Professional Documents

Culture Documents

Ce 3

Uploaded by

Christine AltamarinoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ce 3

Uploaded by

Christine AltamarinoCopyright:

Available Formats

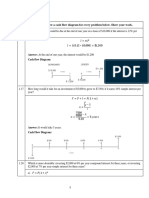

You purchased a bond for $870 one year ago.

Today, you receive your only interest payment for the year

of $70. The bond can currently be sold for $925. What is your total percentage return on

investment? Ignore tax effects.

A) 6.3%

B) 8.1%

C) 14.4%

D) 16.5%

E) 20.8%

Answer: C

12. You purchased 500 shares of preferred stock on January 1, 2002, for $85 per share. The stock

pays an annual dividend of $12 per share. On December 31, 2002, the market price is $91 per

share. What is your total dollar return for the year?

A) $ 3,000

B) $ 4,500

C) $ 6,000

D) $ 9,000

E) $12,000

Answer: D

Response: 500 ($91 - 85 + 12) = $9,000

13. You purchased a bond on January 1, 2002, for $1,065. The bond has a $1,000 face value, a 10%

annual coupon, and can be sold for $975 on December 31, 2002. What is your percentage return

on investment for the year?

A) –4.1%

B) 0.9%

C) 4.6%

D) 8.3%

E) 12.5%

Answer: B

Response: R = [($975 - 1,065) / 1,065] + (100 / 1,065) = .0094

14. You purchased 500 shares of preferred stock on January 1, 2002, for $50 per share. The stock

pays an annual dividend of $8 per share. On December 31, 2002, the market price is $54 per

share. What is your percentage return on investment for the year?

A) 4%

B) 8%

C) 16%

D) 20%

E) 24%

Answer: E

Response: R = [($54 - 50) / 50] + (8 / 50) = .24

Use the following to answer questions 15-18:

You purchase 800 shares of stock at a price of $20 per share. One year later, the shares are selling for $23

per share. In addition, a dividend of $2 per share is paid at the end of each year.

15. What is the total dollar return for the investment?

A) $1,600

B) $2,400

C) $4,000

D) $6,800

E) $8,000

Answer: C

Response: first, you made 800 times your $3 (23-20) capital gain or 800 x 3 or $2400

Second, you made the dividend, or 800 times $2 equals $1,600. Add up the capital gain of $2,400

and the dividend of $1,600 and you get 2,400 + 1,600 or $4,000

You might also like

- 2006 Business CalculationsDocument13 pages2006 Business CalculationsthatasianpersonNo ratings yet

- Acct Exam 1 AnswerDocument10 pagesAcct Exam 1 Answermiranda100789100% (2)

- Fourth Form Quiz 3 (Consumer Arithmetic) Name: - ClassDocument4 pagesFourth Form Quiz 3 (Consumer Arithmetic) Name: - ClassChet AckNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Multiple Choice Questions: Chapter 8 Consolidations - Changes in Ownership InterestsDocument36 pagesMultiple Choice Questions: Chapter 8 Consolidations - Changes in Ownership InterestsHamza JalalNo ratings yet

- File: Chapter 05 - Consolidated Financial Statements - Intra-Entity Asset Transactions Multiple ChoiceDocument53 pagesFile: Chapter 05 - Consolidated Financial Statements - Intra-Entity Asset Transactions Multiple Choicejana ayoubNo ratings yet

- Chapter 10 Stock Valuation A Second LookDocument33 pagesChapter 10 Stock Valuation A Second LookshuNo ratings yet

- Exercises For Before The Exam: November 11th November 18thDocument32 pagesExercises For Before The Exam: November 11th November 18thMušija AjlaNo ratings yet

- CH 05Document11 pagesCH 05kmarisseeNo ratings yet

- Chapter 3 Practice Questions PDFDocument4 pagesChapter 3 Practice Questions PDFleili fallahNo ratings yet

- 4th Quarter Pre-Post Test Applied Math CH 11-12Document2 pages4th Quarter Pre-Post Test Applied Math CH 11-12api-314402585No ratings yet

- Fin 9 PDFDocument2 pagesFin 9 PDFChristine AltamarinoNo ratings yet

- Business Finance (Fin 312) : Spring 2008Document9 pagesBusiness Finance (Fin 312) : Spring 2008southern2011No ratings yet

- TCDNDocument6 pagesTCDNKhoa Hoang TrinhNo ratings yet

- BÀi tập tài chínhDocument5 pagesBÀi tập tài chínhlam nguyenNo ratings yet

- Finance ReviewDocument38 pagesFinance Reviewcricri8787No ratings yet

- PART 1 - Post As Word or Excel Attachment - Total 5 PointsDocument7 pagesPART 1 - Post As Word or Excel Attachment - Total 5 PointsmulNo ratings yet

- Chapter 04 PQDocument3 pagesChapter 04 PQTayyeb AhmadNo ratings yet

- Chapter 11 Risk and Return in Capital MarketsDocument14 pagesChapter 11 Risk and Return in Capital MarketsshuNo ratings yet

- Assignment 5.4 Exercises: Calculation of The Holding Period Return?Document32 pagesAssignment 5.4 Exercises: Calculation of The Holding Period Return?Joel Christian Mascariña0% (1)

