Professional Documents

Culture Documents

Chapter 1 Shor

Uploaded by

April Joy Tamayo0 ratings0% found this document useful (0 votes)

592 views5 pagesasdfghj

Original Title

Chapter-1-Shor

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentasdfghj

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

592 views5 pagesChapter 1 Shor

Uploaded by

April Joy Tamayoasdfghj

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 5

P160,765

c. P157,985

b. P152,985

d. P156,875

Ables and Galang executed a partnership agreement that lists the following assets

contributed at the partnership's formation:

Contributed by:

Ables Galang

Cash 20,000 30,000

Inventory 15,000

Building 40,000

Furniture and Equipment 15,000

The building is subject to a mortgage of P10,000, which the partnership has

assumed. The partnership agreement also specified that profits and losses are to be

distributed equally. What amounts should be recorded as capital for Ables and

Galang at the formation of the partnership?

Ables Galang

a. 35,000 85,000

b. P35,000 75,000

c. P55,000 p30,000

d. P60,000 60,000

Orcajada invested in a partnership a parcel of land which cost his father P200,000.

‘The land had a market value of 300,000 when Orcajada inherited it three years

ago. Currently, the land is independently appraised at P500,000 even though

Orcajada insisted that he "wouldn't take P900,000 for it." The land should be

recorded in the accounts of the partnership at

a. P300,000.

b. 500,000.

Basic Considerations and Formation | 47

Reena aa eases nana emuain a maie aT an eeaaeaa as aera

c, 900,000.

d. P200,000.

On Apr. 30, 2018, Lacson, Yacapin, and Bernal formed a partnership by combining

their separate business proprietorships. Lacson contributed cash of 50,000

Yacapin contributed property. with a P36,000 carrying amount, a P40,000 original

cost, and P80,000 fair value

The partnership accepted responsibility for the

35,000 mortgage attached to the property.

Bernal contributed equipment with a P30,000 carrying amount, a P75,000 original

cost, and P55,000 fair value. The partnership agreement specifies that profits and

losses are to be shared equally but is silent regarding capital contributions. Which

partner has the largest Apr. 30, 2018, capital balance?

a. Lacson c. Bernal

b. — Yacapin

d. — Allcapital account balances are equal

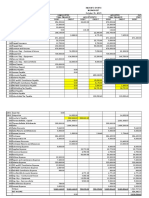

On Aug. 1, Isada and Ureta-Reyes pooled their assets to form a partnership, with

the firm to take over their business assets and assume the liabilities.

Partnership

capitals are to be based on net assets transferred after the following adjustments

Profits and losses are allocated equally

The inventory of Ureta-Reyes is to be increased by P4,000; an allowance for

doubtful accounts of P1,000 and P1,500 are to be set up in the books of Isada and

Ureta-Reyes, respectively; and accounts payable of P4,000 is to be recognized in

Isada’s books. The individual trial balances on August, before adjustments, follow:

Isada

Assets P75,000

Liabilities 5,000

_Ureta-Reyes

P113,000

34,500

What is the capital of Isada and Ureta-Reyes after the above adjustments?

a. sada, P68,750; U. Reyes, P77,250

b.

c

\sada, P65,000; U. Reyes, P81,000

Isada, P65,000; U. Reyes, P76,000

d. _ Isada, P75,000; U. Reyes, P81,000

Calma and Abello formed a partnership on April 1 and contributed the following

assets:

Calma

Cash P 150,000

land

Abello

P 50,000

310,000

prestane! was subject to a mortgage of P30,000, which was assumed by the

pare i ip jusder the rartnerihde agreement, Calma and Abello will share profit

@ ratio of one-third and two- r al

Sree oe erates wo-thirds, respectively. Abello’s capi

48 | Partnership and Corporation Accounting

sina

and

hich

with

ship

nts,

for

and

0

0

ving

the

“ofit

ita!

~

10.

11.

12.

a. P330,000.

b. P360,000.

cc. P300,000.

d. 340,000.

Pedernal, Pating, and Liggayu are forming a new partnership. Pedernal is to invest

cash of P100,000 and stapling equipment originally costing P120,000 but has @

second-hand market value of P50,000. Pating is to invest cash of P160,000.

Liggayu, whose family is engaged in selling stapling equipment, is to contribute cash

of P50,000 and a brand new stapling equipment to be used by the partnership with

‘a regular price of 120,000 but which cost their family’s business P100,000. Partners

agreed to share profits equally. The capital balances upon formation are

Pedernal, P220,000; Pating, P'160,000; and Liggayu, P150,000.

Pedernal, P150,000; Pating, P160,000; and Liggayu, P170,000.

Pedernal, P160,000; Pating, P160,000; and Liggayu, P160,000.

