1 To Q3 SolutionsJAYARAJALAKSHMI IlangoNo ratings yet

- Business Plan Real EstateDocument6 pagesBusiness Plan Real Estateopenid_JpMT3dV9100% (3)

- AUDITING - CPA Board Exam QuestionDocument4 pagesAUDITING - CPA Board Exam QuestionMaureen Derial PantaNo ratings yet

- Payback Period Year Beginning Unrecovered Investment Cash InflowDocument2 pagesPayback Period Year Beginning Unrecovered Investment Cash InflowDEDE KURNIAWANNo ratings yet

- Chapter 20Document3 pagesChapter 20johngay1987No ratings yet

- Accounting Case 2Document6 pagesAccounting Case 2SteveKingNo ratings yet

- Comm 457 Solutions To Practice MidtermDocument9 pagesComm 457 Solutions To Practice MidtermJason SNo ratings yet

- Investment Overview: Issuer & ObjectiveDocument2 pagesInvestment Overview: Issuer & ObjectiveCocoNo ratings yet

- Scan 0009Document7 pagesScan 0009Patrice ScottNo ratings yet

- 11th Lecture Modified-PCFM-Project Cost and Financial ManagementDocument18 pages11th Lecture Modified-PCFM-Project Cost and Financial ManagementMuhammad ArshiyaanNo ratings yet

- 11 - Valuation Case Study - Yp66b - SBM ItbDocument3 pages11 - Valuation Case Study - Yp66b - SBM ItbDaniel TjeongNo ratings yet

- DONE LionGoldCorpLtdAnnualReport2018Document116 pagesDONE LionGoldCorpLtdAnnualReport2018TABAH RIZKINo ratings yet

- Group Project - Finance For Supply ChainDocument3 pagesGroup Project - Finance For Supply ChainArmin SibrianNo ratings yet

- May'22 P2 SOLUTIONSDocument8 pagesMay'22 P2 SOLUTIONSStephano OlliviereNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Funding Application: Balance SheetDocument4 pagesFunding Application: Balance SheetKwasi BoateyNo ratings yet

- Bulletin - CPI July 2020 - 1Document10 pagesBulletin - CPI July 2020 - 1Kwasi BoateyNo ratings yet

- Funding Application: Balance SheetDocument4 pagesFunding Application: Balance SheetKwasi BoateyNo ratings yet

- Funding Application: Balance SheetDocument4 pagesFunding Application: Balance SheetKwasi BoateyNo ratings yet

- DT 0107 Monthly Paye Deductions Return Form v1 2 PDFDocument2 pagesDT 0107 Monthly Paye Deductions Return Form v1 2 PDFpapapetroNo ratings yet

- Notes: Human Rights (New York: Random House, 2001), XVDocument39 pagesNotes: Human Rights (New York: Random House, 2001), XVKwasi BoateyNo ratings yet

- International Standard On Auditing 210 Agreeing The Terms of Audit EngagementsDocument23 pagesInternational Standard On Auditing 210 Agreeing The Terms of Audit EngagementsSreng HongNo ratings yet

- (A) Director:: The Companies Act 1963 (Act 179)Document3 pages(A) Director:: The Companies Act 1963 (Act 179)Kwasi BoateyNo ratings yet

- Chemical Quality of Bottled Drinking Watering HanaDocument42 pagesChemical Quality of Bottled Drinking Watering HanaKwasi BoateyNo ratings yet

- 2011 BMC Bottled Water Stats - 2Document11 pages2011 BMC Bottled Water Stats - 2Kwasi BoateyNo ratings yet

- Opinion of Independent AuditorsDocument7 pagesOpinion of Independent AuditorsShiela Velasco dela PeñaNo ratings yet

- Pension ActDocument94 pagesPension ActKwasi BoateyNo ratings yet