- Chapter 6 Practice Questions PDFDocument7 pagesChapter 6 Practice Questions PDFleili fallahNo ratings yet

- Test 1 W AnswersDocument8 pagesTest 1 W AnswersVaniamarie VasquezNo ratings yet

- Quiz Week 1 SolnsDocument8 pagesQuiz Week 1 SolnsRiri FahraniNo ratings yet

- Inclass P Chapter 3 CF From Fin StatementsDocument6 pagesInclass P Chapter 3 CF From Fin StatementsZhuka TemirbulatovaNo ratings yet

- MockDocument12 pagesMockdulkifil kottaNo ratings yet

- Mathematics 6 Quiz Week 6Document3 pagesMathematics 6 Quiz Week 6JEFERSON OBTINALLA100% (1)

- Chapter 16 Team ProblemDocument4 pagesChapter 16 Team ProblemRachel KleinNo ratings yet

- Midterm Exam ContributionDocument4 pagesMidterm Exam ContributionChristian Peralta ÜNo ratings yet

- ACC1701 Revision Session SlidesDocument38 pagesACC1701 Revision Session SlidesshermaineNo ratings yet

- Fall 203Document6 pagesFall 203mehdiNo ratings yet

- Test A - CambridgeDocument2 pagesTest A - Cambridgerorygog8No ratings yet

- Homework 1 MHRDocument3 pagesHomework 1 MHRRafael RangelNo ratings yet

- Chapter8Risk and ReturnDocument19 pagesChapter8Risk and ReturnAnonymous VnNZmOo6Z100% (2)

- ACCT 6331 Final Exam Review QuestionsDocument5 pagesACCT 6331 Final Exam Review QuestionsMisha KolosovNo ratings yet

- Time Value MoneyDocument4 pagesTime Value MoneyJulie Ann ZafraNo ratings yet

- 0708 T1 Midterm AnsDocument16 pages0708 T1 Midterm AnsYudi KhoNo ratings yet

- 2016 SLC Business CalculationsDocument12 pages2016 SLC Business Calculationssslaa82No ratings yet

- FNCE10002 Summer 2019 Mid-Semester Exam Questions and AnswersDocument12 pagesFNCE10002 Summer 2019 Mid-Semester Exam Questions and AnswersAmir KhanNo ratings yet

- 2023 (ASSIGNMENT) Mathematics in Practical SituationsDocument16 pages2023 (ASSIGNMENT) Mathematics in Practical Situationsalibabagoat1No ratings yet

- Assignment I For Civil KhCEDocument2 pagesAssignment I For Civil KhCEbalkrishna7621No ratings yet

- Practice 4-Stock ValuationDocument3 pagesPractice 4-Stock Valuationelysepa7No ratings yet

- 3530 SU23 Final Exam - Type X - Questions (Post)Document13 pages3530 SU23 Final Exam - Type X - Questions (Post)combatapple25No ratings yet

- FINMAN Answer KeyDocument7 pagesFINMAN Answer KeyReginald ValenciaNo ratings yet

- FinanceDocument22 pagesFinancealyssaNo ratings yet

- Practice Midterm 1 With SolutionsDocument6 pagesPractice Midterm 1 With SolutionsDenise ChenNo ratings yet

- Sheet 1 Time Value of MoneyDocument5 pagesSheet 1 Time Value of MoneyAhmed RagabNo ratings yet

- Metrics 1-4 Worksheets With AnswersDocument11 pagesMetrics 1-4 Worksheets With AnswerslilyNo ratings yet

- StudentDocument29 pagesStudentKhang LeNo ratings yet

- Chapter 07Document10 pagesChapter 07Sadaf ZiaNo ratings yet

- Managerial Finance (BUS 718A)Document5 pagesManagerial Finance (BUS 718A)Kwaku Frimpong GyauNo ratings yet

- Basic College Mathematics An Applied Approach 10Th Edition Aufmann Test Bank Full Chapter PDFDocument40 pagesBasic College Mathematics An Applied Approach 10Th Edition Aufmann Test Bank Full Chapter PDFTaylorHarveyawde100% (13)

- Example Paper CF Exam 2Document6 pagesExample Paper CF Exam 2Ashton Kyle ClarkeNo ratings yet

- Tomas Claudio Colleges: On The Space Provided For Before Each Number.)Document4 pagesTomas Claudio Colleges: On The Space Provided For Before Each Number.)Marijo JuanilloNo ratings yet

- Aptitude Basic Mathematics Practice QuestionsDocument98 pagesAptitude Basic Mathematics Practice QuestionsParth PatelNo ratings yet

- Quantitative Reasoning TestDocument6 pagesQuantitative Reasoning TestHammad KhanNo ratings yet

- TVMDocument5 pagesTVMHannah Ma Ya LiNo ratings yet

- Answers To End-of-Chapter Questions - Part 2: SolutionDocument2 pagesAnswers To End-of-Chapter Questions - Part 2: Solutionpakhijuli100% (1)

- CODES Sections of The Bubble SheetDocument6 pagesCODES Sections of The Bubble SheetAliImranNo ratings yet

- Mid Test HVNHDocument8 pagesMid Test HVNHDương ĐặngNo ratings yet

- Solved Problems Risk AnalysisDocument4 pagesSolved Problems Risk AnalysisRoxy Mestanza RoseroNo ratings yet