Pedernal, P176,666; Pating, P176,666; and Liggayu, P176,668.

ange

Estrada and Molina formed a partnership on Mar. 1, 2018 and contributed the

following assets:

Estrada Molina

Cash 80,000

50,000

Equipment

The equipment was subject to a chattel mortgage of P10,000 that was assumed by

the partnership. The partners agreed to share profits and losses equally, Molina’s

capital account at Mar. 1, 2018 should be

50,000. cc. P40,000.

P60,000.

ey

b. 45,000. d.

On Mar. 1, 2018, Kalaw and Borromeo formed a partnership with each contributing

the following assets:

Kalaw ___Borromeo _

Cash 30,000 P 70,000

Machinery and Equipment 25,000 75,000,

Building. < 225,000

10,000 2

Furniture and Fixtures

to mortgage loan of P80,000, which is to be assumed by the

int provides that Kalaw and Borromeo share profits and losses

8 the balance in Borromeo’s capital

The building is subject

partnership. Agreeme!

30% and 70%, respectively. On Mar. 1, 201

account should be

Basic Considerations and Formation | 49

13.

14.

15.

16.

c. _ P305,000.

8. 0370/0 d. _P290,000.

b. P314,000.

‘The same information in the previous number except that the mortgage loan is not

resumed by the partnership. On Mar. 1, 2018 the balance in Borromeo’s capital

account should be

305,000.

370,000. © ,

b 314,000, d. P290,000.

On July 1, Faminial and Fetalvero formed a partnership, agreeing to share profits

sand loxses in the ratio of 4:6 respectively. Faminial contributed a parcel of land that

ost P25,000. Fetalvero contributed P50,000 cash. The land was sold for P50,000

on luly 4, three hours after formation of the partnership. How much should be

recorded in Faminial’s capital account on formation of the partnership?

a. P50,000. c. P25,000.

b, P20,000. d. P10,000.

On Apr. 30, 2018, Foja, Lupian, and Retada formed a partnership by combining their

separate business proprietorships. Foja contributed cash of P50,000. Lupian

contributed property with a P36,000 carrying amount, a P40,000 original cost, and

80,000 fair value. The partnership assumed the P35,000 mortgage attached to the

property. Retada contributed equipment with a P30,000 carrying amount, a

75,000 original cost, and P55,000 fair value. The partnership agreement specified

that profits and losses are to be shared equally. Which partner has the largest Apr.

30, 2018, capital account balance?

a. Foja.

b. Retada.

cc. Lupian.

d. Allcapital account balances are equal.

Lacson and Solis started a partnership. Lacson contributed a building that she

Purchased 10 years ago for P100,000. The accumulated depreciation on the

balclng on ip date of formation of the partnership is P25,000 and the fair value is

,000. For what amount will Lacson’s capital acco i

af the paren? pi unt be credited on the books

a. 100,000

<< F

b. P75,000 110,000

d. P25,000

50 | Partnership and Corporation Accounting

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Operations Strategy and ProductivityDocument9 pagesOperations Strategy and ProductivityApril Joy TamayoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Study Guide Chap 05Document23 pagesStudy Guide Chap 05MoshNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 3.MAJOR GENRES OF 21st Century LitDocument20 pages3.MAJOR GENRES OF 21st Century LitApril Joy TamayoNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Kashato-Shirts Compress PDFDocument20 pagesKashato-Shirts Compress PDFApril Joy Tamayo100% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Research Methodology and Profile of Respondents: Appendix ADocument92 pagesResearch Methodology and Profile of Respondents: Appendix AEllie YsonNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Chapter 1 Supa My NotesDocument11 pagesChapter 1 Supa My NotesjhouvanNo ratings yet

- Reading 17 PDFDocument7 pagesReading 17 PDFApril Joy TamayoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- University of Northern Philippines: College of Business Administration and AccountancyDocument2 pagesUniversity of Northern Philippines: College of Business Administration and AccountancyApril Joy TamayoNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Write Your Answer On The Space Provided Before The NumberDocument4 pagesWrite Your Answer On The Space Provided Before The NumberApril Joy TamayoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Business Pla1Document3 pagesBusiness Pla1April Joy TamayoNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Sweet Beginnings Co. Case Study Cash Flow AnalysisDocument5 pagesSweet Beginnings Co. Case Study Cash Flow AnalysisChristian Torres31% (13)

- Letter For PanelsDocument3 pagesLetter For PanelsApril Joy TamayoNo ratings yet

- Research DesignDocument6 pagesResearch DesignApril Joy TamayoNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 1 Savemore CO CASE ANALYSISDocument4 pages1 Savemore CO CASE ANALYSISApril Joy TamayoNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Research DesignDocument9 pagesResearch DesignApril Joy Tamayo100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Sample Book ReviewDocument3 pagesSample Book ReviewLou Albert LaurelNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)